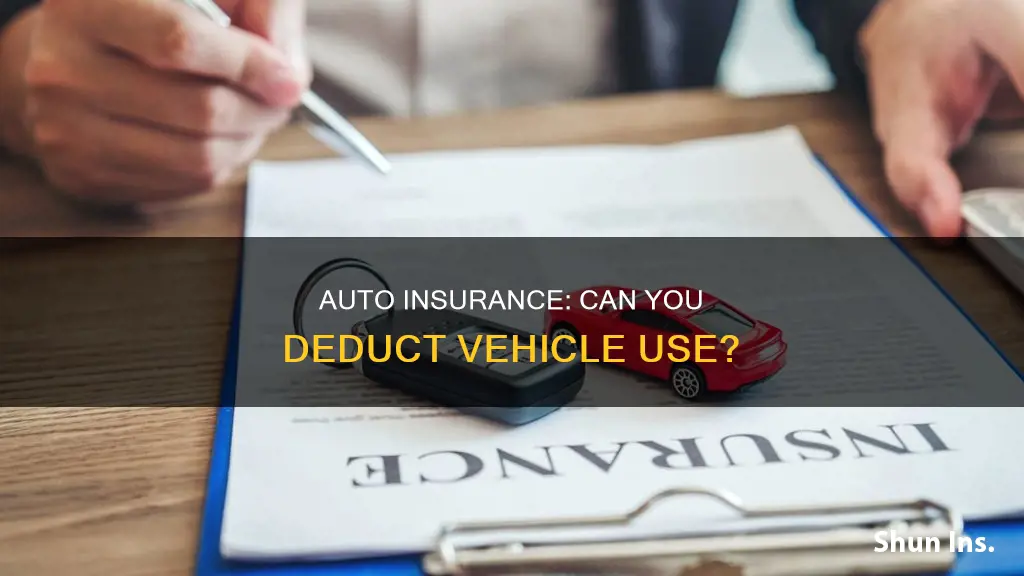

Auto insurance deductibles are the amount a driver pays out-of-pocket for an accident before their insurance company covers the remaining cost. Deductibles are chosen by the policyholder when purchasing an insurance policy and typically range from $100 to $2,000, with $500 being the most common amount. The deductible amount is subtracted from the total claim amount, so if a driver has a $500 deductible and their insurer determines their claim is worth $5,000, the insurance company would pay out $4,500. Deductibles usually apply to collision and comprehensive coverage, which covers damage to the driver's vehicle, but not to liability coverage, which covers damage to another person's property.

| Characteristics | Values |

|---|---|

| What is a car insurance deductible? | The amount you pay when filing a claim for certain types of coverage. |

| When do you pay a car insurance deductible? | When you file a claim that uses a specific coverage type. |

| How does a car insurance deductible work? | You pay the deductible amount out of pocket before your insurer covers any damage costs. |

| How do car insurance deductibles work? | They are a prerequisite for filing certain types of claims, ensuring that policyholders don't file frivolous claims. |

| How do deductibles affect car insurance premiums? | A higher deductible results in a lower premium, and a lower deductible results in a higher premium. |

| How to choose a car insurance deductible? | Determine how much you are willing to pay out of pocket and how likely you are to file a claim. |

| Types of car insurance with a deductible | Collision insurance, comprehensive insurance, uninsured motorist property damage coverage, personal injury protection. |

| Types of car insurance without a deductible | Liability insurance, uninsured motorist bodily injury coverage, medical payments coverage. |

What You'll Learn

Choosing a deductible amount

Evaluate Your Risk Tolerance:

Ask yourself how comfortable you are with taking on risk. Choosing a higher deductible means you are willing to take on more financial risk in the event of a claim, while a lower deductible provides more financial peace of mind. Consider your driving history, the likelihood of filing a claim, and your comfort level with potential out-of-pocket expenses.

Determine the Value of Your Vehicle:

The value of your car plays a crucial role in deciding your deductible. If your car is older or has a lower market value, opting for a lower deductible may be more beneficial. Conversely, if you drive a newer or more expensive car, a higher deductible may make sense to offset the higher cost of repairs or replacement.

Assess Your Financial Situation:

Consider your financial resources and savings. If you have sufficient savings or an emergency fund, you may be in a position to choose a higher deductible to lower your insurance premiums. On the other hand, if paying a higher deductible would be a financial burden, a lower deductible with higher monthly premiums may be a more feasible option.

Calculate Cost Differences:

Compare the cost difference between policies with high and low deductibles. Evaluate how your total costs would vary based on the number of claims you might file. Consider running different scenarios to understand the financial implications, including filing no claims, one claim, or multiple claims. This analysis will help you make an informed decision about the deductible amount that aligns with your budget.

Understand the Impact on Insurance Rates:

Recognize the relationship between your deductible and insurance rates. Choosing a higher deductible will typically result in lower insurance rates, while a lower deductible leads to higher rates. Consider the trade-off between paying more upfront in premiums or potentially facing higher out-of-pocket costs in the event of a claim.

Remember, there is no one-size-fits-all approach to choosing a deductible amount. It's essential to carefully consider your financial situation, risk tolerance, and the value of your vehicle to make an informed decision that best suits your needs and budget.

Cargo Trailer Insurance: Separate from Auto?

You may want to see also

When you have to pay a deductible

The simplest answer is that you have to pay a deductible any time you make a claim for your car insurance. The deductible is an agreed-upon amount that you have to pay out of pocket whenever you make an insurance claim before the insurer will cover the rest of the costs.

However, there are some nuances to this. Firstly, you only have to pay a deductible if the damage meets or exceeds its amount. If the cost of repairs is less than your deductible, you wouldn't want to file a claim, as your insurance premium could increase, even if you weren't at fault for the accident. Secondly, there are some instances in which you don't have to pay a deductible at all. These include:

- When another driver is at fault: If the other driver is at fault for the accident, their insurance company will cover the cost of your repairs and you won't have to pay a deductible.

- Liability claims against you: If another driver files a claim against your liability insurance, you don't have to pay a deductible out of pocket since liability coverage doesn't deal with deductibles.

- Glass repair: In most states, insurance providers will offer free repairs on glass, though windshield glass is a separate issue. Since these are repairs rather than replacements, they don't go through your insurance policy, so your deductible doesn't apply.

It's also worth noting that you don't have to write a cheque or make a payment to your insurer to pay your deductible. They simply subtract your deductible amount from your claim's approved payout.

Auto Insurance Cancellation: Understanding the Cost Implications

You may want to see also

Avoiding paying a deductible

A car insurance deductible is the amount of money you pay out of pocket towards a claim before your insurance company covers the remaining costs. Deductibles are typically required for comprehensive and collision coverage, uninsured and underinsured motorist coverage, and personal injury protection. While liability coverage does not require a deductible, it only covers damages to other drivers' vehicles or property, not your own.

There are a few ways to avoid paying a deductible:

- Choose a higher deductible: Opting for a higher deductible will lower your insurance premium, but be prepared to pay the higher amount in the event of a claim. This is a good option if you are a safe driver and don't anticipate needing to file a claim.

- No-deductible policy: Some insurance companies offer $0-deductible policies or deductible waivers, which eliminate the need to pay a deductible altogether. This option may result in a higher premium.

- Other driver is at fault: If you are in an accident where the other driver is at fault, their insurance company will be responsible for your repairs and medical costs, and you won't have to pay a deductible.

- Windshield repairs: In some states, insurers may repair or replace your windshield without requiring a deductible, or they may offer a $0-deductible option for glass claims.

- Uninsured motorist: If you are hit by an uninsured motorist, some states or insurers may waive your deductible for certain bodily injuries under your uninsured/underinsured motorist coverage.

- Total loss: In some states, you can purchase a total loss deductible waiver, which means you won't have to pay your deductible if your vehicle is deemed a total loss.

It's important to note that attempting to avoid your deductible by using repair shops that offer to waive it is illegal and unethical. This practice can lead to insurance fraud and compromise the quality of your vehicle's repairs.

Farmers and Mechanics Insurance: Exploring Commercial Auto Coverage

You may want to see also

Comprehensive and collision coverage

Comprehensive coverage helps pay for repairs if your vehicle is damaged by specific events, often called "perils." These perils can include hail, theft, or burglary. Deductible amounts for comprehensive coverage typically range from $50 to $1,000. It's worth noting that comprehensive coverage is usually required if you finance or lease your vehicle.

Collision coverage, on the other hand, assists in paying for repairs to your vehicle if you collide with another car or a stationary object, such as a guardrail or pole. Collision coverage deductibles generally range from $0 to $1,000, depending on the insurer.

Both types of coverage are important for protecting your vehicle from physical damage. When selecting your deductibles, it's essential to consider how much you're willing to pay out of pocket if your car is damaged. You can choose different deductibles for comprehensive and collision coverage, but having the same deductible for both can make it easier to predict your out-of-pocket expenses in the event of any physical damage to your vehicle.

Kids and Car Insurance: What You Need to Know

You may want to see also

Personal injury protection

In addition to medical expenses, PIP can cover:

- Lost wages

- Household services, such as childcare or house cleaning

- Disability and rehabilitation costs

- Funeral expenses

PIP policies have a minimum coverage amount and a per-person maximum coverage limit, which is usually set at $25,000. The specific coverage amount varies depending on the state and insurance company. For example, in Florida, the minimum PIP coverage required is $10,000.

In some states, PIP coverage may include a deductible, with a range of deductible amounts to choose from. It's important to note that PIP is different from liability insurance, which covers medical costs for third parties but not for the policyholder if they are at fault.

Spouse's Power: Cancelling Auto Insurance

You may want to see also

Frequently asked questions

A car insurance deductible is the amount of money you pay out of pocket for an accident before your insurance company covers the remaining cost of repairs.

After you pay your deductible amount, your insurance provider will cover the remaining cost of repairs to your vehicle. For example, if you have a $500 deductible and $3,000 in damage, your insurer will pay $2,500, and you will be responsible for the remaining $500.

You have to pay your car insurance deductible when you file a claim under a coverage that carries a deductible, and the damage is covered and costs more than your deductible amount. For example, if you cause an accident and file a claim with your collision insurance, you will have to pay your collision deductible.