An insurance carrier service centre is another name for an insurance company. The terms insurer, carrier, and insurance company are used interchangeably. An insurance carrier is the company that creates and manages insurance policies and is typically the financial resource behind them. They are responsible for underwriting insurance plans and issuing payments for claims. In some cases, a carrier may not be financially responsible but instead serves as an administrator of insurance policies.

What You'll Learn

Insurance carrier vs insurance agency

An insurance carrier, also known as an insurance company or insurer, creates and manages insurance policies. They decide what the policy covers, set the limit on how much will be paid out, and take on responsibility for the policyholder's risk. They also pay out on claims. Carriers are strictly regulated by the government to ensure they have the funds to cover the risks they take on.

Insurance carriers can be classified as either mutual companies, which are wholly owned by their policyholders, or proprietary companies, which are owned by shareholders. Some examples of insurance carriers include Progressive, The Hartford, and Travelers.

An insurance agency, on the other hand, is a company or individual authorised by a carrier to sell insurance policies. Agencies do not create or underwrite policies but work to connect individuals looking to buy insurance with the companies that sell it. They are compensated for any sales they make.

There are two main types of insurance agencies: independent agencies and captive or exclusive agencies. Independent agencies offer products from a variety of carriers, while captive or exclusive agencies only sell the products of a single insurer.

Independent agents typically offer a wider variety of coverage options and can help customers find the best policy from a range of different carriers. They are not incentivised to sell coverage from any particular carrier and have their customers' best interests at heart.

Captive agents, on the other hand, have in-depth knowledge of the policies of the carrier they work for and can offer customers specialist knowledge. They are usually salaried positions with benefits and provide an opportunity to progress within the corporate sector of the insurance industry.

When purchasing insurance, it is important to understand the difference between an insurance carrier and an insurance agency. While a carrier creates and manages the policies, an agency acts as an intermediary, helping customers find the right policy for their needs and connecting them with the carrier.

Multiplan: Insurance Carrier or Not?

You may want to see also

Insurance carrier as the manufacturer

An insurance carrier is the company that manufactures and provides your insurance coverage. It is also known as an insurance company, insurer, or insurance provider. The insurance carrier creates and manages insurance policies and is typically the financial resource behind them.

Thinking of an insurance carrier as a manufacturer can help clarify its role in the insurance industry. Just as a manufacturer creates a product, an insurance carrier creates an insurance policy. This involves deciding what the policy will cover, setting limits on payouts, and determining the price. The carrier then sells its policies directly to customers or through insurance agencies.

Insurance agencies, also known as insurance agents, are like retail stores that sell the policies created by the carrier. Agencies can be independent and sell policies from multiple carriers, or they can be captive/exclusive and sell policies from only one carrier. Agencies and their agents receive commissions or salaries for selling policies and may also help customers with claims and payments.

While insurance agencies sell policies, insurance brokers help facilitate policy sales. Brokers work on behalf of the customer to find the best policy for their needs. They are experts in risk management and can provide valuable advice.

It is important to know the difference between these roles when purchasing insurance. While you may have a great relationship with your insurance agent, it is the carrier that ultimately decides on the coverage you will receive and issues the payments for your claims. Therefore, it is essential to research a carrier's reputation and financial health before signing up for a policy.

Carrier ID: Insurance's Unique Identifier

You may want to see also

Insurance carrier's role in underwriting

An insurance carrier service centre is a place where insurance underwriters work. Insurance underwriters are professionals who evaluate and analyse the risks involved in insuring people and assets. They establish pricing for accepted insurable risks.

Insurance carriers play a crucial role in the underwriting process. Underwriting is a complex process that involves evaluating and assuming the risk of future events, determining coverage amounts and premiums, and deciding whether to offer insurance. Here are some key aspects of the insurance carriers' role in underwriting:

- Risk Analysis: Insurance carriers assess the risk associated with insuring individuals or assets. They consider various factors, such as age, financial history, driving records, health conditions, property conditions, and previous claims, to determine the likelihood and magnitude of potential losses.

- Premium Determination: Carriers set the premium amounts that policyholders pay in exchange for coverage. They use specialised software, actuarial data, and algorithmic rating methods to calculate premiums based on the assessed risk.

- Policy Terms and Conditions: Insurance carriers outline the terms and conditions of insurance policies. They may impose specific conditions that policyholders must adhere to in order to maintain their coverage, such as making necessary repairs or addressing safety hazards.

- Coverage Limitations: Carriers also set coverage limitations based on the assessed risk and the specific circumstances of each case. For example, they may exclude certain types of losses or provide coverage exceptions.

- Application Evaluation: Insurance carriers review and evaluate insurance applications. They screen applicants based on set criteria, analyse their risk profiles, and use automated software to predict potential claims. This process helps them decide whether to approve or reject an application.

- Strategic Decision-Making: Carriers contribute to the insurance company's underwriting strategy. They balance portfolio growth, profitability, and product marketing considerations while managing their capacity and exposure. Their decisions can impact the company's financial performance and loss ratio.

- Collaboration and Negotiation: Insurance carriers collaborate with insurance agents, brokers, and external parties. They may negotiate with external entities while adhering to company rules and regulations. Additionally, they may need to obtain internal approval from senior underwriters or managers before finalising insurance quotes.

- Data Collection and Analysis: Carriers gather and analyse detailed information about applicants. They may request additional information, such as financial statements, property inspections, or medical documents, to make informed underwriting decisions.

- Compliance and Regulations: Insurance carriers work within the framework of insurance regulations and industry standards. They ensure that the underwriting process complies with legal and ethical guidelines, including privacy standards like HIPAA.

- Technological Advancement: Carriers are increasingly leveraging technology to streamline the underwriting process. This includes using data analytics, artificial intelligence, and specialised software to enhance the accuracy and efficiency of their risk assessments and pricing decisions.

In summary, insurance carriers play a vital role in the underwriting process by evaluating risks, setting premiums, determining coverage, and making strategic decisions. They ensure that insurance companies maintain a healthy loss ratio while providing accurate and tailored insurance policies to their customers.

Landlords: Insist on Tenant Insurance

You may want to see also

Insurance carrier's financial responsibility

An insurance carrier is another name for an insurance company. An insurance carrier service center, therefore, refers to the central offices of an insurance company that handles claims. While an agent or broker sells insurance policies, insurance carriers have offices for handling claims.

Insurance carriers have a financial responsibility to their customers, and customers should research a carrier's reputation and financial health before signing up for a policy. Financial backing may not be top of mind for customers, but it is very important. A poor rating might mean that a customer's claim doesn't get paid, which is clearly not a good situation.

Each insurance carrier should issue annual reports that provide detailed information about its financial situation. These can be used to check a carrier's rating and ensure that customers are properly protected. There are five independent rating agencies, each with its own rating system:

- AM Best

- Fitch

- Kroll Bond Rating Agency (KBRA)

- Moody's

- Standard & Poor's

It is recommended to compare the ratings from multiple agencies to get a good idea of a carrier's financial status.

In the context of motor carriers, federal and state laws require motor carriers traveling on US highways to maintain a certain level of limited liability insurance. The amount of insurance a motor carrier must have is dependent on the weight of the vehicle and the type of cargo hauled. The Federal Motor Carrier Safety Administration (FMCSA) is the governing body that regulates motor carrier interstate commerce. The FMCSA has been lobbying Congress to increase the minimum liability amounts required for motor carriers, as the rising cost of medical treatment isn't reflected in the standards set in the 1980s.

Choosing the Right Concealed Carry Insurance

You may want to see also

Finding your insurance carrier's information

An insurance carrier is the company that provides your insurance coverage. It employs your insurance agent, who handles your claims and may help set up your payments.

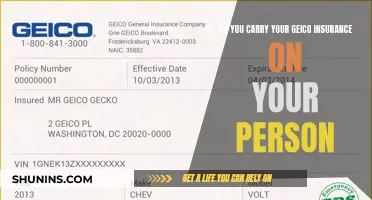

Declarations Page or Insurance Cards

The declarations page is the document you receive from the insurance company that outlines the details of your coverage, limits, and other policy information. Your insurance carrier's information should be listed on this page. Additionally, your insurance cards, which serve as proof of insurance, will also have the carrier's details. These cards are typically mailed to you by the carrier.

Contact Your Agent

If you don't have the necessary documents readily available, your insurance agent will be able to provide the carrier's information. They can guide you through the details of your policy and carrier.

Online Search

In some cases, if you purchased your policy through a large national company, you may be able to find the carrier's information through a simple online search. Catchy jingles and TV commercials can help you recall the name of the company.

Contact the Insurance Department

If you are unable to find the insurance carrier's information through the above methods, you can contact the insurance department in your state. They can provide assistance in confirming the correct name of the company or HMO and ensuring they are licensed to operate in your state.

Remember, it is important to know your insurance carrier's information, as it is the company that underwrites your policy and issues payments for your claims. Knowing the carrier's name can be helpful when filing a claim or contacting their customer service centre.

Medicare: To Carry or Not?

You may want to see also

Frequently asked questions

An insurance carrier is the company that provides your insurance coverage. It creates and manages insurance policies and is typically the financial resource behind them.

An insurance carrier service center is a place where you can go to get help with your insurance policy. It is a central office for handling claims and other customer service inquiries.

An insurance carrier creates insurance policies, decides what the policy will cover, sets limits on how much will be paid out for claims, and pays claims. You pay an insurance carrier for an insurance policy, and when something happens, you submit a claim. The carrier is then responsible for paying some or all of the damages.

You can find your insurance carrier's information on your declarations page, insurance cards, or by calling your insurance agent.