Auto insurance rates are influenced by several factors, including the type of coverage, vehicle characteristics, and an individual's driving record and demographics. One factor that impacts rates is whether a vehicle is financed or owned outright. When a car is financed, lenders typically require borrowers to carry full coverage, including collision and comprehensive insurance, to protect their investment. This additional coverage increases insurance premiums. However, once a car is paid off and owned, individuals have the option to reduce their coverage and may see lower insurance rates as a result.

| Characteristics | Values |

|---|---|

| Cheaper Insurance | Insurance is not automatically cheaper when a vehicle is fully owned, but there are opportunities for savings. |

| Reasons for Cost Difference | When a vehicle is financed, full coverage is often required to protect the financier's interests. This includes collision, comprehensive, and liability insurance. |

| Cost-Saving Opportunities | Once a vehicle is fully owned, some coverages can be removed or reduced, such as comprehensive and collision coverage. |

| Other Factors Affecting Insurance Rates | Location, demographics, vehicle type, driving record, coverage choices, and deductibles can also impact insurance rates. |

What You'll Learn

- Lenders require full coverage to protect their investment

- Comprehensive and collision coverage are no longer required once the vehicle is paid off

- Removing the lienholder is necessary to receive insurance payouts

- Car insurance rates are influenced by factors like age, gender, and location

- Bundling policies and safety features can lower insurance rates

Lenders require full coverage to protect their investment

Full coverage insurance is more expensive than liability-only insurance, as it provides more comprehensive protection. On average, full coverage insurance costs around $80 per month in the United States. This additional cost is necessary to protect the lender's investment and ensure they can recoup their losses in the event of an accident or damage to the vehicle.

Lenders typically require borrowers to maintain full coverage on the vehicle throughout the duration of the loan. This means that if you finance a car, you will likely be required to carry full coverage insurance for the entire loan period. Failure to do so could result in penalties or legal action by the lender.

Additionally, lenders may also require higher limits of coverage and lower deductibles to ensure that the vehicle is adequately protected. This can further increase the cost of insurance for financed vehicles.

It's important to note that the requirement for full coverage insurance is not a rating factor used by insurance companies to calculate premiums. The higher cost of insurance for financed vehicles is due to the additional coverages and higher limits required by lenders, not the insurance companies themselves.

Auto Insurance: What's the Cost Without a License?

You may want to see also

Comprehensive and collision coverage are no longer required once the vehicle is paid off

When a vehicle is financed, the lender or leasing company typically requires the owner to carry both comprehensive and collision coverage. This is to protect their interests in the vehicle. However, once the vehicle is paid off in full, these coverages are no longer required. At this point, the owner has the option to remove comprehensive and collision coverage from their auto policy.

Comprehensive coverage protects against events outside the driver's control, such as natural disasters, theft, or collisions with animals. Collision coverage, on the other hand, pays for repairs to the vehicle if it collides with another object, such as a tree or guard rail. While these coverages are valuable, they are not always necessary, especially for older vehicles with low market value.

When deciding whether to keep or remove comprehensive and collision coverage, it's important to consider the vehicle's age and value. If the vehicle is older and has depreciated significantly, the cost of these coverages may outweigh the potential benefits. Additionally, if the owner has built up substantial savings, they may prefer to rely on their own funds to repair or replace the vehicle in the event of an accident.

However, it's important to note that keeping comprehensive and collision coverage can provide peace of mind, especially for those who cannot afford expensive repairs. Removing these coverages may result in lower premiums, but it also means the owner will be responsible for all repair or replacement costs in the event of an accident. Ultimately, the decision to keep or remove comprehensive and collision coverage depends on the owner's financial situation, the vehicle's value, and their tolerance for risk.

Auto Insurance: One Policy Per Household?

You may want to see also

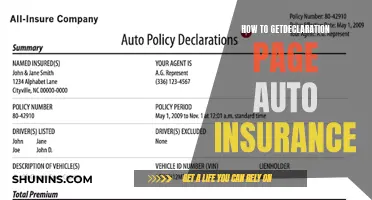

Removing the lienholder is necessary to receive insurance payouts

When you take out a loan to buy a car, the lender will usually require you to have comprehensive and collision coverage, also known as full coverage, on your vehicle until the loan is paid off. This is because the lender, also known as the lienholder, has an interest in the car until the loan is repaid. The lienholder will keep ownership of the vehicle and hold the title until the loan is paid off. This means that if you don't make your payments, the lienholder has the right to repossess the car.

Once you have finished paying off your loan, it is important to remove the lienholder from your car insurance policy. This is because, in the event of an accident, the insurance payout will go to the lienholder to cover the remaining loan balance. Only after the loan is paid off in full will you receive the insurance payout directly.

Removing the lienholder from your policy is a straightforward process. First, contact your lienholder and inform them that you have paid off the loan and would like to remove them from the policy. Next, fill out any necessary paperwork to release the vehicle's title. Finally, notify your insurance company of the change so that you can update your policy accordingly.

It is worth noting that while removing the lienholder is necessary to receive insurance payouts directly, simply owning your vehicle may not affect your insurance rate. However, owning your vehicle does give you more flexibility in choosing your coverage options. For example, you may decide to drop full coverage and switch to liability-only insurance, which can help lower your premium. Ultimately, the decision to change your coverage depends on factors such as the value of your vehicle and your personal financial situation.

U.S. Auto Insurance and Hail Damage: What You Need to Know

You may want to see also

Car insurance rates are influenced by factors like age, gender, and location

Car insurance rates are influenced by a multitude of factors, and age, gender, and location are among the most significant. While shopping for auto insurance, it's important to understand how these factors can impact your premiums and coverage options.

Age

Age is a critical factor in determining car insurance rates. Younger drivers, especially teens, tend to pay higher premiums due to their lack of driving experience and the associated risk of accidents. As drivers age, their insurance rates generally decrease, with the lowest rates typically offered to individuals in their 50s and early 60s, assuming they maintain a clean driving record. However, rates may start to increase again around age 65 as age-related factors, such as changes in vision, hearing, and reaction time, can impact driving abilities.

Gender

In most states, gender also plays a role in car insurance rates. Men often pay higher premiums than women due to a greater tendency for risky driving behaviors, such as speeding and driving under the influence. However, as drivers age and gain more experience, the gender gap in rates narrows, and in some age groups, women may pay slightly more than men. It's worth noting that several states prohibit the use of gender as a pricing factor in auto insurance, including California, Hawaii, Massachusetts, Michigan, North Carolina, and Pennsylvania.

Location

Your place of residence significantly affects car insurance premiums. Insurance companies analyze data to determine the likelihood of claims being filed in specific areas. This includes claims related to auto accidents, as well as claims resulting from vandalism or theft of vehicles. Living in a city or rural area can impact your rates, but it's not always a straightforward correlation. Factors such as the number of uninsured drivers, weather conditions, and the prevalence of drunk driving can also contribute to higher insurance rates in certain locations.

While you cannot change your age or gender, understanding their impact on your insurance rates can help you make informed decisions when shopping for coverage. Additionally, factors like your driving record, credit score, and the types of coverage you choose can also influence your premiums. It's always a good idea to compare quotes from multiple insurance providers and ask about available discounts to ensure you're getting the best rate possible.

GST on Motor Vehicle Insurance: Calculation Method

You may want to see also

Bundling policies and safety features can lower insurance rates

When it comes to auto insurance, there are a few things to consider that can impact the cost of your coverage. One factor is whether you own your vehicle outright or are still paying it off. If you're financing a car, you're typically required to carry more coverage than if you own it outright, which can result in higher insurance premiums. This is because lenders require comprehensive and collision coverage to protect their investment. Once your car is paid off, you may be able to reduce your coverage and lower your insurance costs.

Another way to lower your insurance rates is by bundling policies. Many insurance companies offer discounts if you have multiple types of insurance policies with them, such as home and auto insurance. By combining your policies under one roof, you can benefit from the company's economies of scale and receive a cheaper rate than if you insured each item separately. Additionally, having all your policies in one place can make it easier to manage and keep track of your payments.

Safety features on your vehicle can also help lower your insurance rates. Insurers may offer discounts for vehicles with features such as airbags, anti-lock brakes, and theft-deterrent systems. These features can reduce the risk of accidents and theft, making your vehicle less costly to insure.

It's important to shop around and compare rates from different insurance providers to find the best deal. You can also consider increasing your deductible, which is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible can result in lower insurance premiums, but it's important to weigh this against the risk of having to pay more if an accident occurs.

Additionally, your driving record and claims history can impact your insurance rates. Maintaining a clean driving record and avoiding accidents or claims can help keep your insurance costs down.

Finally, it's worth reviewing your insurance coverage periodically, especially after major life events such as getting married, having a baby, or moving to a new home. Your insurance needs may change over time, and you may be able to find a better deal by switching providers or adjusting your coverage.

Auto Insurance: The Yearly Rollercoaster

You may want to see also

Frequently asked questions

Car insurance premiums don't automatically decrease when you own your car outright, but you can probably lower your premium by dropping coverage that's no longer required.

Banks and financing companies are called lienholders. Lienholders generally require you to have comprehensive and collision coverage while you're paying off a loan. After the loan is paid back and the lienholder is removed, you're no longer required to carry these coverages.

Auto insurance companies use numerous pricing factors to determine the risk that you'll file an insurance claim. Some of these factors include your ZIP code, age, gender, marital status, occupation, vehicle, driving record, coverage, and deductible.

You can lower your car insurance rates by bundling your policies, asking about discounts, opting for safety and security features, improving your credit, and shopping around for the best rates.