Auto-Owners Insurance and Foremost Insurance are both reputable insurance providers, but which one is better? Auto-Owners Insurance is the better option between the two as it underwrites and services its policies, whereas Foremost outsources its policies to Bristol West. Foremost Insurance is a good option for high-risk drivers and those with poor credit seeking non-standard coverage options. However, Auto-Owners Insurance offers better service and a more direct approach to policy management.

| Characteristics | Values |

|---|---|

| Customer Service | Foremost has mediocre customer service and has received more complaints than the average car insurance provider. |

| Affordability | Foremost's auto insurance rates are much higher than the national average. |

| Coverage Options | Foremost offers standard car insurance coverage types, plus many add-ons like rental reimbursement, roadside assistance, rideshare coverage, and gap insurance. |

| Digital Capabilities | Foremost has limited digital capabilities. Its mobile app does not allow for claims filing. |

| Financial Strength | Foremost has an "A" rating from AM Best, indicating strong financial stability and the ability to pay out claims. |

| Customer Satisfaction | Foremost has a low rating of 2.2/5 from users. |

What You'll Learn

Auto-Owners Insurance underwrites and services its own policies, while Foremost outsources this to Bristol West

When it comes to choosing between Auto-Owners Insurance and Foremost Insurance, there are several factors to consider. One key difference between the two companies is that Auto-Owners Insurance underwrites and services its own policies, while Foremost Insurance outsources this function to another company called Bristol West. This distinction is important because it can impact the level of service and convenience that customers receive.

By underwriting and servicing its own policies, Auto-Owners Insurance maintains greater control over the entire insurance process, from policy creation to claims handling. This integrated approach allows Auto-Owners Insurance to develop policies that directly meet the needs of its customers and provide a seamless experience throughout the life of the policy. In-house underwriting and servicing also enable Auto-Owners Insurance to develop expertise in specific areas, such as understanding the unique risks faced by its customers and tailoring coverage options accordingly. This level of specialization can result in more comprehensive and competitive insurance products.

On the other hand, Foremost Insurance's decision to outsource underwriting and servicing to Bristol West has its own implications. Bristol West, as a subsidiary of Farmers Insurance Group, brings the backing of a larger insurance powerhouse. This affiliation provides Foremost Insurance customers with the assurance that their policies are underwritten by a financially stable company with the expertise and resources to protect them properly. Additionally, Bristol West utilizes an insurance agent sales model, which can offer a more personalized level of service compared to direct-to-consumer models. Customers seeking extra attention and guidance may find this approach more appealing.

However, the use of an external underwriter and servicer by Foremost Insurance can also introduce complexities. The involvement of multiple companies may make it challenging for customers to navigate the insurance process, potentially leading to confusion and delays. Additionally, the policies and coverage options offered by Foremost Insurance may be influenced by Bristol West's own business priorities and strategies, which may not always align with the specific needs of Foremost's customers.

Ultimately, the decision between Auto-Owners Insurance and Foremost Insurance depends on individual preferences and circumstances. Those seeking a more integrated and specialized approach may find Auto-Owners Insurance's model preferable. In contrast, Foremost Insurance's partnership with Bristol West may appeal to those who value the support of a larger insurance group and the personalized service of an agent-based model, even if it comes with some added complexities.

Canceling Auto Insurance: Early Termination

You may want to see also

Foremost has a higher-than-average number of customer complaints

Foremost Insurance has received a higher-than-average number of customer complaints, with an NAIC rating of 1.30, indicating more grievances than the average car insurance provider, adjusted for size. This suggests that customers are dissatisfied with the company's offerings and services.

The WalletHub rating of 2.2/5 for Foremost Insurance further reinforces its below-average performance, with high premiums and mediocre customer service contributing to a less favourable perception. The company's high-risk insurance offerings, which cater to drivers with accidents or tickets on their records, also come at a higher cost. This pricing structure may be a factor in the increased number of complaints, as customers seek more affordable options.

Foremost's auto insurance is provided through Bristol West, a subsidiary of Farmers Insurance Group. While Bristol West is known for its agent-based customer service model, which can offer more personalised attention, the varying levels of service across different partnerships may contribute to inconsistencies in customer experiences.

The lack of robust digital capabilities and the absence of online quoting for auto insurance could be another factor in the higher volume of complaints. Customers seeking convenience and accessibility through digital channels may be disappointed with Foremost's limited online features.

Additionally, Foremost's home insurance has also received criticism for its handling of claims and customer service. There are reports of the company denying or delaying claims, which has left customers feeling frustrated and dissatisfied.

Auto Insurance in South Carolina: Who's Covered First?

You may want to see also

Foremost has high premiums

Foremost Insurance has been described as having high premiums by WalletHub, which gave the company a rating of 2.2 out of 5. WalletHub's review states that Foremost's premiums are high relative to its "lacklustre customer service". Foremost's NAIC rating of 1.30 also indicates that the company has received more complaints than the average car insurance provider, when adjusted for size.

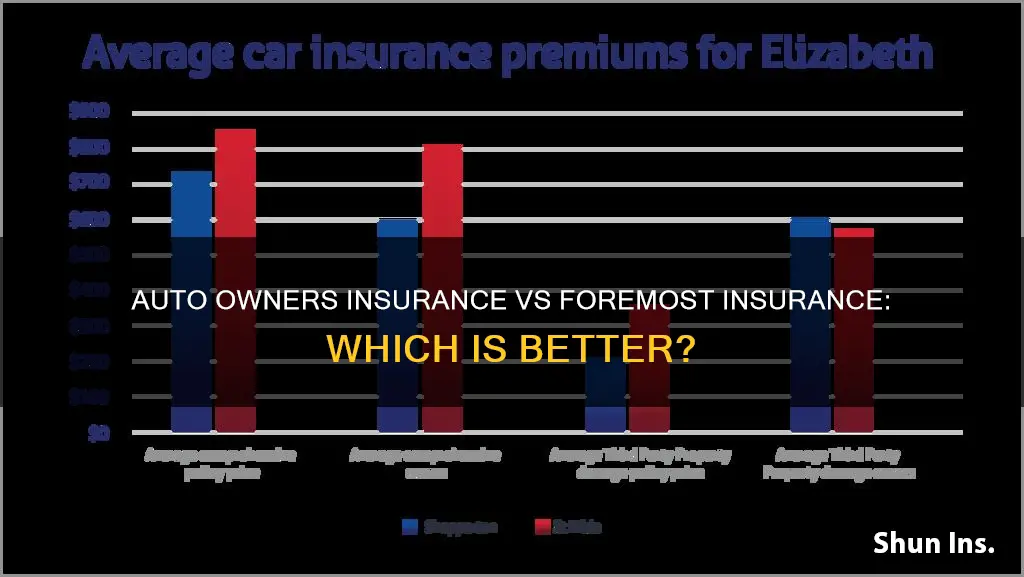

Foremost's auto insurance rates are also said to be higher than the national average. According to Bankrate, Foremost's average premium is $2,543 annually for a full coverage policy, and $1,117 annually for minimum coverage. In comparison, the national average is $2,329 for full coverage and $633 for minimum coverage.

Foremost's high premiums may be due to the fact that it deals with more customers with accidents and tickets. Those with a poor driving record are considered high-risk and are therefore more expensive to insure. Foremost's auto insurance is underwritten by Bristol West, a company that specialises in high-risk drivers.

However, it is important to note that insurance rates are highly dependent on individual factors, such as age, location, driving history, and type of vehicle. Foremost offers a range of discounts that can help lower premiums, including multi-car, multi-policy, good student, and paperless billing discounts.

Understanding Commercial Auto Insurance: Who's Covered and Who's Not?

You may want to see also

Foremost is good for high-risk drivers

Foremost Insurance is a good option for high-risk drivers who may struggle to find insurance elsewhere. The company offers a range of insurance products, including car and home insurance, and has a strong financial rating, indicating that it is financially stable and able to pay out claims.

Foremost's car insurance is available through several partner companies, including Bristol West, Coast National, Economy Preferred, and Security National. It provides all the standard car insurance coverage types, such as liability coverage, comprehensive and collision coverage, and uninsured/underinsured motorist coverage. In addition, Foremost offers several add-on coverage options, including rental reimbursement, roadside assistance, rideshare coverage, and gap insurance.

One of the main advantages of Foremost car insurance is that it caters to high-risk drivers. Foremost's partner company, Bristol West, specializes in providing insurance for drivers who may have difficulty obtaining coverage from standard carriers due to factors such as speeding tickets, accidents, or DUIs. Bristol West can also file an SR-22 or FR-44 for drivers who require it.

Foremost's home insurance is also designed for non-standard customers who may have trouble finding affordable coverage from other insurers. The company offers two basic home insurance packages: Foremost Classic ACV and Foremost Classic CL. These packages provide standard coverages such as dwelling, other structures, personal property, and liability, with a limited number of endorsements available to bolster coverage.

While Foremost may have more coverage options and perks than some non-standard insurance companies, its offerings are still more limited when compared to larger providers. Additionally, Foremost's rates tend to be higher than the national average, especially for drivers with a poor driving record. This is because high-risk drivers are more likely to file claims, resulting in higher insurance costs.

In conclusion, Foremost Insurance is a good option for high-risk drivers due to its specialization in non-standard insurance, range of coverage options, strong financial rating, and ability to provide insurance for those who may struggle to find it elsewhere. However, it is important to compare rates and consider other alternatives before making a decision.

Understanding Dependent Auto Insurance: Are You Covered?

You may want to see also

Foremost has a good financial rating

Foremost Insurance has received a financial rating of A (Excellent) from AM Best. This rating indicates that the company has a strong balance sheet and a proven track record of paying its claims. Foremost has maintained this rating since at least 2008, underscoring its consistent financial stability over time.

The company's financial strength is further bolstered by its affiliation with Farmers Insurance Group, a leading insurance provider in the United States. This partnership provides Foremost with additional resources and expertise, enhancing its ability to protect customers and manage their claims effectively.

Foremost's financial rating is a positive indicator of its ability to meet its financial obligations and provide reliable coverage to its policyholders. This rating reflects the company's prudent management of its financial resources and reinforces its position as a stable and trustworthy insurance provider.

In addition to its strong financial rating, Foremost also offers a range of insurance products, including auto, homeowners, and specialty coverage options. The company caters to diverse customer needs, including those with non-standard insurance requirements, such as high-risk drivers or owners of mobile homes and recreational vehicles.

While Foremost may not be the most affordable option for some consumers, particularly those with a clean driving record, its financial stability and ability to handle claims are commendable. For customers who value financial security and peace of mind, Foremost's excellent financial rating is a significant advantage.

Auto Insurance for Fishing Guides: Navigating the Right Coverage

You may want to see also

Frequently asked questions

Auto-Owners Insurance is an insurance company that underwrites and services its own policies.

Foremost Insurance is a specialty insurance company that is a subsidiary of Farmers Insurance Group of Companies. They underwrite their own policies or outsource the entire policy to Bristol West.

Auto-Owners Insurance is better than Foremost Insurance because companies that write their own policies tend to offer better service.