The Hawaii Medical Service Association (HMSA) is a Blue Cross Blue Shield of Hawaii health plan provider. HMSA offers a range of health insurance plans, including Affordable Care Act (ACA) plans, Medicare Advantage plans, and supplemental insurance. HMSA members can access health services from over 5,000 doctors and specialists in Hawaii and are covered in all 50 states and nearly 200 countries and territories through Blue Cross Blue Shield Global® Core.

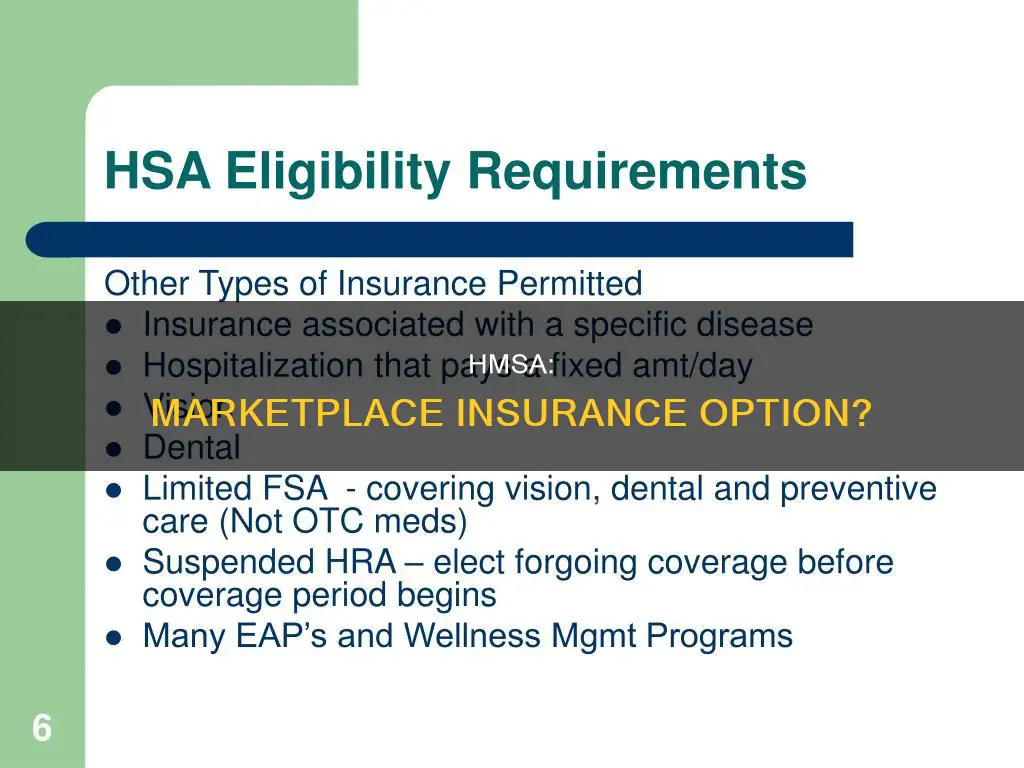

Individuals can purchase insurance directly from HMSA or through the federal health insurance marketplace at HealthCare.gov. Depending on their financial situation, individuals may be eligible for financial assistance, which is only available through the federal marketplace.

| Characteristics | Values |

|---|---|

| Name | Hawaii Medical Service Association (HMSA) |

| Type | Blue Cross Blue Shield of Hawaii |

| Location | Hawaii |

| Years in Operation | 80-85 years |

| Insurance Types | Medicare Advantage, Affordable Care Act (ACA), COBRA, Medicare Advantage prescription drug plan (MAPD) |

| Insurance Provider Types | Employer-sponsored group plans, individual plans |

| Number of Doctors and Specialists | 5,000+ |

| Coverage Area | All 50 states and nearly 200 countries and territories |

What You'll Learn

HMSA's Affordable Care Act (ACA) plans

The Hawaii Medical Service Association (HMSA) offers Affordable Care Act (ACA) plans that individuals can buy on their own. These plans are available to those who meet the eligibility requirements and comply with the ACA.

HMSA's ACA plans offer a range of benefits, including:

- Access to a large network of doctors and specialists close to where you live or work.

- Coverage in all 50 states and nearly 200 countries and territories through Blue Cross Blue Shield Global® Core.

- An annual preventive exam with no copayment.

- Generic drug coverage.

- Adult vision coverage.

- Online care through HMSA's Online Care®.

- Dental care such as cleanings, exams, and more.

In addition, HMSA provides local customer service and support to help individuals understand their options and choose the best plan for their needs.

HMSA's ACA plans are designed to make quality healthcare more accessible and affordable for individuals and families. The specific benefits, premiums, and eligibility requirements may vary, so it is important for individuals to review the plan details and determine if they qualify.

Understanding the Mystery of Insurance Bill Subsidies: Unraveling the Financial Aid Enigma

You may want to see also

Medicare Advantage plans

Medicare Advantage, also known as Medicare Part C, has more benefits than Original Medicare and is available to people aged 65 or older and certain disabled individuals. It combines hospital (Medicare Part A), medical (Medicare Part B), and sometimes drug (Medicare Part D) benefits. Insurance companies contract with the federal government to offer Medicare Advantage plans.

- Network of Doctors and Hospitals: With Medicare Advantage, you have access to a network of doctors and hospitals that are usually cheaper to visit than providers outside of the network. This is similar to an HMO (Health Maintenance Organization) plan, where you typically have a primary care provider who coordinates your care and referrals to specialists.

- Extra Benefits: Most Medicare Advantage plans offer additional benefits beyond Original Medicare. These can include discounts for hearing aids and fitness centres, as well as dental, vision, and wellness benefits.

- Costs and Premiums: While Medicare Advantage plans may have a monthly premium, some plans offer $0-premium options. Even with a $0-premium plan, you would still need to pay the Original Medicare Part B premium, and Part A premium if applicable, to maintain medical coverage. Additionally, with Medicare Advantage, you'll still be responsible for certain out-of-pocket costs like copayments, coinsurance, and deductibles.

- Enrollment and Eligibility: Medicare Advantage plans are offered by Medicare-approved private insurers, such as HMSA. You can apply for a plan during the open enrollment period, which is typically from October 15 to December 7.

- Plan Variations: Medicare Advantage plans can vary in their specific benefits and costs. For example, HMSA offers several Medicare Advantage plans, including HMSA Akamai Advantage Complete, Complete Plus, Standard, Standard Plus, and Dual Care. These plans have different features and are available in specific counties in Hawaii.

- Supplemental Coverage: Keep in mind that Medicare Advantage plans already include prescription drug coverage (Part D). If you're considering additional supplemental insurance for costs not covered by Original Medicare, you may want to look into a Medicare Supplement Plan (also known as Medigap), which is offered by private insurers but is not available if you have a Medicare Advantage plan.

Remember, it's important to carefully review the details of any Medicare Advantage plan you're considering to ensure it meets your specific healthcare needs and budget.

ICICI Term Insurance: Unraveling the Benefits and Features

You may want to see also

COBRA benefit

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the option to continue with their group health benefits for a limited time. This is especially useful in situations such as voluntary or involuntary job loss, reduction in work hours, transition between jobs, death, divorce, and other life events.

- Eligibility: COBRA applies to most private sector businesses with 20 or more employees. It is available to those who were enrolled in an employer-sponsored medical, dental, or vision plan.

- Qualifying Events: To be eligible for COBRA benefits, a qualifying event must occur. This can include termination or reduction of work hours, divorce or legal separation from a covered employee, death of a covered employee, Medicare eligibility, or loss of a child's or dependent's health insurance coverage under the plan.

- Enrollment Period: You have a 60-day enrollment period to enroll in COBRA once your employer-sponsored benefits end. Even if your enrollment is delayed, your coverage will be retroactive to the day your prior coverage ended.

- Cost: COBRA can be expensive as you may have to pay the full cost of the premium, including what you previously paid and your employer's share, plus an additional 2% administrative fee.

- Duration of Coverage: COBRA coverage is temporary and usually lasts for 18 months, but it can be extended up to 36 months if you experience a second qualifying event, such as divorce or the death of a spouse.

- Dependents: Your dependents, including your spouse, former spouse, or children, are also eligible for COBRA coverage, even if you (the former employee) do not sign up.

- Alternative Options: COBRA is not your only option when you lose your job-based coverage. You can explore other alternatives, such as joining your spouse's employer plan, choosing a health insurance market plan at healthcare.gov, or enrolling in a trade or professional group plan.

Remember, if you are considering COBRA benefits, it is important to carefully review the specific terms and conditions to understand your rights and obligations.

Switching Up Your Coverage: Navigating Metro PCS Phone Insurance Options

You may want to see also

Getting insurance through an employer

In the U.S., most people under 65 have health insurance through an employer-sponsored health plan, either from their own job or a family member. However, getting insurance through an employer is not mandatory, and there are several factors to consider when deciding between employer-sponsored health insurance or buying your own private plan.

Advantages of getting insurance through an employer

- Cost: Employer-sponsored health insurance is usually cheaper than an individual plan as employers subsidize premium payments. The average annual insurance company premium for an employer health insurance plan is $1,669 for single coverage, compared to over $5,000 annually for an individual market plan.

- Convenience: Your employer will manage the insurance plan, and premiums can often be deducted directly from your paycheck.

- Tax benefits: Contributions to your insurance plan lower your taxable income.

Disadvantages of getting insurance through an employer

- Limited options: Your job might offer only one plan, or a few options to choose from, limiting your ability to find a plan that suits your needs.

- Dependents: While you can usually add your spouse and dependents to your plan, your employer is not required to split the cost of their premiums.

- Enrollment periods: You may only be able to enroll or make changes to your plan during certain periods.

Additional considerations

- Eligibility: Not all employers offer health insurance to their employees.

- Federal law protections: Federal law requires certain protections for people in job-based group health plans. For example, individuals and their family members cannot be denied eligibility or benefits or charged more because of a health factor.

- COBRA: If you lose your job-based health plan, you may be able to pay to keep your previous coverage for a limited time (18-36 months) under COBRA (Consolidated Omnibus Budget Reconciliation Act).

Understanding Term Insurance Quotes: A Monthly Breakdown

You may want to see also

Getting insurance on your own

There are two main ways to get insurance on your own: through the Affordable Care Act (ACA) marketplace or directly from a health insurance company.

Affordable Care Act (ACA) Marketplace

The ACA marketplace offers a range of plans and potential subsidies based on your income level. The ACA also ensures that you cannot be denied coverage for pre-existing conditions, and your rates won't be affected by them. Additionally, all marketplace health plans cover a standard set of 10 essential health benefits, including prenatal and maternity care, vision and dental care for children, mental health, and prescription drugs.

To be eligible to enroll in health coverage through the ACA marketplace, you must:

- Live in the United States

- Be a U.S. citizen or national, or be lawfully present

- Not be incarcerated in prison or jail

During the annual open enrollment period, which typically runs from November 1 to January 15, you can choose a plan, continue with your current plan, make changes to your current plan, or choose a new plan. However, if you have experienced a qualifying life event, such as losing your job, getting married, or having a baby, you may be eligible for a special enrollment period outside of the standard open enrollment period.

Direct from a Health Insurance Company

You can also buy private health insurance directly from a health insurance company, either through an agent or broker, or online. These plans are generally more expensive than ACA plans, but they offer personalized coverage and flexibility. When buying directly from an insurance company, you will need to do your research to ensure you qualify for coverage and understand the income limits and other requirements.

Cost Comparison

When deciding between the ACA marketplace and direct insurance, it is essential to weigh the costs and coverage. Direct insurance may offer a wider network of providers and more flexibility in your plan choices, but it may also come at a higher price.

According to the Kaiser Family Foundation, the national average unsubsidized health insurance premium for a benchmark plan in 2024 is $477 per month. In comparison, the average annual premiums for employer-sponsored health insurance were $8,435 for single coverage and $23,968 for family coverage in 2023.

DMV Insurance Updates: Florida's Guide

You may want to see also

Frequently asked questions

Yes, individuals can get insurance directly from HMSA or through the federal health insurance marketplace at HealthCare.gov.

Hawaii Medical Service Association (HMSA) is Blue Cross Blue Shield of Hawaii.

HMSA offers Affordable Care Act (ACA) plans that you can buy on your own. You may even be able to get a government subsidy. HMSA also provides access to more than 5,000 doctors and specialists, and you can get covered in all 50 states and nearly 200 countries and territories.

You can enroll in an ACA plan online. Be sure to click the "Check for Subsidies" box to see if you can get financial help from HealthCare.gov.