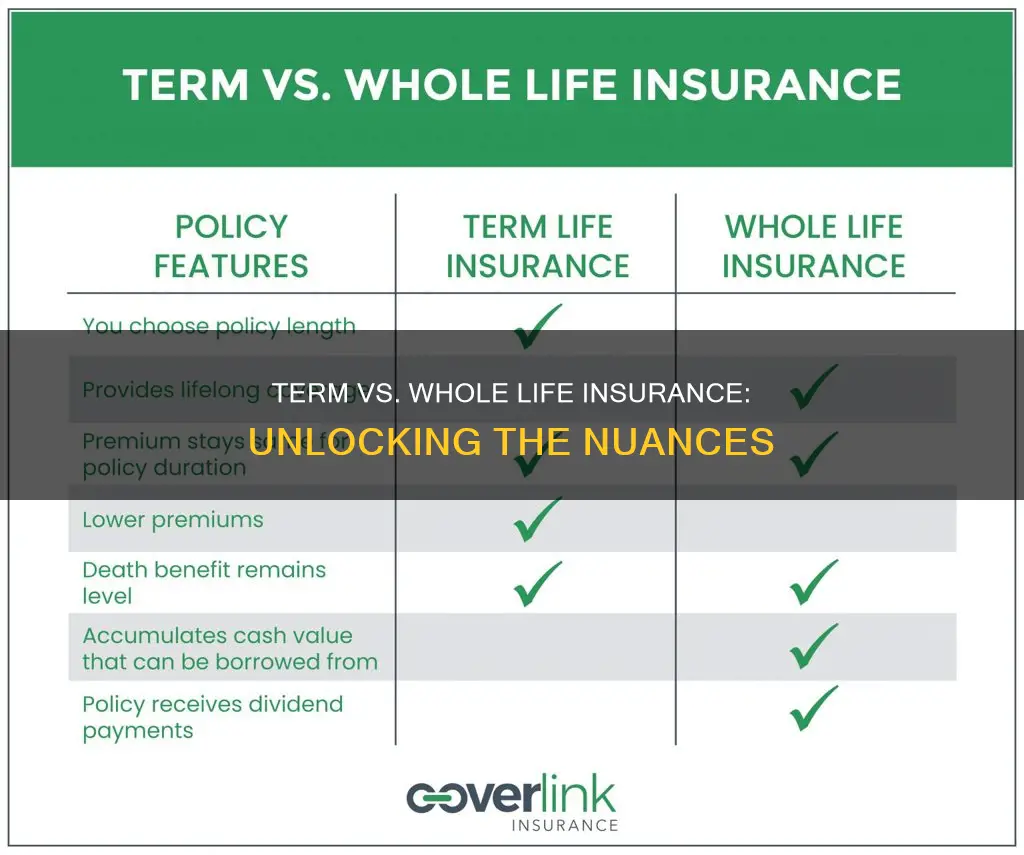

Term life insurance and whole life insurance are two of the most common types of life insurance. The main differences between the two are the length of coverage and cost. Term life insurance is cheaper but only covers you for a set period, whereas whole life insurance is more expensive but lasts your entire life. Term life insurance is a straightforward insurance option that offers basic coverage with a finite duration, making it the best option for those on a tight budget. On the other hand, whole life insurance has a savings component that grows tax-free over time and can be withdrawn or borrowed against. This makes it a more flexible option for those who want lifelong coverage and can afford the higher premiums.

| Characteristics | Values |

|---|---|

| Cost | Term life insurance is cheaper than whole life insurance |

| Coverage length | Term life insurance covers a set period of time, typically 10-30 years |

| Cash value | Whole life insurance has a cash value component that grows over time and can be borrowed against or withdrawn |

| Complexity | Whole life insurance is more complex than term life insurance due to its cash value and changing death benefit amount |

| Conversion | Some term life insurance policies can be converted to whole life insurance |

| Coverage needs | Term life insurance is suitable for temporary needs, such as covering young children or paying off a mortgage, while whole life insurance is better for lifelong needs, such as end-of-life planning and supporting lifelong dependents |

| Coverage amount | Whole life insurance costs around five to 15 times more than term life insurance for the same death benefit |

What You'll Learn

- Term life insurance is cheaper but only covers a set period

- Whole life insurance is more expensive but lasts your entire life

- Term life insurance is simpler and easier to understand

- Whole life insurance has a cash value component that grows over time

- Term life insurance is a good option for those with temporary needs, e.g. parents with young children

Term life insurance is cheaper but only covers a set period

Term life insurance is a more affordable option than whole life insurance, but it only covers the policyholder for a set period, typically between 10 and 30 years. During this time, if the insured person dies, their beneficiary will receive a death benefit payout. However, if the policyholder outlives the term, the policy expires, and no payout is made. Term life insurance is ideal for those with temporary needs, such as parents with young children or people with a mortgage. It is also a good option for those who want affordable coverage or are considering whole life insurance in the future.

In contrast, whole life insurance provides coverage for the entirety of the policyholder's life, as long as they continue to pay the premiums. This type of insurance tends to be significantly more expensive than term life insurance, with premiums that can be five to 15 times higher for the same death benefit. Whole life insurance also includes a cash value component that grows over time and can be borrowed against or withdrawn. This feature adds complexity to whole life insurance policies and increases their cost.

While term life insurance offers temporary coverage at a lower cost, whole life insurance provides lifelong protection and the opportunity to build cash value. The choice between the two depends on an individual's financial situation, goals, and specific needs.

Whole life insurance is more expensive but lasts your entire life

Whole life insurance is more expensive than term life insurance, but it lasts your entire life and can build cash value, which makes it a more complex product. Term life insurance, on the other hand, is a more straightforward type of insurance that covers you for a set number of years and does not accrue any cash value.

Whole life insurance is a form of permanent life insurance that remains in place as long as you make your payments. It has a cash value component that accrues over time, which you can access through a policy loan or a withdrawal. Whole life insurance policies have fixed premiums, and you generally pay for the duration of the policy. The cash value of a whole life policy grows at a guaranteed, fixed rate.

The main advantage of whole life insurance is that it lasts your entire life, as long as you pay the premiums. This makes it a good option for those who want lifelong coverage, such as parents with disabled children or those who want to provide an inheritance for their children. Whole life insurance also offers a guaranteed death benefit and builds cash value that can be useful later in life.

However, the main disadvantage of whole life insurance is that it is significantly more expensive than term life insurance, with premiums that can be five to 15 times higher. The complexity of whole life policies can also make them harder to understand and evaluate. Additionally, if you take out a loan or withdrawal against the cash value of your whole life policy, your death benefit will be reduced by the amount you owe.

In contrast, term life insurance is much more affordable and can be a good option for those who only need coverage for a specific period, such as while they have young children or a mortgage. Term life policies are also easier to understand and have guaranteed premiums and death benefits that remain the same throughout the term.

Ultimately, the decision between term and whole life insurance depends on your financial situation, goals, and budget. Whole life insurance may be a good choice if you want lifelong coverage, need a policy with accruing cash value, or want to use it for estate planning. Term life insurance, on the other hand, is a more affordable option that can provide temporary coverage for specific needs.

The Role of an Insurance Broker: Navigating the Complex World of Insurance

You may want to see also

Term life insurance is simpler and easier to understand

Term life insurance is also easier to understand because it has a defined death benefit for your beneficiary. It is a stripped-down form of insurance that is good for a certain period, after which the policy expires. In contrast, whole life insurance is a form of permanent life insurance that lasts your whole life and accumulates cash value that you can withdraw or borrow against while you are alive.

Term life insurance is also much cheaper than whole life insurance. Whole life insurance costs around five to 15 times more than term insurance with the same death benefit. Term life insurance is the cheapest type of life insurance, often by a wide margin.

Understanding the Insurance Coverage of Short-Term Bonds

You may want to see also

Whole life insurance has a cash value component that grows over time

Whole life insurance is a form of permanent life insurance that lasts as long as you live, provided that you pay the premiums. It also includes a cash value component that grows over time. This cash value can be withdrawn or borrowed against while the policyholder is still alive.

When you pay your premiums for whole life insurance, a portion of the payment is allocated to the policy's cash value. This cash value grows at a fixed rate of interest, which is set by the insurance company. The cash value of a whole life policy typically earns a fixed rate of interest, and interest accrues on a tax-deferred basis. This means that the cash value grows tax-free over time.

The cash value of a whole life insurance policy can be used in several ways. Firstly, it can be used to pay premiums. If there is a sufficient amount in the cash value account, the policyholder can stop paying premiums out of pocket and instead use the accumulated cash value to cover the payments. Secondly, the cash value can be withdrawn. However, if the amount withdrawn exceeds the total premiums paid, that excess amount is taxable. Finally, the cash value can be borrowed against. Interest is charged on policy loans, but the rates are generally lower than for a personal loan or home equity loan.

The cash value of a whole life insurance policy can be a useful tool for financial planning. It can be used to pay for large purchases, supplement retirement income, or fund a business. It can also be used to provide financial security for families, especially those that rely on the income of a single person.

The Intricacies of Insurance Twisting: Unraveling the Practice and Its Impact

You may want to see also

Term life insurance is a good option for those with temporary needs, e.g. parents with young children

Term life insurance is a good option for parents with young children as it is a more affordable option than whole life insurance. This is because term life insurance is temporary and has no cash value. Whole life insurance, on the other hand, is permanent and has a cash value component, which makes it more complex and expensive. Term life insurance is ideal for parents who want to ensure their children are provided for if they die prematurely.

Term life insurance is also a good option for parents with young children because it offers a guaranteed death benefit. This means that if the parent dies during the term of the policy, their children will receive a payout. This can be used to cover expenses such as funeral costs or to provide financial support for the family. Term life insurance can also be used to cover specific debts, such as a mortgage, which may be particularly relevant for parents with young children.

Another advantage of term life insurance for parents with young children is that it can be converted to whole life insurance later on. This means that parents can initially take out a term life insurance policy to cover the years when their children are dependent on them, and then switch to a whole life insurance policy when their children are older and no longer financially dependent on them. This provides flexibility and ensures that parents can get the coverage they need at different stages of their lives.

In summary, term life insurance is a good option for parents with young children because it is affordable, offers a guaranteed death benefit, and can be converted to whole life insurance later on. It provides financial protection and flexibility for families during the years when children are most dependent on their parents.

Understanding the Tax Benefits of Term Insurance: Exploring the 80C Connection

You may want to see also

Frequently asked questions

Term life insurance is more affordable but only lasts for a set period, whereas whole life insurance is more expensive but provides coverage for an entire lifetime.

Term life insurance is a good option for those seeking low-cost coverage for a specific period, such as while children are still dependent. It is straightforward, flexible, and offers similar payout amounts to whole life insurance. However, it does not offer lifelong coverage and does not include a cash value feature.

Whole life insurance offers permanent coverage and includes a cash value component that can be borrowed against or withdrawn. It also guarantees a fixed premium rate. However, it tends to be more expensive and complex, and the death benefit amount can change if there is an outstanding loan against the policy's cash value.

The choice depends on your specific needs, financial situation, and goals. If you require lifelong coverage, want a policy that builds cash value, or need to provide for lifelong dependents, whole life insurance may be preferable. If you are on a budget, only need coverage for a certain number of years, or want to supplement a whole life policy, term life insurance could be more suitable.