In Pennsylvania, auto insurance is mandatory for anyone with a driver's license. If a child is still a learner driver, they can be covered by their parents' insurance policy, but once they pass their test, they must be added to their parents' policy or obtain their own insurance. In the case of divorced parents, both parents may need to add their child to their respective policies, depending on the child's living arrangements and access to vehicles. While auto insurance is not explicitly mentioned in the context of child support in Pennsylvania, medical support, including health coverage and payment of medical bills, is addressed as part of child support obligations.

| Characteristics | Values |

|---|---|

| Is auto insurance mandatory for children in PA? | Yes, if they have a driver's license. |

| Do parents have to add their children to their auto insurance policy? | No, but they can if they want to. |

| When should parents add their children to their auto insurance policy? | As soon as they obtain a driver's license. |

| How does adding a child to an auto insurance policy affect the premium? | It raises the insurance premium. |

| Are there any ways to mitigate the increase in premium? | Yes, by listing the child as an "occasional" driver or assigning them to the least expensive car on the policy. |

| Are there any discounts available for teenage drivers? | Yes, for good students, taking driver education, and being a low-mileage driver. |

What You'll Learn

- In Pennsylvania, is auto insurance mandatory for a child with a learner's permit

- How can parents keep their insurance rates low when adding a teen driver?

- What are the consequences of not adding a child to your insurance policy?

- What are the cheapest types of cars to insure for teens in Pennsylvania?

- What medical support is provided for children in Pennsylvania?

In Pennsylvania, is auto insurance mandatory for a child with a learner's permit?

In Pennsylvania, auto insurance is mandatory for anyone with a driver's license. However, the rules are slightly different for learner drivers. If you are a learner driver in Pennsylvania, you do not need insurance if the car owner is with you while driving. In this case, you can use their car for your driver's test. Once you have passed your test, you must be added to the car owner's insurance policy or obtain your own.

If you have your own car that you plan to use for the driver's test, you must get your own insurance policy beforehand, even as a learner driver. In this case, learner driver insurance is mandatory before and during your test. You will need to register and insure your vehicle with a permit and then bring proof of the vehicle's insurance to your test.

If you are driving someone else's car and they are in the car with you, you do not need learner driver insurance. However, you must bring proof that the vehicle you are using is insured, along with all relevant documents. After passing your driver's test, if you continue driving that car, you will need to be added to their insurance policy.

In Pennsylvania, there is no requirement for a driver's permit insurance if a teen is driving with an insured adult's supervision. It becomes mandatory when they start driving independently. At that point, you may add them to your existing coverage or purchase a new driver insurance policy.

Failing to comply with the law can result in legal sanctions, and you may have to cover all accident-related expenses, including medical bills, injury liability, and property damage.

Requesting Proof of Auto Insurance from a Friend

You may want to see also

How can parents keep their insurance rates low when adding a teen driver?

Adding a teenage driver to your car insurance policy will almost certainly cause your insurance rates to increase. However, there are several strategies parents can use to keep these costs as low as possible.

Firstly, it is worth noting that adding your child to your insurance policy will almost always be more cost-effective than them having their own. Therefore, parents should consider adding their teen to their existing policy.

Parents should also shop around and compare rates from different insurance companies. Each insurance provider calculates their rates differently, so you may be able to find a much better deal by looking at what's on offer from other providers.

Another way to keep insurance rates low is to assign your teen to drive the cheapest car on your policy. Some insurers automatically assign the riskiest driver to the most expensive car, but if your insurance company allows you to assign drivers to specific cars, you can save money by assigning your teen to the cheapest one.

Parents can also encourage their teens to be good students. Most insurers offer good student discounts to teens with a "B" average or above. These can result in savings of up to 25% on your insurance premium.

Encouraging your teen to take a driver's education course can also help to reduce insurance costs. Some insurance companies offer discounts for teens who have completed an approved driver training program or defensive driving course.

Finally, parents can also consider increasing their deductible. Raising your deductible from $500 to $1000 could save you up to $200 a year, or possibly even more.

By following these strategies, parents can help to keep their insurance rates low when adding a teen driver to their policy.

Canceling Elephant Auto Insurance: A Step-by-Step Guide

You may want to see also

What are the consequences of not adding a child to your insurance policy?

In most cases, you are required to add your child to your car insurance policy if they have a driver's license and live in your household. If you fail to do so, you risk having your insurance policy canceled and your claim denied in the event of an accident. Driving without insurance is illegal and can result in significant financial consequences if your child is involved in an accident.

In the state of Pennsylvania, insurance is mandatory for anyone with a driver's license. If your child is a learner driver and you are in the car with them, they do not need insurance. However, once they have passed their test, they must be added to your insurance policy or obtain their own.

There may be situations where you don't have to add your child to your insurance policy. For example, if your child only occasionally drives your vehicle with your permission, they may be covered under your existing policy without being added as a listed driver. It's important to verify this with your insurance provider. Additionally, if your child is away at college or living independently and does not have regular access to your vehicle, they may not need to be listed on your policy.

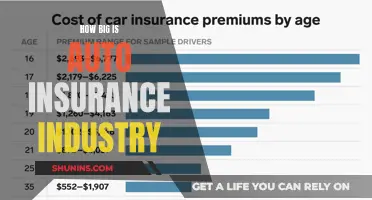

Adding your child to your car insurance policy can result in an increase in your insurance premium, sometimes up to 161%. However, it is still more cost-effective than getting them their own policy. There are also discounts available, such as good student discounts and low-mileage discounts, that can help offset the cost.

Auto Insurance Savings: AARP's Benefits Explained

You may want to see also

What are the cheapest types of cars to insure for teens in Pennsylvania?

The cost of car insurance for teens can be high, but there are ways to reduce the cost of adding a teen driver to your policy. One way is to carefully consider the type of car your teen drives.

In many cases, the cheapest cars to insure for teens are trucks, SUVs, and crossover vehicles. When choosing a car for your teen, it is also important to consider safety features. The Insurance Institute for Highway Safety reports that teen drivers have disproportionately high crash rates, amounting to four times the crash rates of drivers in their twenties.

- Mazda MX-5 Miata

- Subaru Outback

- Volkswagen Golf GTI

- Mini Countryman

- Volkswagen Routan

- Smart Fortwo

- Fiat 500L

- Honda Odyssey

- Subaru Legacy

- Mini Paceman

- Subaru Outback

- Honda CR-V

- Mazda CX-5

The cheapest cars to insure for teens are all midsize crossovers. These cars all let you sit higher and get a better view of the road, have advanced safety features, and starting prices of $30,000 or less.

In addition to choosing a safe and affordable car, there are other ways to lower the cost of car insurance for teens. These include:

- Taking a defensive driving course

- Getting good grades

- Choosing a sensible vehicle

- Driving safely and avoiding accidents or violations

- Looking into discounts, such as for good students or distant students

AAA Auto Insurance: Affordable or Overpriced?

You may want to see also

What medical support is provided for children in Pennsylvania?

Pennsylvania law gives the courts the authority to order either parent to provide medical support if it is available at no cost or at a reasonable cost. "Reasonable cost" is defined as an amount not exceeding five percent of the net monthly income. The incomes and assets of both parents are considered when the court establishes a support order.

Medical support includes health coverage provided for a child or children in a child support case in which there is a medical support order. This includes private health insurance, publicly-funded health coverage such as Medicaid and the Children's Health Insurance Program (CHIP), cash medical support including payment of health insurance premiums, and payment of medical, dental, and eye care bills. Medical support may be provided by either the custodial parent, noncustodial parent, or any third person associated with either parent, such as a step-parent or grandparent.

Anyone who has custody of a child can apply for child support services at the county DRS of the Court of Common Pleas. The DRS will help people seeking child support set up a new support order or change an existing order to include medical support. The court will decide which parent has primary responsibility for medical support; usually, it is the parent who has access to health care coverage at work at a "reasonable cost".

The National Medical Support Notice is a medical child support order that state child support enforcement agencies must use to enforce medical child support. The county DRS sends this notice to the employer when a parent is ordered to provide medical support for their child and is employed or in active or reserve military duty. The employer and the medical support plan administrator must complete the National Medical Support Notice, and the medical support information is then reported to the county DRS.

Auto Express Insurance: Are Saturday Services Available?

You may want to see also

Frequently asked questions

Yes, you should add your child to your auto insurance policy in Pennsylvania. If your child is a licensed driver and lives in your household, you will need to add them to your policy.

You should add your child to your auto insurance policy as soon as they obtain their driver's license. Most insurers will only increase premiums after a teen receives their license. However, it's worth checking with your insurance provider for their specific guidelines.

Adding a teenager to your auto insurance policy will likely result in higher insurance premiums. The increase in cost can vary depending on the insurance company and other factors. It is recommended to shop around and compare quotes from different insurance providers to find the best rate.