Cancelling your car insurance is a relatively straightforward process, but it's important to follow the correct steps to avoid penalties and issues with lapsed coverage. The first step is to get in touch with your insurance provider or agent, which can often be done over the phone. You'll need to know the date you want the cancellation to be effective from, and you may be required to sign a cancellation form or provide written notification. It's also important to have a new insurance policy in place before cancelling your old one to avoid a lapse in coverage, which could result in fines and higher future premiums. Once you've cancelled your policy, your insurer will likely send you a prorated refund for the remainder of the term, minus any cancellation fees.

| Characteristics | Values |

|---|---|

| Method | Phone call, email, postal mail |

| Timing | Any time, but best before the end of the policy period to avoid fees |

| Requirements | May need to sign a cancellation form or provide a cancellation letter |

| Overlapping policies | Get a new policy before cancelling the old one to avoid a lapse in coverage |

| Confirmation | Request a policy cancellation notice |

| Fees | May be charged a cancellation fee |

| Refunds | May be refunded for the unused portion of the policy |

What You'll Learn

Cancelling auto insurance: what to do and what not to do

Cancelling your auto insurance is a straightforward process, but there are some important steps to follow to avoid penalties and higher premiums in the future. Here's a guide on what to do and what not to do when cancelling your auto insurance.

What to do:

- Get a new policy first: Before cancelling your current auto insurance, it's crucial to arrange for alternative insurance coverage to avoid a lapse in coverage. This is because almost all states require some form of liability insurance for drivers. Having a gap in coverage may result in higher premiums in the future.

- Contact your insurer: Reach out to your insurance provider or agent to initiate the cancellation process. You can do this by calling, mailing, faxing, or visiting their office, depending on their specific requirements.

- Provide necessary information: When contacting your insurer, know the date you want the cancellation to be effective and provide all the necessary information, such as your full name, address, policy number, and requested cancellation date.

- Request a cancellation notice: Ask for a policy cancellation notice or confirmation to ensure that your policy has been formally cancelled. This documentation can be helpful if any issues arise in the future.

- Understand fees and refunds: Review your policy to understand any cancellation fees, refund policies, or notice requirements. Your insurer may charge a cancellation fee, and if you've paid your premium in advance, you may be eligible for a prorated refund for the unused portion of your policy.

What not to do:

- Don't let your policy lapse: Failing to notify your insurer about cancelling your policy can have negative consequences. They may continue to bill you, and your credit score may be affected if they report your failure to pay to credit bureaus.

- Don't cancel without a valid reason: While you can cancel your auto insurance at any time, consider whether you have a valid reason for doing so. For example, switching to a less expensive policy, moving to a new state, or having an unpleasant experience with your current insurer are all valid reasons for cancellation.

- Don't forget to update your lender: If you have an outstanding car loan or lease, remember to notify your lender that you have changed insurers. This is an important step to ensure you remain in compliance with the terms of your loan or lease agreement.

The Perks of Staying on Your Parent's Auto Insurance: Understanding the Timeline and Benefits

You may want to see also

How to avoid a lapse in coverage when cancelling auto insurance

Cancelling your car insurance policy can be a straightforward process, but it's important to take steps to avoid a lapse in coverage. A break in insurance coverage, even if it's just for a few days, can have significant consequences. Here are some tips to help you avoid a lapse when cancelling your auto insurance:

Understand the risks of a lapse

Before deciding to cancel your auto insurance, it's crucial to understand the risks associated with a lapse in coverage. Even a short gap of a few days can result in higher insurance rates in the future, as insurers will view you as a high-risk driver. Additionally, driving without the required minimum insurance coverage is illegal in almost every state and can lead to fines, license suspension, or even jail time.

Have another policy in place

To avoid a lapse in coverage, the best practice is to have another insurance policy in effect before cancelling your existing one. Contact other insurance companies and shop around for a new policy that meets your needs. By doing this in advance, you can ensure there is no gap between policies.

Align the dates

When setting up your new policy, try to align the start date of the new policy with the cancellation date of the old one. This will ensure continuous coverage and help you avoid the penalties and risks associated with a lapse.

Notify your current insurer

Once you have a new policy in place, contact your current insurance company to initiate the cancellation process. Depending on the company, you may be able to cancel over the phone, online, or through a signed document. Be sure to clarify any cancellation fees and refund policies.

Avoid driving without insurance

If you need to cancel your insurance but don't have a new policy in place yet, refrain from driving. Driving without insurance is not only illegal but can also lead to significant financial risk if you're involved in an accident.

Consider alternatives to cancellation

If you're considering cancelling your auto insurance due to financial constraints, there are other options to explore. You can shop around for cheaper policies, ask about discounts, reduce your coverage, or raise your deductible to lower your premium.

By following these steps, you can help ensure a smooth transition when cancelling your auto insurance and avoid the negative consequences of a lapse in coverage.

Auto Insurance Licens: Does it Extend to Your Home?

You may want to see also

Cancelling auto insurance: the consequences

Cancelling your auto insurance can have several consequences, and it is important to be aware of these before going ahead. The most significant outcome is that you will no longer have insurance coverage. This means that if you are in an accident and found to be at fault, you will be required to pay out-of-pocket for any damage or injuries caused. This could result in substantial costs.

In almost all states, a minimum amount of auto liability coverage is required by law, so driving without insurance could result in fines, suspension of your license, or even jail time. A lapse in coverage may also make it more difficult and expensive to purchase a new policy in the future, as providers may consider you a higher risk.

To avoid these consequences, it is advisable to purchase a new policy before cancelling your existing one, ensuring there is no gap in coverage. You should also be aware that cancelling your policy may incur fees, and you may be required to sign a cancellation form or letter.

Progressive Auto Insurance: What Massachusetts Drivers Need to Know

You may want to see also

Reasons for cancelling auto insurance

There are several reasons why you may want to cancel your auto insurance. Here are some common reasons:

Switching Insurance Providers

You may have found a better deal with another insurance company that offers cheaper rates or more suitable coverage. It is a good idea to shop around for insurance coverage and compare premiums to get the best deal.

Cancelling Coverage You No Longer Need

If you have subscribed to another service like AAA, you may want to cancel specific coverage features, such as roadside assistance, to save money.

Selling Your Car

If you no longer plan to drive, you will not need car insurance. However, if you are driving a different vehicle, you can simply update your existing policy instead of cancelling and taking out a new one.

Moving to Another State

Insurance laws vary by state, so you may need to change your policy or insurance company to meet the local minimum requirements.

Changing Your Marital Status

Married couples often pay different rates than single drivers, so you may need to update or cancel your coverage after marriage or divorce.

Putting Your Vehicle in Storage

If you do not plan on driving your car for an extended period, you may want to cancel your policy or buy reduced coverage.

Bundling Policies

You may be able to get a better deal by cancelling your current auto insurance and bundling your policy with another company that also provides your homeowners or renters insurance.

It is important to note that state laws may require you to maintain a certain level of insurance coverage, even for stored vehicles. Cancelling your auto insurance can also result in higher rates in the future, as insurance companies may consider you a higher risk. Therefore, it is recommended to have another policy lined up before cancelling your current one.

Understanding Auto Insurance Fraud

You may want to see also

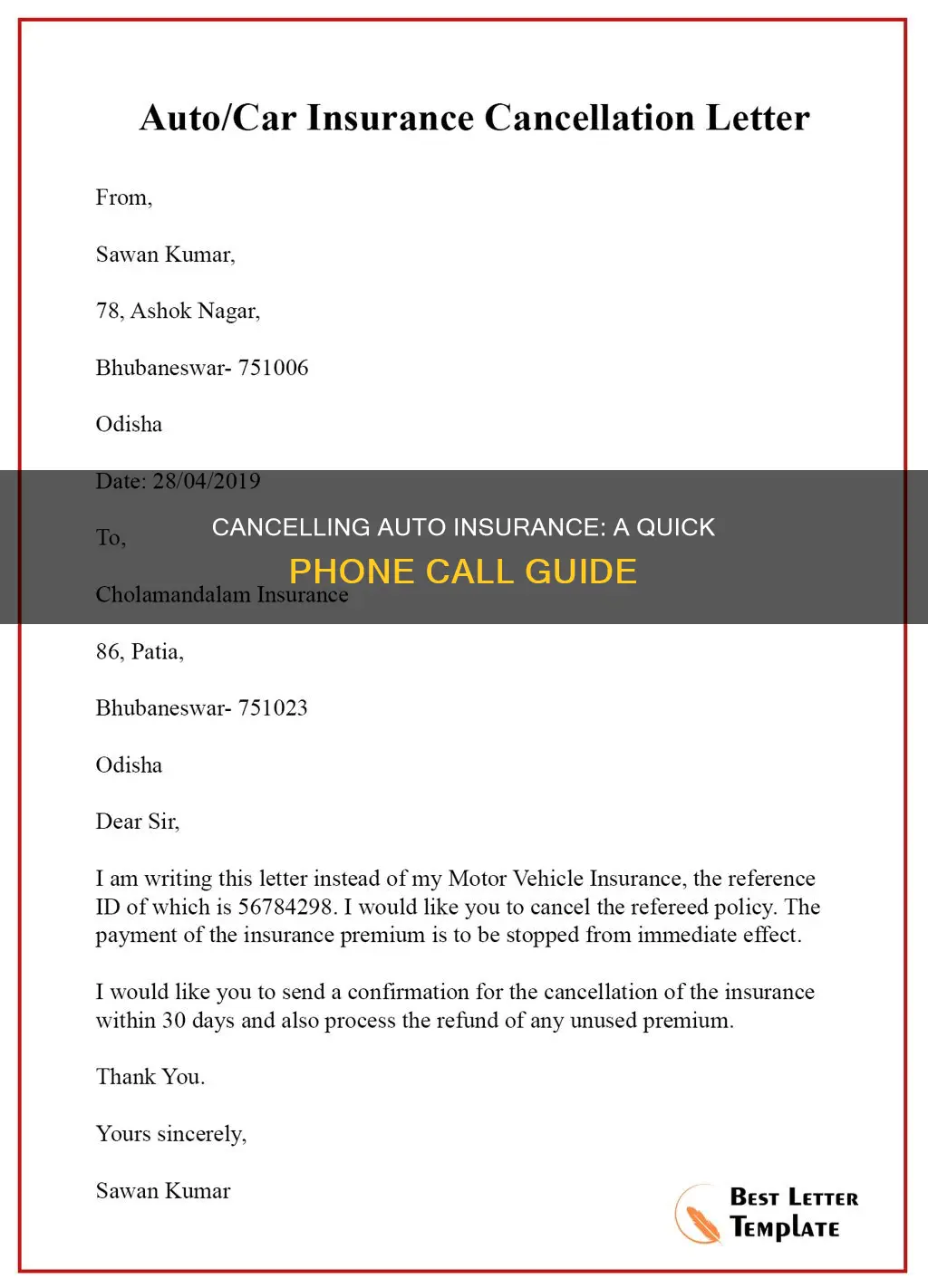

The best way to cancel auto insurance over the phone

The best way to cancel your auto insurance over the phone is to follow the steps outlined below:

Firstly, it is important to understand that you can cancel your auto insurance policy at any time and for any reason. However, before initiating the cancellation process, it is advisable to purchase a new insurance policy to avoid a lapse in coverage, which could increase your future insurance rates.

Once you have a new policy in place, contact your current insurance provider or agent by calling them. This is usually the quickest method to end your policy, but some insurers may require additional steps, such as signing a cancellation form or providing written notification. Ask your agent about their specific cancellation process and any requirements they may have. It is also important to find out if there are any cancellation fees or refunds for unused premiums that may apply.

After initiating the cancellation, be sure to request a policy cancellation notice for your records. This confirms that your policy has been formally cancelled. If you are owed a refund, your current insurer should also refund any pre-paid premiums minus cancellation fees.

Finally, remember that nearly all states require drivers to have a minimum amount of auto liability coverage. Therefore, ensure that your new policy is in effect with another insurer before completely cancelling your existing policy to avoid legal and financial risks.

Enterprise Auto Insurance Checks

You may want to see also

Frequently asked questions

Yes, you can cancel your auto insurance by calling your insurance company or agent. Depending on your insurance company, you may be able to cancel right over the phone.

When contacting your insurance company or agent, know the date you want the cancellation to be effective. You may also need to provide your full name, address, auto policy number, and the date of the requested cancellation.

Your insurer will likely notify your state that you and your vehicle are no longer insured. Your state's Department of Motor Vehicles may ask you for proof that you either sold the vehicle or have obtained other insurance. You may also receive a prorated refund for the remainder of the policy term, minus any cancellation fees.

Cancelling your auto insurance can result in a gap in coverage, which can make it more difficult and expensive to get insurance in the future. It can also lead to fines and jail time for driving without insurance. Additionally, your insurance company may charge a cancellation fee.