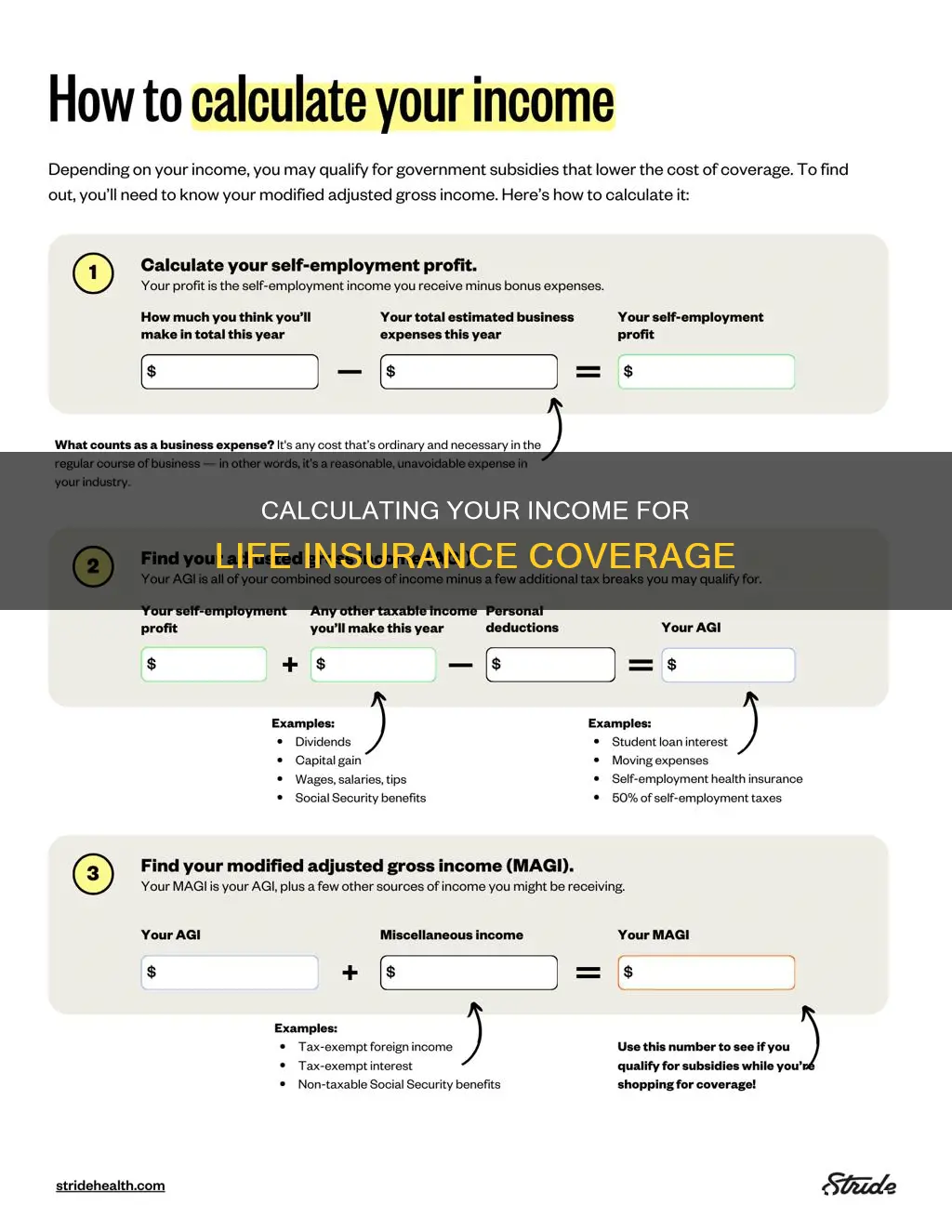

Life insurance is an important financial tool that ensures your loved ones are provided for in the event of your death. The amount of life insurance you need depends on your financial goals and obligations. One common method for calculating your life insurance needs is the 'Income Replacement' method, which is based on your current annual income. This method suggests that you multiply your annual income by the number of years left until your retirement. For example, if you earn $50,000 per year and plan to retire in 20 years, you would need $1,000,000 in life insurance coverage. However, this method does not take into account other factors such as debts, mortgage, education costs, or existing assets. Therefore, it is important to also consider other methods such as the DIME (debt, income, mortgage, education) method, or using a life insurance calculator, to get a more accurate estimate of your life insurance needs.

| Characteristics | Values |

|---|---|

| Method | Income Replacement |

| Formula | (Annual Income) X (Number of years left until retirement) |

| Factors | Annual salary, number of income-earning years, net income of survivors, investments and savings, number of children, funding for one-time expenses |

| Purpose | To replace income for a loved one |

What You'll Learn

Calculating 75% of your income

The Income Replacement Method:

The Income Replacement method is a straightforward way to calculate your life insurance needs. It is based on your current annual income and the number of years left until your retirement. To use this method, multiply your annual income by the number of years until retirement. For example, if you earn $50,000 annually and plan to retire in 20 years, you would need life insurance coverage of $1,000,000 ($50,000 x 20 years). This calculation ensures that your beneficiaries receive an amount equivalent to your income for the duration of your intended working life.

The DIME Method:

The DIME (Debt, Income, Mortgage, Education) method is another approach to determining your life insurance needs. This method takes into account your outstanding debts, income replacement goals, mortgage balance, and future education expenses for your children.

- Debt: Calculate any debts you would leave behind, such as credit card debt or student loans that are not forgiven upon your death.

- Income: Multiply your income by the number of years you wish to provide income replacement for your family. Consider the number of years until your youngest child reaches financial independence.

- Mortgage: Include the balance of your mortgage to ensure your family can remain in their home.

- Education: Add an amount that covers future college costs, including tuition, room, and board for each child.

By adding up these components, you can determine a more comprehensive estimate of your life insurance needs.

The Standard-of-Living Method:

The Standard-of-Living method focuses on maintaining your survivors' standard of living after your death. This method involves multiplying your current income by a factor determined by your age. For individuals between 41 and 50 years old, multiply your income by 20. If you are between 51 and 60 years old, multiply your income by 15. This calculation assumes that your beneficiaries can withdraw 5% of the death benefit each year while investing the principal amount at a 5% rate of return or higher.

Other Considerations:

When calculating 75% of your income for life insurance, it is essential to consider other factors that may impact your coverage needs. These include:

- Funeral and burial expenses: Ensure that your life insurance coverage includes an amount to cover these end-of-life expenses.

- Existing assets and savings: Subtract any significant assets, such as savings or investment funds, from your calculated needs.

- Number of dependents: Consider the number of people who rely on your income when determining the necessary income replacement.

- Health and age: Your age and health are critical factors in determining life insurance rates, as they impact the likelihood of the insurance company paying out a death benefit.

By following these steps and considering your unique circumstances, you can effectively calculate 75% of your income for life insurance purposes and ensure that your loved ones are provided for in the event of your death.

It is always recommended to consult a financial advisor or insurance professional to fine-tune your calculations and choose the most suitable coverage for your specific needs.

Whole Life Insurance: Where to Get Covered for Good

You may want to see also

Deciding on the type of life insurance

When deciding on the type of life insurance, it's important to consider your financial goals, family situation, and budget. Here are some common types of life insurance to choose from:

Term Life Insurance

Term life insurance is a simple and low-cost policy that provides coverage for a specific term, typically 10, 20, or 30 years. It is designed to replace your income when you die and help your loved ones meet short-term financial needs. Term life insurance is usually the cheapest option, but if you outlive the policy term, your beneficiaries won't receive a payout.

Whole Life Insurance

Whole life insurance is a permanent policy that covers you for your entire life, as long as you keep up with the premiums. It is more expensive than term life insurance but offers a guaranteed rate of return and a consistent death benefit amount. Whole life insurance is ideal for those seeking a straightforward permanent policy.

Universal Life Insurance

Universal life insurance is a type of permanent policy that allows for flexibility. You can adjust the premium payments and benefit value over time. It has a cash value component that grows based on market interest rates, but the death benefit and cash value growth are not guaranteed. Universal life insurance is typically less expensive than whole life insurance.

Variable Life Insurance

Variable life insurance is a permanent policy with a cash value component tied to investment accounts such as bonds and mutual funds. It offers the potential for significant gains if your investments perform well, but it requires active management as the cash value can fluctuate daily. Variable life insurance is suitable for those with a higher risk tolerance.

Final Expense Insurance

Final expense insurance, also known as burial insurance, is a small whole life insurance policy that covers funeral, burial, and end-of-life expenses. It usually has a guaranteed death benefit ranging from $5,000 to $25,000, and a medical exam is often not required. This type of insurance is ideal for those who want to cover their own final expenses.

Group Life Insurance

Group life insurance is typically offered by employers as a workplace benefit. It provides coverage for employees or members of an organization, and employers may offer basic coverage for free, with the option to purchase supplemental insurance.

When deciding on the type of life insurance, consider your financial obligations, family situation, and budget. Term life insurance is sufficient for most people, while whole life insurance offers permanent coverage but at a higher cost. Universal and variable life insurance provide flexibility and investment options, while final expense insurance is designed for end-of-life expenses. Group life insurance is a convenient option offered through employers.

Life Insurance: Can Your Employer Require Group Policies?

You may want to see also

Assessing your debts

Identify Your Debts

Start by making a comprehensive list of all your debts, including mortgages, loans, and credit card debts. Knowing the total amount of your debts will help you calculate your insurance needs.

Understand Debt Responsibility

It's important to understand who will be responsible for your debts after your death. In most cases, your estate, which includes all your assets, will be used to pay off your debts. However, in certain situations, others may be held responsible:

- Co-signers and joint owners: If someone co-signs a loan with you, they are typically responsible for it after your death. Joint owners of a debt are also equally accountable.

- Spouses in community property states: In certain states, spouses may be responsible for debts incurred during the marriage. These states include Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin.

Consider the Impact on Heirs

Even if no one is legally responsible for your debts after your death, they can impact your heirs. If your estate doesn't have enough funds to cover your debts, your assets that you intended to pass on to your heirs may be used for debt repayment. Life insurance can help mitigate this by providing a payout that can be used to settle debts, allowing your heirs to receive the full benefit of your estate.

Evaluate Debt Types

Different types of debts have different implications for repayment after your death:

- Mortgages: If you have a co-signer or co-borrower on a mortgage, they would typically be responsible for the debt. Life insurance can help by providing a payout to settle the debt and maintain ownership of the property.

- Credit card debt: Any co-signers or joint owners of a credit card account may be responsible for unpaid balances. Authorized users, such as partners or children, are not responsible for the debt.

- Student loans: Student debt is often forgiven after death. However, if you have taken out private parent loans, these may become part of your estate, and life insurance can help cover this debt.

- Business loans: Life insurance can help your business partners pay off loans they may be solely responsible for after your death.

Calculate Coverage Needed

To determine how much life insurance coverage you need to cover your debts, add up the total amount of your debts. This amount should be included in your overall insurance calculation, along with other factors such as income replacement and future expenses.

In summary, assessing your debts is a crucial step in determining your life insurance needs. By understanding the types and amounts of your debts, as well as who will be responsible for them after your death, you can ensure that your life insurance coverage is sufficient to protect your loved ones and help them manage any financial obligations.

Instant Life Insurance: Get Covered Immediately

You may want to see also

Estimating your savings

When calculating how much life insurance you need, it's important to consider your savings and current assets. If you already have significant savings or investment funds, you may not need as much life insurance as someone with fewer assets.

Assess your current savings and investments:

Take an inventory of your current financial situation. This includes savings accounts, investment funds, retirement accounts, and any other sources of wealth. Knowing the total value of your assets will help you understand how much additional coverage you may need from life insurance.

Calculate your financial obligations:

Make a list of all your financial obligations, such as mortgage payments, loans, future college fees for your children, and any other significant expenses. You can use an online calculator or spreadsheet to add up these obligations and get a clear picture of your financial commitments.

Determine the gap between your assets and obligations:

Subtract your total assets (savings, investments, etc.) from your financial obligations. This will give you an estimate of the gap that needs to be covered by life insurance. For example, if your financial obligations total $500,000 and your current assets are $300,000, you would need life insurance coverage of around $200,000.

Consider future income replacement:

If you want your life insurance to replace your income for a certain number of years, you can multiply your annual income by the number of years you want it replaced. For example, if your annual income is $60,000 and you want it replaced for 10 years, you would need life insurance coverage of $600,000 for income replacement alone.

Account for inflation and unexpected costs:

When estimating your savings and calculating your life insurance needs, it's important to factor in inflation and unexpected costs. You may want to add a buffer to your coverage amount to account for these potential expenses. This could help ensure that your loved ones have sufficient financial support if your income contributes significantly to their daily living expenses.

Remember, the above calculations provide a general estimate, and it's always a good idea to consult a financial advisor or insurance agent to determine the right amount of life insurance coverage for your specific situation.

Life Insurance: Can They Drop You?

You may want to see also

Factoring in future costs

When calculating how much life insurance you need, it's important to consider future expenses and how your income and assets might change over time. Here are some factors to keep in mind when factoring in future costs:

- Income growth: Your income may increase over the years, which could impact the amount of coverage you need. Consider whether you expect your salary to grow and factor that into your calculations.

- Inflation: The impact of inflation on your purchasing power is an important consideration. Your life insurance coverage should ideally include a buffer to protect against inflation, especially if your beneficiaries will be relying on the payout to replace your income.

- Future expenses: Think about any significant future expenses that your life insurance coverage should account for. This could include your children's college tuition, future medical expenses, or other large purchases.

- Investment growth: If you have investments, consider their potential growth over time. You may not need as much life insurance coverage if you have substantial investments that can generate income or be liquidated to cover future expenses.

- Debt repayment: If you're actively working on repaying debts, factor that into your calculations. As you pay off debts, your need for life insurance coverage may decrease.

- Retirement planning: Your life insurance needs may change as you get closer to retirement. Consider whether your retirement savings and plans will impact the amount of coverage you need.

- Long-term care costs: As you age, you may incur long-term care costs that could impact your financial situation. Consider whether you may need life insurance to cover these expenses or if you have other plans in place to manage them.

- Family dynamics: Changes in your family situation, such as marriage, divorce, or having children, can impact your life insurance needs. Review your coverage periodically to ensure it aligns with your current family dynamics and future expectations.

- Career changes: If you're planning a career change or expecting a significant increase in your income, factor that into your calculations. Your life insurance needs may change as your career progresses.

- Risk factors: Consider any risk factors that may impact your health or life expectancy. If you engage in risky hobbies or have health issues, you may need to plan for higher life insurance premiums or additional coverage.

Remember, it's important to periodically review and adjust your life insurance coverage as your financial situation and goals evolve. Consult with a financial advisor or insurance professional to ensure your coverage remains aligned with your future needs and expectations.

Wealthy Estate Planning: Life Insurance and Tax Avoidance

You may want to see also

Frequently asked questions

There are many ways to calculate how much life insurance you need. One way is to multiply your annual income by the number of years you want to replace that income. You can also use an online life insurance calculator, which will take into account your income, debts, savings, and other factors.

The DIME method is a way to calculate how much life insurance you need. It stands for Debt, Income, Mortgage, and Education. You add up your debts, income, mortgage balance, and education costs to get a rough estimate of how much life insurance you need.

If you want to leave an inheritance, you may want to consider permanent life insurance. A financial advisor can help you determine how much coverage you need based on your specific situation.