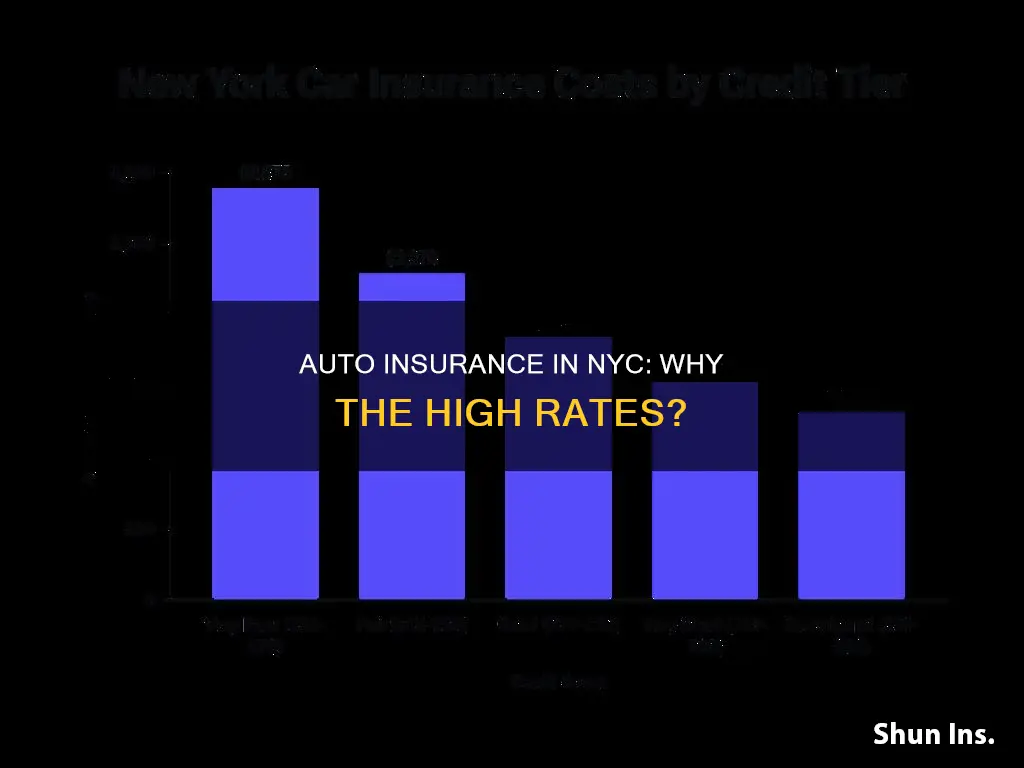

Car insurance in New York City is among the most expensive in the country. The average cost of car insurance in New York is $1,808 per year, but drivers in New York City pay $3,467, the highest average annual rate among major cities in the state.

The high cost of car insurance in New York City is due to a variety of factors, including the city's dense population, high traffic volume, harsh winters, and high likelihood of insurance fraud. Additionally, New York is a no-fault state, which means that residents are generally subject to higher premiums.

While the cost of car insurance in New York City may be high, there are ways to save money. Comparing rates from different insurance providers, taking advantage of discounts, and raising your deductible are all strategies that can help lower your car insurance premiums.

| Characteristics | Values |

|---|---|

| Average cost of car insurance in New York | $3,433 per year |

| Average cost of car insurance in New York City | $3,467 per year |

| Average cost of car insurance in New York State | $1,808 per year |

| Cheapest car insurance company in New York | Progressive |

What You'll Learn

Average cost of car insurance in New York

The average cost of car insurance in New York is $1,808 per year, according to a nationwide analysis. However, drivers in New York City pay $3,467, the highest average annual rate among major cities in the state.

New York is a no-fault state, which means that insurance companies are generally subject to higher premiums. The state's dense population, high traffic volume, harsh winters, and high likelihood of insurance fraud also contribute to elevated rates.

The cheapest car insurance in New York starts at $129 per month, with the best rates offered by Progressive, American Family, USAA, Travelers, and Geico. The average cost of full-coverage car insurance in New York is $4,112 per year, while the average cost of minimum coverage is $2,221 per year.

New York's insurance rates are much higher than the national average. The average cost of full-coverage car insurance in the United States is $2,681 per year, while the average cost of minimum coverage is $869 per year.

Cheapest Auto Insurance in NY: Who Wins?

You may want to see also

Why car insurance is so expensive in New York

Car insurance in New York is among the most expensive in the nation, with an average annual rate of $3,433, more than double the national average of $1,424. New York is a no-fault state, meaning that drivers must file a claim with their insurance company after an accident, regardless of who is at fault. This results in higher insurance premiums as insurance companies set higher policy premiums to compensate for higher-than-average healthcare expenses.

In addition to healthcare costs, New York's insurance requirements also contribute to the high cost of car insurance in the state. New York mandates that drivers carry personal injury protection (PIP) and uninsured motorist coverage in addition to the standard liability insurance. These additional coverages increase the overall cost of insurance for drivers.

Another factor that affects insurance rates in New York is the state's dense population and high traffic volume, particularly in New York City. The high number of accidents, thefts, and vandalism in the state drive up insurance rates.

Finally, severe weather conditions, such as hurricanes and winter storms, also impact insurance rates in New York. These extreme weather events increase the likelihood of accidents and total losses, which are costly for insurance companies to pay out, leading to higher premiums for drivers.

To find more affordable car insurance in New York, it is recommended to compare rates from different providers, consider bundling insurance policies, take advantage of available discounts, and adjust coverage levels and deductibles.

The Complex Art of Auto Insurance Rate Determination

You may want to see also

Cheapest car insurance companies in New York

New York is a no-fault state, which means that residents are generally subject to higher premiums. The average cost of car insurance in New York is $1,808 per year, but drivers in New York City pay $3,467, the highest average annual rate among major cities in the state.

The cheapest car insurance companies in New York include:

- Progressive

- Utica National

- GEICO

- Main Street America

- NYCM Insurance

- Sterling Insurance

- Erie

- Allstate

- American Family

Uncovering the Secrets: Auto Insurance Companies' Strategies to Identify Potential Operators

You may want to see also

Average cost of car insurance by age

The cost of car insurance in New York varies depending on age, gender, driving record, and location. The average cost of car insurance in New York is $1,808 per year, according to one source, while another source states that the average cost is $1,870 per year. The average cost of car insurance in New York City is $3,467, the highest in the state.

For a 17-year-old female driver, the cheapest car insurance in New York is offered by American Family at $2,668 per year, while for a 17-year-old male driver, the cheapest insurance is offered by Geico at $2,054 per year.

For a 25-year-old female driver, the cheapest car insurance in New York is offered by Progressive at $1,079 per year, while for a 25-year-old male driver, the cheapest insurance is also offered by Progressive at $1,161 per year.

For a 35-year-old female driver, the cheapest car insurance in New York is offered by Progressive at $967 per year, while for a 35-year-old male driver, the cheapest insurance is also offered by Progressive at $822 per year.

For a 60-year-old female driver, the cheapest car insurance in New York is offered by Progressive at $710 per year, while for a 60-year-old male driver, the cheapest insurance is also offered by Progressive at $818 per year.

Overall, Progressive offers the cheapest car insurance rates in New York for most driver profiles.

Battling the Insurance Bureaucracy: Strategies for Overturning Auto Claim Denials

You may want to see also

How to get cheap car insurance in New York

Car insurance in New York is expensive, with both full and minimum coverage costing 78% more than the national average. However, there are a few things you can do to get a cheaper rate.

Compare Quotes

No two drivers are the same, and insurers can vary widely on the rates they offer drivers in different categories. The same company that offers your neighbour the cheapest rates may not have the lowest prices for you. You should get quotes from multiple providers and compare them to find the cheapest policy.

Increase Your Deductible

A low car insurance deductible can offer peace of mind, knowing you won’t have to pay a large sum out of pocket toward covered repairs. However, it can also drive up your car insurance premium. If you need to save money now, raising your deductible is a quick and effective way to do it. Just make sure you have enough money set aside to cover the higher deductible if you ever get in an accident.

Drop Unnecessary Coverage

Add-ons like rental car reimbursement and roadside assistance can be nice when you can afford them. However, if your budget is tight due to increasing rates, dropping these options could bring your rate down while keeping your primary coverages intact.

Reduce Your Coverage Limits

Another way to reduce your rates is to lower the limit of what your insurer will pay out on a claim. While this can bring your premiums down in a hurry, it also leaves you at significantly more financial risk in the event of an accident.

Review Your Policy Regularly

As your life changes, so do your coverage needs. Take a look at your New York auto insurance policy to make sure your current coverage aligns with your needs. Review your coverage types, the limits for each coverage type and your deductible amounts. Trim unnecessary extras, such as roadside assistance, to save money.

Shop Around After a Life Change

Certain life events could translate to cheaper car insurance, so shop for quotes whenever something major changes in your life. For instance, many companies offer a lower rate for married couples or domestic partners. Or perhaps you moved to a suburb with lower accident and crime rates. Even if you moved to a more expensive area for car insurance, shopping around can help you get cheaper coverage.

AAA Auto Insurance: Cracked Windshield Conundrum

You may want to see also

Frequently asked questions

New York is a no-fault state, meaning drivers must have personal injury protection (PIP) insurance, which increases insurance costs. New York also has high healthcare costs, and insurance requirements such as wrongful death coverage and uninsured motorist coverage further contribute to high insurance rates.

The average cost of car insurance in New York is $3,433 per year, or $286 per month. However, rates vary depending on factors such as age, driving record, and location.

To get cheaper car insurance in New York, compare rates from different providers, purchase multiple policies from one provider, ask about available discounts, use a comparison tool, and consider raising your deductible.

New York drivers must have liability insurance, personal injury protection (PIP), and uninsured motorist bodily injury coverage (UMBI). The minimum coverage limits are:

- $25,000 per person and $50,000 per accident for bodily injury liability.

- $50,000 per accident for liability for death.

- $10,000 per accident for property damage liability.

- $25,000 per person and $50,000 per accident for UMBI.

- $50,000 per accident for PIP.