Auto insurance is a necessity for anyone driving in New York State. The Empire State is a no-fault state, which means that each person in an accident is responsible for their own medical expenses under personal injury protection (PIP), regardless of who caused the accident. The at-fault party is still responsible for the other party’s property damage.

New York State law requires liability insurance, including bodily injury coverage, property damage coverage, and uninsured motorist coverage, as well as PIP. The minimum coverage requirements are:

- $25,000 for bodily injury coverage per person

- $50,000 for bodily injury coverage per accident

- $10,000 for property damage coverage

- $25,000 for uninsured motorist coverage per person

- $50,000 for uninsured motorist coverage per accident

- $50,000 for personal injury protection (PIP)

- $50,000 for death of one person in an accident

- $100,000 for death of two or more people in an accident

Car insurance in New York is the second most expensive in the country, with costs running over 37% higher than the national average. The average cost of car insurance in New York is $1,436 a year, but many factors can affect the cost of insurance, such as your credit score and driving history.

| Characteristics | Values |

|---|---|

| Minimum bodily injury coverage per person | $25,000 |

| Minimum bodily injury coverage per accident | $50,000 |

| Minimum property damage coverage | $10,000 |

| Minimum uninsured motorist coverage per person | $25,000 |

| Minimum uninsured motorist coverage per accident | $50,000 |

| Minimum personal injury protection | $50,000 |

| Minimum death coverage for one person | $50,000 |

| Minimum death coverage for two or more people | $100,000 |

What You'll Learn

Minimum coverage requirements

To register a vehicle in New York, you must have New York State-issued automobile liability insurance coverage. Failure to maintain coverage can result in the suspension of your vehicle registration and driver's license.

No-Fault (Personal Injury Protection)

Also called Personal Injury Protection (PIP), this coverage pays for medical expenses, lost earnings, and other reasonable and necessary expenses for a driver or passenger injured in your car or a pedestrian injured by your car, regardless of who is at fault. The minimum coverage limit is $50,000 per person.

Liability

Liability insurance protects you against the harm your car might cause to other people and their property. The minimum liability coverage limits mandated by New York's Vehicle and Traffic Law are:

- $25,000 for bodily injury (not resulting in death) or $50,000 for any injury resulting in death sustained by any one person in any one accident.

- $50,000 for bodily injury (not resulting in death) or $100,000 for any injuries resulting in death sustained by two or more persons in any one accident.

- $10,000 for property damage liability protection per accident.

Uninsured Motorists

This coverage protects you, your family, and your passengers in the event of a hit-and-run accident or an accident with an uninsured vehicle. The minimum coverage limits for uninsured motorists are the same as those for liability insurance:

- $25,000 per person for bodily injury.

- $50,000 per accident for bodily injury.

Auto Insurance: Understanding Coverage for Other Drivers

You may want to see also

Average cost of car insurance in New York

The average cost of car insurance in New York varies depending on various factors, including age, location, driving history, and credit score. Here is an overview of the average costs and factors that can affect your car insurance rates in New York.

Average Costs in New York State

According to recent studies, the average cost of car insurance in New York State can range from $2,221 to $4,112 per year for full coverage and $869 to $2,681 per year for minimum coverage. The average monthly cost for full coverage is around $343, while it is about $73 for minimum liability. These rates are significantly higher than the national average, with full coverage costing 78% more and minimum coverage costing 156% more than the national average.

Average Costs in New York City

In New York City, the average cost of car insurance is even higher. The average monthly rate for full coverage is $351, or $4,214 per year, which is about 110% more than the national average. For minimum coverage, the average cost is $163 per month or $1,954 per year, which is more than double the national average. Brooklyn is the most expensive borough for car insurance, with rates averaging $382 per month.

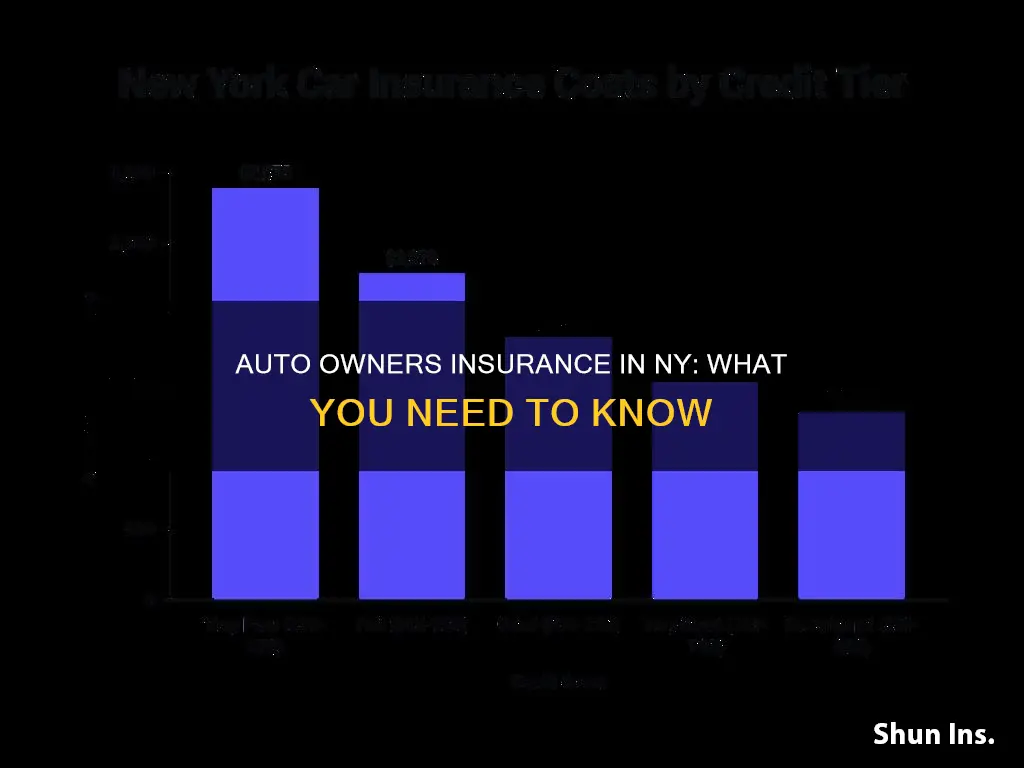

Factors Affecting Car Insurance Rates in New York

Several factors can influence the cost of car insurance in New York. Age is a significant factor, with younger drivers typically paying more for coverage due to their lack of driving experience. Location also plays a role, with rates varying across different ZIP codes in New York. Additionally, your driving history and credit score can impact your rates, with accidents, speeding tickets, and DUIs leading to higher insurance premiums.

Cheapest Car Insurance Companies in New York

When it comes to finding affordable car insurance in New York, Progressive, American Family, USAA, and Geico are often mentioned as some of the cheapest options. Progressive offers the cheapest rates for both minimum and full coverage, with average monthly rates of $52 and $94, respectively. USAA is another affordable option, especially for military personnel and their families. However, it's important to shop around and compare quotes from multiple providers, as rates can vary based on individual factors.

Auto Insurance Shopping: Annual Customer Acquisition Challenge

You may want to see also

Cheapest car insurance companies

Auto insurance is a contract between you and an insurance company that protects you against financial loss in the event of an accident. In New York, car insurance costs an average of $216 per month, or $2,587 per year, for good drivers with a full-coverage policy. However, rates can vary depending on factors such as your driving history, age, gender, and where you live.

Progressive

Progressive is the best car insurance company in New York, offering the cheapest rates for good drivers at $1,356 less than the statewide average. It also has low rates for adding a teen driver and offers various discounts, such as home and auto bundles. However, drivers with bad credit should avoid Progressive, as its rates for poor credit are high.

Main Street America

Main Street America, now part of American Family Insurance, offers the lowest rates for most high-risk drivers and good drivers. However, their rates are high for drivers with bad credit. You need to contact a live agent to get a quote, as they don't offer online quotes.

New York Central Mutual (NYCM)

NYCM is the best car insurance company for customer satisfaction in New York, with the lowest level of customer complaints. They also offer the cheapest rates for adding a teen driver to a parent's policy. However, you can't get a quote online and must call an agent.

USAA

USAA is the best car insurance company for military members in New York, offering competitive rates and discounts for the military community. They also provide a wide range of coverage options, including accident forgiveness and rideshare coverage. However, USAA is only available to military members and their families.

Kemper

Kemper is the overall cheapest option for car insurance in New York, offering minimum coverage for $646 per year and full coverage for $1,121 per year. They also have affordable rates for teens, young adults, and seniors.

GEICO

GEICO is another affordable option, especially for drivers with poor credit. They also offer discounts for students with good grades.

When shopping for car insurance in New York, it's important to compare quotes from multiple companies, as rates can vary significantly. Additionally, consider bundling policies, taking advantage of discounts, and adjusting your coverage limits and deductibles to find the cheapest option for your needs.

Auto Accident Insurance: Is a $60,000 Settlement Unreasonable?

You may want to see also

How to get cheaper auto insurance in New York

Auto insurance in New York is among the most expensive in the country, with costs running over 37% higher than the national average. However, there are ways to lower your premiums and get the best price on auto insurance. Here are some tips to help you get cheaper auto insurance in New York:

Bundle Your Policies

No matter what type of home you live in, if you have homeowners, renters, condo, or any other type of insurance policy, bundle it with the same provider as your car insurance if you want to save money. Many companies offer discounts for insurance bundles.

Ask About Discounts

Every provider offers different auto insurance discounts, so ask your insurance agent for ways to save. You probably have access to cost-saving options, whether they’re in the form of a defensive driving course or automatic billing.

Drop Unnecessary Coverage

If all else fails, you can drop auto insurance coverages the state doesn’t require, like rental car coverage or collision insurance, to save money. Keep in mind that dropping coverage options could cost you more later if you get into an accident.

Lower Your Limits

Similarly, lowering your limits will also lower the cost of your auto insurance, but again, you’ll pay more if you incur injuries or damages in an accident.

Raise Your Deductibles

You can increase your deductible to cut costs, but make sure you could still afford it if you were in an accident. If you can’t pay your deductible, you won’t be compensated for collision or comprehensive claims.

Explore Other Providers

You may be able to cut the cost of your car insurance by requesting an insurance quote from a competitor. When you look into auto coverage with other companies, consider these questions: Does the bodily injury liability cost more? Can you get liability insurance plus all the insurance the law requires for lower prices? If so, it may be worthwhile to switch car insurance.

Auto Insurance Rates: Why the Spike?

You may want to see also

New York auto insurance requirements

New York is a no-fault state, which means that if you are in a car accident, your insurance company will pay for your expenses regardless of who is at fault. To drive in New York, you are required to have liability insurance and uninsured motorist coverage, as well as personal injury protection.

The minimum car insurance requirements in New York are as follows:

- Bodily injury coverage per person: $25,000

- Bodily injury coverage per accident: $50,000

- Property damage coverage: $10,000

- Uninsured motorist coverage per person: $25,000

- Uninsured motorist coverage per accident: $50,000

- Personal injury protection (PIP): $50,000

- Death: $50,000 for the death of one person in an accident, or $100,000 for the death of two or more people in an accident

While these are the minimum requirements, it is recommended that you have liability limits of up to $500,000, as well as collision and comprehensive coverage to cover damages to your car.

If you are caught driving without insurance in New York, you can face legal penalties, including:

- Fine: $150 to $1,500

- Civil penalty: $750

- Imprisonment: up to 15 days

- License suspension: If you are uninsured for more than 90 days, your license will be suspended for the same duration as your registration suspension.

- Registration suspension: You will have to pay a daily fine for each day you are without insurance, ranging from $8 to $12 per day, depending on how long you have been uninsured.

It is important to note that New York does not accept out-of-state insurance, and your insurance coverage must be issued by a company licensed by the New York State Department of Financial Services and certified by the New York State DMV.

Unraveling the Auto Insurance Quote Process: A Step-by-Step Guide

You may want to see also

Frequently asked questions

The minimum car insurance coverage in New York is:

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $10,000 for property damage liability

- $25,000 for uninsured motorist bodily injury per person

- $50,000 for uninsured motorist bodily injury per accident

- $50,000 for personal injury protection (PIP)

- $50,000 for death of one person in an accident

- $100,000 for death of two or more people in an accident

The average cost of car insurance in New York is $1,436 per year, or $120 per month.

Yes, car insurance is mandatory in New York. Driving without insurance can result in fines ranging from $150 to $1,500, imprisonment of up to 15 days, license suspension, and registration suspension.

The cheapest car insurance in New York is offered by Kemper, with an average rate of $442 per year. GEICO is also a good option, with a balance of affordability and quality service.