There are several ways to purchase auto insurance, including shopping online, calling companies directly, or working with an agent or broker. Buying a policy online is often the cheapest and most convenient option, as there are no agency fees or markups, and you can compare quotes from multiple companies at once. However, working with an agent or broker can be helpful if you want more guidance when choosing a policy or have complex coverage needs. When purchasing auto insurance, it is important to gather necessary information, such as driver's license and vehicle information, determine your coverage needs, compare quotes from multiple insurers, and choose a policy that offers the best value for your needs.

| Characteristics | Values |

|---|---|

| Where to buy car insurance | Directly from an insurance company, by working with an agent, or through an independent online insurance marketplace |

| How to buy car insurance | Decide where to buy car insurance, figure out how much auto coverage is needed, fill out an application, compare auto insurance quotes, choose a policy, get insured, and cancel the old car insurance policy |

| Information needed to buy car insurance | Names, birthdays, and driver's license numbers for all drivers in the household, Social Security numbers for all drivers in the household, VINs (Vehicle Information Numbers) or make and model years for all vehicles, and an address for the insured |

| How to save money when buying car insurance | Compare quotes across multiple companies, select a higher deductible, pay upfront, maintain a clean driving record, evaluate current coverage, shop ahead, and bundle auto and home insurance online |

What You'll Learn

Deciding where to buy auto insurance

Buying Auto Insurance Online

The most convenient and quickest way to buy auto insurance is through the insurer's website or a third-party comparison site. This option offers pressure-free shopping, as you can get quotes and buy a policy without having to interact with agents or representatives. It also allows for a quick transition from getting a quote to purchasing coverage. However, the lack of human contact may be impersonal, and you might not find the answer to your specific queries online. Additionally, online quotes are estimates and may differ from the final price.

Buying Auto Insurance Through a Captive Agent

Captive agents work exclusively for a single insurance company and can guide you through the entire buying process. They can answer your questions, help with tricky coverage issues, and provide personalised services. However, they are limited to working with only one company, which may restrict your options for comparing different policies and prices. Captive agents also earn a commission, which could incentivise them to offer pricier policies.

Buying Auto Insurance Through an Independent Agent or Broker

Independent agents and brokers work with multiple insurance companies and can offer a variety of policies and quotes. They have a broader perspective, dealing with several insurance companies, and can help you find the best coverage for your specific needs. They represent the client's interests and are not obligated to sell a particular company's policy. However, they might not be authorised to sell all types of policies, and they might push unnecessary add-ons to increase their commission. Brokers may also charge a fee for their services.

Specialty Agencies for High-Risk Drivers

If you have a history of accidents, DUIs, or lapses in coverage, consider getting quotes from specialty agencies or high-risk car insurance companies. These agencies specialise in non-standard policies and are more likely to offer coverage to drivers with spotty records. They can help you find an insurer that will accept your application.

Factors to Consider When Deciding Where to Buy Auto Insurance:

- Convenience and Speed: Buying auto insurance online is generally the fastest and most convenient option, especially if you are looking for a pressure-free shopping experience.

- Personalised Service: If you prefer personalised guidance and someone to walk you through the process, a captive agent or an independent agent/broker may be a better option.

- Variety of Options: Independent agents and brokers can offer a wider range of policies and quotes from multiple insurance companies.

- Price Comparison: It is essential to compare prices and coverage options from at least three different companies before making a decision. Online comparison tools can be helpful in this regard.

- Reviews and Ratings: Consider checking reviews and ratings for each insurer to assess their customer service and satisfaction.

- Discounts: Look for insurers that offer discounts relevant to your situation, as these can significantly impact the final price.

Gap Insurance: UK Car Protection

You may want to see also

Figuring out how much coverage is needed

Figuring out how much auto insurance coverage you need is one of the most important parts of buying auto insurance. In 2020, the medical costs from fatal motor vehicle accidents totalled more than $537 million. You don't want to be on the hook for expensive medical bills or repairs after a fault accident.

Generally, it's a good idea for drivers to get as much liability coverage as they can afford. Adding comprehensive and collision coverage is a good idea, but the amount of insurance you should get depends on your car's value, too.

A typical full-coverage policy includes:

- Liability coverage: Covers the costs if you cause an accident, including when you damage someone else’s property with your car. Liability insurance is required in most states, and it’s divided into two parts: bodily injury liability (BIL) and property damage liability (PDL).

- Personal injury protection: Often called PIP or no-fault coverage, this covers medical and rehabilitation expenses if you or your passengers are injured in a car accident. Also covers other related expenses, like lost wages.

- Uninsured/underinsured motorist coverage: Covers the costs if you’re in an accident caused by a driver who either doesn’t have insurance or whose insurance can’t pay for the full extent of the damage.

- Collision coverage: Covers damage to your own vehicle after an accident, regardless of who was at fault.

- Comprehensive coverage: Covers any damage to your car that can happen when it isn’t being driven, including damage from extreme weather, falling objects, flood, fire, vandalism, and theft.

- Gap insurance: If your car is totalled, this pays out the difference between the car’s actual cash value (ACV), which includes depreciation, and the amount you still owe on a car loan or lease so you aren’t stuck making payments on a car you no longer have.

Most insurers offer additional coverage options, like roadside assistance or new car replacement coverage, that you can add to your policy (just remember that more coverage means higher rates).

Your state’s minimum car insurance coverage requirements are a starting point for determining coverage, but they’re too low to sufficiently cover you in the event of a major accident. We recommend drivers have at least $100,000 per person/$300,000 per accident in bodily injury liability and $100,000 in property damage liability coverage in order to be fully protected. Comprehensive and collision coverage are optional, but they can be valuable protection for your car.

When determining how much coverage you need, you should also consider your net worth. You'll want to make sure you have enough liability coverage to protect your assets in case you're liable in an accident. You can calculate your net worth using the following equation:

Value of home + value of cars + savings + investments – debt = net worth

The value of your home, vehicles, savings, and investments represents your primary assets. Your net worth is the sum of these assets minus your debts.

Insurance Inspections: In-Person or Virtual?

You may want to see also

Gathering necessary documents

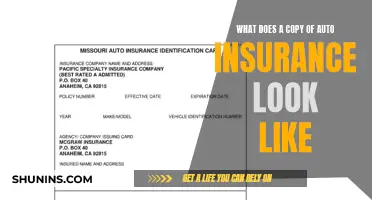

When it comes to purchasing auto insurance, there are several documents you'll need to gather. Here's a detailed list to help you prepare:

- Basic personal information: This includes your full name, date of birth, address, and contact details. This information is essential for the insurance company to identify you and establish your residency.

- Driver's license information: Have your driver's license number and the license details of any other drivers you want to include on the policy. The insurance company will use this information to assess driving experience and history.

- Vehicle information: Collect the details of the vehicle(s) you want to insure, including the Vehicle Identification Number (VIN), make, model, year, mileage, and safety features. The VIN is especially important, as most insurance companies won't issue a policy without it. If you can't provide the VIN, be sure to have the year, make, and model of the vehicle.

- Previous insurance policy information: If you have an existing or previous auto insurance policy, gather the relevant documents. These may include the declarations page, coverage details, policy limits, and expiration date. This information will help you understand your current coverage and decide if you want to switch insurers or adjust your coverage.

- Driving history: It's important to disclose any accidents, violations, or tickets on your driving record. This information impacts your insurance rates and risk assessment.

- Social Security Number (SSN): Some insurance companies may require your SSN to verify your identity and run a credit check. However, if you don't have an SSN or prefer not to provide it, there are insurers who can still offer you coverage.

- Payment method: To purchase the insurance policy, you'll need a valid payment method, such as a debit card or bank account information, to make the initial payment or down payment.

It's a good idea to have all these documents readily available when you start the process of purchasing auto insurance. This will make it easier to compare quotes, finalise your coverage, and secure your policy without delays.

Auto Insurance: Florida's Mandatory Law

You may want to see also

Comparing quotes and discounts

Understanding Quotes and Discounts

When comparing auto insurance quotes, it's crucial to ensure you're making an accurate comparison. This means including the same levels of liability coverage, the same deductibles for collision and comprehensive coverage (if applicable), and the same additional drivers and vehicles. By standardising these factors, you can be confident that any differences in the quoted rates are due to variations in the insurance company's pricing structure or the discounts offered.

Gathering Quotes

You can obtain quotes directly from insurance companies, either by visiting their websites or calling them. Additionally, online insurance marketplaces, such as Policygenius, allow you to compare quotes from multiple companies simultaneously, saving you time and effort. It's recommended to get quotes from at least three different companies to ensure you're getting a competitive rate.

Understanding Discounts

Insurance companies offer a range of discounts that can significantly reduce your premium. Common discounts include:

- Safe driver discounts for maintaining a clean driving record.

- Discounts for paying your annual premium in full rather than in instalments.

- Good student discounts for students with good academic performance.

- Bundling discounts when you purchase multiple types of policies, such as home and auto insurance, from the same company.

- Anti-theft device discount if your vehicle is equipped with security features.

- Paperless discount for opting for electronic documents and communication.

- Discounts for insuring multiple vehicles with the same company.

- Military discounts for current or former military personnel.

- Alternative fuel vehicle discount if your vehicle uses alternative fuels, such as electricity or natural gas.

- Automatic payments discount if you set up automatic payments from your bank account.

Final Thoughts

When comparing quotes, pay attention to both the base rate and the discounts offered. A company with a slightly higher base rate may end up being more affordable due to the discounts you qualify for. Additionally, consider using an online insurance marketplace to streamline the process and ensure you're getting the most competitive rate. Remember, the goal is to find the right balance between coverage and cost, so choose a policy that offers sufficient protection while also fitting within your budget.

Vehicle Insurance: Is It Mandatory in Massachusetts?

You may want to see also

Purchasing the policy

There are several ways to purchase an auto insurance policy. You can buy a policy directly from an insurance company, either online or in person, or you can work with an agent or broker. Buying directly from an insurance company is often the quickest option, as you can get a quote and purchase coverage online. However, when buying directly, you will only see quotes from one company at a time, so you will need to compare costs yourself to find the cheapest rate.

Using an agent or broker can be helpful if you want guidance in choosing a policy, particularly if you are unfamiliar with auto insurance or have specific needs. Captive agents work for a single insurance company and can offer in-depth knowledge of that company's policies. Independent agents, on the other hand, work with multiple insurance companies and can offer a wider range of options. However, they may charge a fee for their services, and there is a risk they may try to sell you more coverage than you need.

When purchasing a policy, you will need to provide some basic information, including:

- Driver's license number

- Social Security number

- Previous violations or accidents

- Personal information for other drivers on the policy

- Vehicle information, including the make, model, and Vehicle Identification Number (VIN)

- Date you want your coverage to begin

- Current policy end date (if applicable)

Once you have chosen a policy, you will need to pay a down payment and set up a monthly payment plan or pay the premium in full. Don't forget to cancel your old policy if you are switching from a different provider, and make sure there is no gap between the end of your old policy and the start of the new one.

Disputing Auto Insurance Claims: Your Rights

You may want to see also

Frequently asked questions

For young drivers, the most affordable option is usually to be added to a parent's insurance policy. If you're buying insurance on your own, you may need to shop around with multiple companies to find cheap insurance.

It's recommended that drivers get a full-coverage policy, which includes both comprehensive and collision coverage, with at least $100,000 per person and $300,000 per accident in bodily injury liability coverage.

You can get an instant car insurance quote by filling out an online form on a provider's website or a comparison site.

You'll need to provide your driver's license number, date of birth, address, living situation, marital status, vehicle information, and details on your insurance history and driving record.

Buying car insurance online can be cheaper than buying through an agent because brokers or agents might charge an extra fee or commission.