Auto insurance scores are ratings based on information from credit reports that insurers use to estimate how likely drivers are to file a claim. A good TransUnion auto insurance score is in the high 700s or above. TransUnion auto insurance scores, also known as TransUnion TrueRisk scores or TransUnion Insurance Risk scores, range from 150 to 950, unlike typical credit scores. TransUnion works with State Departments of Insurance to file the TrueRisk model and can also provide the appropriate documentation to carriers who are required to file directly. You can improve your auto insurance score by checking your credit reports for errors, managing credit responsibly, and building a long credit history.

| Characteristics | Values |

|---|---|

| Score Range | 150-950 |

| Score Calculation | Based on information from credit reports |

| Score Purpose | To estimate how likely drivers are to file a claim |

| Score Impact | A higher score will save you money on insurance premiums |

| Score Improvement | Improve your credit score, check for errors, manage credit responsibly, build a long credit history |

| Score Availability | Not available for free; contact LexisNexis or TransUnion directly |

What You'll Learn

- TransUnion Auto Insurance Scores range from 150 to 950

- A good TransUnion Auto Insurance Score is 770 or above

- A higher TransUnion Auto Insurance Score will save you money

- TransUnion Auto Insurance Scores are calculated using information from your credit report

- You can get your TransUnion Auto Insurance Score for free on Credit Karma

TransUnion Auto Insurance Scores range from 150 to 950

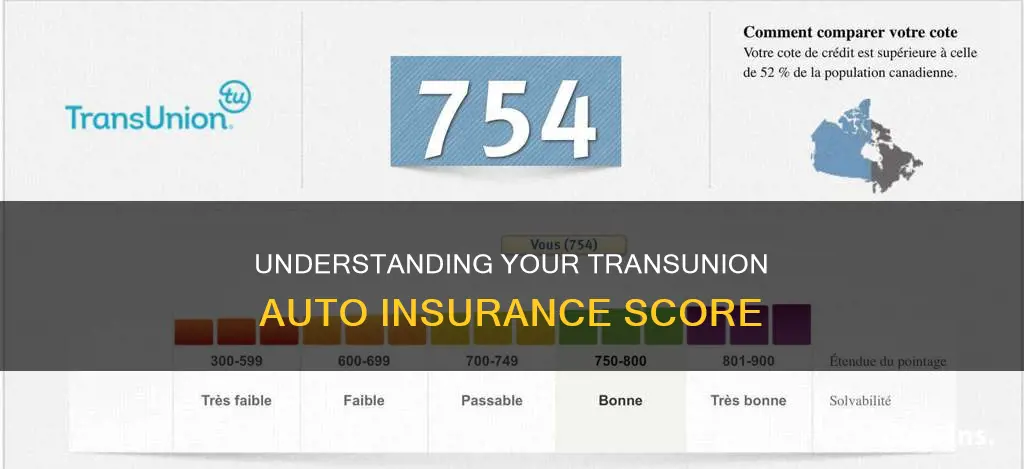

TransUnion Auto Insurance Scores, also known as TransUnion TrueRisk scores or TransUnion Insurance Risk scores, range from 150 to 950. This is unlike typical credit scores, which range from 300 to 850. A good TransUnion auto insurance score is in the high 700s or above. TransUnion considers 770 to be a good insurance score, but it's important to note that insurance companies may have different standards for what they consider a good score.

TransUnion auto insurance scores are calculated using information from your credit report, just like your credit score. However, insurance scores are designed to estimate your risk for insurers, not lenders. This means that insurance companies can use your credit data to set your premium, and a higher score will generally save you money. Therefore, improving your credit score can help raise your insurance score and decrease your car insurance premium over time.

It's worth mentioning that TransUnion is not the only company providing auto insurance scores. LexisNexis insurance scores, for example, range from 200 to 997, and FICO scores fall between 300 and 900. While a good insurance score is typically considered to be around 700 or higher, it's important to remember that each auto insurance score provider and car insurance company may have its own definition of a "good" score.

Auto Insurance Claims: Strategies to Prove Your Innocence

You may want to see also

A good TransUnion Auto Insurance Score is 770 or above

A good TransUnion Auto Insurance Score is generally considered to be 770 or above. This is a credit-based insurance score that uses TransUnion's individual-level credit data to predict the potential loss ratio for a consumer seeking an insurance policy. In other words, it estimates how likely you are to file a claim.

TransUnion Auto Insurance Scores, also known as TransUnion TrueRisk scores, range from 150 to 950, unlike typical credit scores. A score of 770 or above is a good indicator that you are a low-risk customer and will likely pay a lower insurance premium.

There are several ways to improve your auto insurance score, such as checking your credit reports for errors, managing your credit responsibly, and building a long credit history. Open accounts in good standing, low use of available credit, and no late payments are all factors that can positively impact your score.

It's important to note that auto insurance scores are not the same as credit scores. While they are largely based on the same information, they are filtered through a different lens, tailored to the insurance industry. Auto insurance scores focus on predicting your risk as an insurance client, rather than your position as a borrower.

Leasing vs Financing: Insurance Costs

You may want to see also

A higher TransUnion Auto Insurance Score will save you money

TransUnion Auto Insurance Scores, also known as TransUnion TrueRisk scores, range from 150 to 950, with a score of 770 or above considered good. These scores are calculated using information from your credit report, such as payment history and debt. A good credit score for car insurance is 700 or higher, with scores of 750 and above considered excellent.

You can check your TransUnion Auto Insurance Score for free using services such as WalletHub or Credit Karma. Checking your score is considered a soft inquiry and will not impact your credit. By monitoring your score, you can work on improving your credit health, which may result in a lower insurance premium.

Several aspects of a healthy credit history can positively impact your auto insurance score and lead to a lower premium. These include having all your open accounts in good standing, no late payments, and a long credit history. Conversely, accounts in collections, late payments, a short credit history, and a high amount of debt can negatively affect your insurance premium.

By striving for good credit, you can improve your TransUnion Auto Insurance Score and save money on your insurance premiums.

Auto Insurance Costs in Butte, MT: What to Expect

You may want to see also

TransUnion Auto Insurance Scores are calculated using information from your credit report

TransUnion Auto Insurance Scores, also known as TransUnion TrueRisk scores or TransUnion Insurance Risk scores, are calculated using information from your credit report. These scores are designed to estimate your risk for insurers, not lenders. In most states, insurance companies can use your credit data to set your premium, meaning a higher score will save you money.

TransUnion TrueRisk is an industry-leading, credit-based insurance score that uses TransUnion's individual-level credit data to predict the potential loss ratio for a consumer seeking an insurance policy. It provides unmatched predictive power, decreases no scores and no hits, and is designed to meet increasing consumer and regulatory standards.

Auto insurance scores are typically three-digit numbers calculated using information from your credit reports. They can influence your premium rate. The fact that data in your credit reports can affect your auto insurance premium may seem unfair, but studies show that there is a correlation between credit behaviour and the likelihood a consumer will file a claim. In other words, consumers with higher credit scores tend to file fewer insurance claims and, as a result, are typically given better rates.

Several aspects of a healthy credit history can positively impact your auto insurance scores. These include open accounts in good standing (no past-due accounts), low use of available credit, and no late payments. Conversely, accounts in collections, late payments, a short credit history, and a high amount of debt can all negatively affect your insurance premium.

Parents' Auto Insurance: How Long Can I Stay?

You may want to see also

You can get your TransUnion Auto Insurance Score for free on Credit Karma

Your auto insurance score is calculated using information from your credit reports, and it predicts the likelihood of you filing a claim. This score can influence your premium rate, with higher scores typically resulting in lower insurance premiums. TransUnion auto insurance scores, also known as TransUnion TrueRisk scores, range from 150 to 950, while LexisNexis insurance scores range from 200 to 997. A good TransUnion auto insurance score is usually considered to be 770 or higher.

Credit Karma provides free VantageScore 3.0 credit scores from TransUnion and Equifax, two major credit bureaus. They also offer your auto insurance score and home insurance score from TransUnion. Checking your score on Credit Karma is considered a soft inquiry, so it won't impact your credit score.

In addition to your TransUnion auto insurance score, Credit Karma also provides free credit reports from TransUnion and Equifax. These reports may be updated as often as every week, allowing you to quickly identify any signs of possible identity theft.

By regularly checking your TransUnion Auto Insurance Score on Credit Karma, you can stay informed about how insurers may assess your risk as a consumer. This knowledge can help you make informed decisions about your auto insurance and take steps to improve your score if needed.

Understanding Vehicle Insurance Surcharges

You may want to see also

Frequently asked questions

You can check your TransUnion auto insurance score for free on Credit Karma.

A good TransUnion auto insurance score is in the high 700s or above. TransUnion considers 770 to be a good insurance score.

You can improve your TransUnion auto insurance score by improving your credit score, as the two are closely linked. This means paying bills on time, having low credit utilisation, and making other good choices.

A higher TransUnion auto insurance score will generally lead to a lower premium. This is because a higher score means you are less likely to file a claim.

While your auto insurance score is based on your credit score, the two are not the same. Your auto insurance score is specifically designed to estimate your risk for insurers, whereas your credit score is used by lenders to assess your position as a borrower.