Getting an auto insurance estimate is a relatively straightforward process that can be done in a few different ways. The first step is to decide how much insurance you need and what optional coverage types you are considering. This can be done by using an online car insurance calculator or by speaking with an independent auto insurance agent. Once you have an understanding of the amount of coverage you need, you can start requesting quotes from different insurance companies. It is important to provide detailed information when requesting quotes so that you can get an accurate estimate. Factors that can affect the cost of auto insurance include your location, age, gender, driving record, and the type of car you drive. By comparing quotes from multiple companies, you can find the best rates and coverage options for your needs.

| Characteristics | Values |

|---|---|

| Driving record | A clean driving record will result in cheaper rates. At-fault accidents, speeding tickets, and DUIs will increase rates. |

| Location | Urban areas will have higher rates than rural areas. Areas with higher accident rates, vehicle theft, and vandalism will have higher rates. |

| Age | Drivers under 25 and over 70 will pay more than those in their 30s-50s. |

| Gender | Women tend to pay lower premiums, especially in younger age groups. |

| Credit score | A higher credit score will result in lower rates. |

| Coverage | The more coverage, the higher the rates. |

| Discounts | Bundling policies, good student discounts, and safe driver discounts can lower rates. |

| Vehicle | The make, model, age, and safety features of the vehicle will impact rates. |

| Usage | The more you drive, the higher the rates. |

What You'll Learn

Compare quotes from multiple providers

Comparing quotes from multiple providers is a crucial step in getting a quick auto insurance estimate. Here's a detailed guide to help you through the process:

Step 1: Decide on the Coverage You Need

Different insurers will offer varying rates depending on the coverage you opt for. It's essential to understand your state's minimum coverage requirements and any additional coverage you may need. For instance, if you have a new or leased vehicle, you might be required to have comprehensive and collision coverage. Your personal situation, such as your driving record, age, and vehicle features, will influence the coverage you choose.

Step 2: Research Insurers

Before diving into the quotes, it's beneficial to research various insurers. Look into their customer service, claims handling, and overall reputation. Check which insurers offer discounts and whether they apply to you. This step will help you understand which insurers align with your needs and preferences.

Step 3: Understand the Factors Affecting Your Quote

Several factors influence the quotes you'll receive. These include personal characteristics like your age, gender, and marital status. Teen drivers, for example, often receive higher quotes than other age groups. Your driving record, location, and credit score can also impact your quote. Insurers will also consider the make and model of your car, as certain vehicles tend to be stolen or crashed more frequently, leading to higher insurance rates.

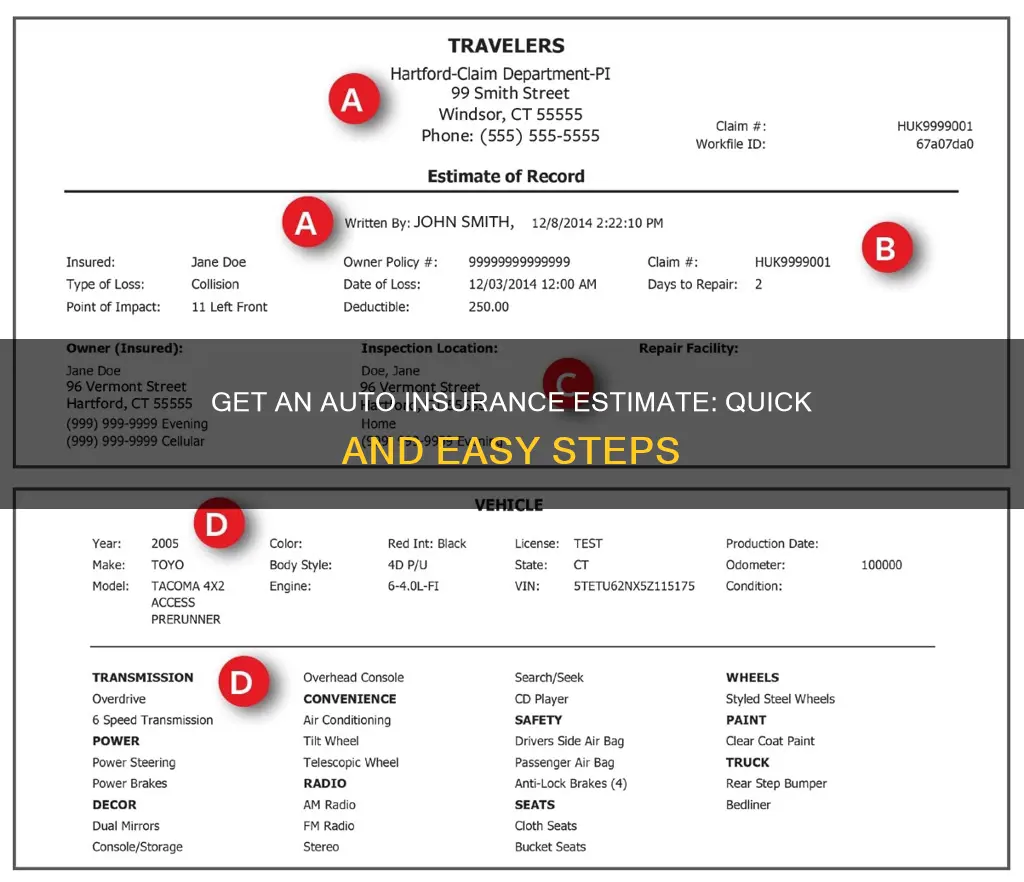

Step 4: Gather Information

To get accurate quotes, you'll need to provide some basic information. This includes your age, gender, marital status, location, and information about your vehicle, such as its make, model, and Vehicle Identification Number (VIN). You'll also need to disclose your current insurance status and details related to your driving history, such as accidents or violations.

Step 5: Use Comparison Tools

Online comparison tools and websites can be a great way to get multiple quotes at once. These tools allow you to input your information and receive quotes from different insurers, making it more convenient than visiting individual insurer websites.

Step 6: Compare Quotes

Once you have the quotes, ensure you're comparing them accurately. Select the same coverage types, policy limits, and deductible amounts across all quotes. This approach will provide you with a true cost comparison and help you identify the most suitable insurer for your needs.

Remember, while price is important, it's also crucial to consider the reputation and customer service of the insurer. Taking the time to compare quotes from multiple providers will help you make an informed decision about your auto insurance.

Personal Injury Claims: No Auto Insurance

You may want to see also

Provide detailed personal information

To get an anonymous car insurance quote, you will need to provide some personal information. However, the level of detail required will vary depending on the company and the type of quote you want.

For a rough estimate, you will need to provide some basic information about yourself and your vehicle. This includes your age, the year, make and model of your car, and your location. You may also need to provide your driving history, including any accidents, tickets or claims.

If you want a more accurate quote, you will need to provide more detailed personal information. This includes your name, date of birth, driver's license number, vehicle identification number, and your address. Some companies may also ask for your Social Security number, although this is not always required.

It is important to note that anonymous quotes are not always accurate and may change once you provide more detailed personal information. It is also worth considering that some companies may use your personal information for marketing purposes or share it with third parties.

How to Identify Another Driver's Auto Insurance Company

You may want to see also

Understand the different types of coverage

Understanding the different types of auto insurance coverage is crucial for making informed decisions about your policy. While some coverages are mandated by law, others are optional but highly beneficial. Here's a detailed overview of the various types of auto insurance coverages:

Liability Coverage:

Liability coverage is typically required in almost every state and includes two main components:

- Bodily Injury Liability: This coverage pays for the medical expenses of individuals injured in an accident caused by you. It covers costs such as medical bills, lost wages, and legal fees, ensuring that you are protected financially if you injure someone else in a car accident.

- Property Damage Liability: This coverage pays for the damage you cause to someone else's property, including their vehicle, fence, building, or utility pole. It ensures that you won't have to bear the full cost of repairs to another person's property.

Uninsured/Underinsured Motorist Coverage:

This coverage is designed to protect you in the event of an accident with a driver who doesn't have insurance or has insufficient coverage. It includes:

- Uninsured Motorist Bodily Injury Coverage (UMBI): Pays for medical expenses if you're hit by an uninsured driver.

- Uninsured Motorist Property Damage Coverage (UMPD): Pays for repairs to your vehicle if an uninsured driver hits you.

- Underinsured Motorist Bodily Injury Coverage (UIMBI): Covers medical bills that exceed the at-fault driver's bodily injury liability limits.

- Underinsured Motorist Property Damage Coverage (UIMPD): Covers repair expenses that exceed the at-fault driver's property damage liability limits.

Medical Payments Coverage/Personal Injury Protection (PIP):

These coverages pay for medical expenses for you and your passengers, regardless of who is at fault in the accident:

- Medical Payments Coverage (MedPay): Pays for hospital bills, doctor fees, ambulance fees, and passenger coverage. It is optional in most places but can provide valuable financial protection if you cannot afford sudden medical costs.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, rehabilitation costs, and funeral expenses. PIP is mandatory in some states, especially those with no-fault insurance laws.

Collision Coverage:

Collision coverage protects your car from damage in any collision, regardless of who is at fault. It helps pay for repairs to your vehicle, whether you collide with another vehicle or an object such as a tree or mailbox. While it covers a wide range of accidents, it does not include reimbursement for mechanical failure or normal wear and tear.

Comprehensive Coverage:

Comprehensive coverage protects your car from damage caused by scenarios other than collisions. This includes weather events, natural disasters, fire, flood, vandalism, falling objects, and animal collisions. Comprehensive coverage is particularly useful for unexpected incidents and is often paired with collision coverage to provide complete protection for your vehicle.

Optional Coverages:

In addition to the standard coverages mentioned above, there are several optional coverages you can add to your policy for enhanced protection:

- Glass Coverage: This covers windshield and window damage and may be included in comprehensive coverage or offered as a supplemental option.

- Gap Insurance: If you lease or finance your vehicle, gap insurance covers the difference between your car's market value and what you still owe on it if it is totaled or stolen.

- Rental Car Coverage: This coverage provides reimbursement for a rental car while your vehicle is being repaired due to a covered claim.

- Roadside Assistance: This coverage offers assistance for issues like towing, flat tires, battery jump-starts, and locksmith services.

- New Car Replacement Insurance: This coverage pays for a brand-new car of the same make and model if your new vehicle is totaled.

Remember, understanding the specific coverages offered by each insurance provider and their limitations is essential. Additionally, the availability and requirements of certain coverages may vary by state, so it's important to review your state's insurance laws and consult with a licensed insurance agent to ensure you have the right protection for your needs.

The Ultimate Guide to Non-Owners Auto Insurance

You may want to see also

Consider your location and driving history

When it comes to auto insurance, your location and driving history are two of the most important factors that influence your premium. Let's break down each of these factors and discuss how they impact your insurance rates:

Location

Your location, including your state, city, and ZIP code, plays a significant role in determining your auto insurance rates. Insurers use your address to assess the likelihood of you filing a claim. Here are some location-related factors that can affect your premium:

- Crime rates: Areas with higher crime rates, particularly vehicle-related crimes such as theft and vandalism, often lead to higher insurance premiums. This is because these crimes result in more claims, increasing the cost of insurance.

- Population density: Living in a densely populated area, especially a big city, usually results in higher insurance rates. More people and vehicles in a small area increase the chances of accidents, congestion, and theft.

- Weather conditions: Severe weather events like floods, hurricanes, tornadoes, and hail storms can cause extensive vehicle damage, leading to higher insurance claims and premiums.

- Road conditions and traffic: Poor road conditions, such as potholes and a lack of proper signage or traffic lights, can increase the risk of accidents. Additionally, areas with heavy traffic congestion may have higher insurance rates due to the increased likelihood of collisions.

- State laws: Each state has its own laws regarding the types and minimum amounts of coverage required. For example, some states mandate uninsured motorist coverage or personal injury protection (PIP), which can increase insurance costs.

Driving History

Your driving history is a crucial factor in determining your auto insurance rates. A clean driving record can help you obtain cheaper rates, while incidents such as accidents, speeding tickets, and DUIs can significantly increase your premium. Here's how your driving history can impact your rates:

- Accidents: At-fault accidents will almost always lead to an increase in your insurance rates, with the average increase being around 45% for property damage and 47% if there are injuries.

- Speeding tickets: On average, a speeding ticket can raise your insurance rates by about 24%.

- DUIs: A DUI will significantly impact your insurance rates, with an average increase of 74%.

- Other infractions: Other driving infractions, such as running a red light or stop sign, can also affect your rates. Multiple violations will likely result in higher increases.

Remember that your driving history reflects your level of risk as a driver. The more incidents on your record, the higher the insurance company will perceive the risk of insuring you, resulting in higher premiums.

Battling a Denied Auto Insurance Claim: Your Rights and Strategies

You may want to see also

Explore discounts and special offers

Discounts and special offers are a great way to save money on your auto insurance. Here are some tips to explore these opportunities and lower your insurance costs:

Driver History Discounts

If you have a good driving record, free of accidents, traffic violations, and claims, you may be eligible for a "good driver" discount. Most insurance companies offer this discount, rewarding your safe driving behaviours. Some companies, like GEICO, offer up to a 22% discount for being accident-free for five years. Other companies may have different timeframes and criteria, so be sure to check with your insurer.

Defensive Driving Discount

Taking a defensive driving course can also lower your insurance rates. These courses teach you tactics to become a safer driver, and your insurer may offer a discount for completing one. However, in some cases, only drivers aged 50 or older qualify for this discount.

Affiliation Discounts

Your affiliations and associations can also lead to insurance savings. For example, GEICO offers discounts for federal employees and members of the military, National Guard, or Reserves. Other companies, like Farmers and Travelers, provide discounts for alumni from certain universities, Greek life alumni, and members of professional organisations. Check with your insurance company to see if any of your affiliations qualify for a discount.

Vehicle-Related Features Discounts

The features of your vehicle can also impact your insurance rates. Insurers may offer discounts for cars with alternative energy sources, such as electric vehicles. Safety features like anti-lock brakes, dual airbags, and anti-theft devices can also result in lower rates. For instance, GEICO offers up to a 23% discount for vehicles with airbags, applied to the medical payments or personal injury portion of your policy.

Personal Traits Discounts

Your personal traits and life circumstances can also lead to insurance discounts. Many companies offer a "good student" discount for full-time students with good grades. GEICO, for instance, provides up to a 15% discount for students with a B average or higher. Additionally, if you own a home, you may be eligible for a discount, even if you don't buy homeowners insurance from your auto insurer.

Customer Loyalty Discounts

Insurers often reward customer loyalty with various discounts. These can include discounts for having multiple policies with the same company, such as bundling your auto and home insurance, or insuring multiple vehicles with them. These discounts can lead to significant savings, so be sure to ask your insurer about any loyalty programmes they offer.

Charging Insurance Companies for Auto Glass: What's a Fair Price?

You may want to see also