Excess and Surplus (E&S) insurance is a type of coverage for businesses with high-risk or adverse loss histories that make it difficult to obtain coverage in the traditional insurance marketplace. E&S insurance is provided to businesses facing risks that admitted carriers won't adequately insure, often because they operate in industries with high liability potential or uncommon risks. E&S insurance is also known as surplus lines or non-admitted insurance.

| Characteristics | Values |

|---|---|

| Type of Insurance | Excess and Surplus (E&S) Lines Insurance |

| Market | Specialty/Non-Admitted Insurance |

| Insured Entities | Businesses with high-risk, unusual or elevated risks |

| Insured Risks | Financial, Casualty, Professional Liability |

| Insurer | Non-Admitted Carriers/Surplus Lines Insurers |

| Policy Flexibility | Higher flexibility in policy design |

| Policy Cost | Typically more expensive |

| State Involvement | Not backed by state guaranty funds |

| State Regulation | Not subject to rate and form regulations of the standard market |

| State Taxes | Subject to state taxes on premiums |

| Policy Availability | Available in most states |

| Prominent Carriers | Lloyd's of London, American International Group (AIG), Markel Corporation Group |

What You'll Learn

E&S insurance is for businesses with high-risk or unusual risks

E&S insurance is a type of coverage for businesses with high-risk exposures or an adverse loss history that makes it difficult to obtain coverage in the traditional insurance marketplace. These businesses often have unusual or elevated risks that standard insurance carriers are unwilling or unable to cover due to state regulations.

The "E&S" in E&S insurance stands for "Excess and Surplus". This type of insurance is provided by non-admitted carriers, which are not licensed in the states where they provide coverage. As a result, they are not subject to the same form or rate regulations as standard insurance carriers. This lack of restriction allows non-admitted carriers to offer policies with higher coverage limits and customisable coverage for unique risks.

Businesses that typically require E&S insurance include those in high-risk industries, such as construction, roofing, electrical work, landscaping, and tree service. These industries often involve the use of heavy machinery, hazardous working conditions, or other unique risks that standard carriers consider too risky to insure. For example, a landscaper who needs $3 million in general liability coverage may turn to the E&S market if standard carriers are only willing to offer $2 million.

In addition to high-risk industries, small businesses may also require E&S insurance due to their business tenure. Admitted carriers often view businesses with less than three years of experience as high-risk and may deny them coverage. In these cases, surplus lines insurance through the E&S market may be the only option for these young businesses.

Businesses located in areas prone to natural disasters or other unique risks, such as hurricanes or wildfires, may also need to turn to the E&S market for coverage. The specialty lines market can provide coverage for these unique risks that are not typically offered by standard carriers.

Overall, E&S insurance is designed to protect high-risk businesses that standard insurers won't cover. It offers customised coverage and higher limits to businesses with unique or elevated risks. By utilising the E&S market, businesses can obtain the necessary coverage to protect themselves and their customers in the event of an accident or loss.

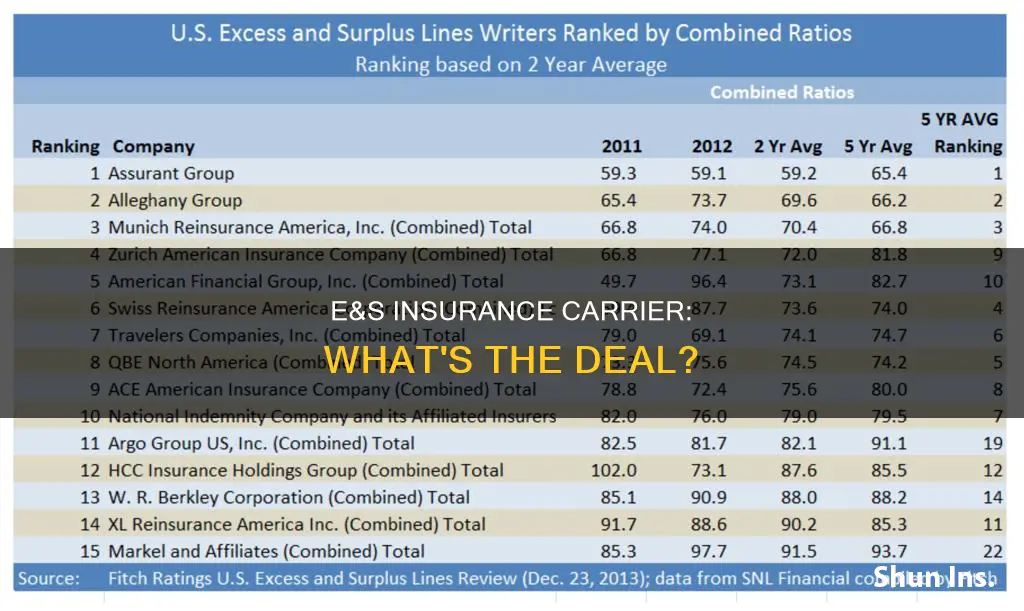

Surplus Insurance Carrier: What's the Deal?

You may want to see also

E&S insurance is more expensive than standard insurance

Excess and Surplus (E&S) insurance is a type of insurance for businesses with high-risk profiles that are unable to obtain coverage from standard insurance companies. E&S insurance is more expensive than standard insurance because it covers heightened risks and exposures that standard insurance companies are unwilling to take on.

E&S insurance is also known as surplus lines or non-admitted insurance. It is purchased by businesses with unusual or elevated risks that are considered too risky for the standard insurance market. These businesses are able to obtain policies through qualified E&S carriers, which have more flexibility in the risks they choose to cover and the premiums they set for that coverage. This freedom allows E&S carriers to adapt to business trends faster than standard insurers and create customised coverages for their clients.

E&S insurance is typically purchased by small businesses, including those with less than three years of experience, which are often considered high-risk by standard insurance companies. More commonly, E&S insurance is purchased by businesses in high-risk industries, such as tree services, roofing, construction, electricians, landscapers, and businesses that use hazardous materials.

In addition, businesses may require E&S insurance to cover risks that standard insurance policies don't address because they are too unique, novel, or complex. For example, cannabis and hemp companies often require E&S insurance due to complex and unprecedented regulatory risks.

The cost of E&S insurance depends on the specific features of the business, including its coverage needs and claims history. While it is generally more expensive than standard insurance, the actual cost can vary significantly depending on these factors.

Contractor Insurance: What Policies Are Essential?

You may want to see also

E&S insurance is provided by non-admitted carriers

E&S insurance, or Excess and Surplus insurance, is provided by non-admitted carriers. These are companies that provide insurance policies to individuals or businesses, assuming the financial risk of their policyholders by offering coverage for a variety of risks, such as property damage, liability, or bodily injury. Non-admitted carriers are not required to be licensed by the state but are allowed to do business in that state. Due to this, they are often referred to as unlicensed carriers. However, they are still financially stable and are regulated in other ways.

Non-admitted carriers are not bound by most of the rate and form regulations imposed on standard market companies, giving them the flexibility to change the coverage offered and the rate charged. This allows them to adapt to business trends faster than standard insurers and create customized coverages for their clients. They can also react quickly to a constantly evolving market and maintain a high level of flexibility to adapt to market changes.

Non-admitted carriers are not backed by the state. This means that if the insurance company fails, the state would not step in to make payments on claims. This is why it is often considered high risk to work with a non-admitted insurance carrier. However, they are still regulated by the state surplus lines office and must meet local regulatory requirements.

The primary difference between standard and E&S insurance is that policies in the standard market come from carriers licensed in the state where they provide coverage, whereas E&S policies come from non-admitted insurance carriers without those licenses. Non-admitted carriers can cover a wider range of dangers and higher levels of risk, but their policies are usually more expensive.

PR Firms: Essential Insurance Coverage

You may want to see also

E&S insurance is also known as surplus lines insurance

E&S insurance, or Excess & Surplus insurance, is a specialty market that insures businesses and individuals with high-risk or unusual exposures that standard carriers won't cover. It is also known as surplus lines insurance, and it falls under the category of property and casualty insurance. This type of insurance is often needed by businesses in high-risk industries, such as construction, roofing, and landscaping, where there is a high potential for liability or uncommon risks.

Surplus lines insurance is typically more expensive than regular insurance due to the higher risks involved. It can be purchased by individuals or companies to protect against financial risks that regular insurance companies are unwilling to take on. These risks can include costly items, such as expensive art or classic car collections, or unique risks associated with special events.

The key difference between E&S insurance and standard insurance lies in the type of carrier and the level of regulation. E&S insurance is provided by non-admitted or unlicensed carriers, which are not subject to the same state regulations as admitted carriers. These non-admitted carriers have greater flexibility in designing insurance products and can cover a wider range of risks. However, they are not backed by the state, and any claims made against them cannot be supported by the state's guaranty fund.

The market for E&S insurance is constantly evolving, and companies must adapt quickly to changing business trends and customer needs. Specialists, also known as general agents or wholesalers, play a crucial role in linking customers, local insurance professionals, and E&S carriers. They possess strong knowledge of both local and regional insurance issues.

Aetna: Insurance Carrier Status Explained

You may want to see also

E&S insurance is not backed by state guaranty funds

E&S insurance, or Excess & Surplus insurance, is a specialty market that insures businesses and operations that standard insurance carriers won't cover due to high-risk exposures. E&S insurance is provided by non-admitted carriers, which are strictly regulated in their home states but are not licensed in the states where they provide coverage. As a result, their policies are not subject to the same form or rate regulations as standard insurance carriers, allowing them to offer coverage for unusual or excessive risks.

One key difference between standard insurance and E&S insurance is that standard insurance policies are backed by state guaranty funds, while E&S insurance is not. State guaranty funds are safety nets administered by U.S. states to protect policyholders if an insurance company defaults on benefit payments or becomes insolvent. These funds are designed to guarantee payment to insurance policyholders in the event of the insurance company's default or insolvency.

State guaranty funds only protect beneficiaries of insurance companies licensed to sell insurance products within that particular state. In the case of E&S insurance, the non-admitted carriers do not hold licenses in the states where they offer coverage, and therefore, their policies are not backed by state guaranty funds. This means that if an E&S insurance carrier becomes insolvent, policyholders cannot rely on the state guaranty fund to cover their claims or provide financial protection.

The lack of backing by state guaranty funds is an important consideration for businesses or individuals seeking E&S insurance. While E&S insurance can provide essential coverage for high-risk or unique operations, the policyholders bear the risk of the insurer's insolvency, as there is no state-backed safety net. This risk is inherent in the nature of E&S insurance and is a trade-off for the increased flexibility and coverage offered by this type of insurance.

Federated Insurance: Admitted Carrier Status

You may want to see also

Frequently asked questions

E&S insurance, or Excess and Surplus lines insurance, is a specialty market that insures businesses with high-risk or unusual risks that standard carriers won't cover.

Businesses that operate in high-risk industries such as construction, roofing, electrical work, landscaping, and tree services often require E&S insurance due to the use of hazardous equipment and working conditions. Additionally, businesses with less than three years of experience are often considered high-risk and may need E&S insurance.

E&S insurance is provided by non-admitted carriers, meaning they are not licensed in the states where they provide coverage and are not subject to the same state regulations as standard insurance carriers. This allows them to cover higher risks and set their own premiums. However, E&S insurance is typically more expensive and is not backed by state guaranty funds in case of insurer insolvency.