Simplified issue life insurance is a type of life insurance that offers quick approvals and low qualification requirements. Unlike traditional life insurance policies, it does not require a medical exam. Instead, applicants are only required to fill out a basic health questionnaire. While this type of insurance is convenient and ideal for those with underlying health issues, it tends to be more expensive than traditional life insurance policies and offers lower coverage amounts.

| Characteristics | Values |

|---|---|

| Medical exam required | No |

| Health questionnaire required | Yes |

| Application process length | Shorter |

| Cost | More expensive |

| Coverage amounts | Lower |

| Approval time | Faster |

| Coverage start time | Immediate |

| Death benefit | Lower |

| Premium | Higher |

What You'll Learn

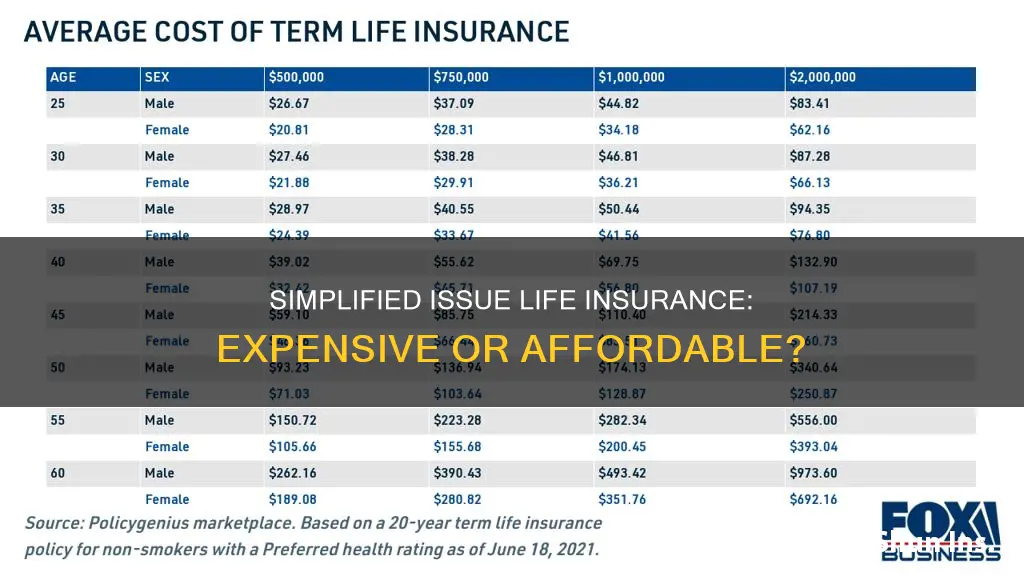

Simplified issue life insurance is more expensive than traditional policies

Simplified issue life insurance is a type of life insurance that does not require a medical examination. Instead, applicants are only required to fill out a basic health questionnaire. This makes it a good option for those with serious health issues or those who dislike medical examinations. However, simplified issue life insurance is more expensive than traditional policies.

Simplified issue life insurance is designed for those who don't qualify for traditional life insurance due to their health or age. The application process is simple and typically only involves answering a few health-related questions. There is no medical exam, making the process faster and more convenient for the applicant. The underwriting process is relatively simple, and approval can often be obtained swiftly, usually within days.

While simplified issue life insurance offers a quicker and more convenient way to obtain life insurance, it comes at a higher cost. The premiums for simplified issue life insurance are higher than those for traditional policies. This is because insurers are taking on more risk by not having comprehensive medical information about the applicant. The increased risk is reflected in the higher premiums charged for simplified issue life insurance.

In addition to higher premiums, simplified issue life insurance policies also tend to have lower coverage amounts compared to traditional policies. The coverage amounts for simplified issue life insurance typically start at $2,000 and rarely exceed $100,000, while traditional policies can provide coverage in the hundreds of thousands or even millions. This lower coverage amount is another factor that makes simplified issue life insurance more expensive relative to traditional policies.

Overall, simplified issue life insurance is a good option for those who need life insurance quickly and may not qualify for traditional policies due to health or age factors. However, it is important to consider the higher premiums and lower coverage amounts associated with simplified issue life insurance when deciding if it is the right choice for your needs.

Christians and Life Insurance: Gospel Coalition's Perspective

You may want to see also

It offers lower coverage amounts

Simplified issue life insurance policies offer lower coverage amounts than traditional policies, with death benefits ranging from $2,000 to $100,000, and occasionally up to $500,000. In contrast, traditional policies can provide coverage in the hundreds of thousands or even millions.

The lower coverage amounts of simplified issue life insurance policies are due to the limited information insurers have about applicants. Without a medical exam, insurers consider applicants higher risk, so they offset this risk by offering lower coverage amounts.

The maximum death benefit for a simplified issue term policy is typically between $100,000 and $250,000, while simplified issue whole life insurance policies have maximum death benefits between $25,000 and $50,000. These policies are designed for burial and other final expenses, so they offer lower death benefits.

While simplified issue life insurance policies offer lower coverage amounts, they are a good option for individuals who may not qualify for traditional policies due to health issues or dangerous occupations. They are also ideal for those who need immediate coverage, as the approval process is faster than traditional policies.

Uncovering Your Husband's Life Insurance: A Widow's Guide

You may want to see also

It's a good option for those with serious health issues

Simplified issue life insurance is a good option for those with serious health issues for several reasons. Firstly, it does not require a medical exam, which can be a barrier for people with health complications. Instead, applicants fill out a short health questionnaire, making it easier to get approved. The approval process is also much faster than traditional insurance policies, with applicants typically receiving a decision within 48 hours, and sometimes even instantly. This quick approval process ensures that individuals with serious health issues can get the coverage they need without delay.

Another benefit of simplified issue life insurance is that it provides a middle ground between traditional and guaranteed issue life insurance. While traditional insurance policies may offer higher coverage amounts, they also have more stringent requirements and a longer application process. On the other hand, guaranteed issue life insurance has no medical requirements and guarantees coverage, but it is more expensive and has lower coverage amounts. Simplified issue life insurance strikes a balance by offering higher coverage amounts and lower premiums than guaranteed issue policies, while still being more accessible than traditional policies for those with health issues.

Additionally, simplified issue life insurance is ideal for those who want to avoid a rigorous medical exam or don't have time to go through the lengthy traditional insurance application process. The application only involves answering a few health-related questions, and coverage can begin immediately upon approval. This makes it a good option for individuals with serious health issues who need coverage right away.

However, it is important to note that simplified issue life insurance typically has higher premiums and lower coverage amounts compared to traditional policies. The cost of simplified issue life insurance depends on factors such as age and health, and it may not be the most cost-effective option for young, healthy individuals. Nevertheless, for those with serious health issues, the benefits of simplified issue life insurance may outweigh the higher costs.

Retiree Benefits: Understanding NEA's Complimentary Life Insurance Offer

You may want to see also

It's ideal for those who don't like medical exams

Simplified issue life insurance is ideal for those who don't like medical exams. The application process is quick and simple, and coverage can begin immediately upon approval. This type of policy is perfect for those who want to avoid a lengthy medical exam or who are concerned about underlying health issues affecting their premiums or eligibility.

Instead of a medical exam, applicants fill out a basic health questionnaire. This typically involves answering a handful of health-related questions, and some insurers may follow up with a phone call to gather more information. It's important to answer the questionnaire truthfully, as failing to disclose a condition could result in the insurance company denying the payment of death benefits to beneficiaries.

Simplified issue life insurance is also a good option for those in dangerous occupations or high-risk hobbies, as many policies don't require applicants to answer questions about their profession or activities. Additionally, it can be a faster way to obtain coverage for those in poor health who may not qualify for traditional policies.

While simplified issue life insurance offers convenience and quicker approval times, it's important to note that it generally comes with higher premiums and lower coverage amounts compared to traditional policies. The lack of a medical exam means the insurer is taking on more risk, resulting in higher costs for the policyholder.

Life Insurance Exam: How Many Questions for North Carolina?

You may want to see also

It's a faster way to get coverage than full underwriting

Simplified issue life insurance is a faster way to get coverage than full underwriting. The application process is quicker and simpler, and coverage can begin immediately.

The simplified issue application process does not require a medical exam. Instead, applicants answer a handful of health-related questions and provide basic information such as age, address, occupation, height, and weight. This makes the application process faster and less invasive, especially for those with health issues or needle phobia.

Approval for simplified issue life insurance is also faster than traditional underwriting. With simplified issue, applicants can receive approval within minutes to days, compared to weeks or months for full underwriting. This makes simplified issue life insurance ideal for those who need immediate coverage or are in poor health.

However, the trade-off for faster coverage is higher premiums and lower coverage amounts. Simplified issue life insurance is generally more expensive than traditional life insurance because insurers have less information to assess the applicant's health risk. The coverage amounts are also typically lower, ranging from $2,000 to $100,000, while traditional policies can provide coverage in the hundreds of thousands or even millions.

Employer's Right to Cancel Group Life Insurance: Explained

You may want to see also

Frequently asked questions

Simplified issue life insurance is a type of life insurance that does not require a medical exam. Instead, applicants fill out a health questionnaire and provide basic information such as age, address, occupation, height and weight.

Simplified issue life insurance is more expensive than traditional life insurance because insurers have limited information about applicants and therefore view them as higher risk. As a result, insurers charge higher premiums to offset this risk.

Simplified issue life insurance is ideal for those who need coverage immediately and don't want to undergo a medical exam. It is also an option for people with serious health issues or dangerous jobs who may not qualify for traditional life insurance.