Full coverage car insurance is a combination of liability, collision, and comprehensive insurance. It covers damage to your car from a wide range of scenarios, including weather damage, accidents, hitting an animal, or vandalism. It also covers injuries or damage caused to others. While it is not legally required, it may be a good idea if you have a new car, live in an area with extreme weather, or have an auto loan or lease.

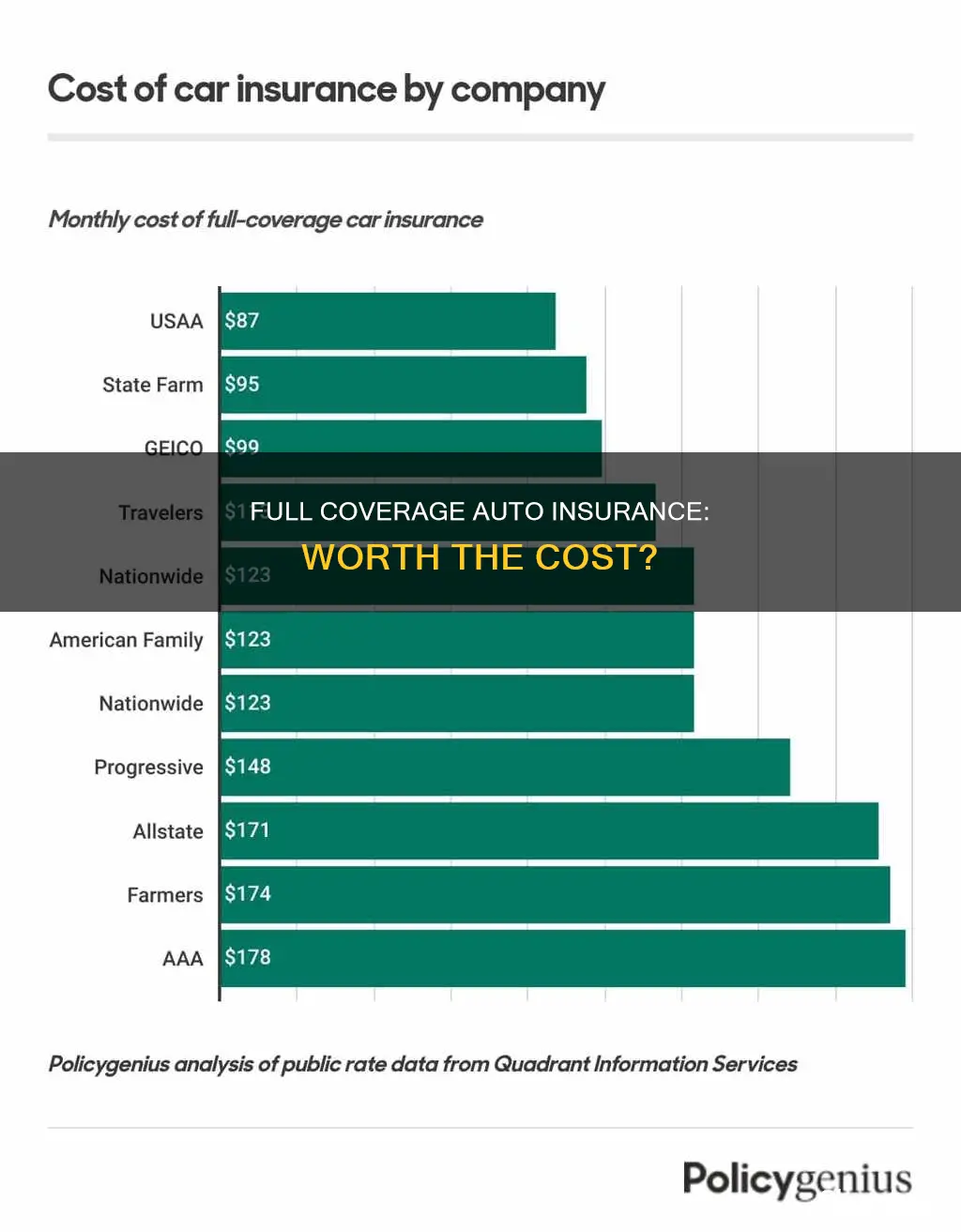

The cost of full coverage car insurance varies, but it is generally more expensive than a policy with only the minimum liability insurance. On average, it can cost around $1,500 to $2,000 per year.

Whether or not full coverage auto insurance is worth it depends on your specific situation. If you can afford the higher premiums and want the added protection, then it may be a good choice. However, if you have an older car or are on a tight budget, you may want to consider other options.

| Characteristics | Values |

|---|---|

| What is full-coverage insurance? | Full coverage insurance is a policy that includes liability, collision, and comprehensive insurance. |

| What does full-coverage insurance cover? | Full coverage insurance covers damage to your car from a storm, an at-fault accident, hitting an animal, or vandalism. It also covers injuries or damage you cause to others. |

| When is full-coverage insurance required? | Full coverage insurance is required if you have a loan or lease on your car. |

| When is full-coverage insurance recommended? | Full coverage insurance is recommended if you have a new or expensive car, live in a place with extreme weather or high crime rates, or can't afford to repair or replace your car if it's damaged or stolen. |

| When is full-coverage insurance not recommended? | Full coverage insurance may not be recommended if you drive an older vehicle, have a low risk tolerance, or rarely drive. |

| How much does full-coverage insurance cost? | The cost of full coverage insurance varies but is generally more expensive than liability-only insurance. The national average is around $1,700 to $2,000 per year. |

What You'll Learn

- Full coverage insurance is a combination of liability, comprehensive and collision insurance

- Full coverage insurance is required for leased or financed cars

- Full coverage insurance is worth it for the broad coverage of liability, collision and comprehensive insurance

- Full coverage insurance costs more than a policy for only your state's minimum requirements

- You should consider dropping full coverage insurance if your car is old or not worth much

Full coverage insurance is a combination of liability, comprehensive and collision insurance

Full coverage auto insurance is a combination of liability, comprehensive, and collision insurance. This "full coverage" provides financial protection in most scenarios, including damage to your car from collisions, vandalism, theft, weather, or fire. It also covers injuries or damage you cause to others.

Liability insurance covers the costs incurred by others if you cause an accident, including medical expenses, lost wages, and property damage. Comprehensive insurance covers damage to your vehicle from non-collision incidents, such as theft, vandalism, fire, or weather damage. Collision insurance, on the other hand, covers damage to your vehicle resulting from a collision with another vehicle or object.

While "full coverage" offers extensive protection, it is important to note that it does not include everything. For example, additional coverage types like new car replacement, roadside assistance, and uninsured motorist coverage may need to be added separately. The specific components of full coverage insurance can also vary depending on your state and insurance company.

Full coverage insurance is typically more expensive than a policy with only the minimum liability insurance required by your state. However, it provides greater financial protection in the event of a car crash. It is particularly useful if you have a new car, live in an area with extreme weather, or have an auto loan or lease.

Gap Insurance: Monthly Payment or One-Time Fee?

You may want to see also

Full coverage insurance is required for leased or financed cars

If you lease or finance your vehicle, your lender or leasing company will probably require you to have full coverage insurance. This is because they want to protect their investment in case the car is damaged or stolen. Full coverage insurance is a combination of liability, collision, and comprehensive insurance. It covers damage to your car from a storm, an at-fault accident, hitting an animal, or even vandalism. It also covers injuries or damage you cause to others.

When you lease a car, insurance coverage is required; you can’t drive off the lot without it. Your leasing company will likely require you to take out full coverage auto insurance, which includes collision coverage, comprehensive coverage, and liability coverage. Collision coverage pays for damages to your car caused by colliding with another vehicle or object, while comprehensive coverage pays for damage not caused by a collision, such as theft, vandalism, or an animal encounter. Liability coverage pays for medical expenses and property repairs due to damage caused by your vehicle.

In addition to the standard coverage types, leased vehicles often require additional coverage, such as gap insurance, which covers the difference between the amount owed on a lease and the actual value of the vehicle if it is totaled or stolen. This is because most cars lose value quickly, and you could end up owing more on your lease than the vehicle is worth.

The cost of full coverage insurance for a leased car can be higher than for a financed or owned car due to the higher coverage requirements. The average cost of full coverage car insurance is around $1,500 to $1,800 per year, but for a leased car, it can be over $2,500 per year.

Overall, if you are leasing or financing a car, full coverage insurance is required to protect your investment and comply with the terms of your lease or loan. It is important to shop around and compare quotes to find the best rate for the coverage you need.

Vehicle Insurance File: What's Inside?

You may want to see also

Full coverage insurance is worth it for the broad coverage of liability, collision and comprehensive insurance

Full coverage insurance is a combination of comprehensive, collision, and liability insurance. It provides coverage for most scenarios, including damage to your car from weather, accidents, hitting an animal, or vandalism. This comprehensive protection makes full coverage insurance worth considering, especially if you want peace of mind and broad coverage.

Liability insurance covers other people's medical bills and property damage resulting from an accident you cause. This coverage is required by law in most states, ensuring compliance with legal requirements. Collision insurance, on the other hand, covers damage to your own vehicle after an accident, protecting you from the financial burden of repairs or replacements.

Comprehensive insurance complements collision insurance by covering damage to your vehicle from non-collision events outside your control. This includes theft, vandalism, glass damage, fire, accidents with animals, and weather-related incidents. Comprehensive insurance is particularly valuable if you live in an area with extreme weather conditions or high car theft rates.

Full coverage insurance is worth considering if you want extensive protection for your vehicle and yourself. It provides financial peace of mind in various situations, from accidents to natural disasters. This type of insurance is ideal if you have a new or expensive car, an auto loan, or a lease. Additionally, if you regularly commute in heavy traffic or live in an area with extreme weather, full coverage insurance can offer valuable protection.

However, it's important to note that full coverage insurance may not be necessary for older vehicles. The decision to opt for full coverage should also consider factors such as the value of your car, your financial circumstances, and personal preferences.

National Insurance Record: Fill Gaps or Not?

You may want to see also

Full coverage insurance costs more than a policy for only your state's minimum requirements

Full coverage car insurance costs more than a policy that only meets your state's minimum requirements. However, it provides more comprehensive protection.

Full coverage insurance is a combination of liability, collision, and comprehensive insurance. It covers damage to your car and injuries or damage you cause to others. Liability insurance, which is mandated in most states, covers the costs incurred by others in an accident you cause. Collision insurance covers damage to your car in a crash, and comprehensive insurance covers damage from non-collision incidents, like theft, vandalism, and extreme weather.

The national average for full coverage is $1,717 per year, according to NerdWallet, while liability-only insurance costs $635 annually on average. The higher cost of full coverage reflects the additional protection it provides.

While full coverage is not required by law, it may be mandatory if you have an auto loan or lease. Even if it's not required, full coverage can offer valuable peace of mind, especially if you can't afford to repair or replace your car after an accident.

Ultimately, the decision to opt for full coverage depends on your financial situation, the value of your car, and your risk tolerance. If you drive an older, less valuable car and are comfortable with the financial risk, liability-only insurance may be sufficient. However, if you have a newer or more expensive car, full coverage can provide important protection against unforeseen events.

Personal Vehicle Insurance: What You Need to Know

You may want to see also

You should consider dropping full coverage insurance if your car is old or not worth much

If your car is old or not worth much, you may want to consider dropping your full-coverage insurance policy. This is because the value of your car decreases as it ages, and full-coverage insurance can become too expensive relative to the value of the car. For example, it may not be worth paying $2,000 per year for full coverage on a 10-year-old car that is only worth $6,000. In this case, switching to liability-only insurance could lower your insurance bill by about $90 per month or $1,080 per year.

Additionally, the cost of full-coverage insurance may exceed the potential payout if your car is damaged or stolen. As a rule of thumb, you should consider dropping full coverage when your annual full-coverage payment equals 10% of your car's value.

However, it is important to note that different states have different requirements for car insurance, and you should check the specific requirements of your state before making any changes to your policy.

Toyota Auto Insurance: Good Option?

You may want to see also

Frequently asked questions

Full-coverage auto insurance is a policy that includes liability insurance, as well as comprehensive and collision coverage. It covers damage to your car from an accident, even if it's your fault, and medical bills if you cause an accident that injures others.

Full-coverage auto insurance is worth it if your car is worth more than the combined cost of a full-coverage policy and deductible, or if you can't afford to replace your car without it. It provides a financial safety net and saves you from paying out of pocket for repairs or replacements.

Full-coverage auto insurance includes liability insurance, which covers damage to other vehicles or injuries to other people from accidents you cause. It also includes comprehensive and collision coverage, which protect your own vehicle against damage.

The cost of full-coverage auto insurance varies depending on factors such as the state, the driver's chosen coverage limits, risk factors, and the vehicle's value. The national average is around $1,700 to $1,800 per year, but it can be higher or lower depending on your specific circumstances.

You need full-coverage auto insurance if your car is leased or financed. It is also a good idea to maintain full coverage if you cannot afford to repair or replace your car in the event of an accident. Additionally, if you live in an area with extreme weather conditions or have a new car, full coverage can be beneficial.