Life insurance is a crucial financial protection for individuals and their loved ones, offering peace of mind and security in the face of life's uncertainties. However, certain occupations present higher risks and can impact life insurance policies. Hazardous occupations are those that involve significant dangers, potential for injury, or a higher risk of premature death. These jobs can affect life insurance coverage and premiums due to the increased likelihood of insurance companies having to pay out earlier than expected. Occupations like logging, fishing, truck driving, and armed forces are considered hazardous and can lead to higher premiums or even exclusion from certain policies. When applying for life insurance, individuals in these professions may need to disclose their occupation and accept specific exclusions or adhere to certain terms set by the insurance provider. It is essential to understand these exclusions and their impact on coverage to ensure adequate financial protection for oneself and loved ones.

| Characteristics | Values |

|---|---|

| Definition of hazardous occupation | A hazardous occupation is one that involves a higher level of premature death. |

| Examples of hazardous occupations | Logging, fishing, Truck driving, on-the-road sales, mining, off-shore oil drilling, firefighting, and police work. |

| Effect on life insurance premiums | Life insurance companies will often compensate for the higher risk of hazardous occupations by charging higher premiums. |

| Effect on life insurance approval | Life insurance companies will usually approve a policy even for people in hazardous occupations. |

| Alternative options | Group life insurance offered by employers is usually the least expensive type of life insurance, but it may not be the best option for people in hazardous occupations due to limited coverage amounts and the risk of losing coverage if employment ends. |

| Exclusions | Life insurance policies may exclude coverage for death resulting directly from occupational hazards related to hazardous occupations. |

| Policy riders | Policy riders can be added to provide additional coverage for individuals in hazardous occupations, such as a hazardous occupation rider or a travel accident rider. |

What You'll Learn

- How hazardous occupations affect life insurance premiums?

- Occupations deemed hazardous by insurance companies

- How insurance companies compensate for the risk of hazardous occupations?

- Group life insurance for people in hazardous occupations

- How to get the best deal on life insurance with a hazardous occupation?

How hazardous occupations affect life insurance premiums

When it comes to life insurance, insurance companies must evaluate all kinds of risks to determine whether to approve a policy application or the level of premiums to charge. While some risk factors are related to health conditions and history, others are related to lifestyle factors such as smoking and excessive alcohol consumption.

Occupations also play a significant role in defining risk. Some jobs are simply more hazardous than others, carrying a higher risk of premature death or exposure to dangerous conditions. As a result, life insurance companies often adjust for this increased risk by charging higher premiums. Occupations deemed hazardous include logging, fishing, truck driving, and on-the-road sales, among others. Insurance companies refer to lists of dangerous occupations from sources like the Bureau of Labor Statistics (BLS) or their own internal data to determine risk levels.

The impact of hazardous occupations on life insurance premiums can vary. Some companies charge premiums based on the occupation itself, resulting in different occupational premium rates for different career fields. Other companies establish a flat rate for any occupation considered hazardous, typically resulting in an additional charge per $1,000 of coverage. For example, on a $200,000 life insurance policy with a flat-rate charge of $2 per $1,000 of coverage, the extra charge would amount to an additional $400 in annual premiums.

It is important to note that most life insurance companies will approve policies even for individuals in the most dangerous occupations. However, they compensate for the higher risk by charging higher premiums. Additionally, individuals in hazardous occupations may need to consider obtaining their own private life insurance coverage in addition to any employer-provided group life insurance, as group coverage may have limitations and is dependent on continued employment.

When assessing life insurance options, it is advisable to work with an experienced agent who can guide you toward companies that will have a more favorable view of your occupation and help you obtain the most suitable coverage.

Haven Life Insurance: Is It Worth the Hype?

You may want to see also

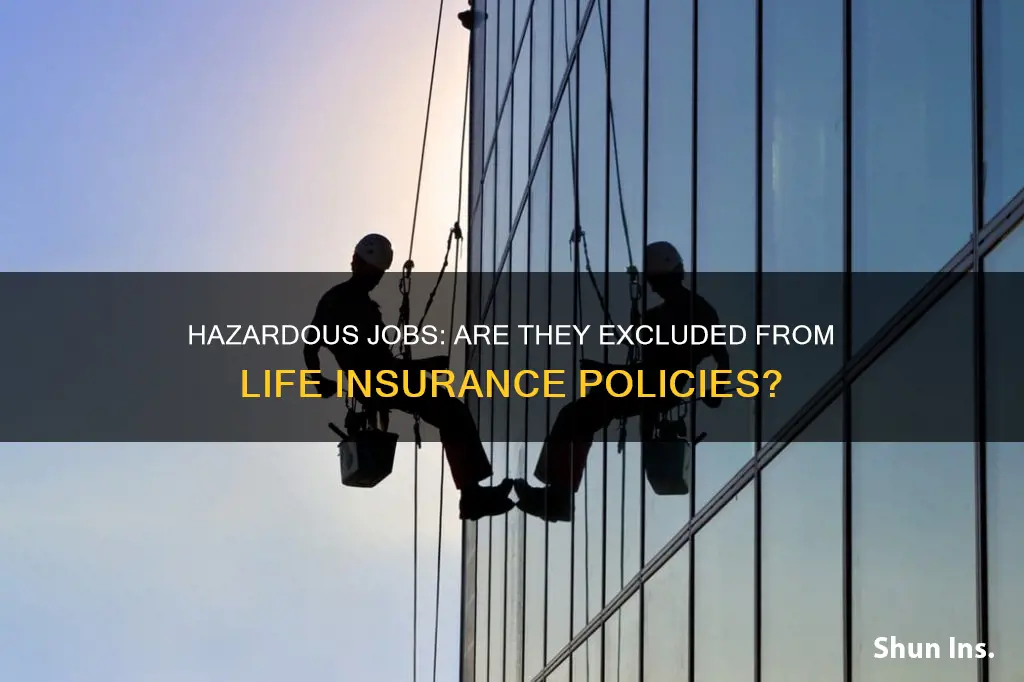

Occupations deemed hazardous by insurance companies

When it comes to life insurance, insurance companies must evaluate all kinds of risks to determine whether to approve a policy application or the level of premiums they will charge. While some risk factors are related to health conditions or history, lifestyle factors such as cigarette smoking and excessive alcohol consumption also affect life insurance premiums.

Occupations also play a role in defining risk. Some jobs are simply more hazardous than others, and insurance companies will adjust for the greater risk through higher premiums. An occupation is deemed hazardous if it involves a higher risk of premature death. For example, logging and fishing carry an obvious higher risk of death due to factors such as falling trees or rough seas. Other jobs, like truck driving and on-the-road sales, are not particularly dangerous but are considered higher risk because they expose workers to conditions that could become hazardous.

- Fishers and related fishing workers

- Airline pilots and flight engineers

- Structural iron and steel workers

- Refuse and recyclable material collectors

- Electrical power-line installers and repairers

- Drivers/sales workers and truck drivers

- Farmers, ranchers, and other agricultural managers

- Construction labourers

- Miners

- Off-shore oil drilling workers

- Firefighters

- Police officers

- Sportspeople

- Couriers and delivery drivers

- Entertainers and DJs

- Bar staff and publicans

- Journalists

- Taxi drivers

In addition to these occupations, hazardous activities that are not work-related can also affect life insurance coverage and premiums. These include scuba diving, BASE jumping, hang gliding, race car driving, flying a plane, horseback riding, bungee jumping, parasailing, and off-roading.

Life Insurance for Parents: Who Needs It and Why?

You may want to see also

How insurance companies compensate for the risk of hazardous occupations

When it comes to life insurance, insurance companies must evaluate all kinds of risks to determine whether to approve a policy application or not. These risks are not only related to an individual's health condition or history but also to their lifestyle choices and occupation. Certain occupations are deemed hazardous and are associated with a higher risk of premature death. This includes jobs such as logging, fishing, truck driving, and on-the-road sales, which involve working with dangerous machinery, working at heights, or long hours on the road.

Insurance companies have different ways of measuring the risk associated with various occupations. They may refer to lists of dangerous occupations published by organizations like the Bureau of Labor Statistics (BLS) or rely on their internal data. Despite the risks, most insurance companies will still approve policies for individuals in hazardous occupations but will compensate for the higher risk by implementing the following strategies:

- Higher Premiums: Insurance companies often charge higher premiums for individuals in hazardous occupations. This means that policyholders will have to pay more in monthly or annual payments to maintain their coverage. The increase in premiums can be applied in two ways. Some companies will charge premiums based on the specific hazardous occupation, resulting in different rates for different careers. Other companies may establish a flat rate for any occupation deemed hazardous, typically charging an extra $2 to $3 per $1,000 of coverage. This flat-rate approach ensures that individuals in less well-known but still hazardous jobs are also covered.

- Exclusions: In some cases, insurance companies may explicitly exclude certain hazardous activities from their coverage. This means that if an individual engages in these activities and suffers a resulting injury or death, the policy will not pay any benefits. For example, an insurer may provide a life insurance policy to a race car driver but exclude death benefits if the death occurs during a car race.

- Hazardous Occupation Riders: Policy riders are supplementary features that can be added to a life insurance policy to expand coverage or address specific exclusions. A hazardous occupation rider can be added to provide coverage for individuals in high-risk professions, ensuring that they receive the necessary financial protection.

- Specialized Insurance Options: Individuals in hazardous occupations may also explore specialized insurance options tailored to their unique circumstances. These options may include higher premiums or additional requirements but provide necessary coverage for high-risk jobs.

It is important to note that each insurance company has its own criteria for classifying hazardous occupations, and the risks associated with certain jobs may be determined differently across insurers. Therefore, individuals in hazardous occupations should seek expert advice from professional insurance advisors to find the best policy suited to their needs.

How 401(k) Changes Affect Group Term Life Insurance Benefits

You may want to see also

Group life insurance for people in hazardous occupations

Life insurance companies evaluate all kinds of risks when determining whether to approve a policy application or set the level of premiums. These risks include not only health conditions and history but also lifestyle factors such as cigarette smoking and excessive alcohol consumption. Occupations also play a role in defining risk, as some jobs are simply more hazardous than others.

An occupation is generally deemed hazardous if it involves a higher level of premature death. For instance, logging and fishing carry an obviously higher risk of death due to factors such as falling trees or rough seas. Other jobs, like truck driving and on-the-road sales, are not particularly dangerous in themselves but are considered hazardous because they expose workers to conditions that could become risky.

Life insurance companies compensate for the risk of hazardous occupations in various ways. They may refer to lists of dangerous occupations published by recognised sources, such as the Bureau of Labor Statistics (BLS), or rely on their own internal data. In most cases, life insurance companies will approve policies for people in hazardous occupations but charge higher premiums to compensate for the increased risk.

Group Life Insurance

Most occupations, including hazardous ones, offer employer-provided group life insurance to their employees. While this type of insurance is usually the least expensive and guarantees approval, it may not always be the best option for those in hazardous jobs. Group life insurance typically has limited coverage, and if you lose your job, you lose your insurance coverage. There is also a growing trend of employers eliminating benefits through contract work and other arrangements.

Independent Coverage

Obtaining your own life insurance coverage can provide a permanent base of insurance, regardless of changes in your employment. Combining an employer plan with a private plan can help ensure you have adequate coverage, especially if you work in a hazardous occupation. Working with an independent agent who understands high-risk occupations and the underwriting processes of different insurance companies can help you secure the most affordable policy.

High-Risk Occupations

The following are some examples of occupations that are typically considered high-risk:

- Commercial fisherman

- Construction workers

- Aircraft pilots and flight engineers

- Truck drivers and sales/driver vendors

- Structural iron and steel workers

- Extraction workers (mineral/resource extraction)

- Farmers and ranchers

- Miners

- Off-shore oil drilling workers

- Firefighters

- Police officers

- Builders

- Engineers

- Security personnel

- Armed Forces (Army, Navy, RAF)

- Offshore workers

Factors Affecting Insurance Costs

In addition to occupation, other factors that can influence the cost of life insurance include age, gender, physical health, and family medical history.

Life Insurance Proceeds: Criminal Restitution Entanglement

You may want to see also

How to get the best deal on life insurance with a hazardous occupation

Life insurance is designed to provide financial protection for individuals and their loved ones, but it's important to recognise that not all life insurance policies are created equal. When it comes to hazardous occupations, there are a few things to keep in mind to ensure you're getting the best deal possible.

First, it's important to understand that hazardous occupations are those that involve a higher level of premature death or significant hazards that could lead to injury or death. These occupations are considered riskier for insurers, who may want to avoid paying out early on. As a result, your monthly premiums may be more expensive. However, this doesn't mean you can't get life insurance at all. The majority of life insurance companies will still offer policies to individuals in hazardous occupations, but it's crucial to be transparent about your occupation during the application process.

To get the best deal on life insurance with a hazardous occupation, consider the following:

- Shop around and compare rates: Different insurance companies will have varying views on hazardous occupations. While common hazardous jobs will likely be classified as such by most companies, there can be significant differences when it comes to occupations that are considered borderline. By shopping around and comparing rates, you can find insurers that offer the most favourable terms for your specific occupation.

- Work with an experienced agent: An experienced life insurance agent can be your key to finding the companies that will have the most favourable view of your occupation. They have the knowledge and expertise to guide you towards insurers who may not classify your occupation as hazardous at all or offer more competitive rates.

- Provide accurate information: During the application process, it's crucial to be transparent and provide accurate information about your occupation and any hazardous activities you engage in. Misrepresentation, whether intentional or unintentional, can have severe consequences and may result in your policy being voided or claims being denied. Be diligent in disclosing all relevant details, even if you're uncertain about their significance.

- Consider specialised insurance options: Individuals in dangerous occupations may benefit from exploring specialised insurance options tailored to their unique circumstances. For example, a hazardous occupation rider can be added to your policy to provide coverage for high-risk professions. Similarly, a travel accident rider can offer coverage for travel to dangerous locations that may otherwise be excluded.

- Review and understand policy riders: Policy riders and endorsements allow you to customise your coverage based on your specific needs. Review and understand the terms and conditions of each rider, paying attention to details such as waiting periods, coverage limits, and cost implications. Regularly review your policy riders to ensure they remain relevant to your evolving needs.

- Maintain good health: If you work in a hazardous occupation but are in good or above-average health, you may be able to secure more affordable life insurance rates. Insurers appreciate that everyone has loved ones who are financially dependent on them, and good health can work in your favour when applying for coverage.

- Seek expert advice: With so many factors influencing your insurance policy, it's essential to seek expert advice from professional insurance advisors. They can help you navigate the complex landscape, ensure you're getting the coverage you need, and provide valuable insights into how your occupation and other factors may impact your premiums.

Remember, each person's situation is unique, and there are many variables that can affect your insurance policy beyond your occupation. By following these steps and staying informed, you can increase your chances of getting the best deal on life insurance even with a hazardous occupation.

Renewing Texas Life Insurance: License Renewal Simplified

You may want to see also

Frequently asked questions

No, people with hazardous occupations are not excluded from life insurance. However, insurance companies may charge higher premiums for these occupations due to the increased risk.

Occupations deemed hazardous vary among insurance companies, but some common examples include logging, fishing, truck driving, and jobs that require working with dangerous machinery, at height, or with firearms.

Insurance companies use lists of dangerous occupations from sources like the Bureau of Labor Statistics (BLS) and their internal data to assess the risk of different jobs. They then adjust their premiums accordingly.