Universal life insurance is a type of permanent life insurance that offers flexible premium payments and lifelong coverage. Unlike whole life insurance, which has fixed premiums and death benefits, universal life insurance allows policyholders to adjust their premium payments and, in some cases, their death benefit. This flexibility, however, comes with the trade-off of fewer guarantees. While universal life insurance can provide the benefit of lower premium costs compared to whole life insurance, there is a risk of the policy lapsing if the cash value becomes too low. Therefore, policyholders need to carefully monitor their cash value and make adjustments to their premium payments to ensure their coverage remains in force.

| Characteristics | Values |

|---|---|

| Type | Permanent life insurance |

| Flexibility | Ability to adjust premium payments and death benefit amount |

| Coverage | Lifetime |

| Cash value | Yes |

| Premium payments | Can be adjusted |

| Death benefit | Can be adjusted |

| Cost | Can be cheaper than whole life insurance |

| Complexity | Can be hard to understand |

| Tax advantages | Yes |

| Guarantees | Fewer guarantees than whole life insurance |

What You'll Learn

Universal life insurance premium payments can be adjusted up or down

Universal life insurance is a type of permanent life insurance that offers flexible premium payments. This means that policyholders can adjust their premium payments up or down within certain limits. This flexibility can be beneficial for those with variable incomes or changing financial circumstances. However, it's important to carefully manage your policy to ensure that it remains in force.

The ability to adjust premium payments is a significant advantage of universal life insurance compared to other forms of life insurance, such as whole life insurance, which has fixed premiums. By raising or lowering premium payments, universal life insurance policyholders can adapt their coverage to meet their evolving needs and financial situation. This flexibility also allows policyholders to increase their premium payments to build up cash value or decrease payments if they have sufficient cash value to cover the cost of insurance and other expenses.

While universal life insurance offers the benefit of adjustable premium payments, it's important to monitor your policy closely. If the cash value falls too low, you may need to make larger payments to keep your coverage active. Additionally, universal life insurance typically has a cost-of-insurance (COI) component, which represents the cost of providing the death benefit and administrative fees. The COI increases over time and can result in higher premium payments in later years.

Universal life insurance policies also offer a death benefit and the opportunity to build cash value. The death benefit can usually be adjusted, providing further flexibility to meet your needs. The cash value component grows over time and earns interest, which can be used to supplement retirement income or cover other expenses. However, it's important to note that the interest rate on the cash value is not guaranteed and can fluctuate, impacting the growth of your cash value.

Variable Whole Life Insurance: What You Need to Know

You may want to see also

Universal life insurance is a type of permanent life insurance

One of the key advantages of universal life insurance is its flexibility. Policyholders can adjust their premium payments within certain limits, which is particularly useful for those with variable incomes. Additionally, universal life insurance offers the option to increase or decrease the death benefit, although this may require further underwriting or a medical exam. This adaptability means that universal life insurance can provide long-term protection that suits an individual's changing needs over time.

Universal life insurance also includes a cash value component, which functions similarly to a savings account. This cash value accumulates over time and can be borrowed against or withdrawn, providing a valuable source of funds for unexpected expenses or retirement income supplementation. However, it is important to monitor the cash value, as insufficient funding can lead to large payment requirements or even policy lapse.

Compared to whole life insurance, which offers fixed premiums and guaranteed benefits, universal life insurance provides more flexibility but fewer guarantees. While whole life insurance premiums are fixed, universal life insurance premiums can vary based on interest rates and the policyholder's age. Additionally, cash value growth and death benefits in whole life insurance are guaranteed, whereas in universal life insurance, they are not.

In summary, universal life insurance is a form of permanent life insurance that offers lifelong coverage, flexible premium payments, adjustable death benefits, and a cash value component. It is a popular choice for individuals seeking long-term protection and the ability to adapt their policy to changing circumstances. However, it is important to carefully manage universal life insurance policies to avoid potential drawbacks, such as insufficient funding and unpredictable cash value growth.

Ladder's Whole Life Insurance: Is It Worth the Climb?

You may want to see also

Universal life insurance has a cash value element

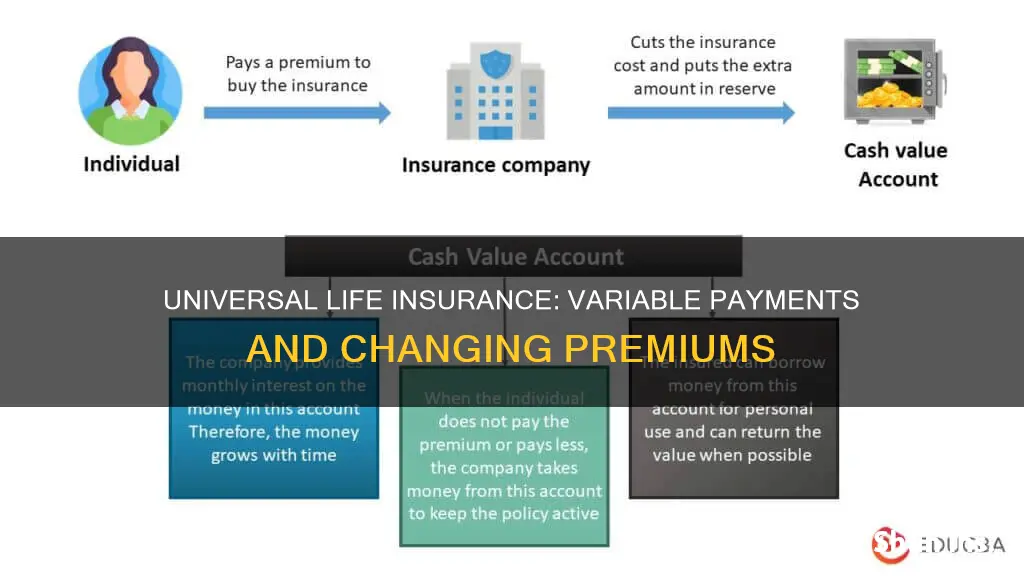

Universal life insurance is a type of permanent life insurance that has a cash value element. This means that it offers lifetime coverage and allows the policyholder to build a cash value that can be used for various purposes while they are alive. The cash value grows over time in a tax-efficient manner and can be accessed through loans or withdrawals.

The cash value of universal life insurance is a savings component that grows over time. Policyholders can contribute more than the minimum premium payment required to keep the policy active, and this excess amount is added to the cash value and accumulates interest. The interest rate on the cash value is set by the insurer and can change frequently, but there is usually a guaranteed minimum rate. The cash value can be used to lower future premium payments, supplement retirement income, or borrow against to access funds.

Universal life insurance offers flexibility in terms of premium payments and death benefits. Policyholders can adjust their premium payments within certain limits, and they may also be able to increase or decrease their death benefit. This flexibility can be beneficial for those with variable incomes or changing needs over time. However, it is important to carefully manage the cash value to ensure that the policy remains in force. If the cash value falls too low, premium payments may increase or the policy may lapse.

The cash value of universal life insurance can be accessed in several ways. Policyholders can take out loans against the cash value, which typically have lower interest rates than personal loans and do not require a credit check. They can also make withdrawals from the cash value, but this will reduce the death benefit and may have tax implications if the withdrawal exceeds the amount paid into the policy. Additionally, the cash value can be used to pay premiums, allowing policyholders to stop paying out of pocket if there is a sufficient amount in the cash value account.

Overall, the cash value element of universal life insurance provides policyholders with flexibility and access to funds during their lifetime. However, it is important to carefully manage the cash value and understand the potential risks, such as increased premium payments or policy lapse, if the cash value is not sufficient.

Primerica Whole Life Insurance: Is It Worth the Investment?

You may want to see also

Universal life insurance is flexible

Universal life insurance is a type of permanent life insurance that offers flexibility in terms of premium payments and death benefits. It allows policyholders to adjust their premium payments within certain limits, making it a suitable option for those with variable incomes. This flexibility also means that universal life insurance can be cheaper than whole life coverage, as it gives the policyholder the option to lower their premiums if needed.

Universal life insurance policies also offer the opportunity to accumulate cash value over time, which can be used to pay premiums or supplement retirement income. This cash value grows on a tax-deferred basis, and policyholders can borrow against it without tax implications, although there may be interest charged on the loan amount. The interest rate on the cash value is set by the insurer and can change frequently, but there is usually a minimum rate guaranteed.

The death benefit provided by universal life insurance is flexible and can be increased or decreased depending on the policyholder's needs. However, increasing the death benefit may require a medical exam. Additionally, universal life insurance policies can remain in force for the rest of the policyholder's life, as long as premium payments are made.

While universal life insurance offers flexibility, it also requires careful management. Policyholders need to monitor their cash value to ensure that it does not drop too low, as this could result in higher premium payments or even cause the policy to lapse. Additionally, withdrawals from the cash value may be taxed, and any unpaid loans will reduce the death benefit.

Life Insurance Payouts After Suicide: What's the Verdict?

You may want to see also

Universal life insurance is complex

Universal life insurance policies have two components: the cost of insurance (COI) and the cash value. The COI covers the cost of providing the death benefit and administrative fees, while the cash value functions as a savings account, earning interest over time. The policyholder can choose to pay more than the COI, with the excess amount added to the cash value. Alternatively, they can pay less than the COI if there is enough cash value to cover the difference. However, if the cash value falls too low, the policyholder may have to make large payments to prevent the policy from lapsing.

The interest rate on the cash value is set by the insurer and can change frequently, affecting the growth of the cash value. While universal life insurance offers the potential for cash value growth, there are no guaranteed returns. Additionally, some withdrawals from the cash value may be taxed.

Universal life insurance is more complex than whole life insurance, which has fixed premiums and guaranteed cash value growth. Whole life insurance offers more stability and guarantees but lacks the flexibility of universal life insurance.

Overall, universal life insurance can be a valuable option for those seeking lifelong coverage and the ability to adjust their premiums and death benefit. However, it requires active management and careful monitoring of the cash value to avoid potential pitfalls.

Voya's Life Insurance Offerings: What You Need to Know

You may want to see also

Frequently asked questions

Universal life insurance payments can change, as policyholders can adjust their premiums within certain limits. However, the cost of insurance (COI) will increase as the insured ages, so premiums may need to be raised to cover this.

If you stop paying your premiums, your policy may lapse. This is more likely to happen if you have a low cash value, as the cash value can be used to cover premium payments.

To avoid your policy lapsing, you should ensure that your cash value remains high enough to cover the COI and other fees. You can do this by paying more than the minimum premium, or by investing your cash value to increase it.