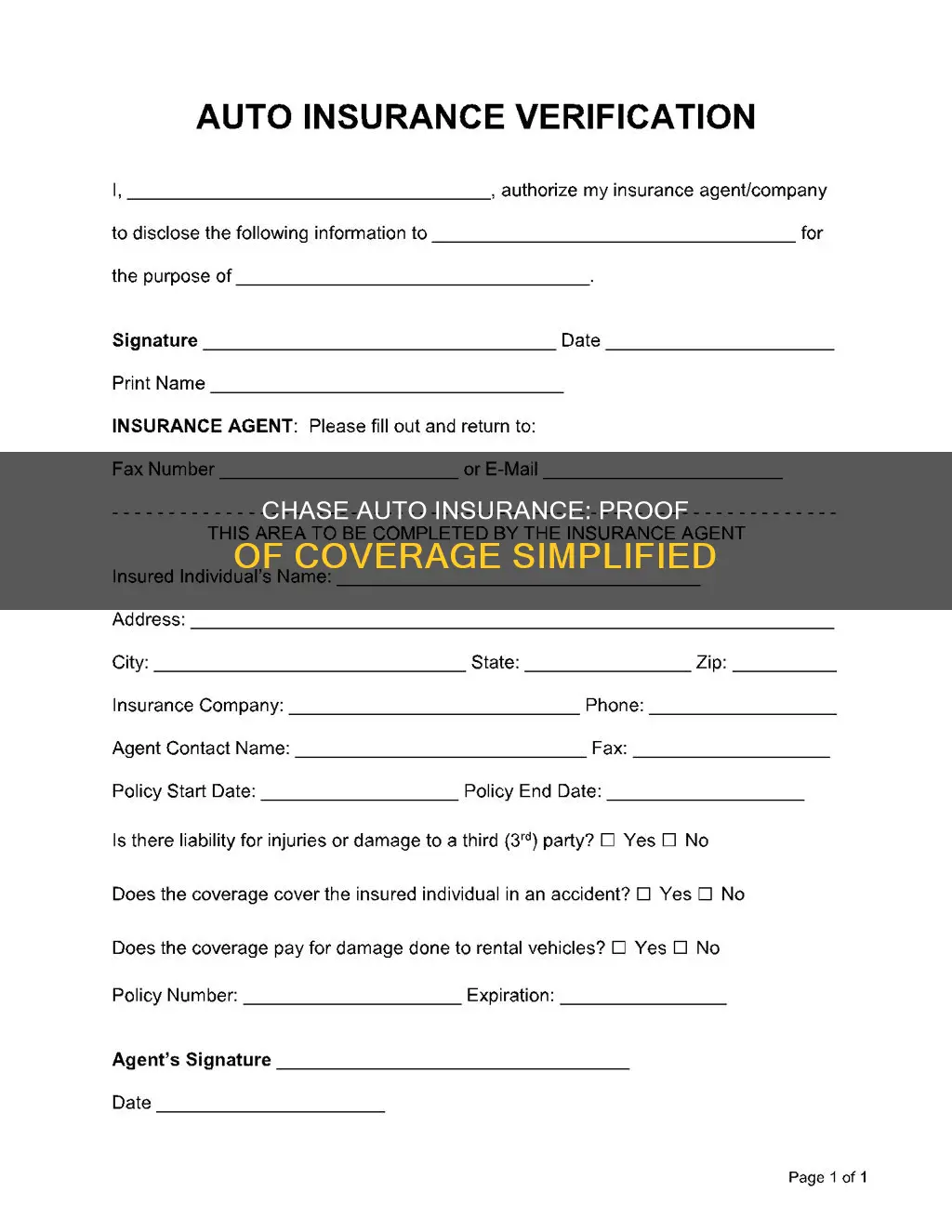

Whether you're registering for a new vehicle, renewing your license, or getting pulled over, you may need to provide proof of insurance. This document proves that you have a current and valid auto insurance policy. While the requirements vary depending on where you live, every driver is legally required to have auto insurance. You can show proof of insurance by presenting a printed card from your insurance company or by using an electronic version on their mobile app. If you're pulled over by the police, you can show an electronic copy in 49 states and Washington, D.C., with New Mexico being the only exception. Your insurance company will provide you with proof of insurance after purchasing a policy, and it's a good idea to keep copies of this documentation.

| Characteristics | Values |

|---|---|

| What is car insurance? | A product designed to protect you, the driver, your vehicle and any parties involved from costs primarily associated with car accidents. |

| Who needs car insurance? | Every driver is mandated by law to have auto insurance, but the requirements vary based on where you live. |

| When do you need car insurance? | You need car insurance before you can legally drive your vehicle away from the dealership. |

| How much insurance do you need? | This depends on the type of car insurance you purchase, your age, your driving record, and other factors. |

| What are the common types of car insurance coverage? | Auto Liability coverage, Collision coverage, Comprehensive coverage, and Gap coverage. |

| What is the process for obtaining proof of insurance? | Your insurance company will provide proof of insurance after you buy a policy. You may receive this document via fax, email, or electronically through your insurance company's mobile app. |

| What information does proof of insurance provide? | Basic information such as the insurance company's name and address, policy number, policyholder's name, insured vehicle's year, make, model, and vehicle identification number (VIN). |

| What if you can't show proof of insurance? | Failing to provide proof of insurance can result in fines or even jail time, depending on the state. |

What You'll Learn

How to get proof of auto insurance from a credit card provider

If you're renting a car, you might be pressured into purchasing insurance as part of the rental agreement. However, you may already have rental car insurance through your credit card provider. Several credit cards cover cardholders against damage caused by theft or accidents. This coverage usually comes in the form of reimbursement after you pay for any losses.

To take advantage of the Collision Damage Waiver (CDW) or Loss Damage Waiver (LDW) policy provided by your credit card, you must:

- Decline the CDW offered by the rental company.

- Be registered as the primary renter of the vehicle.

- Pay for the rental in full with the card providing coverage.

To obtain proof of coverage from your credit card provider, call the Benefits Administrator and request a letter of coverage. This letter should state which countries the policy covers and what types of damage and loss it covers. You can then present this letter to the rental company when you pick up the vehicle.

- Calling in the U.S.: 800-338-1670

- Calling from another country: 216-617-2500

- Calling in the U.S.: 800-627-8372

- Calling from another country: 636-722-7111

- Calling in the U.S.: 800-825-4062

- Calling from another country: 1-804-965-8071 (collect)

- Calling in the U.S.: 888-320-9961

- Calling from another country: 804-673-1691

It's important to note that the CDW policy provided by credit cards does not provide liability insurance if another person or their property is damaged in a crash. You will need to confirm that this is covered by your car insurance policy or travel insurance, or purchase supplemental liability insurance from the rental company.

Auto Insurance Bidding: Navigating the Road to Savings

You may want to see also

What to do if you can't show proof of auto insurance

If you can't show proof of auto insurance, you could face fines or even jail time, depending on the state. Generally, you can contest a ticket by mailing a copy of your proof of insurance or by attending the court hearing with proof that you were insured on the date the officer pulled you over. While the charges could be dismissed, you may have to pay a fine or court fees.

If you receive a ticket for not providing proof of insurance, make sure you respond to all correspondence. If you fail to do so, some states may revoke or suspend your license and registrations if you can't prove you're insured.

If you have coverage but no proof available when asked, you'll need to prove coverage to a government entity within a certain time frame. Ideally, you should get it resolved as quickly as you can.

If you are pulled over without proof of insurance but do have coverage, you should follow the instructions provided by law enforcement and rectify the situation as quickly as possible to avoid penalties, such as fines or license suspension.

If you lose your insurance card and need to get proof of insurance, you can:

- Download the insurance company's app. Many insurance companies have apps that allow you to access digital copies of your insurance cards.

- Access your account online. If your insurance company doesn't have an app, then you may be able to download and print out a card by logging into your account on its website.

- Contact your agent. Call your insurance agent and ask them to send you an updated copy of your insurance card.

Border Crossing: Mexican Auto Insurance

You may want to see also

The benefits of shopping around for insurance rates

Shopping around for insurance rates can be a great way to save money and ensure you're getting the best deal. Here are some benefits of shopping around for insurance:

- Save Money: Insurance companies regularly adjust their prices, so shopping around can help you find a more competitive rate. By comparing quotes from multiple providers, you can choose the one that offers the best value for your needs. According to a survey, 76% of people who shopped around for insurance saved money.

- Improve Understanding: Each time you explore different insurance options, you gain a better understanding of the industry and the various coverage options available. This knowledge can help you identify opportunities to reduce costs, such as accepting a higher auto insurance deductible or taking advantage of discounts for teen drivers.

- Reduce Costs for Teen Drivers: When you add a teen driver to your policy, comparison shopping becomes essential as teens often cause auto insurance rates to increase significantly. However, some insurance carriers offer discounts for teen drivers who maintain good grades, take safe driving courses, or attend school away from home.

- Convenience and Peace of Mind: While bundling insurance policies from the same provider can be a way to save money, it can also provide the convenience of consolidating bills and personal information with a single company. This can give you peace of mind when managing your monthly premiums.

- Take Advantage of Extra Benefits: Insurance providers may offer extra benefits to policyholders, such as discounts on premiums for participating in healthy activities or safe driving benefits. By shopping around, you can discover and take advantage of these additional benefits that may not be offered by your current insurer.

- Keep Up with Changing Circumstances: Life events, such as moving to a new area, insuring a new family member, purchasing a new vehicle, or experiencing personal or financial shifts, can impact your insurance needs and rates. Shopping around allows you to reevaluate your coverage and ensure it aligns with your changing circumstances.

- No Need to Wait for Renewal: You don't have to wait until your current policy expires to start shopping for a new one. By starting your search early, you'll have more time to compare quotes and find the best option. If you find a better deal, you can cancel your existing coverage before it renews, and your current insurer may even offer a lower rate to retain your business.

Auto Insurance and Hurricanes: What You Need to Know

You may want to see also

The importance of proof of insurance when pulled over by the police

Proof of insurance is an essential document to keep in your car. In most of the United States, drivers must have automobile liability insurance to drive a vehicle legally. Most states also require drivers to carry proof that they are covered. If you are pulled over by the police, they can ask to see your proof of insurance, along with your license and registration.

If you are unable to provide proof of insurance, you may face penalties such as tickets and fines. The police officer can write you a ticket, and depending on your state, you may be subject to additional fines and penalties. Therefore, it is important to always keep your proof of insurance in your car, easily accessible, and ready to show if needed.

In most states, you can provide electronic proof of insurance, such as a digital insurance card on your smartphone. However, in some states, such as New Mexico, the police are not required to accept electronic proof. Therefore, it is always a good idea to keep a physical copy of your insurance card in your glove compartment.

Additionally, it is important to ensure that your insurance coverage meets the minimum requirements of your state. State laws vary, but most states require drivers to have bodily injury and property damage liability insurance. This insurance can help cover the other driver's medical bills, vehicle repair costs, and other expenses if you are found to be at fault in an accident.

If you are unsure about your insurance coverage or how to obtain proof of insurance, you can contact your insurance company or agent for more information. They can provide you with the necessary documentation and answer any questions you may have about your policy. Remember, it is your responsibility as a driver to ensure that you have the proper insurance coverage and proof of insurance at all times when operating a vehicle.

Auto Insurance and Sweet Revenge: Sugar in the Gas Tank

You may want to see also

Understanding the different types of auto insurance coverage

Auto insurance policies consist of multiple types of coverage that provide protection in different situations involving your vehicle. Here is a rundown of the different types of auto insurance coverage:

Liability Coverage

Liability coverage protects you if you cause damage to others, including both personal injury and property damage. It can help pay for another person's medical bills or repair costs for their car or property damaged during the accident. There are two types of liability protection:

- Bodily Injury Liability: This covers costs associated with injuries and death that you or another driver causes while driving your car. It can also provide protection for costs related to medical expenses, lost wages, and legal fees.

- Property Damage Liability: This coverage reimburses others for damage that you or another driver operating your car causes to another vehicle or other property, such as a fence, building, or utility pole.

Collision Coverage

Collision coverage protects your car from damage in any type of collision, whether with another vehicle or an object such as a tree or mailbox. It helps pay for the costs of car repairs or reimburse you for damage to your car when it hits or is hit by another vehicle or object. Collision coverage is optional and may not be necessary if your car is older and easily replaceable.

Comprehensive Coverage

Comprehensive coverage also covers repairs to your car, but only for damage caused by scenarios other than a collision. This includes theft, vandalism, fire, flood, hail, falling objects, and vandalism. Like collision coverage, comprehensive coverage is optional and may not be necessary if your car is older and has a low cash value.

Uninsured/Underinsured Motorist Coverage

Uninsured motorist coverage reimburses you when an accident is caused by a driver without insurance or in the case of a hit-and-run. Underinsured motorist coverage, on the other hand, kicks in when the at-fault driver's insurance limits are too low to cover all the injuries or damage they caused. These coverages are especially important because not all drivers carry sufficient insurance, as required by state laws.

Medical Payments Coverage

Medical payments coverage, or "MedPay," pays for medical expenses for you and your passengers following a car accident, regardless of who is at fault. It typically covers hospital bills, doctor fees, treatment costs, medications, and ambulance fees. Medical payments coverage is optional in most places but can provide valuable financial protection if you or your passengers incur unexpected medical costs.

Personal Injury Protection

Personal injury protection (PIP) is similar to medical payments coverage but is more comprehensive. In addition to medical expenses, PIP may cover lost wages, rehabilitation costs, and funeral expenses for you and your passengers, regardless of who is at fault in the accident. PIP is only available in select states and may be required in no-fault states.

Other Coverages

In addition to the standard coverages mentioned above, there are several other optional coverages you can add to your auto insurance policy for extra protection. These include rental reimbursement, roadside assistance, new car replacement insurance, full glass coverage, rideshare insurance, mechanical breakdown coverage, custom parts and equipment value coverage, classic car insurance, and business or commercial auto insurance.

Ridesharing Risks: Progressive Auto Insurance Drop

You may want to see also

Frequently asked questions

You will receive proof of insurance from Chase after buying an auto insurance policy. You will receive immediate proof of insurance via fax or email once you make your first premium payment.

The proof of insurance includes basic information such as the insurance company's name and address, the effective date and expiration of the policy, the policyholder's name, the insured vehicle's year, make, model, and vehicle identification number (VIN), and the policy number.

If you don't receive your proof of insurance from Chase, make sure to reach out to their insurance company to get the appropriate documentation.