Cancelling your auto insurance policy is a relatively straightforward process, but there are a few things to keep in mind. Firstly, it's important to have another policy in place before cancelling your current one to avoid a lapse in coverage, which can result in higher rates and even legal consequences. Most companies allow you to cancel at any time, but you may have to pay a cancellation fee, which can range from $20 to $50 or be calculated as a percentage of your remaining premium. This fee is charged because you are breaking a contract, and the insurance company has already completed most of the work involved in servicing your policy. When cancelling, you will need to notify your insurance provider or agent, either by phone, mail, fax, or in person, and you may be required to sign a cancellation letter. It's also a good idea to confirm that you will receive a refund for any prepaid premiums, minus any cancellation fees.

| Characteristics | Values |

|---|---|

| Can you cancel at any time? | Yes |

| How to cancel | Call your insurance company, send a signed request, ask for assistance from a new carrier |

| When to cancel | Switching providers, cancelling coverage you no longer need, selling a car with no plans to drive |

| When not to cancel | If you still own a car, if you will be driving |

| Cancellation fees | Flat fee, usually less than $100, or a short-rate fee |

| Notice period | Some companies require 30 days' notice |

| Cancellation letter | Some companies require a formal letter |

| Refund | Prorated refund for unused premiums |

What You'll Learn

Cancellation fees

To avoid cancellation fees, it is often possible to wait until the end of the policy and choose not to renew. However, it is important to notify your insurer of your plans to cancel, as non-payment can result in additional costs.

The Mystery of Auto Insurance Premiums: Unraveling the Factors that Influence Your Rate

You may want to see also

When to cancel

When You Move to Another State

If you move to a new state, you will need to review the car insurance laws in your new location. Minimum car insurance requirements vary across states, so it is advisable to purchase a new policy that complies with the regulations of your new state. It is essential to arrange the new policy before ending your current one to avoid a lapse in coverage, as this could lead to higher rates and even fines or legal consequences. Some states, like New York, require drivers to surrender their license plates before cancelling their existing policy, so a few days of overlapping insurance may be necessary to avoid penalties.

When You No Longer Own a Car

If you sell your vehicle and do not plan on replacing it, you can cancel your auto insurance. However, it is recommended to wait until the new owner takes possession and the title is transferred before cancelling. Check with your local DMV about the specific requirements, as you may need to surrender your license plates or keep them with the new owner. If you intend to purchase a new car within a few months, consider converting your policy to a non-owner policy to maintain coverage while driving rentals or borrowed cars.

When You Want a Better Deal

Switching auto insurance providers to secure a more competitive rate is a valid reason to cancel your current policy. However, it is crucial to have the start date of your new policy coincide with the cancellation date of the old policy to avoid a lapse in coverage, which could lead to higher future premiums. It is recommended to start shopping for a new insurance provider six to eight weeks before your current coverage is set to expire.

When You Are Covered Under Someone Else's Policy

If you are a member of a household where another person has coverage and you can be added to their policy, you may consider cancelling your existing insurance. This is common when individuals get married or when adult children move back home. While adding a driver to an existing policy may increase the premium, there are often discounts available to mitigate the increase. Remember that insurance follows the vehicle, so if you cancel your policy, ensure that the vehicle is added to the other person's policy to maintain coverage.

When You Want to Reduce Coverage

If you own an older vehicle outright, you may opt to cancel optional collision and comprehensive coverage. However, consider the risks carefully. Dropping this coverage means you will have to pay out of pocket if your car is damaged or stolen. This would be considered a policy amendment rather than a complete policy cancellation.

Late Payments and Auto Gap Insurance: What You Need to Know

You may want to see also

How to cancel

Cancelling your auto insurance is usually a straightforward process, but there are a few things you should know and steps you should take to ensure you don't incur extra fees or have a lapse in coverage.

First, it's important to note that you can cancel your auto insurance at any time, but there may be a cancellation fee, usually under $100, or a percentage-based fee if you cancel before the end of your policy term. This is something to check with your insurer, as each has its own cancellation policy and procedures.

If you're switching insurers, it's a good idea to initiate coverage with the new insurer before cancelling your existing policy to avoid a lapse in coverage, which could result in higher future premiums and put you at financial risk if you get into an accident.

- Purchase a new policy (if applicable): Before cancelling your current policy, ensure you have continuous coverage by purchasing a new policy, especially if you plan to keep driving. This will help you avoid a lapse in coverage, which could result in higher future premiums and put you at financial risk if you get into an accident.

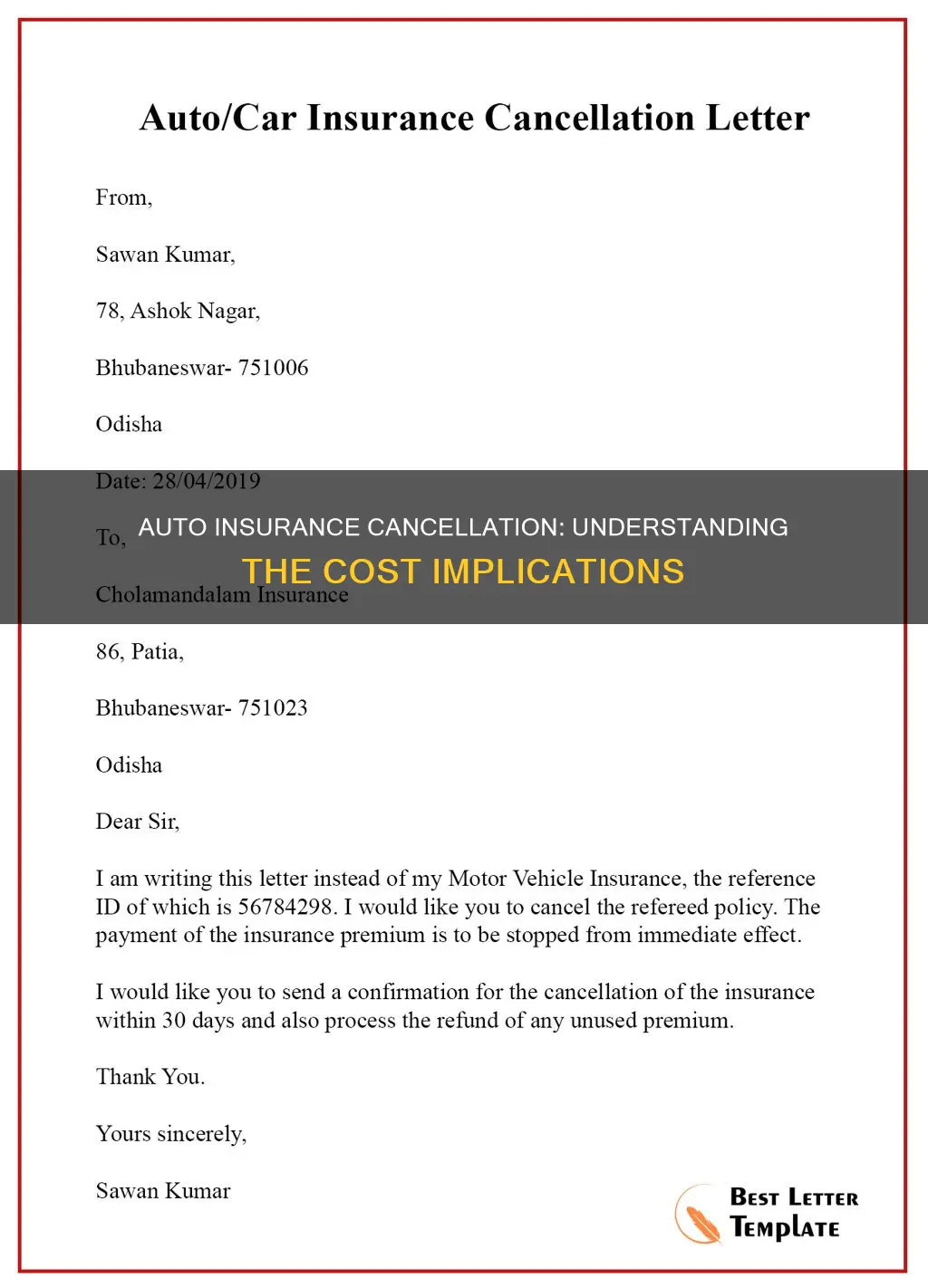

- Contact your insurer: Get in touch with your insurance company or agent by phone, email, postal mail, or through their mobile app. Ask about their specific cancellation process, including any documentation and potential fees or refunds.

- Provide the necessary documentation: Your insurer may require a signed letter or form indicating your intention to cancel, along with details like your policy number, name, and desired cancellation date.

- Request a policy cancellation notice: You may receive this automatically, but if not, you can request it from your insurer.

- Cancel your old policy: Once you have a new policy in place and all the necessary documentation, you can formally cancel your old insurance policy. Keep in mind that you may be charged a cancellation fee, but you may also be eligible for a refund on any prepaid premiums.

Remember, it's essential to understand the potential consequences of cancelling your auto insurance, such as higher future premiums due to a lapse in coverage and the risk of driving without insurance. It's always a good idea to speak with an insurance agent to ensure you're making an informed decision and following the necessary steps for a smooth transition.

Mazda CX-5 Auto Insurance: What's the Cost?

You may want to see also

Reasons to change policies

There are several reasons why you may want to change your auto insurance policy. Here are some key reasons:

- Marriage or Relocation: If you get married, it may be more cost-effective to insure both your vehicles on the same policy. Similarly, if you're relocating, your new address can impact your insurance rates.

- Change in Vehicle: Buying a new vehicle or adding a new driver to your policy can be a good reason to look for alternative quotes.

- Teen Driver: If your teen has received their driver's license, it's usually cheaper to add them to your existing policy than to insure them separately.

- Retirement: Senior drivers often enjoy cheaper insurance rates, and if you're no longer commuting daily, a low-mileage insurance policy can be beneficial.

- Unhappy with Current Insurer: You may want to switch if you're dissatisfied with the customer service or claims handling of your current insurer.

- Lower Premium: You can save money by switching to another insurer or adjusting your current policy, such as raising your deductible or lowering your coverage limits.

- Life Changes: Significant life events, such as marriage, relocation, a new vehicle, or a change in employment status, can prompt a reevaluation of your insurance needs.

- Poor Claims Experience: If you've had a negative experience with filing a claim, you may want to switch to an insurer with better claims handling.

- Policy Renewal: Reviewing your coverage before your policy renews can help you identify if you're overpaying and consider other options.

- Credit Score Changes: In many states, your credit history is considered when pricing your coverage. A change in your credit score can impact your insurance rates, and comparing quotes can help you find a more affordable option.

- Accident or Traffic Violation: While your rates may increase after an accident or violation, shopping around can help you find a company with lower rates.

Auto Insurance: Uninsured Americans' Plight

You may want to see also

When not to cancel

If you still plan to drive your vehicle, it is not advisable to cancel your auto insurance. Driving without insurance can put you at financial risk and violate state laws. Instead, consider reaching out to a licensed insurance agent to discuss alternative options, such as reducing your coverage or exploring discounts to lower your premium.

If you are moving to a new state, it is recommended to contact your current insurance provider to determine if your policy can be transferred. Location is a factor in determining premiums, so your rate may change, but you can avoid a lapse in coverage by maintaining your existing policy.

When you get married or divorced, it is generally advisable to review and adjust your policy accordingly. You can add or remove a spouse from your current policy and may even qualify for discounts or multi-policy discounts.

If you are only temporarily not driving, consider suspending your car insurance instead of cancelling it. Some insurance companies allow you to put your vehicle on a storage plan or request a suspension in writing. Cancelling your policy may result in a lapse in coverage, leading to higher premiums in the future.

If you find your premium to be high, explore alternative options before cancelling. Most auto insurers offer various types of discounts, such as safe driving discounts, virtual driving course discounts, or discounts for safety features in your car. Contact your agent to inquire about available discounts and eligibility requirements.

In summary, while you have the right to cancel your auto insurance at any time, it is important to consider the potential consequences and explore alternative options to avoid legal and financial risks.

Auto Gap Insurance: When to Carry and For How Long?

You may want to see also

Frequently asked questions

The cost of cancelling auto insurance depends on the insurer and the circumstances. Some insurers charge a flat fee, usually under $100, while others charge a percentage of the remaining premium, typically between 10% and 15%. Some insurers may also charge a cancellation fee if you cancel before the end of your policy term.

In some cases, you can avoid paying a cancellation fee by waiting until the end of your policy and choosing not to renew. However, it's important to check with your insurer, as some may still charge a fee even if you wait until the end of your policy.

If you cancel your auto insurance policy before the end of the term, you may be charged a cancellation fee. Additionally, your insurer may prorate your refund based on the number of days your policy was in effect, and you may not receive a full refund for any prepaid premiums.

In addition to cancellation fees, there may be costs associated with a lapse in coverage if you cancel your auto insurance without having a new policy in place. This could result in higher rates or even penalties and fines, depending on your location.