Filling out insurance information on a bill can be a complicated and jargon-filled process, but it's important to do it correctly to ensure your claim is accepted. The first step is to obtain an itemized bill from your doctor or medical provider, which will list every service you received, the cost, and a special code for the insurance company. Next, you'll need to complete a claim form, providing personal information, insurance details, the reason for your visit, and any out-of-pocket expenses. It's important to include as much detail as possible to ensure your expenses are covered by your insurance plan. Making copies of your claim and keeping records is also essential in case there are any issues or disputes with your claim. Once you've gathered all the necessary information and documents, you can submit your claim form and wait for a response from your insurance company.

| Characteristics | Values |

|---|---|

| What to do when you receive a bill | Call the doctor or hospital and ask them to bill your insurance company. Give them the information on your insurance card/certificate. |

| What to do if the hospital refuses to send the bill | Fill out the Blue Care Network Member Reimbursement Form. Fax or mail it following the directions on the form. |

| What to include in the form | Insurance policy number, member number or group plan number; name of the patient; whether or not you have dual coverage or coinsurance; the reason for the treatment. |

| What to attach to the form | An itemized bill and receipts. |

| What to do after filling out the form | Make copies of everything. |

| How to submit the form | Submit the form online or by mail. |

What You'll Learn

Understanding your medical bill

Medical billing can be a confusing process, but it's important to understand what to expect financially when you need to go to the doctor. Here's a guide to help you understand your medical bill and navigate the billing process.

What Medical Bills Cover

The fees on your medical bill may seem arbitrary, but several factors influence how hospitals, physicians' offices, and other institutions calculate the cost of health services. These include facility capacity, supply and demand, hospital reputation, and charge description master (CDM) lists. CDM lists are master lists of service costs and billing codes that medical professionals use during the claims process to calculate how much to bill insurance companies and patients.

The Billing Cycle

The billing cycle starts when you contact a healthcare provider and provide basic information such as identification and insurance details. The provider then contacts your insurance company to verify coverage and determine how much you will need to pay out of pocket. After receiving services, medical coders identify all the services, prescriptions, and supplies you received and update your records with corresponding service codes. The provider then creates an insurance claim using these codes and submits it to your insurance company.

Your Role in the Process

It's important to stay informed throughout the billing process. When scheduling an appointment, ask about the services and supplies you'll receive and the associated costs. Contact your insurance company to confirm coverage and get an estimate of how much the services will cost with your plan. If the cost is not manageable, ask if there are other providers in your area who offer the same services for less.

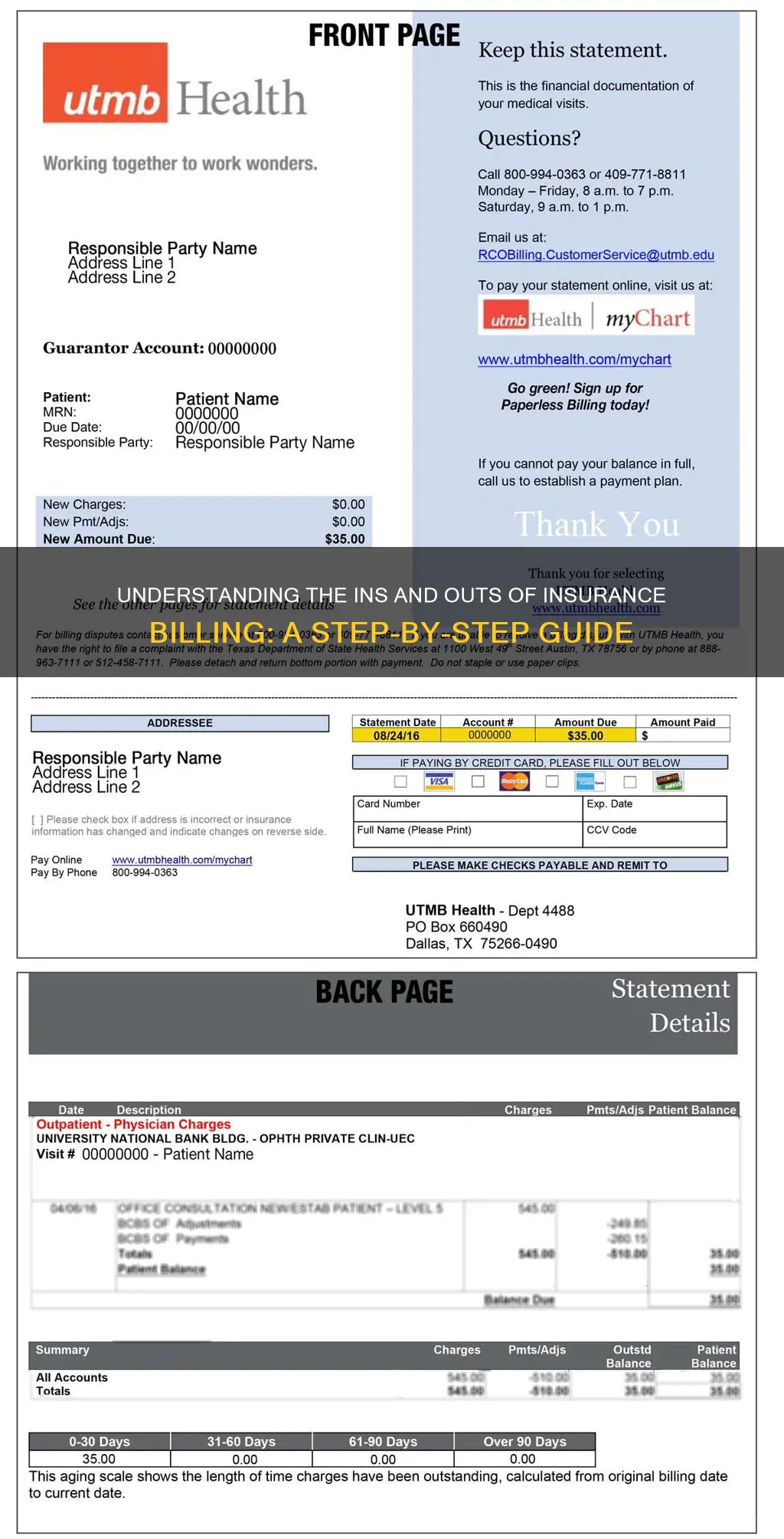

Understanding Your Bill

Your medical bill will typically include the dates of service, a description of the services provided, the full price of the services before insurance, any adjustments, insurance payments, patient payments, and the total amount due. It's important to review your bill carefully and compare it to the list of services you received to ensure accuracy and avoid billing errors, which are common. Look for duplicate charges, incorrect codes or diagnoses, and charges for services you didn't receive. If you find any discrepancies, contact your healthcare provider's billing office to resolve the issue.

Explanation of Benefits (EOB)

In addition to your medical bill, you may receive an Explanation of Benefits (EOB) from your insurance company. This is not a bill but a report explaining how your insurance company handled the claim submitted by your healthcare provider. The EOB will show what services were covered, the amount paid to the provider, and what you may owe. Compare the information on the EOB to your medical bill to ensure they match. If there are any discrepancies, contact your insurance company for clarification.

Dealing with Billing Errors

Billing errors are not uncommon, so it's important to monitor your bills and EOBs closely. Compare estimates provided before your appointment to the final bill to identify any discrepancies. Create a list of charges to help identify incorrect charges in the future. Look out for duplicate charges, upcoding (fraudulently reporting an incorrect diagnosis to increase payment), and incorrect identifying information. If you notice any errors, contact your healthcare provider's billing office to resolve the issue. If necessary, you can also contact your insurer or a credit-reporting agency for further assistance.

Term Insurance: Uncovering the Human Story Behind the Numbers

You may want to see also

Collecting itemised receipts

- Obtain Itemised Receipts: Contact your doctor, medical provider, or relevant service provider and request an itemised bill. This bill should list every service provided, along with the associated costs. This includes medications, lab tests, radiology exams, and any other relevant charges. Ensure that you receive an itemised receipt rather than a simple receipt, as the former provides a more comprehensive breakdown of costs.

- Understand the Contents of the Receipt: Itemised receipts typically include the name and contact information of the business or service provider, a description of each item or service, the price of each item, and applicable taxes, fees, or discounts.

- Make Copies: It is essential to make copies of all itemised receipts. This serves as a backup in case the original receipts are lost or damaged. Having copies will also help you keep track of your expenses and facilitate the insurance claim process.

- Organise and Store the Receipts: Create a dedicated file or folder specifically for these receipts. Ensure that you keep all the receipts together in one place for easy access. You can use digital scanning apps or software to digitise and organise your receipts, making them easier to retrieve when needed.

- Review and Verify the Receipts: Before submitting your insurance claim, carefully review each itemised receipt to verify the accuracy of the information. Check for any errors or discrepancies in the listed items, quantities, prices, or taxes. Contact the service provider if any clarification or correction is needed.

- Attach Receipts to the Claim Form: When filling out the insurance claim form, remember to attach the original itemised receipts. Most insurance companies require the original receipts as supporting documentation for your claim. However, it is always a good idea to keep copies for your records.

By following these steps, you can effectively collect and manage itemised receipts, which are crucial for submitting a comprehensive and accurate insurance claim. These receipts provide a detailed breakdown of your expenses, ensuring that your insurance claim is properly supported and processed by your insurance company.

Unveiling the VM Insurance Term: Understanding Virtual Management Coverage

You may want to see also

Filling out the claim form

Understanding the Claim Form:

Before you begin filling out the form, take the time to read through it thoroughly. Claim forms typically include sections requesting personal information, insurance details, the reason for your medical visit or treatment, and any out-of-pocket expenses incurred. Understanding what information is required will help you gather the necessary details in advance.

Providing Personal Information:

The claim form will require basic personal information, such as your full name, address, and date of birth. Ensure that this information is accurate and up to date.

Including Insurance Information:

You will need to provide your insurance policy number, group number, and any other relevant insurance plan details. This information can typically be found on your insurance card or certificate.

Explaining the Reason for Treatment:

Provide a clear and concise description of why you sought medical attention. Include background information about your condition, especially if it was related to an accident or worker's compensation. It is essential to be thorough in this section to help the insurance company understand the context of your claim.

Detailing Provider Information:

Include the name and address of the doctor or medical provider you visited. This information is crucial for the insurance company to process your claim accurately.

Itemizing Out-of-Pocket Expenses:

List any expenses that you have already paid out of your own pocket. This may include costs for medications, lab tests, radiology exams, or other medical services. It is important to keep track of these expenses and provide an itemized list to support your reimbursement claim.

Attaching Supporting Documentation:

Along with the completed claim form, you will need to attach itemized receipts or bills from your medical provider. These documents should outline the services provided and their associated costs. Contact your doctor's office or the hospital to obtain these itemized receipts.

Making Copies:

Before submitting your claim, it is highly recommended to make at least one copy of the completed form and all supporting documentation. Keep these copies in a safe place, as they will be useful if there are any complications or disputes with your claim.

Reviewing and Submitting:

Once you have completed the claim form and gathered all the necessary documentation, review everything carefully. Double-check that all the information is accurate and that no details have been missed. Then, contact your insurance company to let them know you are about to send in the claim form. Review the paperwork with them and inquire about any additional documents or instructions. Finally, send the claim form and accompanying paperwork to your insurance company, following their preferred submission method (mail, email, or fax).

Understanding Reduced Paid-Up Term Insurance: A Guide to This Policy Option

You may want to see also

Making copies of the claim

Making copies of your claim is an important step in the process of filing an insurance claim. It is recommended that you make at least one copy of your entire claim before submitting it to your insurance company. This includes making copies of the completed claim form and all relevant receipts and itemized bills. Here are some reasons why making copies of your claim is essential:

- Record-keeping: By making copies, you can keep a file of all the documents related to your claim. This ensures that you have easy access to everything you need in one place. It helps you stay organized and allows you to quickly refer to your paperwork if there are any disputes or issues with your claim.

- Reducing errors: Having a copy of your claim allows you to review and double-check all the information you provided. This reduces the risk of errors or missing information, which could lead to delays or even rejection of your claim.

- Refiling: In case your original claim is lost or misplaced during the submission process, having a copy allows you to refile your claim without starting from scratch. This can save you time and effort in resubmitting the necessary documents.

- Reference for future claims: Keeping a copy of your claim can be helpful if you need to make similar claims in the future. You can refer to the information and format used in your previous claim, making the process easier and faster.

- Proof of submission: In some cases, you may need to provide proof that you submitted a claim, especially if there are delays or complications. Having a copy of your submitted claim can serve as evidence that you initiated the process.

- Follow-up and appeals: If you need to follow up on the status of your claim or if your claim is denied, having a copy allows you to easily refer to the details of your submission. You can use this information to support any appeals or further discussions with your insurance company.

Remember to make copies of all relevant documents, including the completed claim form, itemized bills, medical reports, and any other supporting documentation. Keep these copies in a safe place, and consider making digital copies as well as physical ones to ensure you always have access to them when needed.

Maximizing PPO Insurance Benefits for Zirconia Crowns

You may want to see also

Submitting the claim

Submitting an insurance claim can be done in several ways, depending on the insurance company and the type of policy you have. It is important to act promptly and to keep records of all communications and paperwork. Here is a step-by-step guide to submitting an insurance claim:

Step 1: Contact your insurance company

Get in touch with your insurance company as soon as possible, even if you are at the scene of an accident. They will be able to advise you on the specific steps you need to take and any time limits for filing a claim. They will also be able to tell you what documents you need to provide.

Step 2: Document everything

Make sure you document everything you can from the scene of the accident and gather information from all the parties involved. This includes names, addresses, phone numbers, insurance policy numbers, vehicle details, and photos of the accident from multiple angles. If you are injured, keep all medical reports, bills, and other documentation.

Step 3: File your claim

Most insurance companies will allow you to file a claim online, by phone, or by filling out a claims form and sending it by email or fax. You will need to provide basic details such as where and when the accident or incident took place, contact information for everyone involved, and a description of what happened. You may also need to provide an estimated cost of the damage.

Step 4: Follow up

After you have filed your claim, the insurance company may send an adjuster to investigate the accident and the damage. They will determine how much the insurance company should pay for the loss. If your claim is denied, there is usually an appeals process you can follow. Make sure to keep records of all communications and paperwork in case you need to refer to them later.

Maximizing Telehealth Reimbursement: Navigating the Insurance Billing Landscape

You may want to see also

Frequently asked questions

You will need your insurance policy number, group plan number, or member number, as well as the name of the patient receiving treatment and whether they have dual coverage or coinsurance. You will also need an itemized bill from your provider, detailing every service provided and the cost of each.

Contact your doctor or medical provider and let them know you are filing an insurance claim. They should then send you an itemized bill.

First, check if the bill contains the words "insurance pending" or any other indication that the doctor or hospital has submitted the bill to the insurance company. If not, call the doctor or hospital and ask them to bill your insurance company. If they refuse or are unable to do so, you will need to fill out a reimbursement form and submit it along with the bill.

Insurance companies may deny claims for several reasons, including coding errors, failure to obtain prior authorization, missing or incorrect information, deeming the treatment medically unnecessary, or determining that the treatment is not covered by your plan. If your claim is denied, there is usually an appeals process that you can follow.

First, call your insurance company as soon as possible, even from the scene of the accident. You can also use a mobile app to jumpstart your claim. You will need to fill out a "proof of claim" form and may need to provide a copy of the police report. Keep thorough records of anything related to the claim, including the names and phone numbers of everyone you speak to at your insurance company and copies of any bills.