When completing your W2 form, it's important to accurately report all income, including group life insurance benefits. Group life insurance is a valuable benefit offered by many employers, providing financial protection for employees and their dependents in the event of death. On your W2, you will typically find a section dedicated to Box 12 where you list various types of income, including group life insurance. This section is crucial for tax purposes, ensuring that you report all taxable income accurately. Understanding where to list group life insurance on your W2 is essential for proper tax compliance and can help you take full advantage of the benefits provided by your employer.

What You'll Learn

**Group Life Insurance Deductions:**

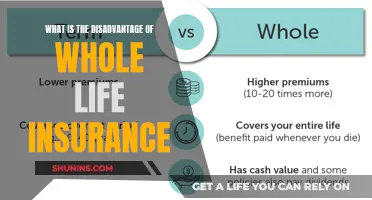

When it comes to reporting group life insurance benefits on your tax return, it's important to understand the specific guidelines and deductions available. Group life insurance is a valuable benefit offered by many employers, providing financial protection for employees and their families. Here's a breakdown of how to handle group life insurance deductions on your W-2 form:

Understanding Group Life Insurance: Group life insurance is a type of coverage provided by an employer to a group of employees. It offers a death benefit to the designated beneficiaries in the event of the insured individual's passing. This benefit can be a significant financial safety net for employees and their loved ones.

Reporting on W-2: The W-2 form, also known as the Wage and Tax Statement, is a crucial document for employees. It summarizes your earnings and the taxes withheld from your paychecks throughout the year. When it comes to group life insurance, the W-2 form typically includes a section for reporting the death benefit or the insurance premium payments made by the employer.

Deductions for Group Life Insurance Premiums: In many cases, the cost of group life insurance premiums is paid for by the employer, and the employee is not directly responsible for these payments. However, if you are required to contribute to the premium, you can deduct these expenses on your tax return. The deduction is generally allowed as a medical expense, which can be beneficial if you have other medical expenses that exceed the standard deduction.

Death Benefit Inclusion: If you are a beneficiary of a group life insurance policy, the death benefit received may be taxable income. However, there are certain exceptions and exclusions that can apply. For instance, if the death benefit is less than a specific threshold (currently $1,000), it may be exempt from taxation. Additionally, if the insurance is provided by your employer and is considered a form of compensation, it might be included in your wages and reported on your W-2.

Consulting a Tax Professional: Tax laws can be complex, and the specific rules regarding group life insurance deductions may vary depending on your jurisdiction and individual circumstances. It is always advisable to consult a tax professional or accountant who can provide personalized guidance based on your situation. They can help you navigate the deductions and ensure you are taking advantage of all available benefits.

Life Insurance Payouts: How Long Do UK Beneficiaries Wait?

You may want to see also

**Group Life Insurance Benefits:**

Group Life Insurance Benefits:

When it comes to group life insurance, it's important to understand the benefits it offers to both the employer and the employees. Group life insurance is a valuable benefit that can provide financial security and peace of mind for employees and their families. Here's a breakdown of the key advantages:

- Financial Security: One of the primary benefits is the financial protection it offers to the employee's beneficiaries in the event of their passing. This ensures that the family is provided for, covering essential expenses and providing a safety net during a difficult time. The coverage amount can be significant, often equal to the employee's annual salary, which can be a substantial financial cushion.

- Employer's Perspective: For employers, offering group life insurance is a strategic decision. It demonstrates a commitment to employee well-being and can enhance employee satisfaction and retention. Additionally, it can be a tax-deductible business expense, providing a financial benefit to the company.

- Employee Morale and Trust: Group life insurance plans can boost employee morale and trust in the organization. Employees feel valued and secure, knowing that their families are protected. This can lead to higher job satisfaction and a more positive work environment.

- Customizable Coverage: These plans often offer flexibility in terms of coverage options. Employees can typically choose the level of coverage that suits their needs and budget. This customization ensures that the insurance plan is tailored to the individual, providing a more personalized benefit.

- Simplified Administration: Group life insurance simplifies the process of managing insurance for both the employer and the employees. Premiums are often deducted from the employee's paycheck, making it convenient and efficient. This streamlined approach ensures that the administration of the plan is straightforward and user-friendly.

Understanding the benefits of group life insurance is essential for both employers and employees. It highlights the importance of this benefit in providing financial security and peace of mind. When considering group life insurance, it's crucial to explore the options available and choose a plan that best suits the needs of the workforce.

Life Insurance: Recession-Proofing Your Finances and Future

You may want to see also

**Group Life Insurance Contributions:**

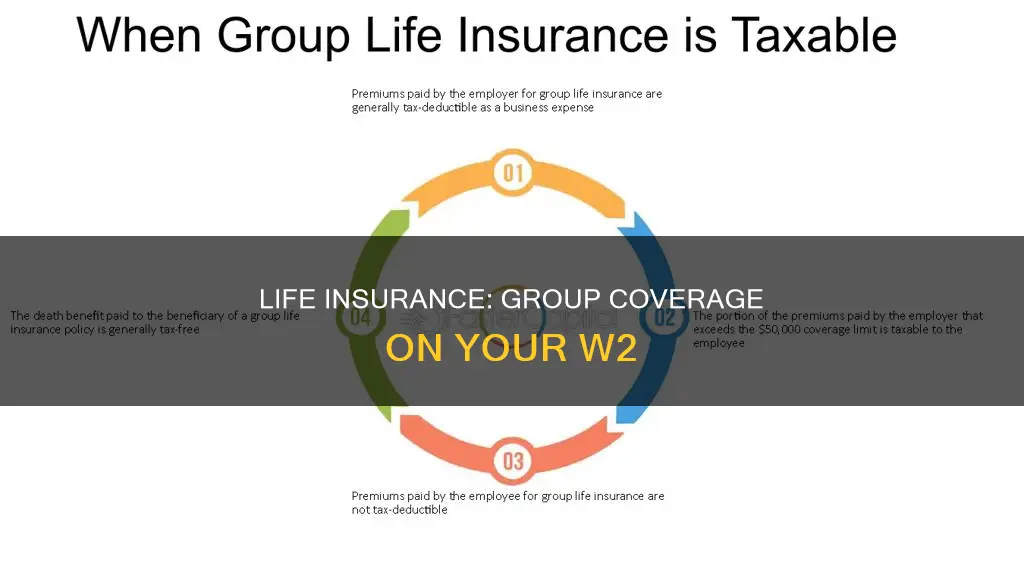

When it comes to reporting group life insurance contributions on your W-2 form, it's important to understand the specific guidelines provided by the Internal Revenue Service (IRS). Group life insurance is a valuable benefit offered by many employers, providing financial protection for employees and their families in the event of death. However, the IRS requires that these contributions be reported accurately on your tax forms.

On your W-2 form, the section related to group life insurance contributions is typically found in Box 12, which is labeled as "Other Compensation." This box is designed to include various types of additional compensation that may be paid to an employee. Group life insurance premiums paid by the employer are considered a form of compensation and should be included here. It is essential to report these contributions accurately to ensure compliance with tax regulations.

The amount reported in Box 12 should reflect the total group life insurance premiums paid by the employer on your behalf. This includes both the basic life insurance coverage and any additional benefits or riders that may be part of the group policy. If the employer pays for any portion of the premium, this contribution will be listed here, even if the employee also contributes to the plan.

It's worth noting that the IRS provides specific instructions for reporting group life insurance in Publication 15-B, "Employer's Tax Guide to Small Business." This publication offers detailed guidance on how to report various types of compensation, including group life insurance. By referring to this resource, you can ensure that your W-2 form is completed correctly, reflecting all applicable group life insurance contributions.

Additionally, if you have any doubts or concerns about reporting group life insurance on your tax forms, it is advisable to consult a tax professional or the IRS directly. They can provide personalized advice based on your specific circumstances and help ensure that your tax obligations are met accurately and on time.

Farmers Life Insurance: Is It a Participating Whole Life Policy?

You may want to see also

**Group Life Insurance Exclusions:**

When it comes to group life insurance, it's important to understand the exclusions and limitations that may apply. These exclusions are specific conditions or circumstances under which the insurance policy may not provide coverage, and they can vary depending on the insurance provider and the terms of the policy. Here are some key points to consider regarding group life insurance exclusions:

Pre-existing Conditions: One common exclusion is pre-existing medical conditions. Insurance companies often have waiting periods for certain health issues, during which they may not cover any related claims. For example, if an employee has a history of heart disease or cancer, the insurance policy might exclude coverage for these conditions for a specified period, typically around 2-5 years, depending on the severity and type of the condition.

High-Risk Activities: Group life insurance policies may also exclude coverage for high-risk activities or hobbies. These activities can include extreme sports like skydiving or rock climbing, racing cars, or even certain professions like firefighting or police work. The insurance provider may consider these activities dangerous and may not cover any related accidents or deaths. It's essential to review the policy to understand which activities are excluded.

Intoxication and Substance Abuse: Insurance policies often exclude coverage for deaths or injuries resulting from intoxication or substance abuse. This exclusion typically applies to alcohol or drug-related incidents, including driving under the influence (DUI) or drug-induced accidents. The insurance company may not provide benefits in such cases, emphasizing the importance of responsible behavior.

Suicide and Mental Health Exclusions: Suicide is often a significant exclusion in life insurance policies, including group plans. The waiting period for suicide-related claims can vary, but it is typically longer than for other causes of death. Additionally, mental health-related exclusions may exist, excluding coverage for deaths or injuries caused by mental illness or self-harm.

Age and Lifestyle Factors: Age and lifestyle choices can also play a role in exclusions. For instance, older individuals may face higher premiums or limited coverage options due to age-related health risks. Similarly, smoking, excessive alcohol consumption, or obesity might lead to higher premiums or exclusions for certain medical conditions.

Understanding these exclusions is crucial for employees to ensure they are aware of any limitations on their group life insurance coverage. It is recommended to carefully review the policy documents provided by the insurance company to identify all applicable exclusions and their respective terms.

Life Insurance Simplified: What's an APS?

You may want to see also

**Group Life Insurance Compensation:**

Group Life Insurance Compensation:

When it comes to group life insurance, understanding how compensation is handled is crucial for both employers and employees. Group life insurance is a valuable benefit that provides financial protection to employees and their dependents in the event of the insured's death. This type of insurance is typically offered by employers as part of their benefits package, and it can significantly impact the financial well-being of the employee's family.

The compensation structure for group life insurance varies depending on the insurance provider and the employer's policies. Generally, the insurance company pays out a death benefit to the designated beneficiaries upon the insured individual's passing. This benefit amount is usually a fixed sum, and it can be a substantial financial resource for the family, especially if the insured individual is the primary breadwinner.

For employees, it's essential to know how to access and utilize this compensation effectively. When an employee passes away, the insurance provider will typically contact the designated beneficiaries to inform them of the death and the subsequent compensation process. The beneficiaries should promptly notify the insurance company of the insured's death and provide any necessary documentation to initiate the claims process.

Employers play a vital role in facilitating this process. They should ensure that the group life insurance policy is properly administered and that employees are aware of their rights and the compensation process. This includes providing clear communication about the policy, its benefits, and the steps employees should take in the event of a covered death. Employers may also need to assist in gathering the required documentation and coordinating with the insurance company to ensure a smooth claims settlement.

In summary, group life insurance compensation is a critical aspect of employee benefits, offering financial security to families during difficult times. Both employees and employers have responsibilities in ensuring that the compensation process is well-managed and that the designated beneficiaries receive the rightful benefits. By understanding the process and staying informed, individuals can make the most of this valuable insurance coverage.

Usaa Life Insurance: Understanding Exclusions and Their Impact

You may want to see also

Frequently asked questions

The W2 form, which is used to report wages and taxes, typically includes a section for listing various types of insurance. Group life insurance is usually found in the "Other Income" or "Additional Income" category. This section may vary depending on the employer's payroll system, but it often includes a line for listing the total amount of group life insurance provided.

Yes, group life insurance is often denoted by a specific code or notation. It might be listed as "GLI," "Group Life," or a similar abbreviation. This code helps the Internal Revenue Service (IRS) and employers categorize and report the insurance benefit accurately.

If your employer offers group life insurance as a benefit, the coverage amount should be reflected in the W2 form. You can review the "Other Income" or "Additional Income" section to find the group life insurance benefit. The amount listed here represents the total value of the insurance provided by your employer.

The W2 form primarily provides a summary of the insurance benefits provided by your employer. It may not include detailed information about the specific terms and conditions of your group life insurance policy. For more detailed coverage information, you should refer to the insurance policy documents provided by your employer or the insurance company.

If you believe your employer should have reported group life insurance on your W2 but it is not listed, you can contact your employer's payroll department or HR representative. They can provide clarification and ensure that all applicable benefits are accurately reported on your tax forms.