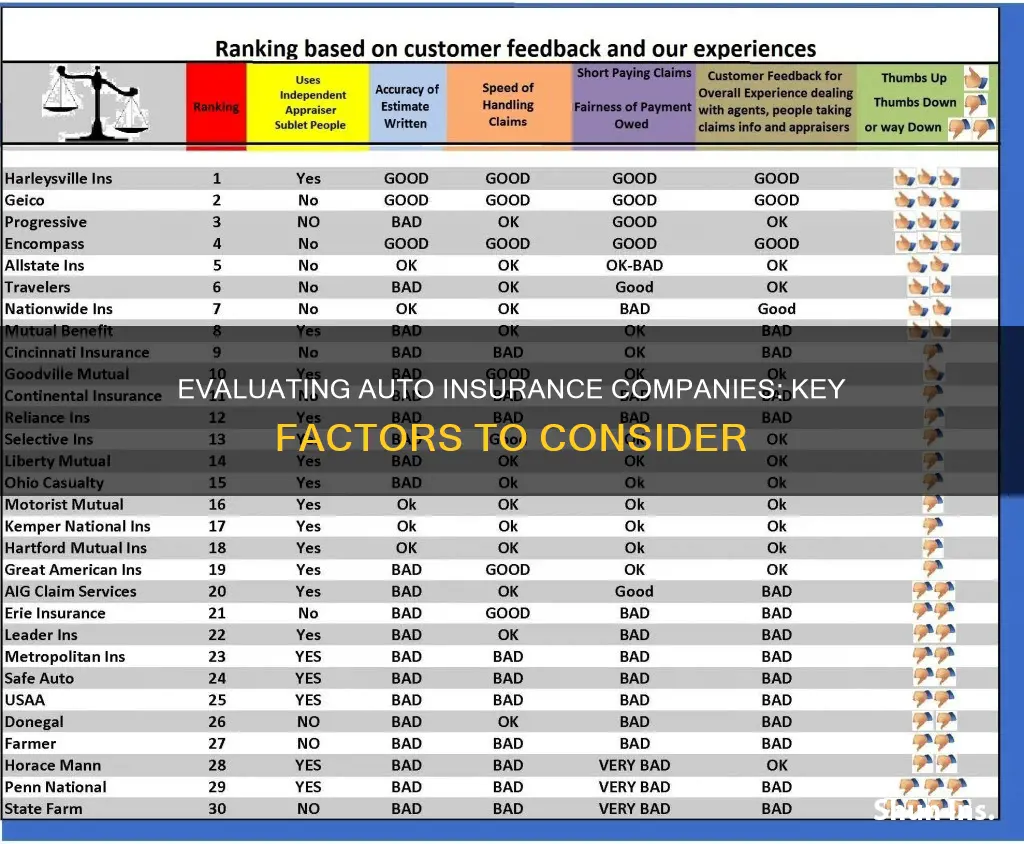

When it comes to rating auto insurance companies, there are a few key factors to consider. These include the company's financial strength, customer satisfaction, affordability, and ease of use. Comparing rates and reading reviews can help identify the best insurer for your needs. It is also important to understand the different types of car insurance and the factors that impact the cost. By shopping around and considering your specific needs, you can find the best auto insurance company for you.

| Characteristics | Values |

|---|---|

| Customer service | High customer satisfaction ratings |

| Claims handling | High claims satisfaction ratings |

| Discounts | Various discounts available |

| Financial strength | Superior financial strength ratings |

| Complaints | Low number of customer complaints |

| Ease of use | User-friendly website and mobile app |

Discounts

There are many different types of discounts available, and they can be grouped into several categories. Here are some of the most common discount categories:

Multi-Policy Discounts

Also known as a multi-line or bundling discount, this is one of the biggest discounts you can get on your auto insurance. You can typically get a discount of between 5% and 25% when you bundle your auto insurance with another type of insurance, such as home, renters, condo, boat, motorcycle, RV, or life insurance.

Good Driver Discounts

If you have a clean driving record, meaning you have no accidents, speeding tickets, or other violations on your record, you can often get a discount on your insurance. This is usually defined as going a certain number of years without any incidents.

Student Discounts

There are several types of student discounts available. Students who are enrolled full-time in high school or college and maintain a certain grade point average (usually a B or above) may be eligible for a discount. There are also discounts available for students who are away at school and don't have regular access to a vehicle.

Vehicle-Based Discounts

If your car has certain safety features or anti-theft devices, you may be eligible for a discount. Common safety features that can qualify for a discount include anti-lock brakes, airbags, and daytime running lights. Anti-theft devices can include GPS-based systems, stolen vehicle recovery systems, and VIN etching.

Payment Discounts

Many insurance companies offer discounts if you pay your premium in full at the beginning of the policy period or if you set up automatic payments. Some companies also offer a small discount if you opt for paperless billing.

Other Discounts

There are many other types of discounts available that don't fit neatly into the categories above. For example, some companies offer discounts for things like loyalty, early signing or renewal, owning a hybrid or electric vehicle, being a member of certain organizations or professions, or being a member of the military.

It's important to note that not all discounts are available in all states, and the amount of the discount can vary. Additionally, some discounts may only apply to a specific part of your insurance policy, rather than your entire bill. It's always a good idea to ask your insurance company about any available discounts and whether you qualify for them.

Behavioral Factors: Auto Insurance Premiums

You may want to see also

Customer service

US News & World Report's rating of the best car insurance companies places USAA at the top for customer service, with 64% of policyholders surveyed describing themselves as "completely satisfied" with the ease of contacting the company's customer service. Auto-Owners is ranked second for customer service, with 61% of customers saying it was easy to get in touch with customer service and 61% happy with the service they received.

Nationwide and State Farm are ranked third and fourth for customer service, respectively.

Forbes Advisor's analysis names USAA as the best car insurance option for military members, with competitive rates and a variety of coverage options. The company also offers a discount of up to 60% for customers who store their car while deployed and up to 15% for those who garage their car on a base.

NerdWallet's analysis ranks American Family as the best car insurance company for affordability, with the lowest average rate for full coverage insurance out of its list of the best car insurance companies. The company also receives fewer consumer complaints than expected for a company of its size.

NerdWallet also ranks Geico highly for accident forgiveness, with two potential ways to gain accident forgiveness and keep rates low.

State Farm is ranked highly for customer satisfaction by J.D. Power, coming first among eight large insurers in the 2023 U.S. Insurance Shopping Study.

Auto Insurance Deductibles: What's the Average?

You may want to see also

Claims handling

Efficiency and Speed:

In the event of an accident, the last thing a driver needs is a lengthy and complicated claims process. Look for insurers that offer speedy and efficient claims processing. Some companies are known for their prompt settlement offers and timely repairs, ensuring you can get back on the road as soon as possible.

Online Claims Filing:

The convenience of online claims filing cannot be overstated. Many leading insurance companies, such as State Farm, offer the ability to file and track accident claims entirely online through their websites or mobile apps. This provides a fast and accessible way to initiate the claims process without having to visit a physical location.

Customer Satisfaction:

When evaluating claims handling, consider the level of customer satisfaction expressed by policyholders. Check independent reviews, ratings, and testimonials to gauge how satisfied customers are with the insurer's claims handling process. Look for companies that consistently deliver on their promises and provide fair and timely settlements.

Adjuster Investigation:

After a claim is filed, the insurance company assigns an adjuster to investigate the incident. The adjuster will determine who was at fault, the cost of repairs, and what losses will be covered. Efficient and unbiased adjusters can help expedite the claims process and ensure a fair outcome.

Payout Offers and Settlements:

Some insurance companies may try to lowball policyholders with inadequate compensation offers or even deny coverage for legitimate claims. Look for insurers with a reputation for providing fair and reasonable payout offers. Understand your policy's coverage limits and exclusions to ensure you receive the benefits you are entitled to.

Additional Perks:

In addition to standard claims handling, some insurers offer unique perks or add-ons. For example, Erie Auto Insurance provides up to $500 per pet for veterinary care in the event of a collision, making it an ideal choice for pet owners.

Truckers' Auto and Cargo Insurance: What's the Cost?

You may want to see also

Customer loyalty

The State of Customer Loyalty in Auto Insurance

Auto insurance customer loyalty is currently on a downward trend. Advertising and the shift to online shopping have contributed to this decline, with consumers being bombarded with insurance ads and finding it easier to shop for quotes from the comfort of their homes. The rising cost of auto insurance, outpacing the growth of median household income, has also played a role in decreasing customer loyalty. As a result, consumers are more likely to switch providers, and insurance companies with lower acquisition costs have been able to benefit from this trend.

Top Auto Insurance Companies for Customer Loyalty

- NJM: NJM has the highest customer loyalty as of Q1 2024. It offers competitive pricing, various discounts (including a discount for full coverage), and has received high marks for customer service. However, NJM is only available in Connecticut, Maryland, New Jersey, Ohio, and Pennsylvania.

- USAA: USAA, available to military members and their families, has some of the lowest rates in the industry and excels in customer service. In J.D. Power's 2023 study, USAA had the highest customer satisfaction score but was not ranked due to limited availability.

- Erie Auto Insurance: Erie offers low rates and is known for its Rate Lock feature, which prevents premiums from increasing over time—a valuable perk considering the recent surge in auto insurance rates. However, Erie is only available in 12 states and Washington, D.C.

- Mercury Auto Insurance: Mercury Auto Insurance provides in-person service through a network of independent agents. It offers affordable prices but has lower customer satisfaction ratings, receiving the second-lowest score in J.D. Power's 2023 auto claims satisfaction study. Mercury is available in 11 states, including California, New Jersey, New York, and Texas.

- The Hanover: The Hanover is known for its excellent customer service and customizable insurance options, but its rates tend to be on the higher side. It sells policies through independent agents in 18 states, including Michigan, New Jersey, New York, and Ohio.

When choosing an auto insurance company, customers often prioritize competitive pricing and great customer service. The top-performing companies in terms of customer loyalty tend to offer one or both of these features. Additionally, smaller, regional carriers often have higher customer loyalty than the large national companies, so it's worth considering insurers with a smaller footprint.

Secura: Auto Insurance Options

You may want to see also

Customer satisfaction

There are several ways to determine customer satisfaction. One way is to look at third-party reviews and surveys. For example, The Zebra, a company that helps customers find the right insurance policy, conducted a customer satisfaction survey of 4,134 current U.S. auto insurance customers. The survey looked at six customer experience categories: willingness to recommend, communication, customer service satisfaction, claims satisfaction, trustworthiness, and online presence. Based on the survey results, USAA, State Farm, and GEICO were the top three insurance companies for customer satisfaction.

Another way to gauge customer satisfaction is through ratings and reviews on third-party websites. For instance, J.D. Power, a global leader in consumer insights, conducts annual studies to evaluate customer satisfaction with auto insurance providers. Their studies examine various factors, including billing process, policy information, claims, interaction, policy offerings, and price. In 2023, J.D. Power's study found that overall customer satisfaction with auto insurance providers had dropped significantly, largely due to lower satisfaction with the price of policies. Despite this, some companies, like State Farm, still managed to receive high ratings in specific categories, such as claims satisfaction.

Additionally, it is worth considering the number of customer complaints when assessing customer satisfaction. Organizations like the National Association of Insurance Commissioners (NAIC) track and publish data on consumer complaints against insurance companies. By comparing the number of complaints to the company's size, you can determine if a company has fewer or more complaints than expected. This information can provide valuable insights into customer satisfaction and help identify companies that are keeping their customers happy.

When evaluating auto insurance companies, it is beneficial to consider multiple factors, including customer satisfaction, to make an informed decision. By reviewing third-party surveys and ratings, analyzing customer complaints, and reading reviews, you can gain a comprehensive understanding of a company's customer satisfaction levels.

Navigating Auto Insurance: Strategies to Avoid Costly Premiums

You may want to see also

Frequently asked questions

The most important factors to consider when choosing an auto insurance company are your personal needs and preferences. Some people may prioritize low rates, while others may value a company with superior customer service. You should also consider the company's financial strength, the number of customer complaints, and the ease of use of their website and mobile app.

To compare auto insurance rates, you should gather your personal information, such as your address, date of birth, and driving history. You can then use an online comparison tool or contact insurance companies directly to get quotes. Make sure to compare the same types and amounts of coverage across different companies.

There are several types of auto insurance coverage, including liability, collision, and comprehensive. Liability coverage pays for the other driver's injuries and property damage if you are at fault in an accident. Collision coverage pays for damage to your car in an accident, regardless of fault. Comprehensive coverage pays for non-collision-related damage, such as theft, fire, or weather damage.

To find the best auto insurance rates, shop around and compare quotes from multiple companies. Consider your coverage needs and look for discounts that you may be eligible for. You can also bundle your auto insurance with other types of insurance, such as homeowners or renters insurance, to get a discount.