Adding a 16-year-old to your car insurance policy can be a costly affair, with premiums increasing by up to 150%. However, it is a necessary step to ensure your child is insured and compliant with state laws. While some insurance companies may not require you to add a 15-year-old with a learner's permit, most insurers will need to be informed when your child passes their driving test and obtains a full license.

Adding your child to your policy is usually the cheapest option, and some insurers may not even offer standalone coverage for young drivers. While this will increase your rates, there are discounts available, such as for good grades or completing driver's education programs. You can also shop around for the best rates and compare different insurers to find the most suitable coverage for your family.

It is important to note that your teen driver should have at least the minimum insurance coverage required by your state, including liability, collision, and comprehensive coverage. Additionally, consider increasing your liability limits and purchasing an umbrella policy to protect your finances in the event of a claim.

| Characteristics | Values |

|---|---|

| Cost of insurance for a 16-year-old | $4,861 per year for a male, $4,532 per year for a female |

| Cost of insurance for a married couple with a 16-year-old | $4,874 per year |

| Cost of insurance for a married couple without a 16-year-old | $2,169 per year |

| Average increase in insurance costs for a married couple with a 16-year-old | $2,705 per year |

| Average increase in insurance costs for a married couple with a 16-year-old (monthly) | $225 per month |

| Average cost of insurance for an adult driver | $1,447 per year |

| Average cost of insurance for an adult driver with a teen | $3,775 per year |

| Average percentage increase in insurance costs with a teen | 161% |

| Average cost of insurance for a teen male | $7,625 per year |

| Average cost of insurance for a 19-year-old male | $4,132 per year |

What You'll Learn

Adding a 16-year-old to your insurance policy

Step 1: Talk to Your Insurance Provider

Before your teen starts driving, contact your current insurance company to understand their specific requirements and guidelines for adding a teenage driver to your policy. Some companies may allow you to list your teen on your policy at no additional cost until they obtain their driver's license, while others may require you to add them as soon as they receive their learner's permit. It is essential to clarify these details with your insurer to avoid any issues.

Step 2: Understand the Impact on Your Premium

Adding a teenage driver to your policy will likely result in an increase in your insurance premium. The exact amount will vary depending on your insurance company, your location, and other factors. According to recent data, adding a 16-year-old male to your policy can result in an average annual rate of around $4,500 to $4,900, while adding a female can cost around $4,500 annually. These rates are significantly higher than the average cost of car insurance for older drivers.

Step 3: Explore Discount Options

To help offset the increased cost, look for available discounts. Many insurance companies offer good student discounts for teens with good grades, typically a B average or higher. You can also ask about other discounts, such as those for vehicle safety features, low mileage, or safe driving programs. By taking advantage of these discounts, you may be able to reduce the overall cost of your policy.

Step 4: Compare Rates and Shop Around

Don't be afraid to compare rates and shop around for the best deal. Insurance rates can vary significantly between companies, so it's worth getting quotes from multiple providers. This will help you find the most cost-effective option for adding your teen to your policy. Remember to consider not just the price but also the coverage options and customer service offered by each insurer.

Step 5: Add Your Teen to Your Policy

Once you have gathered all the necessary information and explored your options, it's time to add your teen to your policy. Contact your chosen insurance company and provide them with the required information about your teen driver. Remember to ask about any available discounts and inquire about increasing your liability limits to ensure adequate protection.

Step 6: Emphasize Safe Driving

Encourage your teen to practice safe driving habits and follow the rules of the road. Maintaining a clean driving record will not only keep them safe but can also help lower your insurance costs in the long run. Consider implementing a safe driving agreement with your teen to establish clear expectations and promote responsible driving behaviour.

No-Fault Insurance: Who Pays?

You may want to see also

Discounts for good grades

Adding a 16-year-old driver to your car insurance policy can be expensive. However, if your child is a good student, you may be able to take advantage of a good student discount. Many insurance companies offer these discounts to help offset the cost of insuring a young driver.

Requirements for Good Student Discounts

To qualify for a good student discount, your child will typically need to meet the following requirements:

- Be under 25 years old

- Be a full-time high school or college student

- Maintain at least a "B" average or a 3.0 GPA, or be in the top 20% of their class

- Provide proof of academic performance, such as a school transcript or report card

Some insurance companies may also accept scores from standardized tests like the SAT or ACT in lieu of a transcript or report card. For homeschooled students, a standardized test score may be the only way to qualify for the discount.

Insurance Companies that Offer Good Student Discounts

Several insurance companies offer good student discounts, including:

- State Farm: Offers up to a 25% discount for full-time students up to age 25 who earn good grades

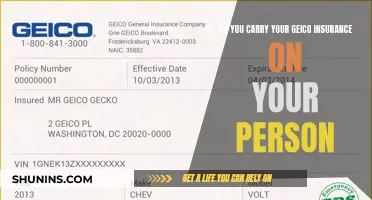

- GEICO: Offers up to a 15% discount for full-time students with a B average or better

- Allstate: Offers a discount of around 20%

- Progressive: Offers an average discount of 10% for students under 23 with a B average or better

- Nationwide: Offers a discount for drivers 16 to 24 who are full-time students with a B average or better

The amount you can save with a good student discount will vary depending on the insurance company and your location. However, on average, good students can save between 4% and 20% on their car insurance premiums. For example, with State Farm, a good student discount can save you about 17% on your policy.

In addition to good student discounts, there are other ways to save on car insurance for your 16-year-old. These include:

- Shopping around for the best rates

- Adding your child to your existing policy rather than purchasing a separate policy

- Increasing your deductible

- Taking advantage of other discounts, such as low-mileage or driver training discounts

Insurance Carriers: Who They Are and What They Do

You may want to see also

Pros and cons of adding your child to your insurance

Adding a 16-year-old to your insurance policy can be costly, but it is a necessary step to ensure your child is covered when driving. Here are some pros and cons of adding your child to your insurance:

Pros:

- Cost-effectiveness: Adding your child to your insurance policy is usually the cheapest option. Standalone coverage for teens can be extremely expensive, and some insurers may not even cover young drivers on their own policy.

- Convenience: It is more convenient to add your child to your existing policy than for them to take out their own.

- Discounts: Many insurers offer discounts to help offset the cost of insuring a teen driver. For example, your insurer might offer a discount if your child maintains good grades or completes a driver's education program.

- Compliance: In most states, insurance providers require you to list all licensed drivers residing in your home on your auto insurance policy. Adding your child ensures you are compliant with these regulations.

Cons:

- Increased rates: Adding a teen driver to your policy can significantly increase your insurance premiums. This is due to teens being considered high-risk by insurance companies because of their inexperience and the increased likelihood of accidents.

- Liability: If your child causes an accident, you may be held liable, and your insurance rates will likely increase even further.

- Gender-based pricing: In most states, insurance companies can consider gender when determining rates. Male teens often pay higher rates than females due to statistics showing they are more likely to be involved in accidents.

Trustees: Ensuring Wishes Are Fulfilled

You may want to see also

When to add your child to your insurance policy

It is recommended to notify your insurance provider when your child obtains their learner's permit, even though they won't need to be added to your policy at this stage. This ensures the insurance company is aware that you will be adding your child to your policy in the near future, helping to avoid any gaps in coverage when your child passes their driving test.

Additionally, if your child is a licensed driver and lives in your household, but does not plan on driving your car, you may still be required to add them to your policy. In this case, you can list them as an "excluded driver," meaning they will not be covered to drive your vehicle, but this will prevent them from affecting your insurance rates.

If your child is going away to college, you may be able to take advantage of discounted rates while they are not regularly driving your car. However, if they are driving your car during breaks or vacations, remember to reinstate them on your policy during those periods.

Finally, once your child moves out and obtains their own vehicle, they are responsible for obtaining their own insurance coverage.

Concealed Carry Insurance: Protection for Gun Owners

You may want to see also

How to save on insurance for 16-year-olds

Insurance for 16-year-olds can be very expensive, but there are a few ways to save money. Here are some tips on how to reduce the cost of insurance for 16-year-olds:

Add your child to your family insurance policy

Adding a 16-year-old to a parent's insurance policy is generally much cheaper than putting the teen on a policy of their own. This can save you hundreds of dollars per year. For example, the average cost of car insurance for a married couple with a 16-year-old child is $4,874, while the average cost for a 16-year-old with their own policy is $7,581 per year.

Reduce your coverage amounts

If you feel comfortable doing so, you can lower your coverage amounts to save money. You could even drop collision insurance and comprehensive insurance and just go with the minimum liability coverage required in your state. However, keep in mind that if you or your teen damage your car, or if someone without enough insurance causes an accident, you will have to pay for repairs out of pocket.

Shop around for the best discounts

There are several discounts that teen drivers can take advantage of to lower insurance costs:

- Good student discount: Students who maintain good grades (usually a B average or above) can often get a discount on their car insurance.

- Student away at school discount: If your teen doesn't take a vehicle to college and attends school at at least 100 miles away from home, you may be eligible for a discount.

- Driver education discount: Some companies offer discounts for students who complete an approved driver training program.

- Usage-based discount: Programs like Progressive's Snapshot®, State Farm's Drive Safe & SaveTM, and Geico DriveEasy award discounts based on good driving habits.

- Multi-vehicle discount: If your teen drives their own vehicle, you can save with this discount.

Choose the right car

The type of car a 16-year-old drives can influence their insurance rates. Generally, insurance rates are higher for luxury vehicles and sports cars. To save money, opt for a reliable and affordable car with good safety ratings.

Increase your deductibles

You can usually save money by choosing a higher deductible for collision and comprehensive insurance. For example, you could increase your deductible from $500 to $1,000. However, keep in mind that 16-year-old drivers are more likely than adults to crash, so weigh the savings against the increased risk.

Keep an eye on driving habits

Encourage your teen to maintain a clean driving record. Accidents and moving violations can increase insurance costs. Safe driving can also make your teen eligible for a safe driver discount.

Bodily Injury Insurance: Florida's Law

You may want to see also

Frequently asked questions

Yes, if your teen is going to be driving, they need to be covered by an insurance policy. The cheapest option is usually to add them to your policy, but they can only be included if they are minors. Once they reach the age of majority (typically 18), they can purchase their own policy.

You should notify your insurer when your child gets their learner's permit, and then add them to your policy when they pass their driving test.

At a minimum, your teen driver should have the amount of liability coverage required by your state. It's a good idea to cover your teen above the minimum requirements if possible. You may also want to consider collision and comprehensive coverage.

Adding a 16-year-old to your policy can significantly increase your premiums. The exact cost will depend on various factors, including your location, insurer, and the age and gender of your teen. On average, adding a 16-year-old can increase your annual premium by around $2,700.

Yes, there are several discounts that may be available, including good student discounts, driver training discounts, usage-based discounts, and family plan discounts. Shopping around and comparing rates from different insurers can also help you find the best deal.