Life insurance is a contentious issue in the Muslim community. While some believe it is permissible, others argue that it is haram, or forbidden, because it may involve elements prohibited by Islamic law, such as uncertainty (gharar), gambling (maysir), and interest (riba). The Qur'an, which serves as the ultimate guide for Muslims, does not specifically mention insurance. However, it emphasizes the importance of responsibility and caring for one's family, which aligns with the purpose of life insurance.

Muslims seeking life insurance must navigate the complex interplay between their faith and financial planning. This has led to the emergence of Islamic insurance models, such as Takaful, which adhere to halal principles. Takaful is based on mutual assistance and risk-sharing among participants, offering a viable alternative to traditional insurance policies.

| Characteristics | Values |

|---|---|

| Uncertainty | Gharar |

| Gambling | Maysir |

| Interest | Riba |

| Speculation | Speculating about future events |

| Takaful | A risk-sharing arrangement between all participants |

| Shariah-compliant | No interest, gambling, or uncertainty |

What You'll Learn

Uncertainty (gharar)

Uncertainty, or gharar, is one of the key factors that determine whether life insurance is considered haram or halal in Islam. Gharar refers to excessive uncertainty or speculation in a contract, which is discouraged in Islamic finance as it resembles gambling (maysir).

Life insurance inherently involves uncertainty regarding the timing of payouts and the amount of benefits received compared to premiums paid. This uncertainty is a significant concern when evaluating the compatibility of life insurance with Islamic principles. The concept of gharar, or excessive uncertainty, is an ethical concern that discourages contracts with high degrees of unpredictability.

Life insurance policies, particularly whole life insurance and universal life insurance, are often considered haram due to the element of gharar. The uncertainty surrounding whether the policyholder will benefit from the policy and the potential for receiving more money than contributed can be seen as risky and uncertain. This uncertainty contradicts the Islamic value of stewardship, which discourages relying on uncertain future gains.

However, proponents of life insurance argue that it can be structured in a way that aligns with Islamic principles. Takaful, a form of cooperative Islamic insurance, is widely accepted by the Muslim community. In Takaful, participants contribute to a shared pool of funds, providing mutual aid and eliminating elements of interest and uncertainty. By sharing risks and contributing to a collective fund, Takaful avoids the excessive uncertainty associated with traditional insurance models.

Life Insurance and Social Security: How Payouts Affect Benefits

You may want to see also

Gambling (maysir)

Gambling, or "maysir", is one of the three elements prohibited by Islamic law that are believed to be present in traditional life insurance, alongside uncertainty ("gharar") and interest ("riba").

The idea that insurance is a form of gambling stems from the fact that the insured person is paying a premium in the hope of receiving a larger payout in the future. This is similar to placing a bet, where the gambler pays a stake in the hope of receiving a larger payout if they win. However, some people disagree with this characterisation of insurance, arguing that insurance is the opposite of gambling because it is a form of risk avoidance or risk reduction.

> Insurance is maysir – gambling (a bizarre assertion – insurance is risk avoidance, which is the opposite of gambling!).

> ...the insurance payoff is designed to have negative covariance with the insured peril (loss), thus reducing the insured party's risk (gharar). And that's a good thing.

In addition, the element of gambling in traditional insurance is believed to be present because the insurance provider is gambling on receiving more income from premiums than they have to pay out in claims.

> The insurance provider gambles on receiving more income from the premiums [...] than it has to pay out.

However, Takaful insurance, a form of Sharia-compliant insurance, is not considered to involve gambling. This is because it is based on individuals pooling their resources to support one another in times of need, without engaging in activities deemed haram. This cooperative approach ensures that risks are shared among participants, promoting solidarity within the community.

Life Insurance and Compound Interest: How Are They Linked?

You may want to see also

Interest (riba)

Interest, or riba, is a key reason why some consider life insurance to be haram. The cornerstone of Islamic finance is the prohibition of riba, which forbids earning profit from loans or investments that include specific interest charges. This principle impacts financial products, especially those that involve interest-bearing investments.

The challenge with life insurance arises when examining the standard practices of investment used to grow the fund from which future payouts are drawn. Conventional life insurance companies rely on interest-bearing investments to grow the funds for payouts, which is incompatible with Islamic ethics. This reliance on interest could potentially classify conventional life insurance as non-compliant with Sharia law.

However, there are alternative options for Muslims seeking life insurance that complies with Islamic principles. Takaful, a form of Islamic insurance, eliminates riba by employing profit-sharing models instead of interest-based investments. Risks are shared among participants in a cooperative manner, and any surplus generated is returned to participants or reinvested in socially responsible ventures.

By choosing Takaful or other Sharia-compliant insurance options, Muslims can ensure their financial security without compromising their faith.

Life Insurance and Cancer: What Accidental Cover Provides?

You may want to see also

Takaful as a Shariah-compliant alternative

Takaful is a Shariah-compliant alternative to conventional insurance, which is often deemed unacceptable in Islam due to its inclusion of riba (interest), al-maisir (gambling), and al-gharar (uncertainty). Takaful, on the other hand, is a cooperative system of reimbursement or repayment in case of loss, with its roots in Islamic or Shariah law.

Under Takaful, people and companies contribute money to a shared pool, from which they are compensated in the event of a loss. This system is based on the Islamic principle of cooperation and mutual protection, where members contribute for their common good. The contributions are considered donations or gifts to the fund, and any remaining surpluses after claims are paid out belong to the participants.

Takaful policies cover health, life, and general insurance needs in the same way as conventional insurance products. Takaful operators manage the funds and charge a fee to cover costs such as sales, marketing, underwriting, and claims management.

Takaful is designed to eliminate uncertainty, a key concern in conventional insurance where it is unknown whether the insured event will occur and what the relationship of compensation to the premium paid will be. In Takaful, there is no investment component, and thus no earning of interest, which is forbidden in Islam.

Takaful has been praised as providing superior alternatives to conventional insurance, promoting values such as personal dignity, community self-help, and economic self-development. However, critics argue that it has dwindled in scope, becoming similar to conventional insurance with Arabic terminology.

In summary, Takaful is a Shariah-compliant alternative to traditional insurance, aligning with Islamic principles of cooperation, mutual support, and risk-sharing. It eliminates uncertainty and interest, addressing the concerns of gambling and speculation that are forbidden in Islam. Takaful provides Muslims with a way to protect themselves and their families while adhering to their religious beliefs and values.

Life Insurance for Epilepsy: What You Need to Know

You may want to see also

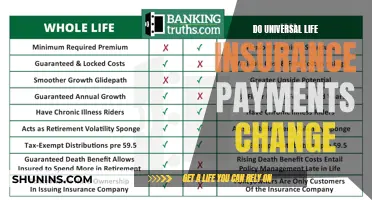

Whole life insurance vs term life insurance

There is some debate within the Muslim community about whether or not life insurance is haram. Some believe that traditional life insurance is haram because it involves three elements forbidden by Islamic law: uncertainty, gambling, and interest. However, there are Islamic insurance products, such as Takaful insurance, that are widely accepted by the community. Takaful is a form of cooperative insurance where everyone contributes to a shared pool, avoiding "gambling" and uncertainty.

Whole Life Insurance vs. Term Life Insurance

When deciding between whole life insurance and term life insurance, it is important to consider the differences between the two. Here is an overview of each type of insurance and how they compare:

Whole Life Insurance

Whole life insurance provides coverage for the entire life of the policyholder. It tends to have higher premiums than term life insurance but offers lifelong protection. One of the key features of whole life insurance is that it builds cash value over time, which can be borrowed against or withdrawn. The premiums remain the same throughout the policy, and the death benefit is guaranteed. However, if you withdraw or borrow against the cash value, it will reduce the death benefit. Whole life insurance is a good option for those who want lifelong coverage and the ability to build cash value.

Term Life Insurance

Term life insurance, on the other hand, provides coverage for a specific period, typically between 10 and 30 years. It is generally more affordable than whole life insurance and offers similar payout amounts. Term life insurance does not have a cash value component, and the coverage ends if the policyholder outlives the term. This type of insurance is suitable for those who only need coverage for a certain period, such as while they have financial dependents or a mortgage.

Key Differences

The main differences between whole life and term life insurance lie in the cost, coverage length, cash value, and complexity. Whole life insurance has higher premiums, lasts for the entire life, builds cash value, and is more complex due to the changing death benefit amount if loans are taken against the policy's cash value. In contrast, term life insurance is more affordable, has a fixed coverage period, does not build cash value, and has straightforward coverage with fixed premiums and death benefits.

The choice between whole life and term life insurance depends on your specific needs and financial situation. If you want lifelong coverage and are comfortable with higher premiums, whole life insurance may be the better option. On the other hand, if you only need coverage for a specific period and want low-cost protection, term life insurance might be more suitable. Consider your financial goals, budget, and the level of coverage you require to make an informed decision.

Life Insurance and COVID: What Cover Does Your Term Offer?

You may want to see also

Frequently asked questions

Life insurance is not deemed haram or forbidden in Islam. However, some Muslims may consider certain types of life insurance haram because of three elements prohibited by Islamic law: uncertainty (gharar), gambling (maysir), and interest (riba).

Whole life insurance is often considered haram because it typically includes an investment component, which is forbidden by Islamic principles due to the involvement of gambling and uncertainty.

Takaful insurance, a form of cooperative insurance, is widely accepted by the Muslim community. It is based on the principles of cooperation, mutual support, and risk-sharing, where participants contribute to a shared pool. This avoids gambling and uncertainty, aligning with Islamic teachings.