Life insurance is a crucial financial tool that provides a safety net for individuals and their families. It offers a way to protect against financial loss in the event of death, ensuring that loved ones are cared for and debts are paid. When considering life insurance, it's important to understand the different types available, such as term life and permanent life, and to choose a policy that aligns with your specific needs and goals. This guide will explore the various aspects of life insurance, including its benefits, types, and how to select the right policy for your circumstances.

What You'll Learn

- Types of Life Insurance: Term, permanent, whole life, universal life, and more

- Benefits of Life Insurance: Financial security for loved ones, estate planning, and tax advantages

- Choosing a Policy: Factors to consider: coverage amount, term length, and premium costs

- Claim Process: Steps to file a claim, required documents, and payout options

- Term Life Insurance: Temporary coverage, affordable, and suitable for specific needs

Types of Life Insurance: Term, permanent, whole life, universal life, and more

Life insurance is a financial tool that provides a safety net for individuals and their families, offering financial protection in the event of the insured's death. It is a contract between the policyholder and an insurance company, where the insurer promises to pay a designated beneficiary a sum of money upon the insured's passing. Understanding the different types of life insurance is crucial for individuals to choose the right coverage that aligns with their financial goals and needs. Here's an overview of the various types of life insurance available:

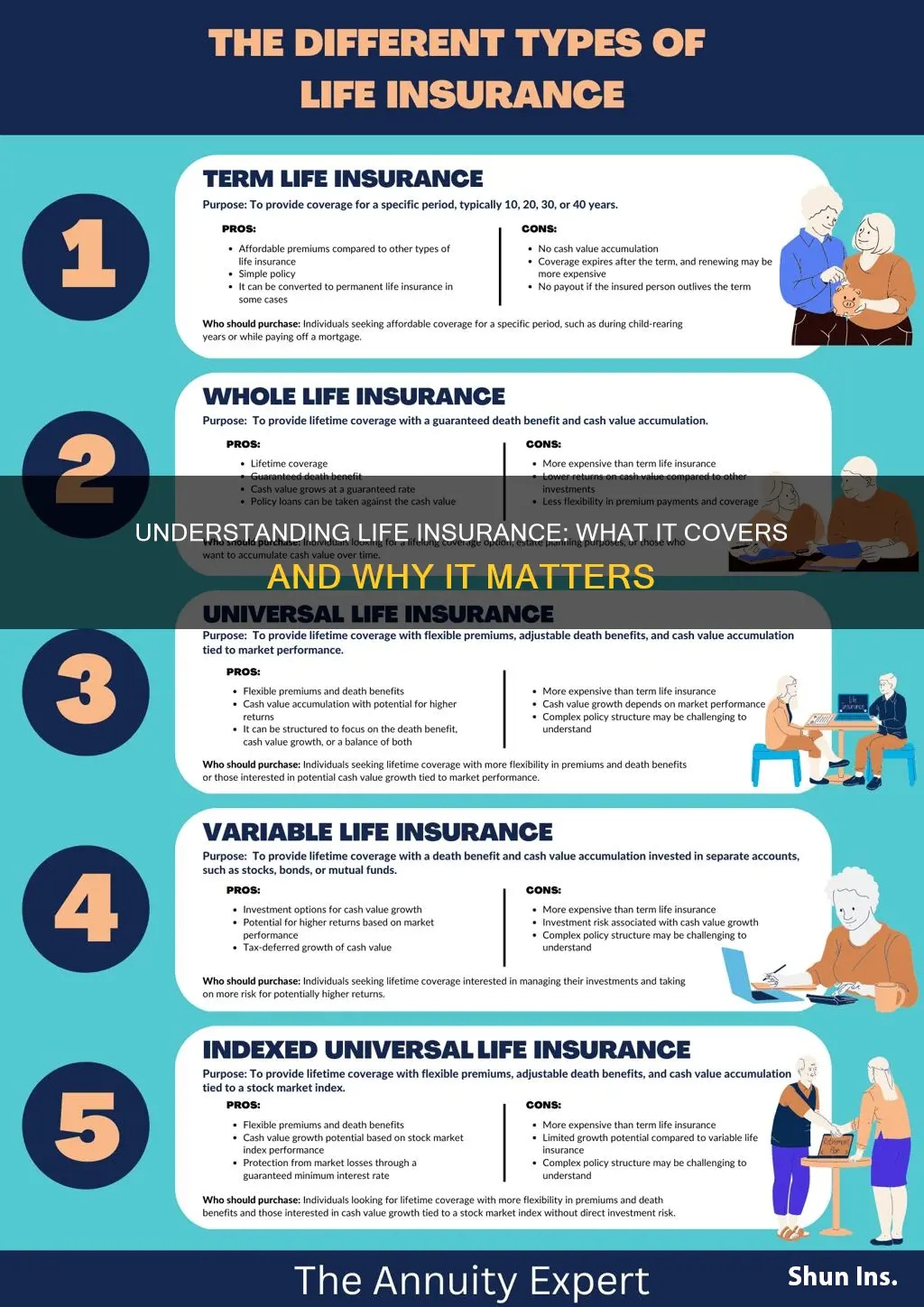

Term Life Insurance: This is a straightforward and affordable type of life insurance that provides coverage for a specific period, known as the 'term.' It is ideal for individuals who want temporary coverage for a particular duration, such as 10, 20, or 30 years. Term life insurance offers a fixed death benefit if the insured dies during the term, and the policy expires at the end of the term without paying out if the insured is still alive. It is a cost-effective way to secure financial protection for a defined period, making it popular among young families or those with substantial debts.

Permanent Life Insurance: In contrast to term life, permanent life insurance is designed to provide coverage for the entire lifetime of the insured. It offers a cash value component that accumulates over time, allowing policyholders to borrow against or withdraw funds. The primary types of permanent life insurance include whole life and universal life. Whole life insurance provides a guaranteed death benefit and fixed premiums, ensuring that the policy remains in force as long as the premiums are paid. Universal life insurance offers flexibility in premium payments and death benefits, allowing policyholders to adjust the coverage as their needs change.

Whole Life Insurance: As a type of permanent life insurance, whole life insurance provides lifelong coverage with a fixed premium and a guaranteed death benefit. It is a popular choice for those seeking long-term financial security. The premiums are typically higher compared to term life, but the policy builds cash value, which can be borrowed against or withdrawn. This type of insurance is ideal for individuals who want the peace of mind of knowing their beneficiaries will receive a payout regardless of their age or health status at the time of death.

Universal Life Insurance: This is another form of permanent life insurance that offers flexibility and adaptability. Universal life policies provide a variable death benefit and allow policyholders to adjust the premium payments and death benefit over time. The cash value component of universal life insurance can grow tax-deferred, providing an investment opportunity. Policyholders can choose to pay higher premiums to increase the death benefit or lower premiums to build cash value. This type of insurance is suitable for those who want control over their coverage and the potential for long-term financial growth.

Other types of life insurance include variable life insurance, which offers investment options, and guaranteed universal life, which provides a fixed death benefit and adjustable premiums. Each type of life insurance has its own advantages and considerations, and the choice depends on individual circumstances, financial goals, and the desired level of coverage. It is essential to carefully evaluate the options and seek professional advice to ensure the selected life insurance policy meets one's needs.

Life Mortgage Insurance: Disability Coverage?

You may want to see also

Benefits of Life Insurance: Financial security for loved ones, estate planning, and tax advantages

Life insurance is a crucial financial tool that provides a safety net for individuals and their families, offering numerous benefits that extend beyond just financial security. One of the primary advantages is the peace of mind it brings to loved ones. When you purchase life insurance, you are essentially creating a financial safety net for your family in the event of your untimely death. This ensures that your loved ones are financially protected, allowing them to maintain their standard of living, cover essential expenses, and achieve their financial goals without the added stress of uncertainty.

Financial security is a cornerstone of life insurance. It provides a steady income stream to your beneficiaries, which can be used to cover daily living expenses, mortgage payments, education costs, and other financial obligations. This financial support enables your family to focus on healing and adjusting to life without the immediate worry of financial strain. Moreover, life insurance can help prevent the sale or liquidation of assets to meet debts, ensuring that your estate is preserved for the intended beneficiaries.

In addition to financial security, life insurance plays a significant role in estate planning. It allows you to have more control over how your assets are distributed after your passing. You can name specific beneficiaries and specify how the death benefit should be allocated, ensuring that your wishes are respected. This aspect of life insurance is particularly valuable for those with substantial assets, businesses, or unique estate planning goals. By incorporating life insurance into your estate plan, you can minimize potential tax implications and ensure a smooth transition of wealth to your heirs.

The tax advantages of life insurance are another compelling benefit. In many jurisdictions, life insurance death benefits are generally not subject to income tax. This means that the proceeds received by the beneficiaries can be used for various purposes without triggering immediate tax liabilities. Additionally, certain types of life insurance policies, such as permanent life insurance, can accumulate cash value over time, providing a tax-deferred investment opportunity. This feature can be advantageous for long-term financial planning and wealth accumulation.

Furthermore, life insurance can be a valuable tool for business owners. It can provide a source of capital for business continuity, allowing owners to maintain operations and fulfill financial obligations in the event of their passing. Key person insurance, a specific type of life insurance, is often used to protect a business's interests and ensure its stability. This type of insurance provides a financial safety net for the business, enabling it to withstand the loss of a critical employee or owner.

In summary, life insurance offers a comprehensive set of benefits that go beyond financial security. It provides peace of mind, enables estate planning, and offers tax advantages. By understanding and utilizing these benefits, individuals can ensure that their loved ones are protected, their wishes are honored, and their financial goals are achieved, even in the face of adversity.

Beneficiaries: Multiple People, One Life Insurance Policy

You may want to see also

Choosing a Policy: Factors to consider: coverage amount, term length, and premium costs

When it comes to choosing a life insurance policy, several key factors come into play that can significantly impact your decision. Understanding these elements is crucial to ensure you select a policy that meets your needs and provides adequate financial protection for your loved ones. Here's a breakdown of the essential considerations:

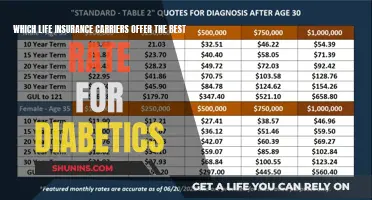

Coverage Amount: The first and most critical factor is determining the appropriate coverage amount. This figure represents the financial benefit paid out to your beneficiaries upon your death. It's essential to assess your family's financial obligations and future expenses to estimate the necessary coverage. Consider factors such as outstanding debts, mortgage payments, future education costs for children, and any other long-term financial commitments. A common rule of thumb is to aim for a coverage amount that is 10 to 15 times your annual income. This ensures that your family can maintain their standard of living and cover essential expenses in the event of your passing. For instance, if your annual income is $50,000, you might consider a policy with a coverage amount of $500,000 to $750,000.

Term Length: Life insurance policies typically offer two main types of coverage: term life and permanent life. Term life insurance provides coverage for a specified period, known as the "term," such as 10, 20, or 30 years. During this term, the policy remains in force, and if you pass away within this period, the beneficiaries receive the death benefit. After the term ends, the policy may lapse unless you choose to renew it. On the other hand, permanent life insurance, such as whole life or universal life, offers lifelong coverage. The premiums for permanent life insurance are generally higher, but they provide a guaranteed death benefit and an investment component, allowing your money to grow over time. When choosing the term length, consider your financial situation and the likelihood of outliving the term. If you have a mortgage or other debts that will be paid off within the term, a shorter-term policy might be sufficient. However, if you want long-term financial security, a permanent policy could be more suitable.

Premium Costs: The cost of life insurance is a significant consideration, as it directly impacts your budget. Premiums are the regular payments you make to maintain your policy. The premium amount is influenced by various factors, including the coverage amount, term length, your age, health, and lifestyle. Generally, younger and healthier individuals with no significant health conditions or risky hobbies will pay lower premiums. As you age, premiums tend to increase due to the higher statistical risk associated with older individuals. Additionally, certain lifestyle choices, such as smoking or engaging in extreme sports, can also lead to higher premiums. It's essential to compare quotes from different insurance providers to find the best rates for your specific needs. While it's tempting to opt for the cheapest policy, ensure that you understand the coverage details and any potential limitations to avoid future surprises.

Other factors to consider include the type of policy (term or permanent), the insurer's financial strength, and the flexibility of the policy to meet changing needs. It's advisable to consult with a financial advisor or insurance specialist who can provide personalized guidance based on your unique circumstances. They can help you navigate the complexities of life insurance and ensure you make an informed decision. Remember, choosing the right life insurance policy is a personal journey, and what works for one person may not be suitable for another.

Ad&D vs. Life Insurance: Understanding the Key Differences

You may want to see also

Claim Process: Steps to file a claim, required documents, and payout options

The claim process for life insurance is a crucial aspect of ensuring that your loved ones receive the financial support they need during a difficult time. Here's a breakdown of the steps involved, the necessary documents, and the payout options available:

Steps to File a Claim:

- Notify the Insurance Company: As soon as the insured individual's death is confirmed, notify your life insurance company. This can typically be done by contacting their customer service department via phone or email. Provide them with the necessary details, including the name of the deceased, their policy number, and the date of death.

- Obtain a Death Certificate: You will need to obtain an official death certificate from the appropriate authorities. This document confirms the individual's passing and is essential for the claim process. Contact your local health department or vital records office to request this certificate.

- Complete the Claim Form: The insurance company will provide you with a claim form, which you need to fill out accurately. This form typically includes personal information about the deceased, beneficiary details, and the reason for the claim. Ensure all information is correct and complete.

- Submit Required Documents: Along with the claim form, you will need to submit the following documents:

- Death Certificate: A certified copy of the death certificate is usually required.

- Proof of Identity: This could include a copy of the deceased's birth certificate, passport, or driver's license.

- Policy Documents: Provide a copy of the life insurance policy, including the front and back pages, and any endorsements or riders.

- Beneficiary Information: If the policy has a designated beneficiary, provide their contact details and any relevant information.

Follow Up and Provide Additional Information: The insurance company may request further documentation or clarification. Be prompt in responding to their inquiries to expedite the process.

Required Documents:

- Death Certificate: This is the primary document proving the individual's death.

- Identity Proof: Documents like a birth certificate, passport, or driver's license are essential to verify the identity of the deceased.

- Life Insurance Policy: The original policy document is crucial, as it contains the terms and conditions, coverage details, and beneficiary information.

- Medical Records (if applicable): In some cases, especially for pre-existing conditions, medical records may be required to support the claim.

- Beneficiary's Documentation: If the policy has a beneficiary, their identification and contact information are necessary.

Payout Options:

Life insurance companies offer various payout options to suit the needs of the beneficiaries:

- Lump Sum Payout: This is a one-time payment of the full death benefit amount. It provides a significant financial sum to the beneficiaries, allowing them to cover immediate expenses and plan for the future.

- Regular Income Payout: Some policies offer the option to receive regular income payments over a specified period. This can provide a steady financial stream for beneficiaries, especially if they are dependent on the deceased's income.

- Flexible Payouts: Certain policies offer flexibility in payout options, allowing beneficiaries to choose between a lump sum or regular payments based on their financial needs.

- Tax-Free Payouts: In many jurisdictions, life insurance payouts are often tax-free, providing beneficiaries with the full amount without deductions.

Remember, the specific claim process and payout options may vary depending on the insurance company and the terms of your policy. It's essential to review your policy documents and understand the procedures to ensure a smooth and efficient claims experience.

Life Insurance Payouts: Can You File for Bankruptcy?

You may want to see also

Term Life Insurance: Temporary coverage, affordable, and suitable for specific needs

Term life insurance is a type of life insurance that provides coverage for a specific period, often ranging from 10 to 30 years. It is a straightforward and cost-effective way to secure financial protection for your loved ones during a defined period. This type of insurance is particularly appealing to those who want a simple and affordable solution for their life insurance needs without the complexities of permanent policies.

The beauty of term life insurance lies in its temporary nature. It is designed to cover a specific period, such as the years when you are likely to have a mortgage, children's education expenses, or other financial commitments. For example, if you have a 20-year mortgage, term life insurance can ensure that your family is financially protected if something happens to you during that period. Once the term ends, the coverage expires, and you can decide whether to renew it or explore other insurance options.

One of the significant advantages of term life insurance is its affordability. Since the coverage is temporary, the premiums are generally lower compared to permanent life insurance policies. This makes it an excellent choice for individuals who want to secure their family's financial future without breaking the bank. Young and healthy individuals often find term life insurance particularly attractive due to its competitive rates.

Term life insurance is also highly customizable, allowing you to choose the coverage amount and duration that best suit your needs. You can select a higher coverage amount if you have substantial financial responsibilities or a larger family to support. Additionally, you can opt for a longer term to ensure extended coverage, providing peace of mind for a more extended period.

In summary, term life insurance offers a practical and affordable solution for those seeking temporary coverage. It is an excellent option for individuals with specific financial obligations who want to ensure their loved ones' financial security without the long-term commitment of permanent insurance. With its customizable nature and competitive pricing, term life insurance provides a flexible and effective way to protect your family's future.

Understanding Life Insurance Trustee Roles and Responsibilities

You may want to see also

Frequently asked questions

Life insurance is a financial protection tool that provides a monetary benefit to the beneficiaries upon the insured individual's death. It offers financial security to the family or designated recipients, ensuring they receive a lump sum or regular payments to cover expenses, debts, or daily living costs.

When you purchase a life insurance policy, you agree to pay a premium (a regular payment) to the insurance company. In return, the insurer promises to pay out a death benefit to your chosen beneficiaries if you pass away during the policy's term. The death benefit can be a lump sum or paid out in installments, depending on the policy type.

There are several types of life insurance policies, including:

- Term Life Insurance: Provides coverage for a specified period, offering a death benefit if the insured dies during that term.

- Permanent Life Insurance: Offers lifelong coverage with a cash value component, providing flexibility and potential investment options.

- Whole Life Insurance: A type of permanent life insurance with fixed premiums and a guaranteed death benefit.

- Universal Life Insurance: Offers flexible premiums and potential investment options, allowing policyholders to adjust their coverage over time.

Life insurance is crucial for several reasons:

- Financial Security: It ensures your loved ones have financial support to cover living expenses, mortgage payments, children's education, and other financial obligations after your passing.

- Debt Management: Life insurance can help pay off debts, such as loans or credit card balances, preventing financial strain on your family.

- Long-Term Care: Certain life insurance policies offer long-term care benefits, providing financial assistance for medical expenses and daily care needs.

- Legacy Planning: Life insurance can be used to create a financial legacy, helping to pass on wealth to future generations.