Life insurance is a valuable tool for financial planning, and when combined with compound interest, it can be a powerful strategy for growing your wealth over time. Compound interest is often referred to as a magical mathematical principle, where the interest earned on your savings begins to earn interest on itself, leading to exponential growth in your investments. This concept is especially beneficial when applied to life insurance policies, such as whole life and universal life insurance, which offer compound interest rates.

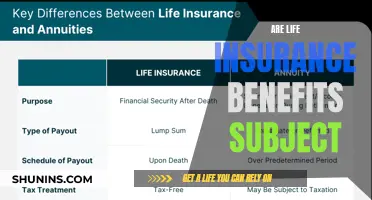

When considering life insurance with compound interest, it's essential to understand the difference between simple and compound interest. Simple interest is calculated based on the net death benefit, excluding previously earned interest. On the other hand, compound interest is calculated against the full current account value, including any interest already earned. This distinction significantly impacts the pace at which your account value grows and the costs of repaying insurance loans or making financial withdrawals.

By investing in life insurance with compound interest, you can take advantage of the power of compounding to build a substantial nest egg for your future. The earlier you start, the more time your money has to compound and grow, potentially resulting in a higher account value over time. However, it's important to carefully consider all the features and terms of life insurance products and choose the one that aligns with your financial goals and risk tolerance.

| Characteristics | Values |

|---|---|

| Type of interest | Compound interest |

| How it works | Interest is earned on invested principal over multiple periods of time, taking into account interest earned in earlier periods. |

| Compared to simple interest | Interest is only paid on principal for simple interest, not on any interest earned on that principal. |

| Benefits | Significantly amplifies wealth, turning even modest savings into substantial sums over the long term. |

| Best for | Individuals who want a policy to remain in force for their entire lifetime and guarantee a payout to their beneficiaries. |

| Whole life insurance types | Traditional, participating, simplified, and guaranteed. |

| Cash value | A key component of permanent life insurance that gradually accumulates value. |

| Borrowing against cash value | Loans are available with a favourable interest rate and are not reported to credit bureaus. |

| Whole life insurance providers | MassMutual, State Farm, Nationwide, New York Life, and Northwestern Mutual. |

What You'll Learn

Understanding compound interest

Compound interest is often hailed as the eighth wonder of the world, and for good reason. It can amplify your wealth, turning even modest savings into substantial sums over time.

Compound interest is best understood by comparing it to simple interest.

Simple interest is the interest earned on invested principal over multiple periods of time that does not take into account the interest earned in earlier periods. In other words, interest is only paid on the principal, not on any interest earned on that principal.

For example, if you invest $10,000 in a bank account paying simple interest of 4% over 30 years, your account will grow by $400 a year, every year, no matter what the total value of the account becomes.

Compound interest, on the other hand, is interest earned on invested principal over multiple periods of time that does account for the interest earned on the principal in earlier periods. Interest is earned on interest plus principal when compound interest is used.

Using the same example as above, if you invest $10,000 in a bank account paying compound interest of 4% over 30 years, your account will be worth $32,433.98 at the end of the period. That's an additional $10,000+ in value, or a 47% greater return than with simple interest.

The power of compound interest lies in the fact that the interest earned is reinvested, and the next interest calculation adds more financial value to the principal amount invested. This creates huge long-term accumulation.

The key to maximising the impact of compound interest is to start early. The longer your money has to compound and grow, the more opportunity there is for those earnings to earn additional money.

For example, if Emily starts saving $440 a month from the age of 25, her nest egg will top $1 million by the time she's 67, assuming a 6% average annual return on her investments.

Her friend Elliot, who is also 25, decides to wait five years before investing. He'll need to put aside $613 a month, assuming a 7% annual rate of return, to have the same portfolio at age 67. In the end, Emily will have paid $50,412 less for her $1 million nest egg.

Compound interest can be a compelling feature when comparing a life insurance product with a simple interest payment structure to one with a compound interest feature. For example, a whole life insurance product with a value of $100,000 and an annual fixed interest rate of 5% would be worth $148,000 within thirty years if it paid simple interest. With compound interest, the account value would climb to $263,846 over the same period, making a substantial difference to the insurance policy value without any further contributions.

It's important to understand all the features and terms of any life insurance product and company you are considering. Varied interest calculation methods could impact the pace at which your account value grows and the costs of repaying an insurance loan or financial withdrawal.

Creditors and Life Insurance: Can They Garnish Proceeds?

You may want to see also

Whole life insurance

Advantages of Whole Life Insurance

- Lifetime coverage

- Cash value that can be used for loans, withdrawals, or premium payments

- Guaranteed death benefit amount

- Predictable premium payments

- Tax-free loans

Disadvantages of Whole Life Insurance

- More expensive than term life

- Cash value may grow slower than with other policies

- No flexibility to adjust the premium

- Limited ability to adjust the death benefit

Life Insurance: An Investment or a Safety Net?

You may want to see also

Universal life insurance

One of the biggest advantages of universal life insurance is its flexibility. Policyholders can adjust their premiums and death benefits to some extent. If you pay extra towards your premium, you will receive interest on that excess amount. Additionally, if there is enough cash value built up, you may be able to lower or skip payments without the risk of a policy lapse.

However, it is important to carefully monitor the cash value of your universal life insurance policy. If the cash value drops too low and your premiums do not cover the cost of insurance, you may have to make large payments to keep the policy active or risk policy lapse.

When considering a universal life insurance policy, it is essential to understand all the features, terms, and potential risks involved. Consult with a licensed insurance agent or financial advisor to determine if this type of policy is suitable for your needs and goals.

Life Insurance: Unearned Income or Smart Investment?

You may want to see also

Variable life insurance

Variable universal life insurance (VUL) is a type of variable life insurance that offers flexibility. In addition to death benefit protection, VUL offers the ability to allocate among purely market-driven and fixed options with guaranteed minimum interest crediting. With a wide range of investment options, you can adjust your policy's allocations to meet a potential lifetime of growth objectives and risk tolerances.

Before investing in a variable life insurance policy, it is important to understand how it works, figure out the costs, and get the details of the policy. Variable life insurance is only appropriate for individuals with specific life insurance protection needs. Substantial fees, expenses, and tax implications generally make variable life insurance unsuitable as a short-term savings vehicle.

Genetic Testing: Insurance Coverage and Life Insurance Applications

You may want to see also

Permanent life insurance

Whole life insurance offers a guaranteed rate of growth, with the cash value increasing over time based on a fixed interest rate. This type of policy also offers dividends, which are not guaranteed but can be taken as cash, used to pay premiums, or reinvested into the policy. The death benefit is paid to beneficiaries tax-free. However, whole life insurance tends to be the most expensive type of permanent life insurance, and the interest rate earned may be lower than other investment options.

Universal life insurance offers more flexibility, allowing the policyholder to adjust premium payments and the death benefit within certain parameters. There are several types of universal life insurance policies, including guaranteed universal life insurance, indexed universal life insurance, and variable universal life insurance, each with different levels of investment risk and potential upside. Universal life insurance tends to be less expensive than whole life but still more costly than term life insurance.

Covid Vaccines: UK Life Insurance Invalidation Concerns

You may want to see also

Frequently asked questions

Compound interest is when the interest you earn on savings begins to earn interest on itself. This means that interest grows at an exponential pace, dramatically increasing your savings.

Compound interest is a feature in some life insurance policies, where the financial interest earned against the account value or death benefit increases over time because it is calculated to include previous interest earnings.

Simple interest is calculated against a fixed net death benefit, excluding previously earned interest. Compound interest is calculated against the full current account value, including interest already earned.

It is more common to find compound interest offered on permanent life coverage products, such as universal life, whole life, and variable life insurance.