Cheating phone insurance is illegal and unethical, and it can have serious consequences. Insurance fraud is a crime that can result in fines, imprisonment, and a permanent criminal record. It's important to understand the risks and consequences before attempting to cheat phone insurance. This guide will provide an overview of the common methods used to defraud phone insurance companies, as well as the legal and ethical implications of such actions. It's crucial to remember that honesty and transparency are the best policies when it comes to insurance claims.

What You'll Learn

Identify Coverage Gaps: Understand your policy to find loopholes

To effectively "cheat" phone insurance, the first step is to thoroughly understand your policy and identify any coverage gaps or loopholes. This process requires a detailed examination of the fine print and a strategic mindset. Here's a step-by-step guide to help you navigate this process:

- Read the Policy Thoroughly: Start by reading the entire insurance policy from cover to cover. Pay close attention to the definitions of terms, the scope of coverage, and the specific conditions and exclusions. Often, the answers to your questions are hidden in the details. Look for sections related to device coverage, damage claims, and the process for filing claims.

- Identify Exclusions and Limitations: Insurance policies typically have exclusions and limitations that define what is not covered. These may include natural disasters, water damage, theft, or wear and tear. Identify these exclusions and understand the circumstances under which your claim might be denied. For example, if your phone is stolen, the insurance might require you to report the incident to the authorities and provide proof of the theft. Knowing these conditions can help you plan your strategy.

- Look for Ambiguous Language: Insurance policies often use complex language to confuse policyholders. Identify any sections with ambiguous or vague wording. These areas might provide opportunities for interpretation, allowing you to potentially exploit loopholes. For instance, if a policy states that coverage is provided for "accidental damage," you could argue that a specific incident was accidental, even if it was not.

- Understand Claim Filing Processes: Familiarize yourself with the steps required to file a claim. This includes knowing the documentation needed, the time limits for filing, and the procedures for submitting a claim. Sometimes, insurance companies might have specific requirements or forms that must be completed accurately. Understanding these processes can help you navigate them effectively and potentially avoid delays or rejections.

- Research Industry Standards: Research industry standards and common practices in phone insurance. This can provide insights into what is typically covered and how claims are processed. By understanding the general expectations, you can identify any deviations in your policy and assess whether they could be advantageous.

Identifying coverage gaps and understanding the policy's intricacies are crucial steps in the process of cheating phone insurance. It requires a meticulous approach and a keen eye for detail. While this guide provides a starting point, remember that insurance companies often have legal teams to protect their interests. Therefore, any attempt to exploit loopholes should be done ethically and responsibly, ensuring that you do not cause harm to others or violate any laws.

Santander 123 Account: Unraveling Mobile Phone Insurance Benefits

You may want to see also

Document Damage Carefully: Take detailed photos for evidence

When it comes to cheating phone insurance, one of the most crucial steps is to document the damage to your device meticulously. This process is essential as it provides evidence that can support your claim and potentially lead to a smoother resolution. Here's a detailed guide on how to approach this step:

- Immediate Action: As soon as you notice any damage to your phone, take immediate action. Do not delay, as the faster you document the issue, the better your chances of a successful claim. The initial state of the device is vital information for insurance companies, as it helps them assess the validity of your claim.

- Detailed Photography: Documenting damage with photographs is an art. Here's how to do it effectively:

- Capture multiple angles: Take photos of the damaged area from various angles. This provides a comprehensive view, allowing the insurance company to understand the extent of the damage. For example, if your screen has a crack, take photos from the front, back, and sides to show the full impact.

- Close-up shots: Use the macro mode or get close to the device to capture high-resolution images of small scratches, dents, or any other minor damage. These details can make a significant difference in the assessment process.

- Before and after images: If possible, take photos of the device before and after the damage occurred. This visual comparison can be powerful evidence, especially if the damage is subtle.

- Include the device in context: Sometimes, it's helpful to show the device in a normal setting. For instance, you can take a photo of the damaged phone alongside a ruler or a credit card to give a sense of scale.

- Note the Date and Time: When taking photos, remember to include the date and time in the metadata. This information is crucial for establishing the timeline of events, which is essential for insurance claims. Most modern smartphones and cameras automatically add this data, making it easy to include.

- Describe the Damage: Along with the photos, provide a detailed description of the damage. Note any specific characteristics, such as the type of scratch, the size of the dent, or any unusual patterns. This additional information can assist the insurance company in their assessment.

- Keep Receipts and Documentation: Along with the visual evidence, keep all relevant receipts and documentation related to the device's purchase, warranty, and any previous repairs. This additional paperwork can support your claim and provide further proof of ownership and authenticity.

By following these steps, you can ensure that your phone insurance claim is well-documented and increase your chances of a successful outcome. Remember, the more detailed and comprehensive your evidence, the better equipped you'll be to navigate the insurance process and potentially receive the compensation you deserve.

Term vs. Whole Life Insurance: Unlocking the Nuances

You may want to see also

Shop Around for Repairs: Compare prices to save costs

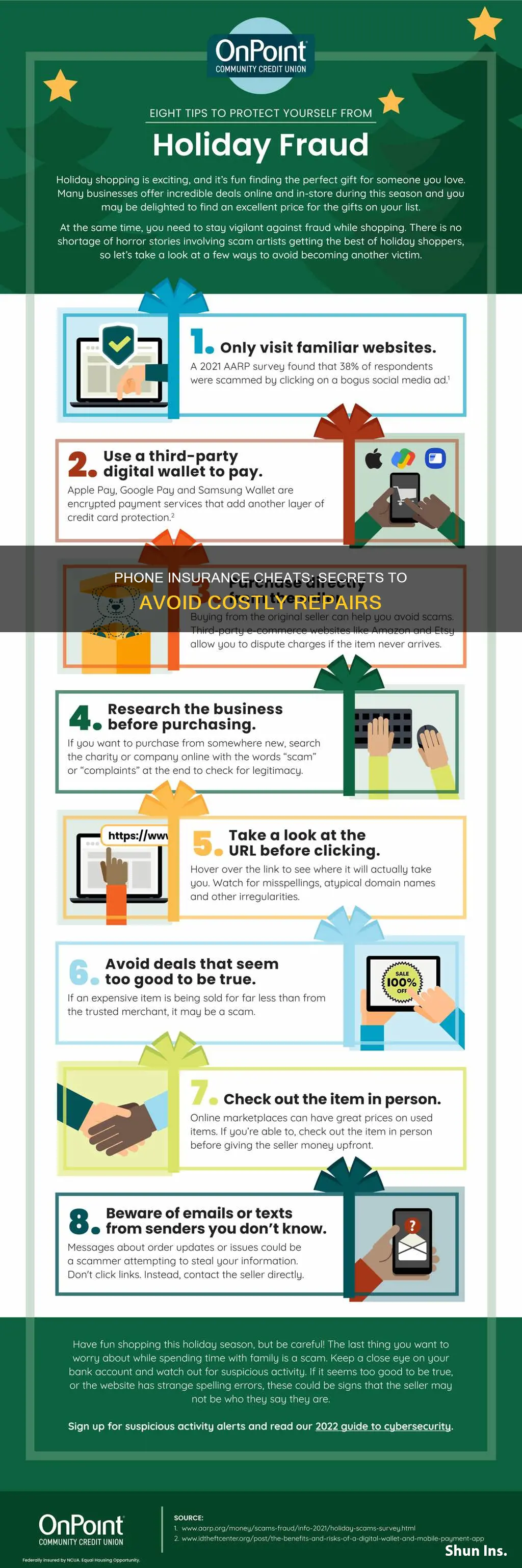

Before you consider any fraudulent activities, it's important to understand that insurance fraud is illegal and unethical. However, if you're facing high repair costs and are looking for ways to manage your expenses, here's a guide on how to shop around for phone repairs while keeping costs down:

Research and Compare Prices: Start by researching different repair shops or service centers in your area. You can use online directories, local business listings, or even ask for recommendations from friends or family. Make a list of at least three to four reputable repair shops. Contact each of these places and inquire about the repair services they offer for your specific phone model. Ask for quotes or estimates, and ensure you get a breakdown of the costs, including parts and labor. This initial step will give you a clear idea of the average prices in your region.

Online Marketplaces and Comparison Websites: Utilize online platforms that aggregate repair service providers. These websites often allow customers to post reviews and ratings, providing valuable insights into the quality of service. Compare prices and services offered by multiple providers on these platforms. Some websites might even offer tools to compare prices side by side, making it easier to identify the most cost-effective options.

Check for Discounts and Special Offers: Many repair shops offer discounts or promotions to attract customers. Keep an eye out for these deals, especially during seasonal sales or holidays. Some shops might provide discounts for students, seniors, or specific phone models. You can also inquire about any ongoing offers or loyalty programs they might have.

Consider DIY Repairs (with Caution): If you're tech-savvy and feel confident in your abilities, you might consider repairing your phone yourself. Online tutorials and video guides are readily available for various phone models. However, be cautious, as improper repairs can void your warranty and potentially cause further damage. Ensure you have the necessary tools and knowledge, or consider seeking guidance from a professional before attempting a DIY repair.

Negotiate and Ask for Alternatives: When you receive repair quotes, don't be afraid to negotiate. Many repair shops are open to discussions, especially if you're a loyal customer or have a valid reason for requesting a lower price. You can also inquire about alternative solutions, such as refurbished parts, which are often more affordable but may not come with a manufacturer's warranty.

Remember, while it's essential to manage your expenses, always prioritize the quality of the repair. Cheaper options might seem appealing, but they could lead to further issues down the line.

PPO Insurance: How Many Americans?

You may want to see also

Negotiate with Carriers: Communicate to get better deals

To effectively negotiate with phone insurance carriers and potentially save money, it's important to approach the conversation with a strategic mindset. Here's a guide on how to communicate and negotiate to get better deals:

Research and Prepare: Before initiating any negotiation, research the current market rates for phone insurance. Understand the average costs and coverage options provided by different carriers. This knowledge will empower you to recognize if you're being offered a fair deal or if there's room for improvement. Gather information about your phone's value, any recent repair costs, and your usage patterns. This data will be useful when discussing potential discounts or tailored plans.

Contact Multiple Carriers: Don't settle for the first quote you receive. Contact several phone insurance carriers and provide them with your specific requirements. Inquire about their coverage options and pricing. By comparing offers, you can identify the carriers that are more competitive and willing to negotiate. This approach also allows you to gauge the range of available deals and understand the maximum discount you might be able to secure.

Highlight Your Value as a Customer: When communicating with carriers, emphasize your loyalty and value as a customer. If you've been a long-standing client, mention this and express your interest in continuing the relationship. Carriers often appreciate customer retention and may offer incentives to keep you onboard. Additionally, discuss your phone usage habits and any specific needs or concerns you have. Carriers might provide customized solutions or discounts based on your unique profile.

Negotiate and Ask for Alternatives: Be direct and ask for better deals. Communicate your desire for a more competitive rate and inquire about any available discounts or promotions. Carriers may offer reduced premiums, extended coverage periods, or additional benefits in response to your negotiation. If they refuse to lower the price, request alternative options such as bundle packages or customized plans that suit your budget and requirements.

Consider Self-Insurance Options: If negotiations with carriers don't yield satisfactory results, consider exploring self-insurance alternatives. This could involve setting aside a dedicated fund for phone repairs and accidents. While this approach requires more financial responsibility, it can be cost-effective in the long run. Alternatively, you can research and compare third-party insurance providers who might offer more competitive rates and coverage options.

Navigating ADP Insurance Changes: A Comprehensive Guide

You may want to see also

File Claims Strategically: Time claims right to avoid suspicion

When it comes to cheating phone insurance, timing is crucial. Filing claims strategically can help you avoid suspicion and potentially increase your chances of a successful claim. Here's a guide on how to time your claims right:

Understand the Policy: Before anything, thoroughly read and understand your insurance policy. Know the terms and conditions, coverage limits, and any specific requirements for filing a claim. This knowledge will enable you to make informed decisions and avoid any potential pitfalls.

Assess the Damage: After an incident, carefully assess the damage to your phone. Take multiple photos from different angles to document the extent of the damage. If the phone is still functional, try to identify any issues and note them down. This evidence will be crucial when filing the claim.

Time is of the Essence: Insurance companies often have strict timelines for reporting and filing claims. Missed deadlines can lead to claim denial. Report the incident to your insurance provider as soon as possible. Provide them with all the necessary details, including the date, time, and location of the event. Quick reporting shows promptness and can help you get the ball rolling on the claim process.

Avoid Immediate Claim: While quick reporting is essential, avoid filing a claim immediately after the incident. Take some time to gather evidence and assess the situation. Sometimes, a second incident or a change in circumstances might occur, providing more grounds for a legitimate claim. This strategic approach can make your claim more convincing.

Be Consistent: Consistency is key when dealing with insurance claims. If you have multiple claims, ensure they are filed consistently and at the right time. Inconsistent or random claim filings might raise red flags and attract suspicion. Maintain a record of all claims and their corresponding timelines to ensure a professional approach.

Remember, cheating insurance is a serious offense and can have legal consequences. The above strategies are meant to guide you on how to navigate the insurance process effectively while maintaining honesty and integrity. Always ensure you have a valid reason for a claim and provide accurate information to the insurance company.

Negotiating Power: Strategies for Requesting Lower Insurance Premiums

You may want to see also

Frequently asked questions

No, it is not advisable or ethical to attempt to cheat or defraud insurance companies. Insurance fraud is a serious crime and can have legal consequences. It is important to be honest and transparent when making a claim to ensure you receive the appropriate coverage and support.

To maintain trust and integrity, always provide accurate and detailed information when filing a claim. Keep all necessary documentation, such as purchase receipts, repair invoices, and medical reports. If you have any doubts or concerns, consult with your insurance provider to ensure you understand the claims process and any specific requirements they may have.

Insurance fraud can take various forms, including exaggerated damage, fabricated incidents, or claiming for losses that never occurred. Be cautious if you notice any suspicious activities, such as sudden spikes in claims, inconsistent stories, or attempts to claim for high-value items without proper evidence. Insurance companies often have fraud detection teams to identify and investigate potential fraudulent activities.

Cheating phone insurance is not beneficial and can lead to severe repercussions. Insurance companies have sophisticated systems to detect fraud, and if caught, you may face legal penalties, including fines, imprisonment, and a permanent black mark on your insurance record. It is always best to be honest and explore legitimate avenues for resolving issues with your phone insurance provider.