Yes, you can cancel your auto insurance policy at any time, even if you have an open claim. However, it is important to note that doing so may not be the best idea, as it could result in higher rates when you switch to a new insurance provider. While you can cancel your auto insurance, you may have to pay a cancellation fee, and you will need to stay in contact with your old provider regarding the open claim. Additionally, if you have already received a reimbursement check, you may only be able to cancel your claim if you return the money.

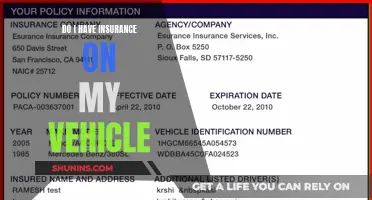

| Characteristics | Values |

|---|---|

| Can you cancel auto insurance with an open claim? | Yes |

| Can you cancel an auto insurance claim after filing it? | Yes |

| Can you cancel an auto insurance claim after receiving a check? | Yes, as long as you haven't cashed it |

| Can you cancel an auto insurance claim if you were at fault? | No |

| Can you cancel an auto insurance claim if someone filed a liability claim against you? | No |

| Can you cancel an auto insurance claim if you can't afford the deductible? | Yes |

| Can you cancel an auto insurance claim to avoid higher premiums? | Yes |

| Can you cancel an auto insurance claim if you decide to pay for repairs yourself? | Yes |

| Can you cancel an auto insurance claim if you no longer want the repairs? | Yes |

| Can you cancel an auto insurance claim if you want to keep your safe driver discount? | Yes |

| Can you cancel an auto insurance claim online? | Yes |

| Will cancelling an auto insurance claim affect your future claims? | No |

What You'll Learn

Cancelling auto insurance after filing a claim

However, if you haven't been found at fault and you haven't cashed any cheques, you can cancel a claim by contacting your insurance agent or company. This can be done at any time during the claims process, even after receiving the cheque, as long as it hasn't been cashed. The sooner you let your insurance company know, the quicker the cancellation process will be. It's worth noting that even if you cancel the claim, it will still show on your insurance file as a withdrawn or zero-dollar claim.

There are several reasons why drivers might want to cancel a claim. One common reason is to avoid paying the deductible, especially if the repair costs are only slightly higher than the deductible amount. For example, if the repair costs are $550 and the deductible is $500, you may decide it's not worth claiming as you would only receive a $50 payout from the insurance company. Another reason to cancel a claim is to prevent an increase in your insurance premiums, as filing a claim can sometimes lead to higher rates.

It's important to weigh the pros and cons before cancelling a claim, as it could still have an impact on your driving record and future insurance rates, even if your premiums don't increase immediately. If you're unsure about the potential consequences, it's best to speak directly to your insurance agent or company to understand the specific terms of your policy.

Finding Auto Insurance: A Quick Guide

You may want to see also

Cancelling a claim before receiving reimbursement

Cancelling an auto insurance claim before receiving reimbursement is possible in most cases. However, there are a few important things to keep in mind. Firstly, you need to contact a representative of your insurance provider as soon as possible to initiate the cancellation process. Secondly, you may still be able to cancel if you have received a reimbursement check, as long as you haven't cashed it yet. It is important to check with your provider, as some companies may still increase your premiums even for cancelled claims.

There are several reasons why drivers might want to cancel a claim before receiving reimbursement. One common reason is to avoid paying the deductible, especially if the cost of repairs is only slightly higher than the deductible amount. For example, if your deductible is $500 and the repair cost is $550, you may decide it's not worth claiming as you would only receive a $50 payout from the insurance company. Another reason to cancel a claim is to prevent your insurance premiums from rising, as filing a claim can often lead to increased rates. If you can afford to pay for the damages yourself, it may be more cost-effective in the long run to avoid making a claim.

It's worth noting that there are some situations in which you may not be able to cancel an auto insurance claim. If you have been found at fault for an accident, you may not be able to withdraw the claim. Additionally, you cannot cancel a liability claim made by another driver against you. In these cases, your insurance company will still need to pay out to the other driver, and your premiums are likely to be affected.

Tennessee Auto Insurance: Is It Mandatory?

You may want to see also

Cancelling a claim after receiving reimbursement

If you have already received a reimbursement check, you can still cancel the claim, but you must not have cashed the check. In this case, contact your insurance company and ask if they are willing to cancel the claim if you return the funds. Most companies will be happy to accommodate this request, as it saves them from having to cover the cost of your damages.

It's important to note that even if you cancel a claim, it will still show on your insurance record as a withdrawn or zero-dollar claim. This won't affect your insurance rates, but it could impact your ability to file future claims or switch insurance providers. Therefore, it's essential to consider your options carefully before deciding to cancel an auto insurance claim.

Michigan Auto Insurance: Denial and Your Rights

You may want to see also

Switching auto insurance providers with an open claim

Yes, you can switch auto insurance providers with an open claim. However, it is important to note that doing so may not be the best idea for several reasons. Firstly, switching insurance providers with an open claim can result in higher costs. Making a claim will cause your rates to increase when you switch insurance providers or renew your policy. Therefore, if you switch insurance shortly after making a claim, you may end up paying higher premiums much earlier than if you had waited until the end of your current policy term.

Secondly, switching insurance providers with an open claim can be a hassle as you will have to manage communications with both your old and new insurance companies. Your claim will not be transferred to your new insurance company, and you will need to stay in touch with your previous insurer until the claim is settled. The length of time this process takes will depend on the type of claim, with medical or personal injury claims taking longer than an open glass claim, for example.

Thirdly, switching insurance providers with an open claim may not result in any cost savings. Insurance companies calculate premiums based on your claim history and driving record, so changing insurance providers after a claim may not lower your insurance costs. In fact, you may end up paying higher rates if you switch to a new insurance provider with less competitive pricing.

Finally, it is important to note that if you do decide to switch insurance providers with an open claim, you should not cancel your current coverage before your new policy starts, as this could result in a gap in your insurance coverage. Additionally, be prepared to pay a cancellation fee to your current insurance provider, as this may be required to end your coverage early.

Canceling Liberty Mutual Auto Insurance: A Guide

You may want to see also

Cancelling auto insurance after an accident

First, it's crucial to understand the potential impact on your rates. Making a claim will typically cause your rates to go up when you switch insurance providers or renew your policy. If you cancel your current policy and switch providers right after an accident, you may end up paying more for coverage than if you had waited until the end of your policy term.

Additionally, cancelling your policy before securing a new one could result in a lapse in coverage, which is illegal in most states and can lead to increased insurance rates and possible fines from the Department of Motor Vehicles (DMV). Therefore, it's recommended to purchase a new policy before cancelling your existing one.

If you're considering cancelling your auto insurance after an accident due to high premiums, there may be alternative options. Most auto insurance companies offer various types of discounts that can help lower your rate. These may include discounts for safe driving, taking a virtual driving course, or reporting safety features on your vehicle. Contacting your insurance agent to discuss these options could be a beneficial first step.

In some cases, you may also have the option to suspend your car insurance instead of cancelling it. This could be a viable choice if you plan on taking a break from driving for an extended period. However, it's important to check with your insurance carrier and state requirements before making any decisions.

When it comes to the process of cancelling your auto insurance after an accident, the steps may vary depending on your insurance provider. Some providers may require you to pay a cancellation fee or give advance notice before the cancellation date. Speaking directly with an agent from your insurance company can help clarify the specific requirements and steps needed to cancel your policy.

In conclusion, while it is possible to cancel your auto insurance after an accident, it may not be the most financially prudent decision. Considering alternative options, such as discounts or suspending your policy, and carefully reviewing the requirements and potential consequences of cancellation, can help you make an informed choice that aligns with your needs and circumstances.

NY Auto Insurance: No-Fault State

You may want to see also

Frequently asked questions

Yes, you can cancel your auto insurance policy at any time, even after filing a claim. However, there may be a cancellation fee involved.

Yes, you can cancel your auto insurance claim in most cases, even after receiving the reimbursement check, as long as you haven't cashed it.

Yes, you typically cannot cancel a claim if you were at fault in the accident or if there is a liability claim filed against you by another driver.

Cancelling a claim won't affect your insurance rates, but it will still show on your records. Your insurer is unlikely to increase your premiums for a claim with a $0 payout.

Contact your insurance provider's claims department or a representative to cancel your claim. Some companies also allow online cancellations.