Auto insurance proceeds are generally not taxable, but there are some exceptions. The IRS only taxes money that is considered income, which is money that makes you better off financially than before. Money to fix or replace your car is not taxable, as it returns you to the state you were in before the accident. However, insurance claim proceeds may be taxable if they are deemed to provide financial gain, such as lost wages, pain and suffering, and litigation. It's important to consult a tax professional or a CPA to determine the taxability of your specific situation, as tax laws vary by state.

| Characteristics | Values |

|---|---|

| Are auto insurance proceeds taxable? | Generally not taxable, but there are exceptions. |

| When are auto insurance proceeds taxable? | When the IRS classifies the settlement as income, i.e., when it provides financial gain. |

| What types of proceeds are taxable? | Lost wages, pain and suffering, litigation, punitive damages, and emotional distress. |

| What types of proceeds are not taxable? | Repair or replacement of a vehicle, medical expenses, and property damage. |

| How to determine taxability | Consult a tax professional or seek guidance from the IRS based on your unique circumstances. |

What You'll Learn

Proceeds for pain and suffering are taxable

The taxability of auto insurance proceeds depends on the type of payment and whether it provides financial gain. The Internal Revenue Service (IRS) considers each type of payment to have specific purposes, so the individual intended function of payments is important.

Proceeds for pain and suffering are generally taxable unless they are caused by a physical injury. This is because the IRS considers compensation for pain and suffering to be a financial gain, making it taxable income. However, if the pain and suffering are classified as emotional distress resulting from a physical injury, then it is tax-exempt.

It is important to note that tax laws vary by state, and it is always recommended to consult a tax professional or a Certified Public Accountant (CPA) to determine the taxability of specific situations. They can provide guidance based on applicable tax laws and help individuals find tax exemptions.

U-Turn: USAA's 12-Month Auto Insurance Offering

You may want to see also

Lost wages are taxable

Lost wages are generally taxable. The IRS considers lost wages as income, which is taxable. However, there are some specific circumstances where lost wages may not be taxed. For example, if the lost wages are a result of a personal injury or sickness, they may be excluded from taxable income. In addition, tax laws vary by state, so it is important to consult a tax professional or CPA to determine the taxability of your specific situation.

Lost wages are considered taxable income because they replace your regular income, which would have been subject to income tax. While insurance is designed to "'make you whole'" and bring you back to the state you were in before an incident, lost wages are intended to replace the income you would have earned if you had not been injured. Therefore, they are typically taxed as income.

The taxation of lost wages can be complex, and there are a few important considerations. First, if you receive a large settlement for lost wages, representing several years of income, you may be taxed at a higher rate than your usual tax bracket. Second, if you hire a lawyer to help you recover lost wages, their fees will likely be deducted from your settlement, reducing the amount you receive. Finally, if you receive a settlement for lost wages, you will likely receive a 1099 form to help you file your taxes, and you will be responsible for paying the employer's portion of Social Security and Medicare taxes.

To ensure you are complying with tax laws, it is essential to consult a tax professional or CPA who can guide you through the process and determine the taxability of your specific situation. They can also help you understand any state-specific tax laws that may apply.

Lucrative Career: Auto Insurance Sales

You may want to see also

Medical claims are not taxed

When you make a health insurance claim, the insurance company usually pays the healthcare provider directly. But even if you paid out of pocket for a medical expense and are reimbursed later, you won't have to pay taxes on the amount you're paid. This is because the purpose of insurance is to "make you whole" and put you back in the state you were in before an incident occurred.

It's important to note that while medical claims themselves are not taxed, if you receive a settlement that includes compensation for pain and suffering, those portions may be taxable. Additionally, if you deduct medical expenses from your taxes in one year and then receive a settlement for those expenses in a future year, you will need to pay taxes on the settlement amount.

If you have any questions about whether your specific situation may result in taxable proceeds, it is recommended to consult a tax professional or seek guidance from the Internal Revenue Service (IRS). They can provide advice based on your unique circumstances and applicable tax laws.

Transferring Car Insurance: MD to Other States

You may want to see also

Property insurance claims are not taxed

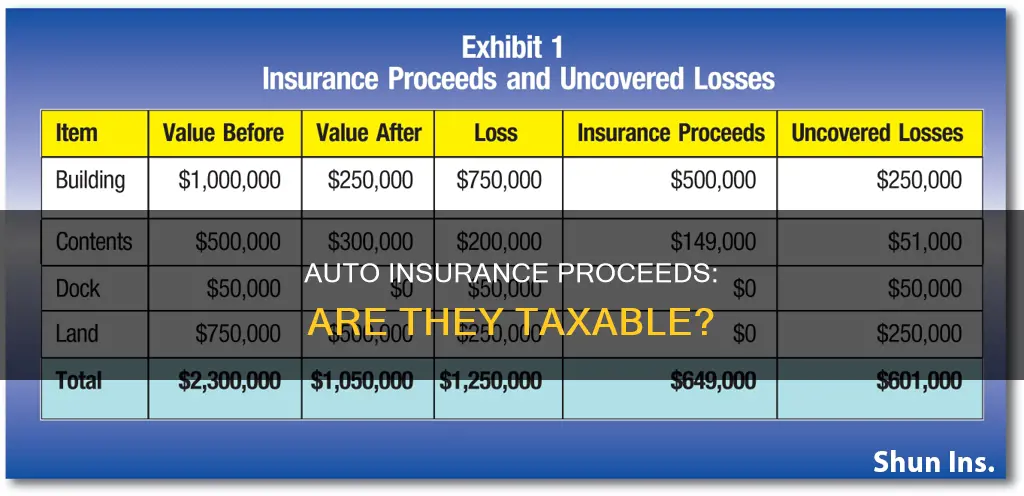

When it comes to insurance and taxes, it's important to understand the implications of any claims or settlements you receive. While the topic may seem complex, it's crucial to know whether your insurance proceeds will be taxed or not. Let's focus on property insurance claims and explore why they are generally not taxed.

Property Insurance Claims: Not Taxed

When you make a claim on your property insurance, whether it's for your home or rental property, you're typically seeking compensation for repairs or replacements due to damage or loss. This could be from a natural disaster, fire, or theft. The key point here is that you are trying to restore your property to its previous condition.

The Internal Revenue Service (IRS) considers property insurance claims as non-taxable income. This means that the money you receive from your insurance company to fix or replace your property is not subject to taxation. The reasoning behind this is that insurance aims to "make you whole" again. In other words, it intends to put you back in the same financial position you were in before the incident occurred. You haven't gained any additional wealth, so there is no income to tax.

For example, let's say your car, worth $10,000, is totaled in an accident. Your insurance company compensates you with $10,000 (minus the deductible) to purchase a new car. In this scenario, you are in the same financial position as before the accident. You haven't gained anything, so the IRS won't tax this compensation.

Exceptions to the Rule

While property insurance claims are generally not taxed, there are a few exceptions to keep in mind. If your property damage settlement includes compensation for emotional distress or punitive damages, these portions may be subject to taxation. Additionally, if the insurance company overpays you or if you perform the repairs yourself and pay yourself, the excess amount could be considered taxable income.

Furthermore, in the case of business property, different rules may apply. If the insurance proceeds are reinvested into replacing the property, taxes may be deferred. However, if the proceeds are not reinvested and are instead used for other purposes, they may be taxable as income.

Proper Record-Keeping

It's important to maintain proper records of your property insurance claims. While the proceeds are typically non-taxed, keeping detailed documentation can help you support your financial position if any questions arise. Be sure to record the insurance settlement, including the date, amount, and purpose of the payment. Additionally, allocate the proceeds to the appropriate accounts based on the nature of the damage.

In summary, property insurance claims are generally not taxed because they are designed to reimburse policyholders for their losses, not to provide additional income. However, it's important to be aware of the exceptions and consult with tax professionals or refer to the IRS guidelines to fully understand your specific situation.

Suing Insurers: Your Rights After a Car Accident

You may want to see also

Lawsuit proceeds may be taxed

The IRS generally regards money from lawsuit settlements as income, and taxes it accordingly. However, there are exceptions. The IRS does not tax awards for personal injury cases, which must be physical injuries. The IRS refers to this as "observable bodily harm".

You may be taxed on settlements for emotional distress, which is not classed as a physical injury. However, if you sought medical attention for emotional distress, such as counselling, these sessions may be tax-free. If your emotional distress arose from physical injuries, you may not have to pay tax on this either.

There are some settlements that are almost always taxable:

- Interest on monetary awards

- Punitive damages

- Payments for lost wages or lost profits

- Damages for emotional distress

- Damages for Title VII (Civil Rights Act) cases

- Damages for patent or copyright infringement or breach of contract

- Money received for settlement of pension rights

- Attorney fees and costs, if they are awarded as part of the settlement

If you are involved in a lawsuit, it is recommended that you work with your accountant and attorney to ensure you don't encounter any problems with the IRS.

Tax Exemptions

There are some exemptions to the rule that lawsuit proceeds are taxable. For instance, if the proceeds are used to repair or replace a damaged vehicle, they are typically not taxed. Medical expense reimbursements related to the accident are also generally not subject to taxation.

Safe Auto: Comprehensive and Collision Insurance Costs Explained

You may want to see also

Frequently asked questions

Auto insurance proceeds are generally not taxable. However, there are some situations where you may have to pay taxes on a settlement. This happens when the settlement exceeds the actual expenses incurred, or when the settlement includes compensation for pain and suffering, lost wages, or emotional distress.

Auto insurance proceeds may be taxable if they exceed the actual cost of repairs or the value of your car. In this case, the excess money is considered a taxable gain by the IRS. Auto insurance proceeds may also be taxable if they include compensation for lost wages, pain and suffering, or emotional distress.

Auto insurance proceeds are typically not taxable if they are used to repair or replace a damaged vehicle or to cover medical expenses.