Auto insurance company codes are used to identify specific providers and are usually a combination of numbers and letters. Each company has a unique code assigned by the National Association of Insurance Commissioners (NAIC) and the Department of Motor Vehicles (DMV). These codes help consumers determine a provider's legitimacy and rates. Higher auto insurance codes typically correspond to higher rates, based on factors like driving records, credit history, and vehicle type. You can find a company's NAIC code on the official NAIC website, while the DMV code is usually on the insurance card or documentation.

| Characteristics | Values |

|---|---|

| Number of codes | Two: one from the NAIC and one from the DMV |

| Code structure | Varies; NAIC codes are five-digit national codes, while DMV codes are three-digit state-specific codes |

| Where to find the codes | NAIC codes can be found on the NAIC website; DMV codes are on your insurance ID card |

| Code purpose | To help consumers determine a provider's legitimacy and allow access to provider information such as closed complaints and enforcement actions |

What You'll Learn

- Auto insurance company codes are listed on your insurance card

- NAIC codes are five-digit national codes, while DMV codes are three-digit state-specific codes

- Policy numbers can be a combination of letters and numbers and vary by company

- You can find the NAIC code for a specific provider on the NAIC website

- The DMV code is on your insurance ID card

Auto insurance company codes are listed on your insurance card

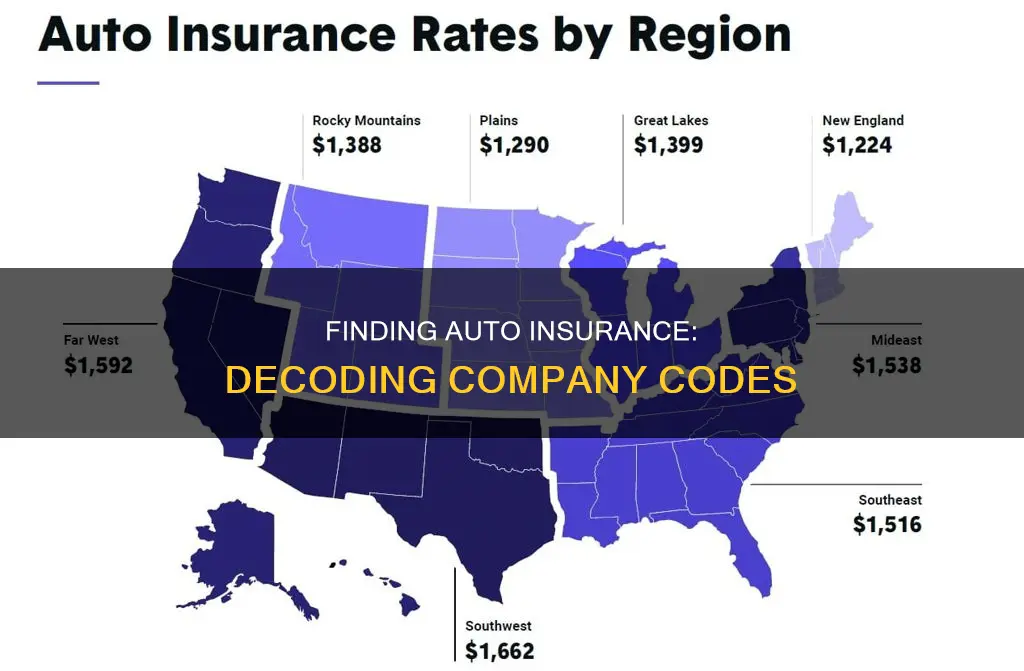

The insurance company codes are typically numbered from one to 27. Lower-numbered codes are assigned to cheaper auto insurance rates, while higher-numbered codes are assigned to higher insurance rates. For example, the Geico Insurance Company ID number in Massachusetts is 343, and in New York, it's 639. These codes vary by state, so it's important to check the correct state-specific code for your insurance company.

In addition to the unique three-digit auto insurance code, your insurance provider is also given a number by the National Association of Insurance Commissioners (NAIC). This NAIC number differs from the driving record insurance codes used by insurance companies to set rates.

While a person's driving record is the main factor affecting insurance rates, the type of car they drive can also impact the cost of auto insurance coverage. Auto insurance company codes identify the type of car or truck insured and represent the rates for insuring different types of vehicles.

By understanding auto insurance company codes and how they work, you can make more informed decisions about your insurance coverage and look for ways to qualify for lower rates.

Driving Without Auto Insurance: Is It Possible?

You may want to see also

NAIC codes are five-digit national codes, while DMV codes are three-digit state-specific codes

NAIC codes and DMV codes are two different types of codes used in the auto insurance industry. NAIC stands for the National Association of Insurance Commissioners. The NAIC code is a five-digit number assigned to insurance providers by the association. For example, the NAIC code for Geico is 35882, while the NAIC code for State Farm is 25178. These codes are used for reference and can be found on insurance cards and accident reports.

On the other hand, DMV codes are specific to each state's Department of Motor Vehicles. These codes are typically three digits long and are used to identify insurance providers within a particular state. For instance, the DMV insurance code for Geico in Florida will be different from the code used in Texas or New York. These codes help the state DMV recognize the insurance company of a vehicle owner.

It is important to note that auto insurance company codes, including NAIC and DMV codes, are separate from insurance rate group codes or symbols. These rate codes are assigned to vehicles based on factors such as their type, value, risk of theft or vandalism, and replacement and repair costs. Lower-numbered insurance rate codes are typically assigned to cheaper insurance rates, while higher-numbered codes correspond to higher insurance rates.

Admiral Insurance: Understanding Auto-Renewal

You may want to see also

Policy numbers can be a combination of letters and numbers and vary by company

Policy numbers are unique identifiers assigned to individual auto insurance policies. They are used as reference numbers to help insurance companies and policyholders track and manage their specific policies. While some policy numbers consist entirely of numbers, others may include a combination of letters and numbers. This combination of letters and numbers can appear in different formats and orders, depending on the insurance company. For example, a Geico policy number typically includes 8-10 digits, while a Liberty Mutual policy number may include letters and numbers, such as "AOX-111-1111111-1111".

Policy numbers can typically be found on various documents related to your insurance policy, such as your insurance ID card, policy declarations page, insurance policy documents, or correspondence from your insurance company. It is important to keep your policy number accessible, as you may need it when filing a claim, making changes to your policy, or providing information to the police or other drivers after an accident.

While policy numbers are unique to each policy, they may share similarities with other policy numbers from the same company. For example, if you and another driver both have 8-digit policy numbers and are insured by Progressive, it is likely that you are both using the same insurance company. However, without additional information, it can be challenging to definitively identify a company solely based on their policy number structure.

If you need to identify an insurance company by policy number, there are a few steps you can take. First, report the accident to your insurance company, as they may recognize the policy number if the other driver is also insured by them. You can also try calling other insurance companies, especially larger ones, to see if they can identify the policy number. Additionally, contacting a local independent insurance agent may be helpful, as they often work with multiple companies and have experience with competing providers.

Full Coverage Auto Insurance: Worth the Cost?

You may want to see also

You can find the NAIC code for a specific provider on the NAIC website

For example, the NAIC code for AAA Insurance Company is 11983, while the code for Allstate Insurance is 19232. These codes are useful for identifying your insurance provider, especially when filling out forms such as accident reports, which require the five-digit NAIC number.

You can also find your insurance company's code on your insurance card, listed as the "Company Number". This code, along with the unique three-digit auto insurance code, will help identify your insurance provider. These codes are important for understanding your insurance coverage and rates, as well as making informed decisions when comparing insurance providers.

By knowing your insurance company's code, you can better understand your insurance coverage and rates, as well as make informed decisions when comparing insurance providers.

General Auto Insurance: Understanding Coverage Areas

You may want to see also

The DMV code is on your insurance ID card

The DMV code is important because it helps identify your specific insurance company and policy. It is used by the Department of Motor Vehicles to recognize your insurance provider and ensure you have the required coverage. This code is also known as the insurance company code or the insurance ID card number.

Insurance company codes vary by state, so it is essential to check the correct state code. For example, the Geico Insurance Company ID number in Massachusetts is 343, while in New York, it is 639. These state-specific codes are crucial when providing proof of insurance or during insurance verification processes.

In addition to the DMV code, your insurance card may also display a National Association of Insurance Commissioners (NAIC) number. This NAIC number is assigned to your insurance provider and is different from the DMV code or insurance company code.

By locating your insurance ID card, you can easily find the DMV code and other relevant insurance information. This code helps identify your insurance company and ensures compliance with state requirements. Remember to check for state-specific codes to ensure you have the correct information for your location.

Dropped by Your Auto Insurer: Understanding the Reasons and Your Rights

You may want to see also

Frequently asked questions

Insurance company codes are strings of digits used to identify specific providers. Each provider has two codes: one from the National Association of Insurance Commissioners (NAIC) and one from the Department of Motor Vehicles (DMV).

You can find your insurance company's NAIC code on the NAIC website.

Your insurance company's DMV code will be on your insurance ID card.

First, check if the other driver's policy number looks similar to yours. If you're both insured by the same company, there's a good chance that your policy numbers will be structured similarly. If that doesn't work, you can try asking a local independent insurance agent, as they work with multiple companies and may be able to help you identify the company.