California's Low-Cost Automobile (CLCA) insurance program was established in 1999 to provide affordable insurance to income-eligible good drivers who would otherwise be uninsured. While the coverage offered by CLCA is less comprehensive than a standard insurance policy, it is significantly cheaper and satisfies the state's financial responsibility laws. Private insurance policies offer more comprehensive coverage but are more expensive, and high-risk drivers could pay $2,000 or more per year. CLCA policies are designed for low-income individuals who cannot afford private insurance but still require a vehicle.

What You'll Learn

CLCA eligibility requirements

The California Low-Cost Auto Insurance Program (CLCA) is a program designed to provide affordable insurance to income-eligible good drivers who would otherwise be uninsured. The CLCA was established in 1999 and exists pursuant to California Insurance Code Section 11629.7. The program is not meant for consumers who are just looking for lower rates.

License

You must have a valid California driver's license, a pending license reinstatement, or an out-of-state license while you are in the process of getting a California one. An AB60 license is also accepted, regardless of immigration status.

Age

You must be at least 16 years of age. If you are under 18, you must be legally emancipated. If you are a dependent, you must be filing your own tax return or residing with your parents.

Income

Your household's annual income must be below 250% of the federal poverty level. The income eligibility requirements vary based on the size of your household. For example, a one-person household must earn $37,650 or less per year, while a five-person household must make $91,450 or less per year. You must provide proof of income, such as a W-2 form, 1099 form, payroll stub, or pension letter.

Vehicle

Your vehicle cannot be worth more than $25,000, and you cannot have more than two vehicles registered in your name. All cars registered to you must be insured under CLCA.

Driving Record

You must have a good driving record. In the last three years, you cannot have had an accident where you were at fault and someone was injured or killed. You should also not have more than one point on your license. Additionally, you must have held a license for three consecutive years, with no felonies or misdemeanors on your record.

Vehicle Use

Your vehicle can only be used for personal purposes, such as travelling to work, school, errands, or vacations. It cannot be used for commercial purposes such as deliveries or ridesharing.

Farmers Auto Insurance: Good Option?

You may want to see also

CLCA insurance costs

The California Low-Cost Auto Insurance Program (CLCA) was established in 1999 to provide affordable insurance to income-eligible good drivers who would otherwise be uninsured. The CLCA program is not auto insurance sold by the California Department of Insurance but a program that assigns a licensed auto insurance company to provide a policy through the California Automobile Assigned Risk Plan.

The base CLCA policies provide liability-only coverage with the following limits:

- $10,000 of bodily injury or death liability per person

- $20,000 of bodily injury or death liability per accident

- $3,000 property damage liability per accident

The CLCA policy is not very customizable. Comprehensive and collision coverage are not available through this program. However, CLCA policyholders may add the following coverages to their policies for an added cost of around $43 to $82 per year:

- $1,000 of medical payments coverage per person

- $10,000 of uninsured motorist bodily injury per person

- $20,000 of uninsured motorist bodily injury per accident

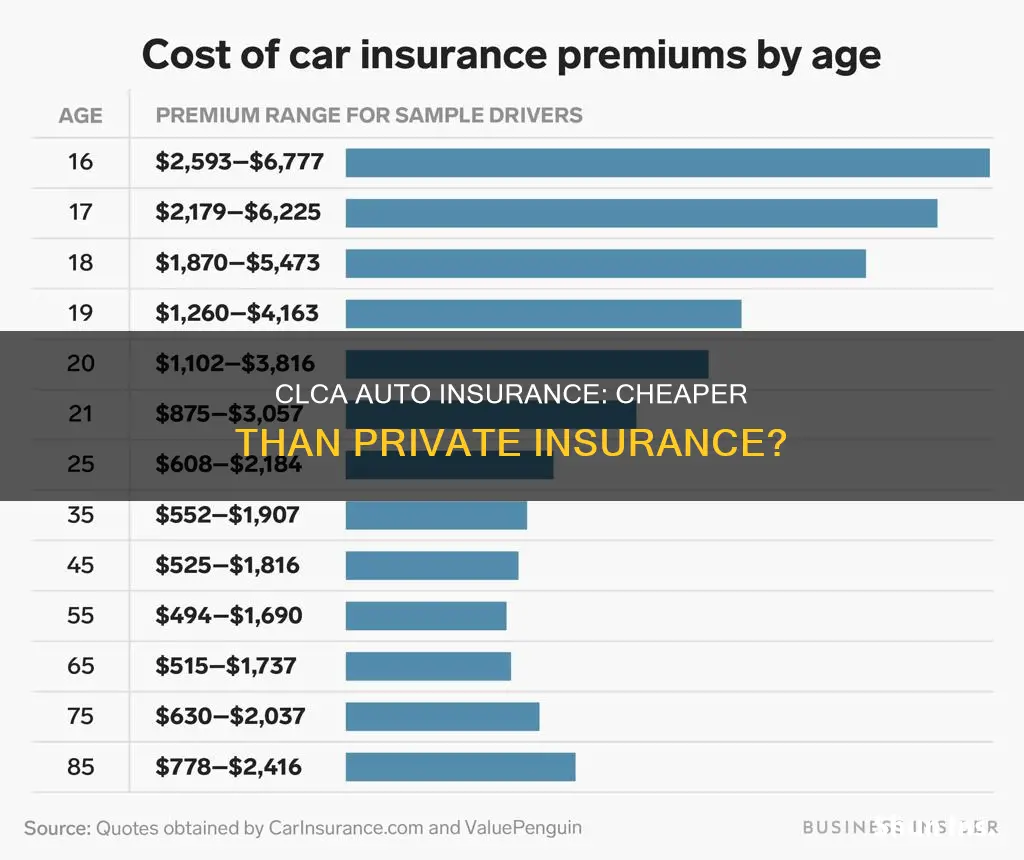

The costs of the basic CLCA policy with only liability coverage are generally fixed, but there are three factors that can increase the cost. If you're 16–18 years old, your rates are double the base rate. If you're a single driver between the ages of 19 and 24, your rates are typically 30% higher than the base rate, assuming you've been continuously licensed for at least three years. If you're a driver with less than three years of verifiable driving history, you’ll pay a 40% surcharge.

The available optional coverages—medical payments and uninsured motorist bodily injury—are fixed amounts that vary by county. They're not affected by the surcharge and are simply added to your total premium cost.

To determine how much a policy under CLCA will cost you, calculate your county's base rate and then add the cost of any optional coverage to get your annual premium. In general, premiums range from $198 to $802. Prices range from $232 to up to $1,039 per year.

Toggle Auto Insurance: Good or Not?

You may want to see also

CLCA insurance coverage limits

California's Low-Cost Automobile (CLCA) insurance program was established in 1999 to provide affordable insurance to good drivers who would otherwise be uninsured due to financial constraints. The CLCA program is not auto insurance sold by the California Department of Insurance but a program that assigns a licensed auto insurance company to provide a policy through the California Automobile Assigned Risk Plan.

The coverage limits of a CLCA policy are lower than the insurance requirements mandated by California law, but they still satisfy the state's financial responsibility requirements. The CLCA coverage limits are as follows:

- Bodily Injury: Up to $10,000 per person and $20,000 per claim in an accident where the policyholder is at fault. This covers medical care and a few other expenses for the driver and passengers of the other car.

- Property Damage: Up to $3,000 per accident for damage to other people's property.

- Uninsured Motorist Bodily Injury: Optional coverage of up to $10,000 per person and $20,000 per accident for injuries caused by an uninsured driver.

- Medical Payments: Optional coverage of up to $1,000 per person for medical care after an accident.

The CLCA program does not offer collision or comprehensive coverage options, which are typically included in full-coverage policies. Therefore, if a policyholder wants coverage for damage to their own vehicle, they would need to purchase a separate policy from another provider.

While the CLCA program offers more affordable coverage than private insurance, it is important to note that it is not meant for consumers who are just looking for lower rates. The program has very restrictive eligibility requirements, including income limits, and is specifically designed for motorists whose income is below the federal poverty level.

Printing Your AAA Auto Insurance Card: A Step-by-Step Guide

You may want to see also

CLCA vs private insurance

California's Low-Cost Automobile (CLCA) insurance program was established in 1999 to provide affordable insurance to income-eligible good drivers who would otherwise be uninsured. While CLCA policies are cheaper than standard private insurance policies, they offer lower coverage limits than the minimum required by the state of California.

Coverage

CLCA policies provide liability-only coverage with the following policy limits:

- $10,000 of bodily injury or death liability per person

- $20,000 of bodily injury or death liability per accident

- $3,000 property damage liability per accident

Unlike private insurance policies, CLCA policies do not offer comprehensive and collision coverage. However, CLCA policyholders can add the following coverages to their policies for an additional cost of around $43 to $82 per year:

- $1,000 of medical payments coverage per person

- $10,000 of uninsured motorist bodily injury per person

- $20,000 of uninsured motorist bodily injury per accident

Eligibility

The CLCA insurance program is not meant for individuals looking for cheap insurance in California. It is designed for motorists whose income falls below the federal poverty level. To be eligible for the program, individuals must:

- Have a valid California driver's license, a pending license reinstatement, or an out-of-state license while in the process of obtaining a California license

- Be at least 16 years old (applicants under 18 must be legally emancipated)

- Meet income eligibility requirements (household income should not exceed 250% of the federal poverty level)

- Own a vehicle worth no more than $25,000

- Have a good driving record (no at-fault accidents resulting in injuries or death within the past three years, and no more than one point on the driving record)

Cost

The cost of CLCA policies is calculated differently from private insurance policies. While private insurance companies determine the annual cost of a policy based on various factors such as the type of vehicle and the driver's location, CLCA policies have set rates that range from $198 to $802 per year. The base price may vary depending on the driver's age and driving experience. Teen drivers between 16 and 18 years old pay double the base price, while drivers between 19 and 24 years old see a 30% surcharge on their base rates. Adult drivers with less than three years of licensing experience pay 40% more than the base price.

In summary, while CLCA insurance is cheaper than private insurance, it offers limited coverage and has strict eligibility requirements. It is designed to provide financial responsibility for low-income good drivers who would otherwise be uninsured.

Auto Insurance Claims: The Costly Aftermath

You may want to see also

Applying for CLCA insurance

California's Low-Cost Auto Insurance Program (CLCA) is a program designed to provide income-eligible persons with liability insurance protection at affordable rates. The program was established in 1999 to ensure that all Californians have access to essential auto insurance.

To apply for CLCA insurance, you must meet the following eligibility criteria:

- Have a valid California driver's license.

- Own a vehicle worth no more than $25,000.

- Be at least 16 years old (applicants under 18 must be legally emancipated).

- Meet income eligibility requirements (below the federal poverty level).

- Have a good driving record.

The CLCA defines a "good driver" as someone who:

- Has held a license for three consecutive years.

- Has no felonies or misdemeanors on their record.

- Has earned no more than one point on their driving record in the past three years.

- Has no at-fault accidents that resulted in injuries or death within the past three years.

Income eligibility requirements vary based on household size:

- $37,650 or less per year for a one-person household.

- $51,100 or less per year for a two-person household.

- $64,550 or less per year for a three-person household.

- $78,000 or less per year for a four-person household.

- $91,450 or less per year for a five-person household.

To prove your income, you can provide a W-2 form, 1099 form, payroll stub, pension letter, or another qualifying form. A full list of accepted documents can be found on the CLCA website.

Additionally, there are restrictions on the number of vehicles you can insure through the CLCA program. Only two vehicles and two policies are allowed per person, and the program does not cover commercial vehicles or motorcycles. All cars in the household must be insured under CLCA for you to qualify.

To apply for the CLCA insurance program, you can either visit the CLCA website (www.mylowcostauto.com) and fill out the questionnaire or contact a CLCA agent. On the website, click the "Apply Online" button, choose an agent, and submit the required information. If you encounter any problems or disputes, you can contact the California Department of Insurance helpline at 1-866-602-8861.

Report Auto Accidents: Claiming on Another's Insurance

You may want to see also

Frequently asked questions

The California Low Cost Auto Insurance program (CLCA) is an insurance system that could help you save money. By taking advantage of the CLCA, you could get good car insurance at an affordable price.

To be eligible for the program, you must have a valid California driver's license, meet income eligibility guidelines, own a vehicle valued at $25,000 or less, be at least 16 years old, and have a good driving record.

The cost of the CLCA program depends on your age, the county you live in, your driving experience, and whether you choose to add uninsured motorist and medical payments coverage to your policy. Premiums typically range from $198 to $802 per year.

You can sign up for the CLCA program by visiting the official website, MyLowCostAuto.com, and filling out an application. You can also call 1-866-602-8861 to speak to a CLCA agent and determine your eligibility.