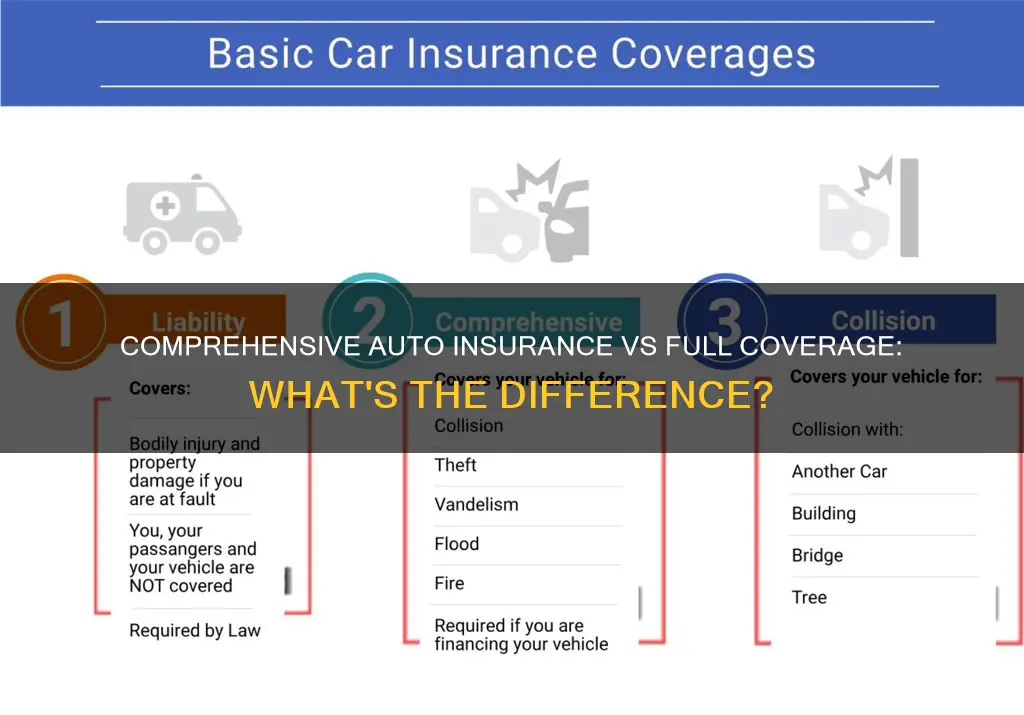

Comprehensive insurance is an optional coverage that protects against damage to your vehicle caused by non-collision events outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature. Comprehensive insurance is not the same as full coverage. Full coverage insurance is a combination of insurance coverage types, typically including comprehensive, collision, and liability insurance, plus any other coverage types required by a particular state.

| Characteristics | Values |

|---|---|

| Definition | Comprehensive insurance is an optional coverage that protects against damage to your vehicle caused by non-collision events that are outside of your control. |

| Coverage | Comprehensive insurance covers damage to your car caused by animals, falling trees, natural disasters, theft, and vandalism. |

| Cost | The average cost of comprehensive insurance is $134 per year but can go up to nearly double that amount depending on factors such as the state where you live. |

| Requirements | Comprehensive insurance is not required by law in any state. However, lenders may require you to carry comprehensive insurance if you finance or lease a vehicle. |

| Collision Coverage | Comprehensive insurance does not cover damage caused by a collision with another vehicle or object. Collision coverage is needed for that. |

| Deductible | Comprehensive insurance has a deductible, which is the amount you pay out-of-pocket before the insurance company covers the rest. A higher deductible typically leads to lower insurance costs. |

| Full Coverage | "Full coverage" typically includes comprehensive insurance, collision insurance, and any other coverage types mandated by the state. |

What You'll Learn

- Comprehensive insurance covers theft, vandalism, and natural disasters

- It doesn't cover damage to other vehicles or people

- Comprehensive insurance is optional, but often required by lenders

- It's not the same as full coverage, which includes collision and liability insurance

- Comprehensive insurance is worth it for newer, more valuable cars

Comprehensive insurance covers theft, vandalism, and natural disasters

Comprehensive auto insurance is an optional coverage that assists with payments to repair or replace your vehicle in incidents of theft or non-collision damage. It covers theft, vandalism, and natural disasters, as well as other scenarios.

Theft

Comprehensive insurance covers vehicle theft. You will be paid the value of your vehicle at the time of the theft, minus your deductible.

Vandalism

Comprehensive insurance covers damage resulting from vandalism, but only if the policy includes comprehensive coverage. This includes damage such as spray painting, scratches, broken windows and lights, and slashed or stolen tires.

Natural Disasters

Comprehensive insurance covers damage to your car caused by natural disasters, including hurricanes, wildfires, earthquakes, and hail. It's important to note that you must have this coverage in place before a natural disaster occurs, as insurers may place temporary restrictions on policy changes or new policies during a storm.

Auto Insurance Availability: State-by-State Coverage

You may want to see also

It doesn't cover damage to other vehicles or people

Comprehensive insurance is an optional coverage that protects against damage to your vehicle caused by non-collision events that are outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, and weather damage. However, it is important to note that comprehensive insurance does not cover damage or injuries caused to other vehicles or people. This type of coverage is typically required if you finance or lease your vehicle but is optional if you own it outright.

When purchasing comprehensive insurance, you will need to choose a deductible, which is the amount you pay out of pocket after a claim is approved. A higher deductible will result in a lower insurance premium, but you will have higher out-of-pocket costs if your vehicle is damaged. Comprehensive insurance is often confused with collision coverage, which protects against damage to your car from hitting another vehicle or object. While both types of coverage protect your vehicle, they cover different types of events.

The cost of comprehensive insurance varies depending on factors such as your age, driving record, vehicle, state, deductible, and coverage limit. According to the National Association of Insurance Commissioners, the average annual comprehensive insurance premium in the US in 2019 was $171.87, with prices ranging from $96.53 in California to $347.61 in South Dakota.

In summary, comprehensive insurance can provide valuable protection for your vehicle in the event of non-collision damage. However, it is important to understand that it does not cover damage or injuries to other vehicles or people. The cost and benefits of comprehensive insurance should be carefully considered to determine if it is the right choice for your needs.

Auto Insurance Injury Claims: Understanding the Check-Cutting Process

You may want to see also

Comprehensive insurance is optional, but often required by lenders

Comprehensive insurance is optional for car owners, but it is often required by lenders if you are financing or leasing a vehicle. This is because comprehensive insurance covers damage to your car from non-collision events, such as theft, vandalism, or natural disasters, which can be costly to repair or replace.

Comprehensive insurance is often confused with collision coverage, which protects your vehicle in the event of a collision with another vehicle or object. While collision coverage is typically required by law in most states, comprehensive insurance is not. However, lenders may require you to carry comprehensive insurance to protect their investment in the vehicle.

The cost of comprehensive insurance varies depending on factors such as the value of the vehicle, the location, and the driver's insurance history. It is generally more expensive than minimum liability coverage but can provide valuable protection against unforeseen events.

For example, if you live in an area prone to natural disasters or high crime rates, comprehensive insurance can provide peace of mind and financial protection. On the other hand, if your vehicle is older and has a low cash value, comprehensive insurance may not be worth the additional cost.

Ultimately, the decision to purchase comprehensive insurance depends on your financial circumstances, personal preferences, and the value of your vehicle. It is essential to weigh the potential costs of repairs against the premiums and deductibles of maintaining comprehensive coverage.

Kemper Auto Insurance: Good or Not?

You may want to see also

It's not the same as full coverage, which includes collision and liability insurance

Comprehensive auto insurance is not the same as full coverage, which includes collision and liability insurance. Comprehensive insurance is an optional coverage that protects your vehicle from damage caused by non-collision events outside your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, and weather events. It is often required by lenders if you lease or finance your vehicle.

Full coverage, on the other hand, is an ambiguous term that typically includes comprehensive, collision, and liability insurance, as well as any other coverage types mandated by your state. Collision insurance covers damage to your car from colliding with another vehicle or object, regardless of fault. Liability insurance, which is required in most states, covers damage to other vehicles and property, as well as injuries to others, in an accident that you cause.

While comprehensive insurance is useful for protecting your vehicle from unforeseen events, it does not cover damage caused by collisions or potholes. It also does not cover personal belongings inside your car or normal wear and tear. The value of comprehensive insurance decreases as your car gets older, as it reimburses you for repairs only up to the car's current market value minus your deductible.

In summary, comprehensive auto insurance is a valuable addition to your policy if you want peace of mind and protection against non-collision events. However, it is not the same as full coverage, as it does not include collision and liability insurance.

Missouri's Auto Insurance Tracking: What You Need to Know

You may want to see also

Comprehensive insurance is worth it for newer, more valuable cars

Comprehensive car insurance is an optional coverage that assists with payments to repair or replace your vehicle in incidents of theft or non-collision damage. It is often referred to as "bad luck coverage" for your car, protecting it from random events outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature.

Comprehensive insurance is particularly worth it for newer, more valuable cars. This is because comprehensive insurance reimburses you for repairs only up to the actual cash value of your car, minus your deductible, and that value declines as your car ages. Therefore, if you have a newer car with a high cash value, comprehensive insurance could save you a lot of money on repair or replacement costs.

On the other hand, if your car is older and has little value, comprehensive insurance may not be worth the price. In this case, it may make more financial sense to repair or replace your car out of pocket if it is damaged or stolen.

When deciding whether to opt for comprehensive insurance, you should consider the value of your car, your personal preferences, and your financial circumstances. You should also review the frequency of extreme weather, car theft, and vandalism in your area, as well as the amount of savings you have available to pay for a replacement vehicle after a crash.

Does AAA Auto Insurance Cover U-Haul?

You may want to see also

Frequently asked questions

Comprehensive insurance is an optional coverage that protects your vehicle from damage caused by non-collision events outside of your control, such as theft, vandalism, fire, accidents with animals, and weather-related incidents.

Full coverage insurance typically includes comprehensive, collision, and liability insurance, as well as any other coverage types mandated by the state. Comprehensive insurance, on the other hand, specifically covers non-collision-related damage.

If you lease or finance your vehicle, your lender will likely require comprehensive insurance. If you own your vehicle outright, the decision depends on factors such as the value of your car, your financial situation, and personal preferences.