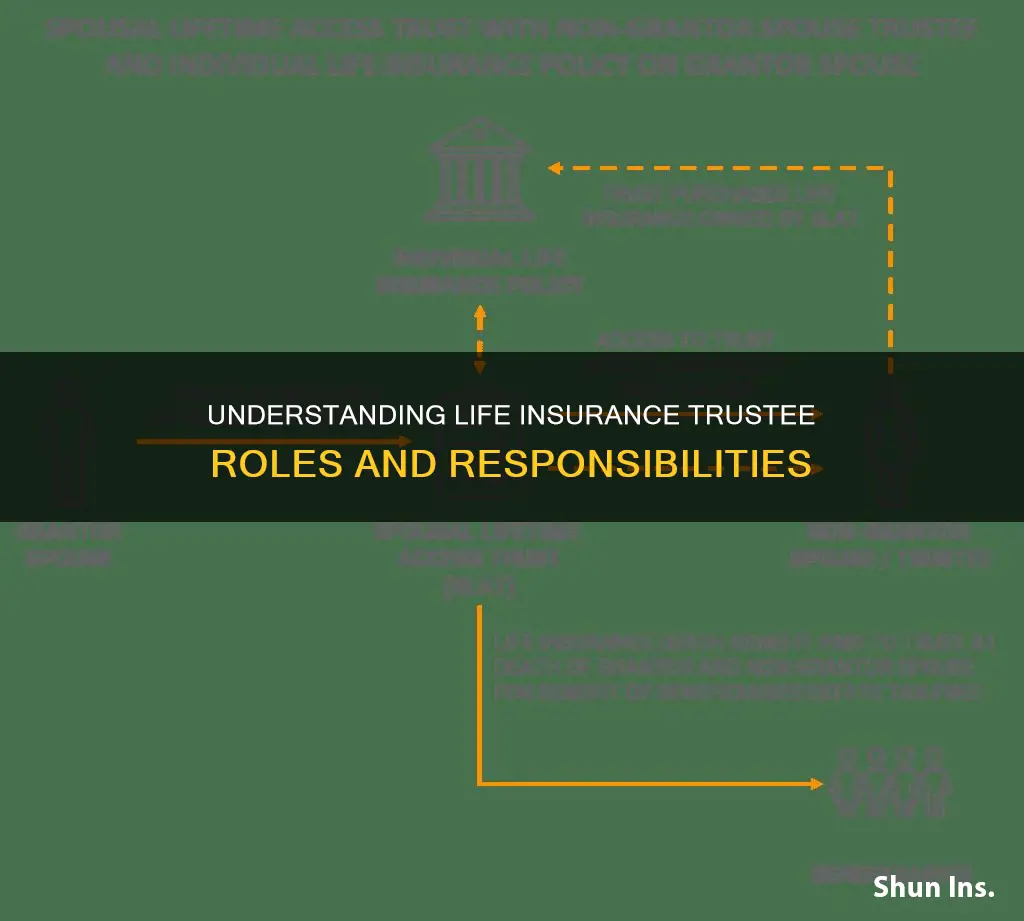

A life insurance trustee is a third party that manages the death benefit from a life insurance policy. Trustees are responsible for distributing the policy's death benefit to beneficiaries according to the rules set out in the trust agreement. They are also in charge of managing premium payments, monitoring policy performance, ensuring beneficiary awareness and communication, and handling taxation and compliance. Life insurance trustees are commonly used by individuals with a high net worth and parents who want to structure benefit payments for their children.

What You'll Learn

Life insurance trustees manage death benefits

Life insurance trustees play a crucial role in managing death benefits and ensuring they are distributed according to the wishes of the deceased. A life insurance trust is a legal agreement that allows a third party, the trustee, to manage the death benefit from a life insurance policy. This arrangement ensures that the policy's death benefit is distributed to the beneficiaries as per the grantor's instructions.

The trustee's primary responsibility is to ensure that the death benefit is distributed in accordance with the grantor's wishes, as outlined in the trust agreement. This involves clarifying the trust's goals and objectives, regularly reviewing the policy's performance, and ensuring that the beneficiaries are aware of their rights and entitlements under the trust. Trustees also have a fiduciary duty to act in the best interests of the beneficiaries, which includes managing premium payments and staying informed about new life insurance products and market trends.

The trustee is responsible for notifying the grantor of premium due dates, collecting payments, and ensuring timely submission to the insurance provider. They must also confirm that premiums are correctly applied to the policy to prevent lapses or coverage issues. Trustees must also monitor the financial strength of the insurer and stay updated on any significant changes in its structure, which could impact the policy.

In addition to beneficiary communication, trustees have a duty to handle taxation and compliance for the trust. This includes ensuring compliance with tax filings, preparing and submitting annual returns, and staying abreast of changes in tax laws that may affect the policy or the trust. Trustees also play a role in policy management and optimisation, evaluating the policy's cost structure, performance, and supplementary benefits relative to market trends and the trust's long-term needs.

Life insurance trustees have a complex and time-consuming role, requiring expertise in financial and legal matters. They are responsible for safeguarding the interests of the beneficiaries and ensuring the efficient management and distribution of death benefits.

Life Insurance Benefits: Subject to Taxation or Not?

You may want to see also

Trustees ensure beneficiaries receive funds

Trustees play a crucial role in ensuring that beneficiaries receive their funds in a timely and controlled manner. They are responsible for managing and distributing the death benefit from a life insurance policy according to the wishes of the insured person and the rules set out in the trust agreement. This process ensures that the beneficiaries receive their inheritance as intended.

When an individual sets up a life insurance trust, they transfer ownership of their life insurance policy to the trust. The trustee then becomes the manager of the policy's benefits. Upon the insured person's death, the death benefit is paid to the trust, and the trustee distributes the funds to the beneficiaries. This process ensures that the funds are exempt from probate, which can cause delays, and may also reduce any estate tax owed.

The role of a trustee is to act in the best interests of the beneficiaries. They are responsible for clarifying the goals and objectives of the trust, ensuring they align with the grantor's intentions. Trustees must also manage premium payments, monitor policy performance, and handle taxation and compliance. They are also responsible for notifying beneficiaries of their rights under the trust and resolving any issues that may arise.

The type of trust chosen can impact the level of control and flexibility allowed. Irrevocable trusts, such as Irrevocable Life Insurance Trusts (ILITs), cannot be modified or cancelled once created, while revocable trusts offer more control and can be changed or terminated at any time. For example, a revocable trust may be beneficial for parents who want to control how their children receive their inheritance, such as in instalments over time, rather than a lump sum.

Overall, trustees play a vital role in ensuring that beneficiaries receive their funds in a timely and controlled manner. They are responsible for managing and distributing the death benefit, clarifying trust goals, handling premium payments, monitoring policy performance, and ensuring compliance with tax laws. By fulfilling these duties, trustees help protect the financial interests of the beneficiaries.

Zoloft Use: Life Insurance Impact and Implications

You may want to see also

Trustees can be family, friends or solicitors

When you take out a life insurance policy, you will need to decide who you want to be the trustee. A trustee is responsible for managing the life insurance policy and ensuring that the benefits are distributed according to the policyholder's wishes. Now, let's focus on the specific aspect of who can be a trustee:

Trustees can be family members, friends, or solicitors, and it is important to choose someone you trust implicitly. They should be reliable and have the necessary skills to carry out the role effectively. The role of a trustee is to act in the best interests of the beneficiaries, so it is important to choose someone who is trustworthy and has the beneficiaries' best interests at heart. Family members, friends, and solicitors can all bring unique advantages to the role. Appointing a family member or a close friend as a trustee can provide a sense of comfort and familiarity, especially if they are already well-integrated into your life and understand your wishes implicitly. On the other hand, solicitors can offer professional expertise and an unbiased perspective, ensuring that the management of the trust remains objective and in full compliance with legal requirements.

If you choose a family member or friend, it is important to consider their reliability and availability. Will they be able to act impartially and in the best interests of all the beneficiaries? Are they likely to outlive you, and do they have the time and willingness to take on the responsibilities of a trustee? These are crucial questions to ask when considering a loved one for the role. It is also worth noting that acting as a trustee can be a time-consuming and sometimes complex task, so you should choose someone who is organized and capable of handling the administrative duties involved.

Solicitors, on the other hand, can provide a level of expertise and impartiality that friends or family may not be able to offer. They can ensure that the trust is managed effectively and efficiently, and they can also provide legal advice and guidance to the beneficiaries. If you choose to appoint a solicitor as a trustee, it is important to select someone who is experienced in this role and who you feel comfortable working with. The solicitor should be someone you trust to carry out your wishes and act in the best interests of your chosen beneficiaries.

Ultimately, the decision of who to appoint as a trustee is a personal one. It is important to consider the strengths and weaknesses of potential candidates and to choose someone who you believe will act in the best interests of your beneficiaries. By understanding the role and responsibilities of a trustee, you can make an informed decision and ensure that your life insurance policy is managed effectively.

Life Insurance: Regular Updates for Peace of Mind

You may want to see also

Trustees are responsible for taxation and compliance

One of the key responsibilities of trustees is tax compliance. The trustee must obtain an Employer Identification Number (EIN) and file the necessary tax returns. The trustee must also adhere to all IRS regulations and ensure that the trust is compliant with all applicable laws and regulations. This includes making sure that the trust is structured in a way that helps mitigate tax liabilities.

In addition to tax compliance, trustees are also responsible for ensuring that the trust is compliant with any other applicable laws and regulations. This includes ensuring that the trust is properly structured and managed, and that the distribution of funds is carried out in accordance with the terms of the trust document. Trustees are also responsible for maintaining the independence of the trust and not being connected to the grantor.

Overall, the role of a trustee comes with significant responsibilities and duties. Trustees are responsible for ensuring that the trust is compliant with all applicable laws and regulations, including tax laws. They are also responsible for managing the trust's assets and distributing the funds to the beneficiaries in accordance with the terms of the trust document. By fulfilling these responsibilities, trustees play a crucial role in protecting the financial interests of the beneficiaries.

Life Insurance Beneficiaries: Who Can You Choose?

You may want to see also

Life insurance trusts can be irrevocable or revocable

Life insurance trusts are a critical component in estate planning, helping to protect your assets and the financial future of your loved ones. Trusts can be managed by family members, friends, or a legal professional.

When deciding between an irrevocable or revocable life insurance trust, it is important to consider your financial goals and the level of control you wish to maintain over your assets. It is also recommended to seek independent financial and legal advice before making any decisions.

Life Insurance Underwriters: Are They Doctors in Disguise?

You may want to see also

Frequently asked questions

A life insurance trustee is a third party that manages the death benefit from a life insurance policy. A trustee ensures that the policy's death benefit is distributed to beneficiaries according to the policyholder's wishes.

A life insurance trustee can help reduce the chance of an inheritance tax bill and speed up how quickly the money is released. It can also ensure that a child with special needs is still eligible for government assistance.

A life insurance trustee can be expensive to form and can create significant tax and legal ramifications. They can also add unnecessary complexities to estates.

A life insurance trustee has several critical duties and responsibilities, including clarifying trust goals and objectives, managing premium payments, monitoring policy performance, ensuring beneficiary awareness and communication, handling taxation and compliance, providing ongoing policy management and optimisation, and maintaining insurance expertise.