Term life insurance is a simple and cost-effective way to provide a financial safety net for your loved ones. It is a type of life insurance that covers a set period, typically 10 to 30 years, and pays out a death benefit if the insured person passes away during that time. Term life insurance is generally the most affordable option, especially for young and healthy individuals, as it does not build cash value and only offers temporary coverage. However, it may not be suitable for those seeking lifelong coverage or wanting to accumulate cash value through their policy. Whole life insurance, on the other hand, tends to be significantly more expensive but offers permanent coverage and the ability to build cash value.

| Characteristics | Values |

|---|---|

| Cost | Cheaper than whole life insurance |

| Coverage | Covers a set period of time |

| Cash value | No cash value |

| Premium | Premium stays the same during the level term period |

| Renewal | Renewal rates can be unaffordable |

| Death benefit | Guaranteed death benefit amount |

| Investment | Not a good investment option |

What You'll Learn

Term life insurance is the most affordable option

Term life insurance is significantly cheaper than whole life insurance because it is temporary and does not build cash value. The premiums for term life insurance are based on the policy's value, the insured person's age, gender, and health, as well as the insurance company's business expenses and investment earnings. The absence of a cash value component in term life insurance makes it a more affordable option.

Term life insurance provides financial protection during the period when individuals have significant financial obligations, such as a mortgage or funding their children's education. It is also a good option for those who want coverage for specific financial concerns, such as a mortgage. Additionally, term life insurance offers locked-in rates for the duration of the policy, making it a cost-effective choice.

The simplicity and affordability of term life insurance make it a popular choice for individuals seeking financial security for their families. It is essential to consider one's financial obligations and budget when deciding between term and whole life insurance.

Life Insurance and IRS Levy: What You Need to Know

You may want to see also

It provides coverage for a set number of years

Term life insurance is a contract that lasts for a set period of time, usually between 10 to 30 years. It provides coverage for a specified term, and if the insured person dies during this period, the insurance company pays out a death benefit to the policyholder's beneficiaries. The length of the term is an important consideration when purchasing term life insurance, as it should match the financial obligation being covered. For example, new parents might opt for a 20-year policy to cover them until their child is financially independent.

Term life insurance offers locked-in rates for the duration of the policy, making it a good option for those seeking affordable coverage for a specific period. The premiums and death benefits remain the same throughout the term, making it easy to plan budgets. However, if coverage is still needed after the term ends, renewal rates can be unaffordable.

Term life insurance is the most affordable type of life insurance as it offers temporary coverage without building cash value. It is a good option for those who want to provide a financial safety net for their loved ones for a set number of years. It is also well-suited for people with growing families, as it offers the necessary coverage until children reach adulthood.

Compared to whole life insurance, term life insurance is significantly more affordable. Whole life insurance offers lifelong coverage and includes a cash value component that grows over time, making it a more expensive option.

Whole Life Insurance: Do Payouts Decrease as We Age?

You may want to see also

It has no cash value

Term life insurance is a temporary contract between an individual and a life insurance company. It is designed for the sole purpose of providing a death benefit payout to the insured's beneficiaries if the insured person dies during the specified term. This means that term life insurance policies have no value other than the guaranteed death benefit and do not feature a savings component. In other words, term life insurance does not offer any cash benefits before the policyholder's death. There is no refund if you cancel or outlive a term life policy.

Term life insurance is often the cheapest form of life insurance because it does not offer a cash value component and has an expiration date. The absence of a cash value component means that term life insurance is a simple and affordable option for individuals seeking life insurance. However, it is important to note that term life insurance premiums are based on factors such as age, health, and life expectancy, and these premiums increase with age.

In contrast, permanent life insurance policies, such as whole life insurance, universal life insurance, and variable life insurance, offer a cash value component. These policies are significantly more expensive than term life insurance because they provide both a death benefit and a savings-like account that grows over time. Part of the premiums paid towards permanent life insurance policies is allocated to a separate cash value account, which accumulates tax-deferred over the life of the policy. This cash value can be accessed by the policyholder during their lifetime through loans or withdrawals, providing additional financial flexibility.

While term life insurance does not offer a cash value component, it is important to weigh the benefits of both term and permanent life insurance options to determine which best suits an individual's needs and financial circumstances.

Life Insurance Cash Redemption: What's the Real Deal?

You may want to see also

It is a good option for those with young children

Term life insurance is a good option for those with young children as it is affordable, simple, and provides a financial safety net for your loved ones. It is a straightforward type of insurance that offers coverage for a specific period, usually between 10 to 30 years. During this time, if you pass away, your beneficiaries will receive a payout, also known as a death benefit. This benefit is typically income tax-free and can be used to cover expenses such as funeral costs, mortgage payments, or college tuition for your children.

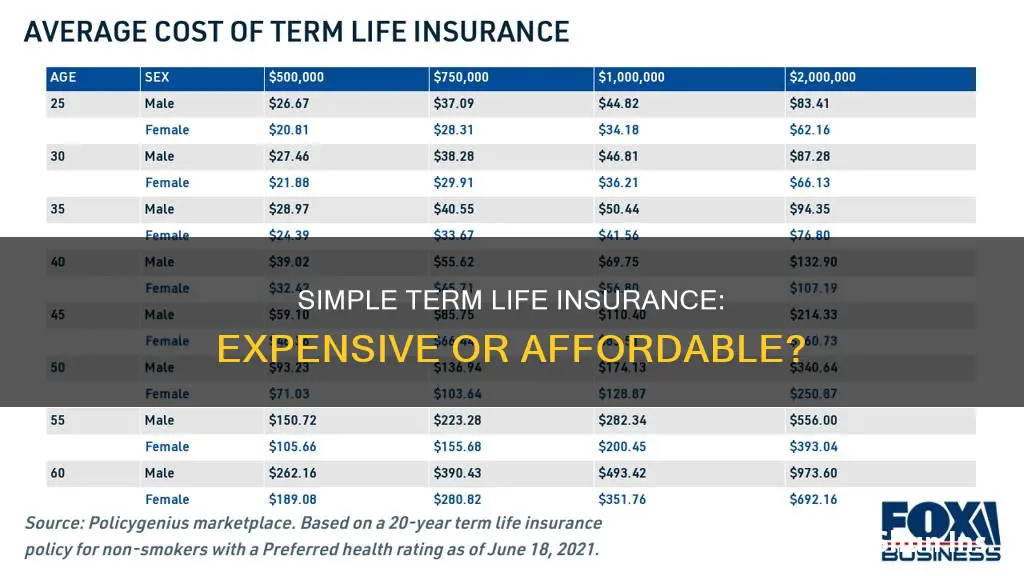

Term life insurance is particularly attractive to young parents as it provides substantial coverage at a low cost. For example, a 30-year-old non-smoking female in good health can expect to pay around $22 per month for a 20-year term life insurance policy with a $500,000 payout. This makes it an affordable option for those with young families who want to ensure their children are financially protected in the event of their death.

Another advantage of term life insurance is its simplicity. It is easy to manage and understand, without the complex tax implications and restrictions that come with permanent life insurance options. Most term life policies have level premiums and death benefits, meaning your premium payments and the payout amount remain the same throughout the duration of the policy. This makes it easy to plan your budget and provides stability for your family.

Additionally, term life insurance offers flexibility. You can choose the length of coverage based on your specific needs. For instance, you can opt for a 20 or 25-year term to cover you until your children are through college and financially independent. This flexibility ensures that you only pay for life insurance while you need it and can adjust the term length according to your family's changing needs.

While term life insurance does have an expiration date, and you will need to renew it at a higher premium or purchase a new policy, it is still a good option for those with young children. It provides the necessary coverage during the years when your family is most dependent on your income and offers peace of mind at a reasonable cost.

Flex Term Rider: Enhancing Your Life Insurance Coverage

You may want to see also

It is best suited for those who want simple, straightforward coverage

Term life insurance is a good option for those who want simple, straightforward coverage. It is a contract that lasts for a set period of time, typically between 10 and 30 years, and then it expires. It is simple and straightforward because it has no cash value, no payout after the term expires, and no value other than a death benefit. If the insured person dies during the specified term, the policyholder's beneficiaries will receive a guaranteed death benefit. This benefit is usually tax-free and can be used by the beneficiaries to settle the deceased's debts, funeral costs, and other expenses.

Term life insurance is also easy to manage and understand. Unlike permanent life insurance, it does not have any complex tax implications or restrictions. It simply provides financial protection during a period when you may have major financial obligations, such as a mortgage or funding your children's education.

Additionally, term life insurance is more affordable than permanent life insurance. It is usually the least costly option available because it offers a death benefit for a restricted time and doesn't have a cash value component. For example, a healthy, non-smoking 30-year-old man could get a 30-year term life insurance policy with a $250,000 death benefit for an average of $18 per month.

Term life insurance is well-suited for those who want simple and straightforward coverage because it provides a guaranteed death benefit without any complex features or high costs. It is easy to understand and manage, and it offers financial protection during the period when it is most needed.

Transamerica Life Insurance: Understanding the Cash Value Component

You may want to see also

Frequently asked questions

Term life insurance is a policy that lasts a set term — usually between 10 and 30 years. Whole life insurance, on the other hand, is intended to last a lifetime and has an added cash value component that earns interest over time.

Term life insurance is affordable, easy to manage and understand, and provides coverage when you need it the most, such as when you have major financial obligations to meet. However, term life insurance has an expiration date, and does not have a cash value savings component.

Anyone looking for an affordable, simple, and flexible way to offer their loved ones a financial safety net for a set period of time in the event of their death should consider buying term life insurance. This includes newlyweds, married couples, parents, guardians, people planning on having children, and homeowners with a mortgage or other significant debt.

The cost of term life insurance depends on factors such as age, gender, health, coverage amount, and term length. For example, a 30-year-old non-smoking female in good health can expect to pay $22 per month for a 20-year term life insurance policy with a $500,000 payout.