Term life insurance provides coverage for a set time period, typically 10, 15, 20, or 30 years. It is an affordable and simple option for those who want to provide financial protection for their loved ones for a specific number of years. The cost of term life insurance depends on various factors, including age, gender, medical history, and the term length selected. Quotes for term life insurance are typically provided on a monthly basis and can be obtained online or through an insurance agent. These quotes are estimates of the premium costs, which may vary based on individual circumstances.

| Characteristics | Values |

|---|---|

| Purpose | Provides financial security for loved ones in the event of your death |

| Coverage | Coverage for a set time period, typically 10, 15, 20, or 30 years |

| Cost | Dependent on age, gender, medical history, lifestyle, and the term length selected for the policy |

| Comparison | Term life insurance is more affordable than whole life insurance |

| Benefits | Lower costs, more coverage, tax-free payout, guaranteed protection and premium |

What You'll Learn

Term life insurance quotes are estimates of monthly premiums

Term life insurance is a type of life insurance policy that provides coverage for a specific period, known as the term. It is a simple and affordable option for those who want to give their loved ones financial security if they pass away unexpectedly during that time. The cost of term life insurance depends on factors such as age, gender, medical history, and the length of the policy term.

When considering term life insurance, it is important to get quotes from multiple insurers to find the most affordable option. Term life insurance quotes are estimates of the monthly or annual premiums you would pay for the policy. These quotes are based on information such as your age, gender, occupation, and medical history. They are not a guarantee of coverage or price, but they give you an idea of what similar policyholders in your area are paying for coverage.

By comparing term life insurance quotes, you can evaluate the features, benefits, exclusions, and costs of different policies. This helps you make an informed decision and choose a plan that best suits your needs and budget. It is recommended to get term life insurance quotes from multiple companies and compare them to find the most suitable coverage at the best rate.

Additionally, term life insurance quotes can vary based on the type of term insurance plan chosen. There are several types of term insurance plans, including Level Term Plans, Term Plans with Return of Premium (TROP), Increasing Term Plans, Decreasing Term Plans, and Convertible Term Plans. The premiums for each type of plan differ, with decreasing term plans generally being the most affordable option.

In conclusion, term life insurance quotes are essential in helping individuals understand the estimated costs and features of different term life insurance policies. By comparing quotes, individuals can make informed decisions about their coverage needs and choose a plan that provides the necessary financial protection for their loved ones.

Understanding Term Insurance: A Guide to This Essential Coverage

You may want to see also

Factors like age, gender, and health affect quotes

Age, gender, and health are key factors that affect term insurance quotes. Generally, the younger and healthier you are, the lower your insurance quote will be.

Age

The older you are, the more your term insurance quote will be. This is because the likelihood of needing to make a claim increases with age. Term life insurance is typically available for a set time period, such as 10, 15, 20, or 30 years. The length of the term will also impact the quote, with longer terms resulting in higher costs.

Gender

Women tend to pay less for term life insurance than men. This is because women generally have a longer life expectancy than men. However, gender is not the only factor that determines the price of premiums. Other factors, such as lifestyle and age, also play a role.

Health

Serious health conditions can lead to higher rates or even result in denied coverage. Mild conditions may also impact the cost of premiums. The insurance company will consider your medical history, including any past or current health problems, treatments, and prescription medications. They will also look at your height, weight, and body mass index (BMI).

In addition to your health, the insurance company may also consider your lifestyle choices, such as smoking, drinking, and drug use, and risky hobbies like skydiving or racing cars. These factors can increase your risk profile and result in higher insurance quotes.

Compare quotes from multiple insurers to find the best rates

Comparing quotes from multiple insurers is the best way to find affordable insurance that meets your needs. Here are some tips to help you compare quotes and find the best rates:

- Determine your insurance needs: Calculate your sum assured requirement by assessing your term insurance coverage needs. Sum assured is the amount payable to the nominee in the event of the policyholder's death. It should be calculated by adding up annual expenses, long-term liabilities, and subtracting any assets.

- Compare coverage of different plans: After determining your sum assured requirement, identify term plans that offer the required coverage and compare them based on inclusions and exclusions. Consider the mode of payment of the benefit as well.

- Check the terms and conditions: Insurance policies often contain fine print, so it's important to carefully read the terms and conditions of the policy. There may be a number of conditions attached to the plan that could make it a bad bargain.

- Choose the optimal plan: Avoid veering towards the cheapest premium amount without considering coverage. Low premiums usually mean low coverage, which can prove more expensive in the long run. Instead, look for a plan that offers optimal coverage at affordable rates.

- Informed Decision-Making: Comparing quotes helps identify the coverage, exclusions, features, and benefits of a plan, enabling you to make an informed decision.

- Convenience: It is more convenient to compare quotes online, as you can access multiple quotes on a single platform instead of referring to multiple documents.

- Quick Process: The availability of ready and customized information on term insurance quotes makes the process of purchasing insurance quicker and less cumbersome.

- Less Paperwork: Purchasing a term insurance plan online involves less paperwork than offline methods, as most processes are digitalized.

When comparing term insurance quotes, it's important to evaluate the following components:

- Age: Consider your age, as health risks tend to increase with age, which can impact your premium amount. This is one of the key reasons why term insurance is recommended at an early age.

- Base Premium: Base premium refers to the basic amount of premium, excluding taxes and riders. Pay close attention to the base premium, as it is influenced by your age, gender, and smoking habits. Smokers are considered higher-risk and are typically charged higher premiums.

- Riders: Evaluate the presence of riders attached to the base term insurance plan. Common optional riders include accident cover, disability cover, and critical illness cover. Choose a rider that aligns with your daily lifestyle and keep in mind that additional riders will increase your premium.

- Policy Term: Policy duration, or term, is a key factor to consider. It depends on factors such as your age, expected retirement age, current and future financial responsibilities. Remember that the total cost of your policy is influenced by the policy duration.

- Medical Test: Some insurance companies may require a medical test before issuing a term insurance policy. Medical tests are advisable because they can help reduce your premium if the results indicate good health. Even if the tests reveal a health problem, it can still be beneficial for claim settlement and avoid future issues.

- Lapse Charges: Every term insurance policy has a Policy Lapse clause, which means you could lose your term insurance benefits if you don't pay your premium within a specific time frame. Review the policy carefully to understand the lapse charges and the process for reinstating your policy.

- Tax Component: Term insurance policies typically offer tax benefits. Analyze the tax implications of your term insurance policy, such as deductions on yearly premiums and exemptions on maturity amounts, and factor them into your financial planning.

Understanding Direct Term Insurance: Unraveling the Basics of This Pure Protection Plan

You may want to see also

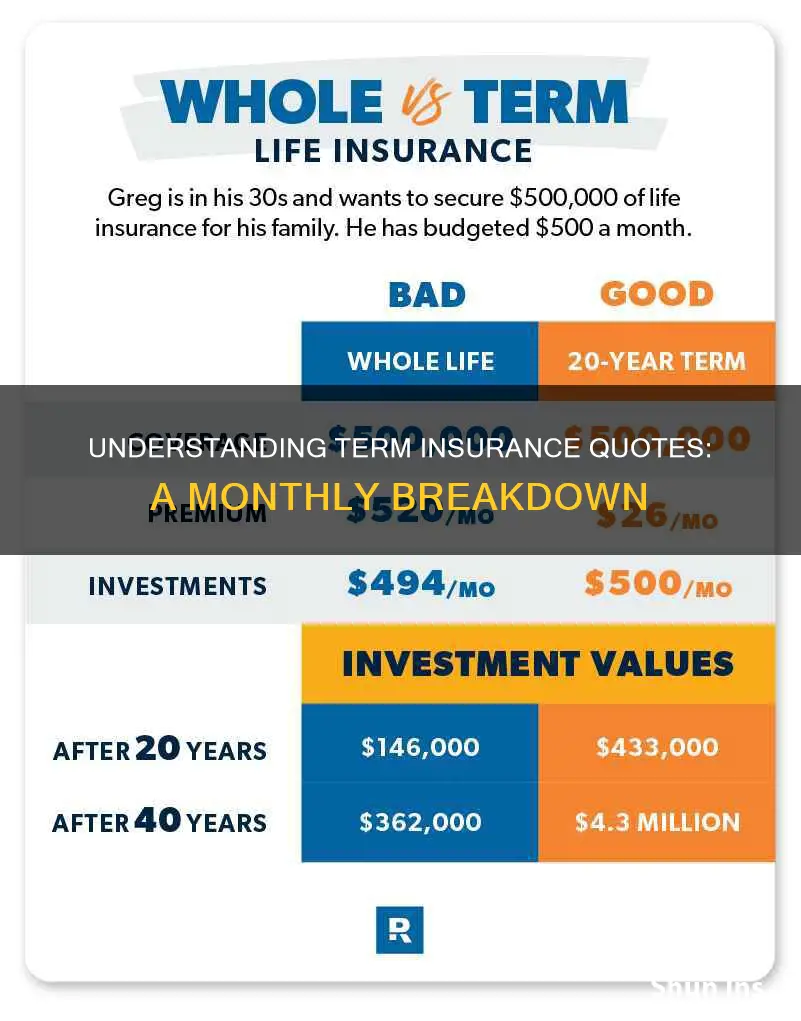

Term life insurance is more affordable than whole life insurance

Term Life Insurance is Cheaper

Term life insurance is the most basic and least expensive type of policy available. It is cheaper because it is temporary and has no cash value. Whole life insurance, on the other hand, is permanent and has a cash value component, which makes it more complex and expensive. Whole life insurance costs around five to fifteen times more than term life insurance with the same death benefit.

Term Life Insurance is Simple

Term life insurance is straightforward insurance without a savings or investing component. It is easy to understand and apply for. Whole life insurance, on the other hand, is a hybrid of insurance and investment components, making it more challenging to understand.

Term Life Insurance is Flexible

Term life insurance offers flexible coverage for a specific period, typically 10 to 30 years. You can choose the length of coverage depending on your needs. Whole life insurance, being permanent, does not offer this flexibility.

Term Life Insurance is Sufficient for Most People

Term life insurance is sufficient for most families as it provides financial protection for loved ones when they need it the most. It is also a good option for those who want to leave an inheritance or pre-pay their funeral expenses. Whole life insurance, being more expensive, may not be affordable for everyone.

Term Life Insurance is Convertible

Some term life insurance policies can be converted to whole life insurance at a later date. This is a good option for those who want permanent coverage but cannot afford it at the moment.

Understanding Extended Term Nonforfeiture: An Important Decision for Policyholders

You may want to see also

Riders and add-ons can increase term insurance quotes

Riders are add-on features that can be purchased alongside a term insurance plan. They enhance the base plan by providing additional protection or unique offerings. For example, a waiver of premium rider can be added to a term insurance policy, which would cover the cost of premiums if the policyholder becomes seriously ill, disabled, or is unable to work. Similarly, an accidental death benefit rider provides an extra payout to the policyholder's family if their death is due to an accident.

While riders provide additional benefits, they also increase the cost of the insurance policy. The cost of adding riders depends on the type of rider selected and the insurance provider. Some riders are available at a low cost, while others can significantly increase the premium. It is important to carefully consider the benefits and costs of each rider before making a decision.

- Waiver of Premium (WOP) Rider: Covers the cost of premiums if the policyholder becomes seriously ill, disabled, or is unable to work.

- Critical Illness Rider: Provides a lump-sum payout if the policyholder is diagnosed with a critical illness. There are two types: standalone riders that pay an additional amount on top of the base policy, and accelerated critical illness (ACI) riders that reduce the base sum assured.

- Accidental Death Benefit Rider: Provides an extra payout to the policyholder's family if their death is due to an accident.

- Terminal Illness Rider: Provides a cash benefit if the policyholder is diagnosed with a terminal illness and has a low chance of survival beyond a certain period.

- Life Stage Benefit Rider: Allows the policyholder to increase the sum covered in case of major life events such as marriage or having children.

- Return of Premium (ROP) Rider: Refunds the premium paid by the policyholder at the end of the policy term if they survive.

The Intricacies of Level Term Insurance: Unraveling the Meaning of "Level

You may want to see also

Frequently asked questions

A term insurance quote is an estimate of the premium price of a term insurance policy. It is not a guarantee of the final cost, as this will depend on the results of the underwriting process.

You can get a term insurance quote online by using a free quote tool or calculator, or by visiting the website of a life insurance company. You will need to provide some personal information, such as your age, gender, medical history, and the term length you want for your policy.

Several factors influence term insurance quotes, including age, gender, medical history, lifestyle habits (such as tobacco or alcohol consumption), occupation, and the desired coverage amount. The longer the policy term and the higher the coverage amount, the higher the quote is likely to be.