Life insurance is designed to provide a financial safety net for your loved ones when you die. However, it can also be used as an investment strategy during your lifetime. Permanent life insurance policies, such as whole life insurance and universal life insurance, offer the potential to grow a cash value that can be accessed through loans or withdrawals. This cash value accumulates tax-deferred, and the funds can be used for various expenses, including paying premiums, investing in real estate, or supplementing retirement income. While life insurance can provide an additional source of money, it is important to carefully consider the impact on the death benefit, account growth, and potential tax implications before making any decisions.

What You'll Learn

Withdraw or take a loan on the cash value

Withdrawing or taking a loan from the cash value of your life insurance policy is a straightforward way to leverage your whole life insurance policy. This option is available to those who have accumulated a significant cash value and no longer need the full death benefit. It is also a good option if you need to pay for major expenses, such as college, a down payment on a house, an emergency fund, or retirement income.

If you choose to withdraw from the cash value of your life insurance policy, you can expect to receive a lump sum or payments. Withdrawals are usually readily available up to a set limit, which is typically the amount you have put in. It is important to note that withdrawals may reduce your death benefit and may not be an option within the first two years of the policy.

Taking a loan from your life insurance policy is another option. This involves borrowing funds from your insurer provider, using your policy as collateral. Loans from your insurer typically have lower interest rates compared to personal or home equity loans, and there is no loan application or credit check required. However, you may incur interest charges, and any unpaid balance will reduce your benefits.

When considering withdrawing or taking a loan against the cash value of your life insurance policy, it is important to weigh the pros and cons carefully. Consult with a financial professional or tax advisor to fully understand the implications of your decision.

Life Insurance and Syphilis Testing: What's the Connection?

You may want to see also

Create generational wealth

Life insurance is a valuable tool for creating generational wealth, offering financial security and peace of mind. It can be used to build wealth during your lifetime and create a lasting legacy for your family after your passing. Here are some ways life insurance can help create generational wealth:

Choose the Right Type of Life Insurance

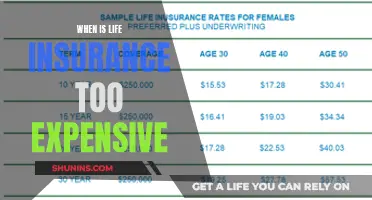

There are two main types of life insurance: term life insurance and permanent life insurance. Term life insurance provides coverage for a specific period, often ranging from 12 months to 30 years, and is ideal for breadwinners looking to protect their families. Permanent life insurance, on the other hand, offers lifetime coverage and is designed to build cash value over time. It comes with a higher premium but provides the advantage of a guaranteed death benefit and potential dividends.

Leverage, Guarantees, and Simplicity

Life insurance provides leverage by offering a larger payout than the premium paid, benefiting designated beneficiaries. It also offers guarantees through fixed annual premiums and assured death benefits. Additionally, life insurance simplifies the complex world of estate planning, as the death benefit is generally received by the beneficiary free of income tax and without probate delays.

Tax Benefits and Creditor Protection

Investing in a life insurance policy provides tax benefits. In India, for example, individuals can claim a tax benefit of up to ₹1.5 lakhs under the Indian Tax Act, section 80C. Life insurance proceeds are included in the taxable estate, but federal estate tax exemptions often eliminate federal estate taxation concerns. Depending on state laws, the death benefit may also be exempt from potential creditor claims against the policyholder and beneficiaries.

Long-Term Wealth Generation

Life insurance policies are typically long-term financial vehicles, making them ideal for wealth generation for future generations. You can choose to invest in long-term plans like ULIPs (Unit Linked Insurance Plans), which offer market-linked returns and life protection. Part of your premium is invested in money market instruments, providing returns linked to market performance.

Minimum Risk of Losing Money

Life insurance policies are a great choice for low-risk investments with healthy returns. Your premiums are not directly invested in the volatile stock market, so your investment is relatively protected from market movements. This ensures that your investment corpus grows steadily without significant barriers.

In conclusion, life insurance is a powerful tool for creating generational wealth. By strategically choosing the right type of policy, leveraging its benefits, and utilizing its tax advantages, you can build wealth during your lifetime and leave a lasting financial legacy for your family.

Term Life Insurance: What Happens When You Die?

You may want to see also

Collect dividends

Dividends are the money an insurance company distributes to eligible clients when the company performs better financially than expected for the year. Not all whole life insurance contracts offer dividends, but if your policy does, there are a few ways you can use them to get the most out of your investment.

Credit your dividend toward your premium to reduce out-of-pocket payments

If you want to reduce the amount you pay out of pocket for your insurance premium, you can credit your dividend toward it. This will lower your expenses while still maintaining your insurance coverage.

Pay yourself directly in cash with a check for the dividend amount

If you need cash, you can pay yourself directly with a check for the dividend amount. This option provides you with immediate funds that you can use for any purpose.

Credit the dividend to your life insurance contract to earn interest

If you want to increase your earnings, you can credit the dividend to your life insurance contract. This will allow the money to grow over time through interest accumulation.

Pay back any loans you've taken out against your contract

If you have taken out a loan against your life insurance policy, you can use your dividend to pay it back. This will reduce your debt and the interest charges associated with the loan.

Purchase paid-up additional insurance to increase your contract's cash value and death benefit

Using the dividends from your whole life insurance policy, you can purchase paid-up additional insurance (PUA). Each PUA has its own death benefit and cash value and can be thought of as a mini life insurance policy. PUA earns dividends, allowing you to further increase the value of your investments.

Life Insurance: Who's Missing Out and Why?

You may want to see also

Surrender the policy

Surrendering your life insurance policy means cancelling your coverage in exchange for a lump sum payout. This payout is known as the cash surrender value and is calculated by subtracting any surrender fees and outstanding loans from the policy's cash value. Surrender fees typically range from 10-35% and are usually highest in the early years of the policy, phasing out over time.

To surrender your policy, you'll need to contact your insurance company, fill out some paperwork, and then wait for your payout. The process is relatively quick and easy, but it's important to consider the pros and cons before making a decision.

Pros of Surrendering Your Life Insurance Policy

- You'll get some money back, which is better than letting the policy lapse by stopping payments.

- The process is simple and fast. You just need to contact your insurance company and let them know you want to surrender the policy.

Cons of Surrendering Your Life Insurance Policy

- You'll only get one offer from the insurance company, and they will try to give you the lowest amount possible.

- There are limited options for negotiation. The insurance company will give you a take-it-or-leave-it offer, with no room to negotiate.

- You may have to pay surrender fees, which can be up to 35% of the cash value.

- You'll lose your coverage, and your beneficiaries won't receive a death benefit when you pass away.

Overall, surrendering your life insurance policy should be a last resort, as there are alternative options such as selling the policy that can yield a higher payout. It's important to carefully consider your options and the potential implications before making a decision.

HPV and Life Insurance: What's the Connection?

You may want to see also

Terminate and surrender the policy for cash

Terminating and surrendering your life insurance policy for cash is an option if there are no other ways to access money from your policy. This option is available for permanent policyholders. By doing so, you will receive the cash surrender value described in the policy. However, this option usually brings less money than the sale of a policy. You will no longer be required to pay premiums, but no beneficiaries will be named, and your coverage will end.

You may have to pay taxes on the amount of the settlement that exceeds the amount of premiums you paid to the insurance company. Additionally, you may have to pay a surrender charge to end the insurance policy contract.

- You cannot continue to pay the premiums

- The policy is no longer needed

- You need a large amount of cash quickly

- You found a better deal

Before surrendering your policy, it is important to understand the potential financial benefits and effects of doing so. Consult your policy administrator, a tax planning professional, or someone knowledgeable about life insurance policies and financial planning.

Crohn's Impact: Life Insurance Underwriting

You may want to see also

Frequently asked questions

Life insurance is a financial product that pays out a sum of money to your beneficiaries after you die.

If you have a permanent life insurance policy, you can borrow or withdraw money from the cash value of your policy. You can also use the cash value as collateral for a loan.

Term life insurance covers your life for a specified period, usually 1, 5, 10, 15, 20, 25 or 30 years. It does not build cash value. Permanent life insurance provides coverage throughout your life, regardless of your health condition, and accumulates a cash value that can be used as a loan source or collateral.

Yes, there are several risks to consider. If you borrow or withdraw money from your policy, you may reduce the death benefit paid to your beneficiaries. Additionally, if you do not repay the loan, your policy may lapse. It's important to carefully review the terms and conditions of your policy before making any decisions.