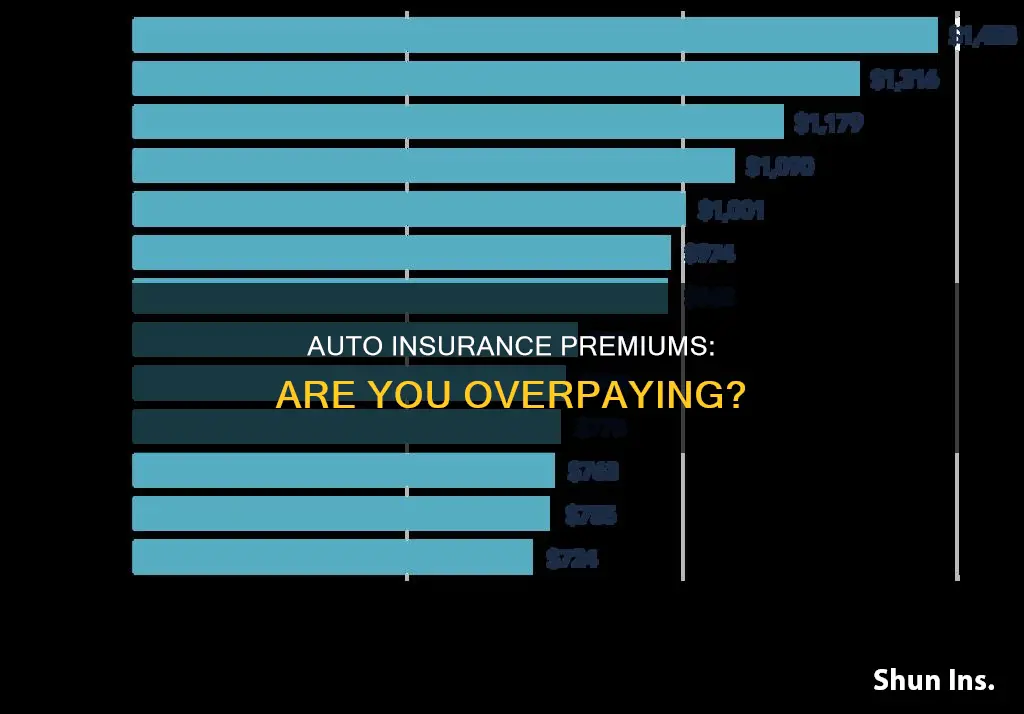

There are a multitude of factors that determine the cost of auto insurance. Some of these factors are controllable, such as the type of car you drive and how much coverage you buy, while others are not, such as your age or inflation. Poor credit, accidents, and violations can significantly raise your rates in many states. The area you live in can also be a reason for high insurance costs, as densely populated areas have higher rates of accidents, traffic violations, and theft. Additionally, insurance companies may view you as a high-risk driver if you have a history of at-fault accidents or moving violations, which will result in higher rates.

| Characteristics | Values |

|---|---|

| Age | Younger and older drivers tend to pay higher insurance premiums. |

| Gender | Men pay more than women. |

| Marital Status | Married people pay less than single people. |

| Education | People with lower education levels pay more. |

| Occupation | People with certain occupations pay more. |

| Credit Score | Poor credit score results in higher insurance rates. |

| Homeownership | Homeowners pay less than non-homeowners. |

| Driving Record | Accidents, violations, and claims increase insurance rates. |

| Location | Insurance rates vary by state, metro, and ZIP code. |

| Vehicle Type | Expensive, luxury, and sports cars are more expensive to insure. |

| Insurance Company | Rates differ by insurance company. |

| Coverage Level | Higher coverage levels result in higher insurance rates. |

| Deductible | Higher deductibles lead to lower insurance rates. |

What You'll Learn

- Your personal characteristics, such as age, gender, marital status, education level, occupation, and credit score

- Your insurance choices, including the company, coverage, and deductible you select

- Your driving history, including accidents, violations, and claims

- Your vehicle, including its make, model, safety features, and repair costs

- Your location, including state, ZIP code, and whether you live in an urban or rural area

Your personal characteristics, such as age, gender, marital status, education level, occupation, and credit score

Several personal characteristics can influence auto insurance rates. Here's how:

Age

Age is a significant factor in determining auto insurance rates. Younger drivers, especially teenagers, are considered higher-risk due to their lack of driving experience. As a result, they often pay higher premiums. For example, an 18-year-old driver typically pays more than double the annual full-coverage premium of a 25-year-old. Elderly drivers, especially those over 80, may also face higher rates due to increased accident risks. However, it's important to note that some states, like Hawaii and Massachusetts, do not allow age to be used as a rating factor, ensuring that drivers of different ages pay similar rates if other factors are identical.

Gender

In most states, insurance companies can consider gender when setting rates. While men and women generally pay similar amounts as adult drivers, younger men tend to pay more than their female counterparts due to higher accident risks and claims. However, the price difference between genders decreases as drivers age.

Marital Status

Marital status also impacts auto insurance rates. Married drivers are often viewed as more financially stable and safer, resulting in lower premiums. On average, a married driver pays $96 less per year than a single, widowed, or divorced driver. This is because married individuals are often homeowners, bundle their policies, cover multiple vehicles, and insure more than one driver, reducing their risk profile.

Education Level

Education level can also influence auto insurance rates. Insurance companies have found that more educated drivers tend to file fewer claims and exhibit safer driving behaviours. As a result, individuals with higher education levels, such as college degrees or advanced degrees, often benefit from lower premiums. Conversely, those with lower educational attainment may be deemed high-risk and face higher rates.

Occupation

Your occupation can impact your auto insurance rates as it relates to vehicle usage and stress levels. Certain occupations are considered higher-risk due to irregular work hours or travel requirements. For example, a truck driver may have higher rates due to the amount of time spent on the road. Additionally, individuals with long commutes tend to pay more for their coverage. On the other hand, occupations that require attention to detail and have a lower likelihood of accidents, such as teachers, nurses, and engineers, often benefit from lower insurance rates.

Credit Score

Insurers also consider your credit score when determining auto insurance rates. Those with lower credit scores are generally deemed higher-risk as they tend to file more claims. Improving your credit score can help lower your insurance premium, depending on your location and insurance company.

Capital One Loans: Gap Insurance Included?

You may want to see also

Your insurance choices, including the company, coverage, and deductible you select

Your insurance choices can have a significant impact on the cost of your auto insurance. Here are some factors to consider:

Company

The insurance company you choose can make a big difference in your rates. Different companies use different systems to calculate premiums, so you may find lower rates by shopping around and comparing quotes from multiple insurers. It's worth reviewing rates from different companies every year or so, as rates can change over time.

Coverage

The amount and type of coverage you choose will affect your premium. Full coverage, which includes collision and comprehensive insurance, costs more than minimum liability coverage. Collision coverage pays for repairs to your vehicle if you collide with another vehicle or object, while comprehensive coverage protects against other types of damage, such as vandalism, theft, or natural disasters. You can also add optional riders, such as rental reimbursement or emergency road service, which will increase your premium.

Deductible

Your deductible is the amount you pay out of pocket before your insurance company covers the rest. A higher deductible will result in a lower premium, but keep in mind that you'll need to be able to afford the higher out-of-pocket cost if you have an accident. A lower deductible means a higher premium, but you'll pay less if you need to make a claim.

Auto Insurance Company Lawyers: Friend or Foe?

You may want to see also

Your driving history, including accidents, violations, and claims

Your driving history is one of the most important factors that affect your auto insurance premium. A history of accidents, traffic violations, and claims will likely result in higher insurance rates. Insurance companies consider you a high-risk driver if you have a record of at-fault accidents, speeding tickets, or driving under the influence (DUI) violations. These factors indicate a higher probability of future accidents and insurance claims, leading to increased rates. The impact of violations and accidents on your insurance rates can vary depending on their severity and your state's laws. For example, a DUI conviction may stay on your record for up to a decade in some states, while a speeding ticket may only remain for three years.

The presence of multiple accidents or traffic infractions on your record suggests a higher likelihood of similar issues in the future, increasing the insurer's liability. Consequently, insurance companies may deem you too risky to insure or charge higher rates to compensate for potential claims payouts.

It's important to note that insurance companies typically review your driving record when you initially apply for auto insurance and before each renewal period. They assess your driving history, including moving violations and accidents, to determine your risk level and calculate your premium.

To reduce the impact of your driving history on your insurance rates, consider improving your driving record over time by avoiding accidents and violations. You can also shop around for insurance providers who offer better rates for drivers with a history of claims or violations. Additionally, taking a defensive driving course or increasing your deductible may help lower your insurance premium.

Uncovering the Secrets: Auto Insurance Companies' Strategies to Identify Potential Operators

You may want to see also

Your vehicle, including its make, model, safety features, and repair costs

The make, model, safety features, and repair costs of your vehicle all influence your auto insurance rate.

The type of car you drive plays a significant role in setting your car insurance rate. Insurance companies look at past claims from similar models and evaluate repair costs, theft rates, and payments made for comprehensive claims. Luxury vehicles with new technology and advanced safety features cost more to repair or replace, so they typically cost more to insure. Cars with racing-spec engines, an array of high-tech features, or a luxury price tag will also be more expensive to insure.

The brand of the vehicle also affects your auto insurance premium. For example, according to Quadrant Information Services, Dodge has the highest car insurance costs on average, while Mazda has the lowest.

The age of your car also matters. In general, newer, more expensive vehicles will cost more to insure than older base-model vehicles with a lot of miles.

Vehicles such as sports cars are considered higher risk due to their association with racing, so insurance for these vehicles will be more expensive than vehicles such as minivans.

Cars with extra features like lane sensors, backup cameras, and high-end audio can cost more to repair and therefore more to insure than base models of the same vehicle. Moving to a higher trim level typically raises not just the price of the car but also the insurance premium.

Vehicles with a strong safety record and good safety equipment often qualify for discounts. On the other hand, some safety features can lead to higher premiums because high-tech safety equipment can be expensive to repair or replace after an accident.

DIY Auto Repairs: Is it Worth the Risk?

You may want to see also

Your location, including state, ZIP code, and whether you live in an urban or rural area

Your location is a significant factor in determining your auto insurance premium. The state, city, and ZIP code you reside in can either increase or decrease your insurance rate. Here's how:

Claims Frequency in Your Area

Insurance companies may designate your neighbourhood as high risk if people in your ZIP code file numerous auto insurance claims. To offset potential costs, insurers will typically quote higher premiums in that ZIP code. Higher population density means a higher likelihood of car accidents, so urban areas tend to have higher insurance rates than rural areas.

Weather Conditions

Harsh weather, such as heavy rain, hail, snow, or flooding, can increase the probability of accidents. If you live in an area prone to such weather conditions, your premium may be higher to offset the potential costs for insurance companies.

Crime Rate

If you live in an area with frequent incidents of vandalism or auto theft, your insurance company will likely take this into account when calculating your rate. High crime rates often lead to higher insurance claims and, subsequently, higher premiums.

Road Conditions and Infrastructure

Poorly maintained roads, dangerous intersections, or ill-designed roadways can increase the likelihood of accidents. As a result, insurance companies may charge higher premiums in areas with subpar road infrastructure.

State Minimum Coverage Requirements

States with higher minimum-coverage car insurance requirements tend to have higher premiums. For example, Michigan's minimum coverage requirements include personal injury protection of up to $250,000 and personal property insurance of up to $1,000,000. In contrast, Wisconsin has lower minimum requirements, resulting in cheaper car insurance for its residents.

Unemployment Rate

In areas with high unemployment, some people may choose to drive without insurance due to financial constraints. This can lead to higher rates for those who do carry insurance, as insurance companies need to compensate for the increased risk of uninsured drivers on the road.

Get Licensed to Sell Auto Insurance: A Step-by-Step Guide

You may want to see also

Frequently asked questions

There are many factors that can influence the price you pay for auto insurance. These include your demographics, driving behaviour, the type of vehicle you drive, and your location.

Although dozens of factors go into your final insurance premium, these are among the most important:

- Your driving history

- Your credit history (in most states)

- The coverage and deductibles you choose

Here are some ways to lower your premium costs:

- Choose the right car: Research insurance costs for the models you are considering before purchasing your next car.

- Take driving courses and drive carefully: Staying accident- and ticket-free will help keep your car insurance rates low.

- Compare multiple auto insurance quotes: Each insurer has its own formula for setting rates, so it's possible to find a car insurance company that will charge you less than your current insurer.