Creating a life insurance website can be a daunting task, but with the right tools and strategies, it can be a seamless process. Whether you're an independent agent or part of a larger agency, an effective website is crucial to reaching potential customers and guiding them through the often confusing and sensitive process of choosing a life insurance provider. In this discussion, we will delve into the key considerations for building a life insurance website, exploring topics such as design, functionality, and marketing strategies to ensure your online presence is professional, engaging, and successful in generating leads and sales.

| Characteristics | Values |

|---|---|

| Website Builder | 10Web, B12, AgentMethods, Mobirise, Weblium |

| Website Design | Cohesive, modern, responsive, user-friendly, SEO-friendly |

| Website Content | Tailored, dynamic, educational, informative, conversion-oriented |

| Website Features | Calculator, quote form, blog, testimonials, contact form, CRM, live chat, payment gateway |

| Security | SSL encryption, DDoS protection, advanced security measures |

| Maintenance | AI-driven, automated, customizable, drag-and-drop editor, seamless integration |

What You'll Learn

Using AI to generate content, images, and videos

AI can be used to generate content, images, and videos for a life insurance website. AI tools can save time and money, increase efficiency and productivity, and boost content scalability. For example, using AI, you can generate an article in less than a minute, which is significantly faster than writing it manually. This can also save costs, especially if you usually pay someone else to create content for you.

AI tools can also ensure that your content is well-structured, engaging, and error-free. You can also use AI to create different types of content, such as text, audio, and images, within a matter of minutes. This can be particularly useful for creating visual content, as image editing and video creation can be expensive and time-consuming.

AI can be used to generate content for your life insurance website by providing keywords or a free-text description of what you need. The software will then create content tailored to your requirements. For instance, you can use AI to generate a full website, including tailored content, images, and a unique layout, based on your input. This ensures that your site is visually appealing and aligned with your goals and audience expectations.

Additionally, AI can be used to create a coverage calculator for your life insurance website, providing quick, personalized calculations directly on your site, enhancing user engagement. You can also use AI to create a resource section with articles, videos, and FAQs about life insurance policies, terms, and benefits, positioning your agency as an authority in the field.

However, it is important to note that AI-generated content may lack creativity and a personal touch. It is recommended to review and append the content created by AI to add a human touch and ensure quality.

Life Insurance: Your Unsung Asset Hero

You may want to see also

Making the website mobile-friendly

Implement a Responsive Layout:

A responsive layout is essential to make your website adaptable to different screen sizes and devices, including mobile phones and tablets. This ensures that your website rescaless itself to fit the user's device, without any rendering issues. A responsive design works well for both mobile and desktop platforms, as it changes its appearance accordingly. You can use tools like BrowserStack Responsive to test the responsiveness of your website during development.

Optimize for Mobile Speed:

Speed is critical in creating a positive first impression. Most users expect websites to load within a few seconds, and slow loading times can lead to a higher bounce rate. To optimize for speed, consider hosting videos on third-party sites and embedding them on your site. Additionally, compress images to reduce file sizes and improve downloading speeds. You can use tools like Kraken.io for image compression.

Subtle Pop-Up Implementation:

While pop-ups are common on desktop versions of websites, they can be disruptive and challenging to manage on mobile devices. If you must use pop-ups, implement them subtly. For example, trigger the pop-up when the reader scrolls down a certain percentage of the page, and ensure the close button is easily visible. Match the pop-up design to a mobile-optimized template, and make sure any call-to-action buttons are clear and actionable.

Incorporate Viewport Meta Tag:

Adding the viewport meta tag to your website's code lets developers control the viewport's width and scaling, ensuring the website is sized correctly on all devices. This tag instructs the browser to resize the webpage width according to the device screen size. Here's the code snippet to add:

Declutter Your Web Design:

A cluttered website with too many functionalities on one page can be confusing and challenging to navigate on mobile devices. Offer only the critical functions upfront, and opt for a neat, minimalist design. You can incorporate the "Hamburger" button, which allows mobile users to access the entire menu with a single click, improving navigation and visual appeal.

Test on Real Mobile Devices:

It's essential to test your website on various real mobile devices, including both iOS and Android platforms. This will help you identify and resolve any issues users may encounter in real-world conditions. Test across different browsers and device-OS combinations to ensure a seamless experience for all your users.

By following these steps, you can create a mobile-friendly life insurance website that provides a smooth and engaging experience for your users, regardless of their device.

Life Insurance: Understanding Payout Timelines and Delays

You may want to see also

Adding a coverage calculator

Understanding the Purpose

The coverage calculator is a tool that will enable your clients to estimate their insurance needs directly on your website. It empowers users to make informed decisions about their coverage requirements, providing quick and personalized calculations. This feature not only improves user experience but also establishes your website as a go-to resource for insurance-related queries.

Types of Calculators

When adding a coverage calculator, consider the specific insurance products you offer. For instance, you may want to include a life insurance calculator, health insurance calculator, or both. You can also provide calculators for other insurance types, such as car insurance or homeowners insurance, if relevant to your business.

Calculator Features

Ensure your coverage calculator is easy to use and provides accurate calculations. Allow users to input their personal information, such as age, health status, and family details, to receive tailored estimates. Consider including interactive elements, such as sliders or dropdown menus, to make the process engaging and intuitive.

Visual Design

The visual design of your coverage calculator should be consistent with the overall look and feel of your website. Ensure it aligns with your branding and colour schemes. Consider using graphics or charts to present the calculation results in a visually appealing way.

Integrating with Your Website

When adding the coverage calculator to your website, ensure seamless integration. It should be easily accessible from relevant pages, such as the homepage, service pages, or a dedicated resources section. You may also want to include a prominent call-to-action (CTA) button that encourages users to utilize the calculator.

Testing and Feedback

Once you've added the coverage calculator, test it thoroughly to ensure accuracy and functionality. Seek feedback from users and make adjustments as needed. Regular maintenance and updates will ensure the calculator remains reliable and beneficial to your clients.

By following these steps, you can create a valuable coverage calculator that enhances your life insurance website and provides your clients with a powerful tool to estimate their insurance needs.

Life Insurance Traps: Can Trail Commissions Be Revoked?

You may want to see also

Simplifying the quote process

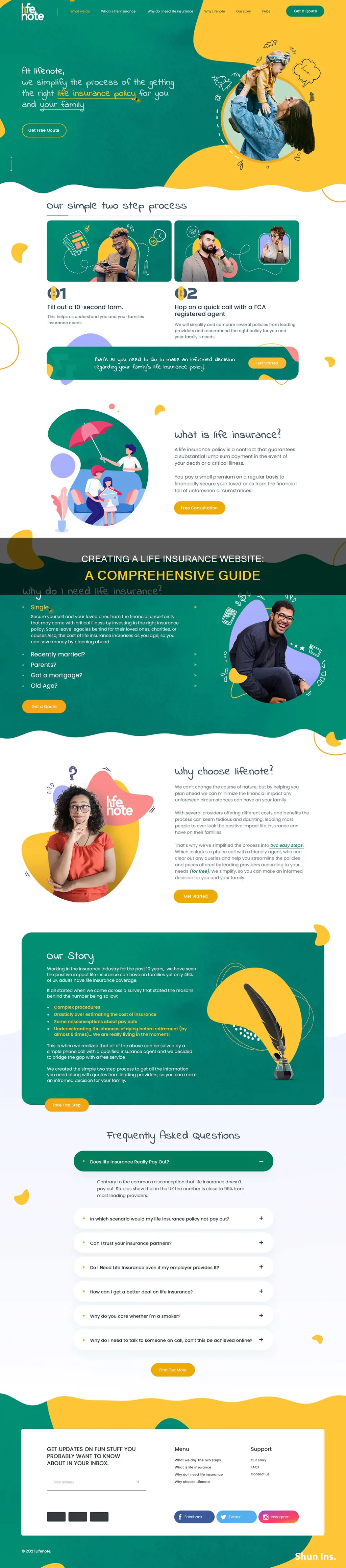

Implement an Intuitive Quote Form

Design an easy-to-use and intuitive quote form that is straightforward and requires minimal steps to complete. Avoid overwhelming potential clients with complex procedures or excessive information requests. Keep the form simple, clear, and concise, asking only for the essential information needed to generate a quote. This approach will lower the barrier to entry and increase the likelihood of users engaging with your quote process.

Drag-and-Drop Form Builder

Utilize a drag-and-drop quote form builder to create customizable forms tailored to your specific needs. This functionality allows you to easily adjust and refine your quote form as needed. By offering flexibility in form design, you can ensure that you capture all the necessary details while also providing a user-friendly experience. This feature is provided by platforms such as AgentMethods, which specializes in life insurance website design.

Instant Quotes with No Personal Contact Information

Provide users with instant quotes by leveraging an online quote engine or calculator. This allows users to compare rates from different insurance companies without having to submit their personal contact information. For example, LifeInsure.com offers instant term life insurance quotes without requiring users to speak to an agent or disclose their personal details. This approach respects users' privacy and saves them time in their decision-making process.

Educational Resources

Establish your website as an authoritative source of information by offering educational resources that explain the different types of life insurance, their benefits, and the application process. This can take the form of articles, videos, FAQs, and other informative content. By empowering users with knowledge, you not only build trust but also enable them to make more informed decisions about their insurance needs.

Mobile Optimization

Ensure that your quote process is fully optimized for mobile devices, offering a seamless experience for users on-the-go. With the increasing usage of mobile internet, a mobile-friendly site is crucial for reaching potential clients wherever they are. Make sure your website is responsive and adaptable to various screen sizes and device types, providing an optimal user experience regardless of their browsing platform.

Group Term Life Insurance: Taxable or Not?

You may want to see also

Showcasing customer testimonials

Customer testimonials are an essential aspect of your life insurance website, providing social proof of your agency's expertise, reliability, and ability to meet client needs. Here are some strategies for showcasing customer testimonials effectively:

Collect a Range of Testimonials:

Diversify your testimonials by collecting feedback from a variety of clients with different backgrounds, demographics, and experiences. This approach ensures that prospective customers can relate to the testimonials and trust that your agency can cater to a wide range of situations. Aim to gather testimonials from clients of different ages, genders, locations, and financial circumstances.

Highlight Specific Benefits:

Choose testimonials that highlight specific benefits your agency provides. For example, testimonials might speak to your agency's ability to provide prompt customer service, simplify complex processes, offer competitive rates, or provide personalised advice. By showcasing testimonials that cover a range of benefits, prospective customers can better understand the advantages of choosing your agency.

Include Detailed Stories:

Instead of vague testimonials, aim for those that share specific stories and experiences. For instance, a testimonial might detail how your agency helped a client increase their coverage, resolve an underwriting issue, or choose the most suitable policy for their unique situation. These detailed stories add credibility and illustrate the human impact of your agency's work.

Feature Testimonials Prominently:

Ensure that your website design includes a dedicated and easily accessible page for customer testimonials. Don't bury the testimonials at the bottom of the page or hide them behind multiple clicks. Prospective customers should be able to find them quickly and easily. Additionally, consider featuring select testimonials on your homepage or in prominent sections of other pages to reinforce the message of your agency's quality and reliability.

Use Testimonials in Marketing Materials:

Incorporate customer testimonials into your marketing campaigns and promotional content. Include testimonials in social media posts, email newsletters, or even offline marketing collateral. By integrating testimonials into your marketing efforts, you reinforce the positive experiences of your clients and create a cohesive message across all touchpoints with potential customers.

Regularly Update Testimonials:

Maintain a fresh selection of testimonials by regularly collecting and adding new ones to your website. This practice ensures that prospective customers see recent feedback and know that your agency continues to deliver exceptional service. It also demonstrates that you are actively engaged with your clients and value their feedback.

By following these strategies, you can effectively showcase customer testimonials on your life insurance website, building trust, credibility, and a positive reputation for your agency.

Life Insurance: A Dependent's Safety Net and Financial Security

You may want to see also

Frequently asked questions

A life insurance website can bring in new customers through search engines, social media, and other online channels. It can also help close sales with existing prospects by serving as a marketing and sales assistant, keeping them engaged and educating them on the options available.

You can create a life insurance website by choosing a unique domain name, selecting a hosting provider, and installing a life insurance template. You can then customise the template with your branding, content, images, and contact information. Alternatively, you can use a website builder platform, such as Weblium, which provides templates and tools to help you build and launch your site.

How do I make my life insurance website stand out?