Auto insurance is a necessary expense for many, but it doesn't have to break the bank. There are several ways to reduce your insurance premiums and save money. Infinity Insurance Agency, Inc. is one such company that offers customizable insurance options to meet your individual budgetary and coverage needs. Here are some tips to help you get started on lowering your auto insurance costs:

- Practice safe driving: Maintaining a good driving record is one of the best ways to keep your insurance costs down. Accidents and traffic violations can lead to higher premiums.

- Pay in full and on time: Improving your credit score can positively impact your insurance premiums. Paying your premium in full and on time can help build your credit score, leading to potential discounts.

- Shop around for discounts: Compare prices and policies from different insurance providers to find the best deal. Don't be afraid to ask about possible discounts, such as those for safe drivers or students.

- Drive an older vehicle: Insuring a newer, more expensive vehicle will likely cost more. Consider the repair costs, safety features, and reliability of an older model to reduce your premium.

- Increase deductibles: By opting for a higher deductible, you can lower your premium. Just make sure you have enough savings to cover the higher deductible in case of an accident.

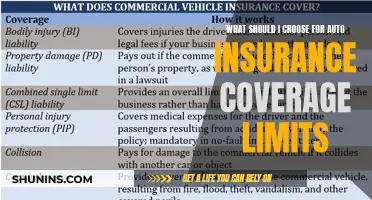

- Customize your policy: Review your coverage and consider removing any optional add-ons that you may not need. Liability-only policies, for example, can be a cheaper alternative.

| Characteristics | Values |

|---|---|

| Driving record | The better your driving record, the lower your insurance costs. Accidents and traffic violations lead to points against your record that can cause insurance premiums to rise. |

| Shop around for insurance | Compare insurance costs from different companies. Prices vary from company to company. |

| Deductibles | Requesting higher deductibles can lower your costs substantially. |

| Car choice | Insuring an expensive new vehicle will likely cost more than an older one. |

| Credit score | Establishing a solid credit history can cut your insurance costs. |

| Discounts | Take advantage of discounts such as low mileage, group insurance, anti-theft systems, and safe driving courses. |

What You'll Learn

Practice safe driving

Safe driving is one of the most important factors in keeping auto insurance costs down. Accidents and traffic violations lead to points against your record that can cause insurance premiums to rise. Safe driving habits can also be incentivized by your insurance company, with some offering discounts or lower rates for customers who can demonstrate their safe driving.

Safe driving encompasses a range of behaviours and practices. Staying focused on the road is paramount, avoiding distractions such as phone usage. It is also important to always wear your seatbelt, use turn signals, and pay attention to traffic signs. Driving within the speed limit is another key component of safe driving. Maintaining a safe distance from the vehicle in front of you and avoiding hard braking are also important.

In addition, safe driving means being mindful of the conditions in which you are driving. This includes avoiding driving during inclement weather or hazardous conditions, such as heavy rain or snow, which can increase the risk of accidents. Driving at night can also pose challenges, so it is important to ensure your vehicle's lights are functioning properly and to adjust your speed and following distance as needed.

Safe driving also involves being aware of other drivers and road users. This includes being cautious around aggressive or reckless drivers, as well as being mindful of pedestrians and cyclists. By adopting these safe driving practices, you can help keep yourself and others safe on the road, while also potentially reducing your auto insurance premiums.

There are also some apps that can help you practice safe driving. For example, general safety apps like Safest Driver offer driving safety tips and rewards, and let you compete with friends. Insurance company apps, such as those from State Farm, Allstate, and Progressive, monitor your driving habits and offer potential discounts or lower rates for safe driving. However, it's important to note that using your phone while driving can be dangerous and may be illegal in some places, so hands-free options or passenger usage may be necessary.

Understanding Full Coverage Auto Insurance: What You Need to Know

You may want to see also

Pay in full and on time

Paying your auto insurance premium in full and on time is a great way to reduce your overall auto insurance costs. Many insurance providers, including Infinity, offer discounts or lower fees if you pay your premium in full. This means that you can save money by choosing to pay your premium annually, rather than in monthly instalments.

Paying in full and on time can also help to improve your credit score. In many states, your credit score is a factor when calculating insurance premiums, so this is an important way to keep costs down. Maintaining a good credit record can cut your insurance costs, as it demonstrates that you are less likely to make a claim. You can further improve your credit score by paying your bills on time, keeping your credit balances low, and only obtaining the credit you need.

If you are unable to pay your premium in full, you can still keep costs down by setting up an auto-pay option. This will allow you to make monthly instalments without incurring late payment fees.

State Farm Auto Insurance: Locksmith Coverage and Benefits

You may want to see also

Shop around for discounts and deals

Shopping around for car insurance is a great way to save money on your premiums. It's important to compare multiple companies at once to find the best rates and discounts. Here are some tips to help you shop around for discounts and deals:

Get Multiple Quotes

It's recommended to get at least three price quotes from different insurance companies. You can call companies directly, use their websites, or access information online to get quotes. Your state insurance department may also provide comparisons of prices charged by major insurers. Getting multiple quotes allows you to compare prices and coverage options to find the best deal for your needs.

Compare Different Types of Insurance Companies

There are a few types of insurance companies to consider when shopping around. Some companies sell policies through their own agents, who have the same name as the insurance company. Others sell through independent agents who offer policies from several insurance companies. There are also companies that don't use agents and sell directly to consumers over the phone or via the internet. Comparing quotes from different types of insurance companies can help you find the best deal.

Consider More Than Just Price

While price is important, it's not the only factor to consider when shopping for car insurance. Ask friends and family for recommendations and check with your state insurance department to find out about consumer complaints by company. Pick an agent or company representative who takes the time to answer your questions and provides helpful information.

Research the Company's Financial Health

It's important to choose a financially stable insurance company. You can check the financial health of insurance companies with rating companies such as AM Best and Standard & Poor's. Consulting consumer magazines and reviews can also give you insights into the reliability and reputation of different insurance providers.

Compare Insurance Costs Before Buying a Car

The cost of car insurance can vary significantly depending on the vehicle. Insurance premiums are based on factors such as the car's price, repair costs, safety record, and the likelihood of theft. By comparing insurance costs for different vehicles before making a purchase, you can make an informed decision and choose a car that won't break the bank when it comes to insurance.

Ask About Discounts

Insurance companies offer a variety of discounts that can help lower your premiums. These include discounts for safe driving, low mileage, bundling policies, student discounts, and more. Be sure to inquire about any potential discounts that may apply to your situation.

Use an Online Comparison Tool

Using an online quote comparison tool is a fast and efficient way to get quotes from multiple companies at once. These tools allow you to fill out one form and quickly compare prices, coverage options, and available discounts. However, they may not cover all situations, such as classic car insurance or ridesharing insurance.

By following these tips and shopping around for discounts and deals, you can significantly reduce your auto insurance premiums and find the best coverage for your needs.

Auto Insurance: Claiming for Wheel Damage

You may want to see also

Drive an older vehicle

Driving an older vehicle is one way to reduce your auto insurance premiums with Infinity. The idea is simple: insuring a new vehicle will likely cost more than what you'd pay for an older one. According to Credit.com, a 5-year-old version of a certain model is nearly 13% less expensive to insure than its current model year version.

While newer cars will cost more to replace, an exception exists for some older cars, especially those with expensive, after-market parts or those that are more difficult to repair or replace. However, it's important to note that older cars are less likely to have modern safety features, which could increase your premium.

When it comes to insurance coverage for older cars, comprehensive coverage is usually not required by states. The value of your vehicle will dictate whether you need comprehensive coverage. If your vehicle is older and not worth as much, you may be able to reduce your insurance premium by avoiding comprehensive and collision coverage. However, if you have a loan on the vehicle or are leasing it, you may be required to have comprehensive coverage to protect your lender's investment. According to ValuePenguin, if your vehicle is 10 years or older, you may be paying too much for insurance if you have comprehensive or collision coverage. The average cost of comprehensive coverage is $134 per year, while the average cost of collision insurance is $290 per year.

Before choosing an insurance policy for an older car, it's important to consider the level of insurance coverage you need. While you may want to save money by choosing a minimum insurance policy, this type of policy does not cover vehicle damages if you are in an accident. Instead, it only covers vehicle damages for the other driver. Therefore, it's crucial to review your policy to understand what types of coverage are mandatory and which may be excessive.

Additionally, consider the cost of repairs and replacement parts for your older vehicle. Older vehicles can cost more to insure because they may require more expensive repairs due to hard-to-find parts. You can also look into gap insurance, which can help cover the difference between your insurance payout and the amount you owe on the vehicle if it is totaled or stolen.

Finally, don't forget to shop around and compare insurance costs for older vehicles before making a decision. Prices vary from company to company, so getting multiple quotes can help you find the best coverage at the most affordable price.

Leasing a Subaru: Is GAP Insurance Included?

You may want to see also

Increase deductibles

Increasing your deductible is a way to lower your auto insurance costs. A deductible is the amount you pay before your insurance policy kicks in. By increasing the amount of your deductible, you can lower your insurance costs substantially. However, this also means you will have to pay more out of pocket in the event of an accident or repairs.

For example, increasing your deductible from $200 to $500 could reduce your collision and comprehensive coverage costs by 15% to 30%. Moving to a $1,000 deductible could save you 40% or more. The higher the deductible, the cheaper the premiums will be, as you are assuming more financial responsibility in the event of a claim.

However, it is important to ensure you have enough money set aside to pay your deductible in the event of a claim. If you choose a deductible of $1,000 or higher and you end up filing several insurance claims over a few years, you will have to pay the deductible amount each time. Therefore, it is crucial to weigh the potential savings against the possibility of having to pay a higher deductible multiple times.

Additionally, there may be limitations on the maximum deductible you can choose. If you have a car loan or lease, most vehicle financing agreements set a maximum deductible for collision and comprehensive coverage, often no more than $500. This means you may not be able to select a higher deductible, such as $1,000.

Before choosing a higher deductible, carefully consider your financial situation and the potential risks involved. While increasing your deductible can lead to significant savings on your auto insurance premiums, it is essential to ensure you have sufficient funds to cover the higher deductible in case of an accident or repairs.

Liberty Mutual Auto Insurance: Understanding the 3-Year Lookback

You may want to see also

Frequently asked questions

One of the best ways to keep your auto insurance costs down is to have a good driving record. Accidents and traffic violations can cause your insurance premiums to rise.

It's a good idea to shop around for insurance and get multiple quotes. Prices vary from company to company. You can also ask about bundling your insurance policies, such as buying auto and home insurance from the same provider.

Yes, many companies offer discounts for safe drivers, students, homeowners, members of the military, and more. You can also ask about increasing your deductible, but this means you'll pay more out of pocket if you get into an accident.

Yes, the make, model, and year of your car can affect how expensive it is to repair or replace, which will impact your insurance premiums. Insuring an older vehicle is usually cheaper than insuring a newer one.

You can also consider pay-per-mile insurance, which is a good option if you don't drive very often. This type of insurance charges a flat daily rate plus a few cents per mile.