Gaps in your National Insurance record can prevent you from qualifying for benefits and the State Pension. You may have gaps in your record due to low earnings, unemployment, self-employment, living or working outside the UK, or long-term reliance on state benefits. To avoid this, you can pay voluntary contributions to fill in any gaps, depending on your eligibility. You can check your National Insurance record online to identify any gaps and assess your eligibility for voluntary contributions.

What You'll Learn

Check your National Insurance record for gaps

Gaps in your National Insurance record can prevent you from qualifying for benefits. They happen when not enough National Insurance contributions are made by you or your employer to qualify for benefits. Therefore, it is important to check your National Insurance record for gaps.

You can check your National Insurance record online to see what you’ve paid up to the start of the current tax year, any National Insurance credits you’ve received, and if there are any gaps in contributions or credits that mean some years do not count towards your State Pension.

To check your National Insurance record, you’ll need to sign in to your personal tax account using your Government Gateway user ID and password. If you do not have a personal tax account, you will need a Government Gateway user ID and password to set one up. You’ll also need your National Insurance number or postcode and two of the following:

- A UK photocard driving licence issued by the DVLA (or DVA in Northern Ireland)

- A payslip from the last 3 months or a P60 from your employer for the last tax year

- Details of a tax credit claim, if you made one

- Details from a Self Assessment tax return in the last 2 years, if you made one

- Information held on your credit record if you have one (such as loans, credit cards or mortgages)

If you have gaps in your National Insurance record, you can then check if you’re eligible for National Insurance credits before deciding to pay voluntary contributions. You can contact HM Revenue and Customs (HMRC) if you think your National Insurance record is wrong.

Gap Insurance: Another Loan Only?

You may want to see also

Understand the impact of gaps on your State Pension

Understand the impact of gaps in your National Insurance record on your State Pension

Gaps in your National Insurance record can affect your eligibility for the State Pension. The State Pension is a financial safety net that most people in the UK rely on for their retirement income, especially those without personal savings or workplace pensions. The amount you receive is linked to your National Insurance record.

Qualifying for the State Pension

You qualify for the State Pension based on the number of qualifying years for which you have paid National Insurance contributions. A minimum amount of contributions or credits is required for a year to count as a 'qualifying year'. At present, 10 qualifying years will guarantee you a minimum State Pension, while 35 years will secure the maximum entitlement.

Gaps in your National Insurance record

Gaps in your National Insurance record can occur due to various reasons, including:

- Unemployment or low earnings

- Self-employment (due to exemptions, irregular income, payment delays, limited access to employment benefits)

- Missing National Insurance (NI) number

- Living or working outside the UK

- Long-term reliance on state benefits

- Taking time off to raise a family

Impact of gaps on your State Pension

Gaps in your National Insurance record can lead to the following issues:

- Inadequate qualifying years: Gaps can result in not having enough qualifying years to receive the full State Pension. Each gap year means losing out on a portion of your pension.

- Reduced pension amount: The State Pension amount is calculated based on your National Insurance record. Gaps in contributions will result in a lower pension amount.

- Ineligibility for certain benefits: Gaps can also affect your eligibility for certain benefits linked to National Insurance contributions.

Filling the gaps

If you identify gaps in your National Insurance record, there are ways to address them:

- Voluntary contributions: You may be able to pay voluntary contributions to fill in the gaps, especially if you are close to retirement age. Different classes of voluntary contributions (such as Class 2 and Class 3) are available depending on your circumstances.

- Check your records: Log in to your government account and check your NI contribution record. This will help you identify any gaps and take appropriate action.

- Seek advice: Contact the Future Pension Service or a financial advisor to understand your options and the potential impact of filling the gaps on your State Pension.

- Calculate the cost: Determine the cost of making voluntary contributions to fill the gaps. The cost varies depending on the number of years and your situation.

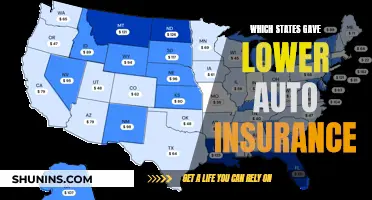

Affordable Auto Insurance: Finding the Cheapest Rates

You may want to see also

Reasons for gaps in your National Insurance record

Gaps in your National Insurance record can happen for a variety of reasons, and it's important to be aware of them to ensure you're on track for your retirement. Here are some common reasons for gaps in your National Insurance record:

Unemployment or Low Earnings

If you were unemployed or had low earnings, you might not have made enough money to contribute to National Insurance. This is particularly relevant if you were earning less than £242 per week from a single employer. Even if you were earning between £123 and £242 per week, you may still have a qualifying year, so it's important to check.

Self-Employment

Self-employment can negatively impact your National Insurance contributions due to exemptions, irregular income, payment delays, and limited access to employment benefits. If you're self-employed, you might not have paid contributions because your profits were small.

Missing NI Number

If you don't have an NI number or didn't provide it to your employer, it can be difficult to accurately track and attribute your contributions to your account, leading to potential gaps in your record.

Living or Working Abroad

Living or working outside the UK may result in exemptions from UK National Insurance, lack of contribution credits, and potential loss of eligibility for certain benefits, creating gaps in your record.

Long-Term Benefit Recipient

If you've been relying on state benefits like Jobseeker's Allowance or Carer's Allowance for an extended period, there may be gaps in your record as you might not have been able to contribute or earn credits during that time.

Life Events and Choices

Surprisingly, some positive life events can also cause gaps in your National Insurance record. For example, taking time off to travel, starting a new business, pursuing a job opportunity abroad, or raising a family can all lead to interruptions in your contributions.

It's important to regularly check your National Insurance record to identify any gaps and take appropriate action if needed. You can do this by accessing your Personal Tax Account or requesting a printed National Insurance statement.

Dropping Vehicle Insurance: Sunday Options

You may want to see also

Voluntary contributions to fill gaps

Voluntary National Insurance contributions can be made to fill gaps in your record and increase your State Pension. This is a good option if you have fewer than 35 years of National Insurance contributions (NICs), as you will receive a reduced pension. For example, if you have 30 qualifying years instead of 35, you will get 30/35ths of the full sum, or just over £133 a week.

You can pay for several years' worth of gaps in your NI record all at once. It is better to pay for the oldest years first, as they are the cheapest. You can pay for up to six years at once.

You can check your State Pension forecast to see if voluntary contributions will boost your pension. The Check your State Pension forecast service is a joint service by HM Revenue and Customs (HMRC) and the Department for Work and Pensions (DWP). It will show you by how much your State Pension could increase and the details of the voluntary contributions you would need to pay to achieve this.

You can pay voluntary contributions for the previous six tax years. The deadline is 5 April each year. However, those eligible can pay voluntary contributions to make up gaps in their NI record between 6 April 2006 and 5 April 2018 until 5 April 2025.

You can pay voluntary contributions by Direct Debit or BACS, but you will need an 18-digit reference number to do so. You can get this from HMRC.

Auto Insurance Grace Periods: Do They Exist?

You may want to see also

Deadlines and cost of voluntary contributions

Deadlines and Cost of Voluntary National Insurance Contributions

The deadline to pay voluntary National Insurance contributions is usually the 5th of April each year for the previous 6 tax years. For example, the deadline for the 2023-2024 tax year is the 5th of April 2030.

However, there are some exceptions to this rule. The deadline to pay voluntary contributions for the tax years 2016-2017 and 2017-2018 has been extended to the 5th of April 2025. Additionally, men born after the 5th of April 1951 and women born after the 5th of April 1953 have until the 5th of April 2025 to pay voluntary contributions for gaps between the tax years of April 2006 and April 2016.

After the 5th of April 2025, you may have to pay higher rates or be ineligible to pay for voluntary contributions. The cost of voluntary contributions depends on the tax year involved. For example, the cost of Class 3 voluntary contributions for the 2006/07–2019/20 tax years is £824.20 for each full year.

For the 2024/25 tax year, the rates for voluntary contributions are £3.45 a week for Class 2 and £17.45 a week for Class 3. If you are paying for gaps between the 6th of April 2016 and the 5th of April 2023, you will pay the rates that applied in the 2022/23 tax year.

It is important to note that voluntary contributions do not always increase your State Pension. It is recommended to check your State Pension forecast to see if paying voluntary contributions is worthwhile for you.

Florida DMV: Updating Vehicle Insurance

You may want to see also

Frequently asked questions

Your National Insurance record comprises National Insurance Contributions paid or credited to you in each tax year.

Gaps in your National Insurance record could mean that you will not have enough years of National Insurance contributions to qualify for the State Pension or certain benefits.

Gaps in your National Insurance record can be caused by unemployment, low earnings, self-employment, missing NI number, living or working abroad, or long-term reliance on state benefits.

You can check your National Insurance record online or request a printed statement. You will need your National Insurance number and additional forms of identification.

You may be able to fill gaps in your National Insurance record by paying voluntary contributions, known as Class 2 or Class 3 contributions, depending on your employment status and income level.