Lupus is a reasonably common autoimmune condition that affects around 50,000 people in the UK. While lupus is not generally considered to be severe or life-threatening, it can cause short-term and long-term sickness that could mean the patient is unable to work for periods of time. Critical illness insurance is designed to pay out a cash lump sum if the policyholder is diagnosed with a serious condition. Many critical illness policies will pay out a claim if the policyholder is diagnosed with Systemic Lupus Erythematosus (SLE), but insurers are more likely to offer cover to those who have Discoid Lupus Erythematosus. However, if the policyholder already has SLE, it will be difficult to secure a critical illness policy.

| Characteristics | Values |

|---|---|

| Is lupus considered a critical illness? | No |

| What is critical illness insurance? | A plan that protects you financially in the event of a future major illness diagnosis. |

| What does critical illness insurance cover? | Conditions classified as critical illnesses, including major organ transplants, Alzheimer's disease, cardiac issues, and progressive diseases. |

| Does critical illness insurance payout for lupus? | No, but other conditions can develop that may be covered. |

| Can I get critical illness insurance with lupus? | Yes, but it may be difficult to secure a policy. |

What You'll Learn

Lupus life insurance

Lupus is an autoimmune condition that affects around 50,000 people in the UK, with the most common form being Systemic Lupus Erythematosus (SLE). The condition is usually chronic, but it does not generally reduce life expectancy. If you have lupus, you may be wondering about your options for critical illness insurance and life insurance. Here is some information to help you understand your options:

Critical Illness Insurance for Lupus

Critical illness insurance provides additional coverage for medical emergencies and pays out cash to help with expenses that may not be covered by traditional health insurance. This can include costs related to transportation, childcare, and other non-medical expenses. While critical illness insurance can be helpful in the event of a major illness, it is important to note that it may not cover all types of illnesses and has specific conditions for payout.

In the case of lupus, critical illness insurance does not specifically payout for the condition itself. However, if you have been diagnosed with lupus, you may be at risk for other medical issues that could be covered. Critical illness insurance typically covers conditions that have a significant impact on your quality of life, such as permanent disability, major organ transplant, Alzheimer's disease, or loss of the ability to speak, hear, or see.

When considering critical illness insurance, it is important to carefully review the policy to understand the specific conditions covered and any restrictions or exclusions. Some plans may not cover certain types of cancer or chronic illnesses, and there may be limitations based on age. Additionally, critical illness insurance may require a health screening and provide coverage only under specific circumstances for certain conditions.

Life Insurance with Lupus

If you are concerned about providing financial protection for your family in the event of your death, life insurance is an option to consider. Life insurance will typically payout a tax-free lump sum to your family if you die from lupus or any other cause. The cost of life insurance with lupus will depend on factors such as your age, the cover amount, and the length of the policy.

When applying for life insurance with lupus, you may be asked questions about your condition, such as which parts of your body are affected, when it was diagnosed, and if it is linked to any other medical conditions. In some cases, you may be required to provide additional medical evidence, such as a GP report. It is recommended to speak with an expert advisor who understands medical conditions and underwriting to find the best insurer for your circumstances.

Overall, lupus is generally not considered a severe or life-threatening condition, and it should not prevent you from obtaining life insurance. By understanding your options and carefully reviewing the terms and conditions of different policies, you can make informed decisions about critical illness insurance and life insurance to ensure you have the coverage you need.

Billing Insurance: A Guide for Sole Proprietors

You may want to see also

Systemic Lupus Erythematosus (SLE)

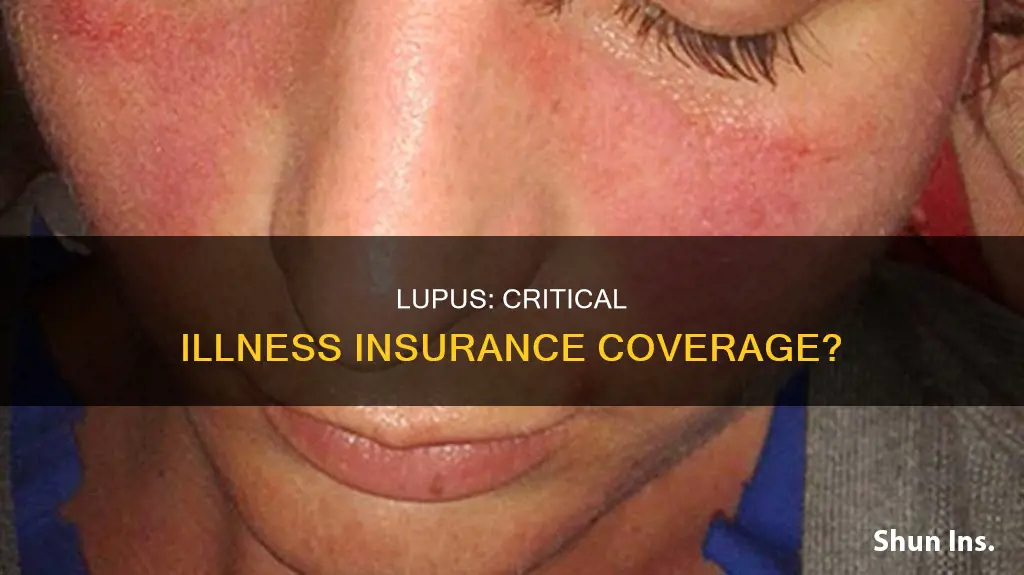

SLE is characterised by periods of illness (flares) and periods of wellness (remission). Symptoms vary from person to person and can range from mild to severe. Common symptoms include joint pain, swelling, and stiffness; a butterfly-shaped rash on the face; skin lesions that worsen with sun exposure; sensitivity to sunlight; sores in the nose and mouth; swelling in the legs or around the eyes; headaches; dizziness; and confusion.

SLE can lead to several complications, including kidney disease, seizures, memory problems, heart valve damage, inflammation of the heart and lungs, blood clots, low blood cell counts, and anxiety and depression. It is a multisystemic disease with an unknown etiology, but it is believed to be influenced by various factors, including genetics, immune dysfunction, endocrine disorders, and environmental triggers.

SLE is the most common form of lupus, affecting approximately 70% of people with the disease. It predominantly affects women of childbearing age, with a female-to-male ratio of 9:1. While anyone can develop SLE, it is more common in certain ethnic groups, including African Americans, Asian Americans, Hispanics/Latinos, and Native Americans.

SLE is a challenging disease to diagnose due to its varied symptoms and overlap with other conditions. Treatment aims to prevent organ damage and achieve remission, ranging from minimal treatment with non-steroidal anti-inflammatory drugs (NSAIDs) and antimalarials to more intensive treatment with cytotoxic drugs and corticosteroids.

Unraveling the Pharmacy Billing Conundrum: Navigating Multiple Insurances

You may want to see also

Discoid Lupus Erythematosus (DLE)

DLE can affect anyone but occurs more frequently in women in their 20s, 30s, and 40s. It is also more common in people of colour. The condition is thought to be autoimmune, with the body's immune system incorrectly attacking normal skin. It tends to run in families, with females outnumbering males 3:1.

DLE can be localised (above the neck in 80% of cases) or generalised (above and below the neck in 20%). The rash is often asymptomatic but can be itchy and sore. Most patients only have skin involvement, but some develop signs of systemic lupus erythematosus (SLE). Localised DLE includes initial dry red patches that evolve into red plaques with adherent scales. As the condition progresses, atrophic scarring and scarring alopecia are common, along with hyperpigmentation and hypopigmentation, especially noticeable in those with darker skin.

DLE is typically located on the nose, cheeks, earlobes, and conchal bowl. It may also involve the lips, oral mucosa, nose, or eyelids. Generalised DLE includes similar morphology but is distributed more widely, including the anterior chest, upper back, hands, and less commonly, the lower limbs, palms, and soles. Rarely, there is involvement of the anogenital mucosa.

DLE is diagnosed through its distribution and the clinical appearance of the plaques. A skin biopsy usually confirms the diagnosis. Treatment includes sun protection, topical or intralesional corticosteroids, and topical calcineurin inhibitors. If DLE is refractory to these treatments, systemic therapy may be required. Antimalarial medications such as hydroxychloroquine are often used.

DLE is not considered life-threatening and should not prevent someone from getting life insurance. However, it can cause short and long-term sickness that may result in an inability to work.

Navigating ADP Insurance Changes: A Comprehensive Guide

You may want to see also

Drug-induced Lupus (DIL)

DIL is a rare condition, with 15,000 to 30,000 cases per year in the US. It usually occurs after taking the offending drug for three to six months. The symptoms of DIL are similar to those of SLE and include muscle and joint pain, weight loss, fever, and skin rash. However, DIL rarely affects the body's major organs, and it is not usually life-threatening.

The drugs most commonly associated with DIL are:

- Hydralazine (treats high blood pressure)

- Procainamide (treats irregular heart rhythms)

- Quinidine (treats irregular heart rhythms)

- Isoniazid (treats tuberculosis)

- Minocycline (treats infections and acne)

The symptoms of DIL usually disappear within a few weeks or months of stopping the offending medication. Treatment may include nonsteroidal anti-inflammatory drugs (NSAIDs), corticosteroid creams, and antimalarial drugs.

Navigating Healthcare Insurance: A Guide to Making the Switch

You may want to see also

Critical illness insurance coverage

Critical illness insurance is a type of insurance that provides additional coverage for medical emergencies such as heart attacks, strokes, or cancer. These policies are designed to cover the high costs of treating life-threatening illnesses, which often exceed what a standard health insurance plan will cover.

Critical illness insurance typically pays out a lump sum to the insured, which can be used for a variety of purposes, including:

- Out-of-network treatment

- Therapy and rehabilitation

- Transportation expenses

- Mortgage payments or other daily living expenses

- Childcare expenses

The instances covered by critical illness insurance are generally limited to a few specific illnesses or emergencies, and the cost of the policy will depend on the number and extent of the conditions covered, as well as the age, sex, and health of the insured.

When it comes to lupus, critical illness insurance does not specifically pay out for this condition. However, lupus is a chronic autoimmune condition that can lead to other medical complications that may be covered. For example, lupus can cause short-term and long-term sickness, and income protection policies may pay out if the insured needs to take time off work due to the illness. Additionally, lupus can be linked to other medical conditions, such as autoimmune thyroid disease, antiphospholipid syndrome, and rheumatoid arthritis, which may be covered by critical illness insurance.

It is important to note that critical illness insurance policies have specific criteria for what constitutes a covered illness, and the circumstances under which a payout will be made. For example, a policy may only pay out for cancer if it has spread beyond the initial point of discovery or is life-threatening. Therefore, it is essential to carefully review the terms and conditions of any critical illness insurance policy before purchasing it.

Newborn Insurance: When to Change Policies

You may want to see also

Frequently asked questions

Critical illness insurance covers conditions that are classified as critical illnesses. Lupus is not specifically listed as a critical illness, but other conditions may develop as a result of lupus that are covered by critical illness insurance.

Critical illness insurance typically covers conditions such as major organ transplants, Alzheimer's disease, coronary artery bypass graft, sudden cardiac arrest, progressive diseases, and loss of the ability to speak, hear, and/or see.

Critical illness insurance provides a lump-sum payment that can be used to cover various expenses, including medical costs not covered by traditional insurance, transportation, childcare, and daily living expenses.