Auto insurance policies are often filled with legal jargon, making them confusing to understand. However, it is important to read and understand your auto insurance policy to avoid costly coverage gaps or frustration with your insurer after an accident. The best place to start is the declarations page, which is usually the first page of the policy document. This page summarises your coverages, limits of liability, premiums and deductibles. It also includes personal information, such as your address, and details of the insured drivers and vehicles. The declarations page is followed by the insurance agreement, which outlines the terms, conditions and exclusions of your policy. The rest of the policy document contains important information such as definitions, coverage sections, exclusions, endorsements, cancellation terms and contact information. Understanding your auto insurance policy can help you make informed decisions about your coverage selections and ensure you have the protection you need.

| Characteristics | Values |

|---|---|

| Purpose | To summarise the contents of your contract with your insurer |

| Position in policy documents | Usually the first page |

| Information included | Policy number, term, insured drivers, insured vehicles, coverage types and limits, endorsements, premium, discounts, financial institution information |

What You'll Learn

Understanding the declarations page

The declarations page is the first page of your auto insurance policy documents. It contains a summary of your policy and is sometimes referred to as the "information page". Here is a breakdown of the information you will find on the declarations page:

- Policy Number: This is a unique number assigned to your policy, which you will need when filing a claim.

- Policy Term: The policy term is the length of time your policy is valid, typically six or 12 months. The term includes the start and end dates of the policy.

- Policyholder Address: The address listed is that of the policyholder, which is also the primary location of the insured vehicle.

- Named Insured: Any driving resident of your household should be listed here, unless specifically excluded.

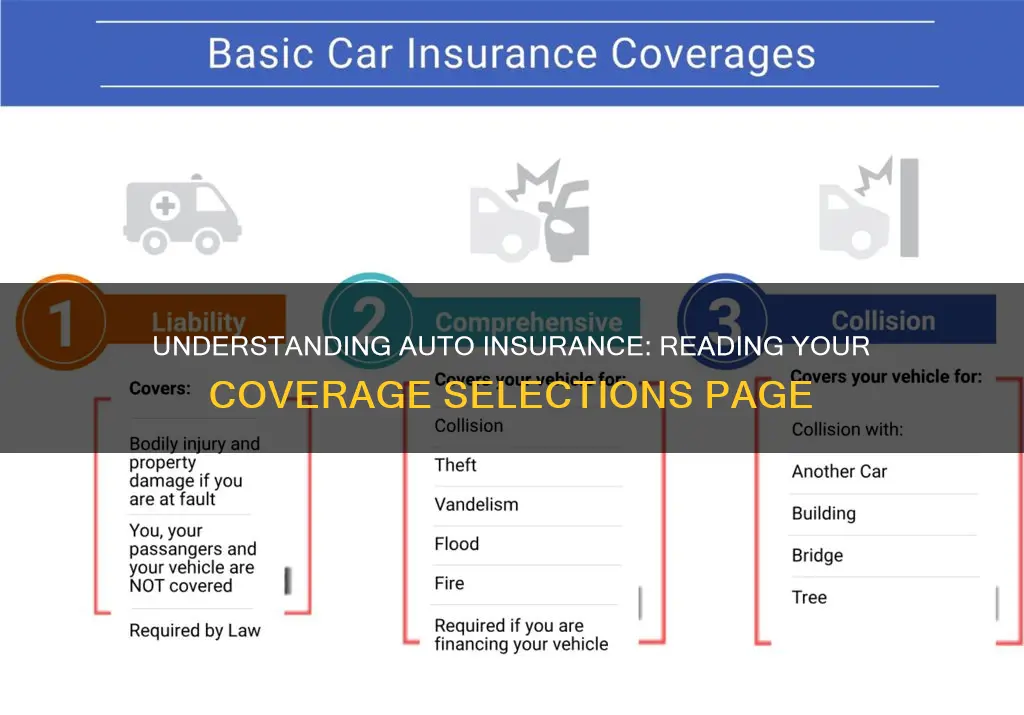

- Coverages: This section lists the types of coverage you have, including bodily injury and property damage liability (required in most states), as well as any additional coverages you have elected, such as comprehensive, collision, uninsured motorist, etc.

- Policy Limits/Deductible: This section outlines the maximum amount that each coverage will pay out, as well as any deductibles you need to pay out of pocket.

- Premium: The premium is the total amount you will pay over the course of the policy term. It can be listed as a six-month or one-year total.

- Endorsements: This section includes details about any optional endorsements or add-ons to your policy, such as roadside assistance, rental car reimbursement, accident forgiveness, etc.

- Discounts: Some declarations pages will show any discounts that have been applied to your policy.

- Financial Institution Information: If you have a loan or lease on your vehicle, the name and contact information of the financial institution will likely be listed here.

The declarations page is a crucial part of your auto insurance policy as it outlines the basics of your coverage. It is important to review this page periodically to ensure accuracy and that you understand your coverage limits and any exclusions. If you make changes to your policy, such as adding or removing a driver or vehicle, you should receive an updated declarations page from your insurance company.

Equity vs. Gap Insurance: What Car Owners Need to Know

You may want to see also

Understanding the insuring agreement

An insuring agreement is a critical component of an insurance contract, outlining the commitments made by the insurance company to the insured. This section details the specific circumstances under which the insurer will provide financial protection in exchange for the insured's premium payments. The insuring agreement is a summary of the insurer's major promises and defines the scope of coverage.

In an auto insurance contract, the insuring agreement will specify the sections or areas that the insurance company will cover, such as legal liability, accident benefits, and physical damage. These areas are typically labelled as Sections A, B, and C, with subsequent pages providing detailed explanations of each section's coverage.

The insuring agreement also provides clarity on the exclusions to coverage. Exclusions are an essential part of the agreement as they define the specific circumstances or risks that are not covered by the insurance policy. By listing these exclusions, the insurance company ensures that the policyholder is aware of the exact extent of their coverage.

Additionally, the insuring agreement may include information on the types of coverage provided, such as "named-perils coverage" or "all-risk coverage". Named-perils coverage only insures against the specific risks or perils listed in the policy, whereas all-risk coverage protects against all losses except those explicitly excluded.

It is important to note that the insuring agreement is designed to prevent confusion and disputes over coverage. However, disagreements may still arise, leading to legal proceedings where both parties present their interpretations of the agreement.

The insuring agreement is a critical component of an auto insurance policy as it provides transparency and helps policyholders understand their coverage, exclusions, and the insurer's commitments.

Finding Affordable Auto Insurance: Navigating the Market for Cost-Effective Coverage

You may want to see also

Understanding policy exclusions

Policy exclusions are a way for insurance companies to define what is not covered in a car insurance policy. Exclusions are typically listed in your auto insurance policy and may vary depending on your insurance coverage. They are often found in umbrella and excess insurance coverage policies. Exclusions are usually written in fine print and may contain jargon, making it difficult for the layperson to understand.

- Named driver exclusion: This clause specifically excludes a driver or drivers from your policy. If an excluded driver causes an accident while driving your vehicle, the insurance company will not provide coverage. This type of exclusion is often used for high-risk drivers living in the same household as the policyholder.

- Family member exclusion clause: This states that the insurance company will not cover personal injury damages claimed by one family member against another while both are occupying the insured vehicle. This clause aims to prevent fraud, such as two family members colluding to cause an accident for financial gain.

- Intentional act exclusion: This clause voids insurance coverage for injuries or property damage if the insured driver intentionally tries to harm someone or something with their vehicle.

- Owned-but-unlisted vehicle exclusion: This clause exempts from coverage any vehicles that an insured person owns or uses regularly but fails to list as insured vehicles on their policy.

- Act-of-god exclusion: This exclusion applies to acts of nature and other unpredictable events, such as hurricanes, floods, tornadoes, and other natural disasters. While comprehensive coverage may pay for damages caused by hail or vandalism, it typically does not include events that are more common in your geographic area.

- Punitive damages exclusion: This clause limits coverage for damages by excluding any punitive or exemplary damages that may be awarded by a jury. For example, if a driver causes an accident while intoxicated, the insurance policy may cover the actual damages but not any punitive damages awarded by a jury.

- Normal wear and tear: Auto insurance policies typically do not cover damage resulting from everyday use and routine maintenance.

- Specific catastrophic events: Policies may exclude coverage for losses caused by war, terrorism, nuclear events, sinkholes, and other catastrophes.

- Use of a personal vehicle for business: Most personal auto insurance policies will not cover incidents that occur while the vehicle is being used for business purposes, even if it is only occasional or part-time.

- Theft of personal belongings: Comprehensive coverage usually does not extend to personal belongings that are lost or stolen from your vehicle. These items may be covered by your renters or homeowners insurance policy.

- Unapproved vehicle modifications: If you modify your vehicle without informing your insurance company, these modifications may not be covered under your policy. Modifications can increase your insurance premiums and, in some cases, may even lead to your coverage being dropped.

It is important to carefully review your auto insurance policy to understand the specific exclusions and how they may impact your coverage.

Insurance Claims: Deceased Vehicles

You may want to see also

Understanding policy endorsements

When you buy a car insurance policy, you will receive a document containing specific details about the car, such as the renewal date, personal information, and policy number. However, there may be times when the information in the document is incorrect or needs to be updated. This is where policy endorsements come into play. An endorsement in a car insurance policy refers to making changes or modifications to the existing policy document. It is an agreement between the policyholder and the insurer to rectify errors or update information in the policy.

There are two types of endorsements: basic and advanced. Basic endorsements involve changes to the policyholder's name, address, or contact number. Advanced endorsements, on the other hand, are usually related to amendments or additions to the comprehensive car insurance policy, which can directly impact the scope of the coverage. Endorsements can also be categorised into financial and non-financial endorsements. Financial endorsements are written changes for which the insurer will charge a fee, while non-financial endorsements are modifications for which the insurer will not charge a fee.

The process of making an endorsement typically involves submitting a request letter or email to the insurer, along with any required documents to support the requested changes. Once the endorsement is approved, the insurer will issue an endorsement certificate and send a new policy document with the updated information. Endorsements can be made during the policy period or before renewal, and most insurers allow for one or two endorsements per year. It is important to note that frequent changes to the policy may create confusion and impact the claims process.

When making endorsements, it is essential to inform the insurance provider of any changes made to the insured vehicle, even if you are unsure whether an endorsement is necessary. This ensures transparency and avoids potential issues with claim settlement. Endorsements can also impact the premium, as modifications to the vehicle may increase or decrease the Insured Declared Value (IDV).

In summary, understanding policy endorsements is crucial when reviewing and managing your auto insurance coverage. Endorsements allow you to make necessary changes to your policy, ensuring that the information remains accurate and up-to-date. By following the endorsement process and working with your insurer, you can maintain a current and comprehensive auto insurance policy that reflects your needs and circumstances.

Uncovering Auto Insurance Savings: A Personal Guide to Lower Premiums

You may want to see also

Understanding liability insurance

Liability insurance consists of two primary components: bodily injury liability and property damage liability. Bodily injury liability covers the medical expenses of those injured in an accident caused by the insured driver. It may also extend to cover lost wages and legal fees if the injured party takes legal action. On the other hand, property damage liability covers the costs of repairing or replacing the damaged property of others in an accident caused by the insured driver. This includes not only the other driver's vehicle but also other forms of property, such as fences, buildings, or utility poles.

The minimum liability limits for bodily injury and property damage vary from state to state. For example, in Nevada, the minimum motor vehicle liability insurance coverage is $25,000 in bodily injury per person, $50,000 in bodily injury per accident, and $20,000 in property damage. It's important to note that liability insurance does not cover damages to your own property or injuries to yourself or your passengers, which would be covered under separate insurance types.

When selecting liability insurance, it's essential to consider your specific needs and choose coverage limits that provide adequate protection. While purchasing the minimum required by your state is mandatory, opting for higher levels of coverage is often recommended, as state-required minimums may not be sufficient in the event of a serious accident. By working with an insurance agent, you can ensure that you have the right amount of liability coverage to protect yourself financially in case of an accident.

State Farm Auto Insurance: Understanding Your Policy

You may want to see also

Frequently asked questions

A car insurance declaration page is typically the first page of the policy that you will see. It contains basic information about your policy as well as the name and contact information of your insurance company. It allows you to tailor an insurance policy to your individual needs. It's the go-to place to find out what your auto policy covers. While it may not go into great detail about each facet of your insurance coverage, it can give you a good idea of your coverage amounts and the basic elements of your policy.

Going into a bit more depth than the insurance declarations page, the policy form outlines various coverages as well as the insuring agreement, conditions, exclusions, and endorsements for your policy. These go into more detail about what is covered (or not covered) and your specific obligations.

Any legal agreement is conditional on both parties holding up their end of the deal. This section lists any rules, provisions, obligations, or codes of conduct to which you are required to adhere. If you are in breach of any of these conditions, it is likely that coverage or claims will be denied.

Knowing what your car insurance policy won’t cover is nearly as important as being aware of what it does cover. The policy exclusions section lists any perils that are not covered. These exclusions can differ by state and from one driver to another. Typical insurance policy exclusions include intentional damage or bodily injury, government action or confiscation, using a vehicle for prearranged racing events, and catastrophic events such as war or nuclear accidents.