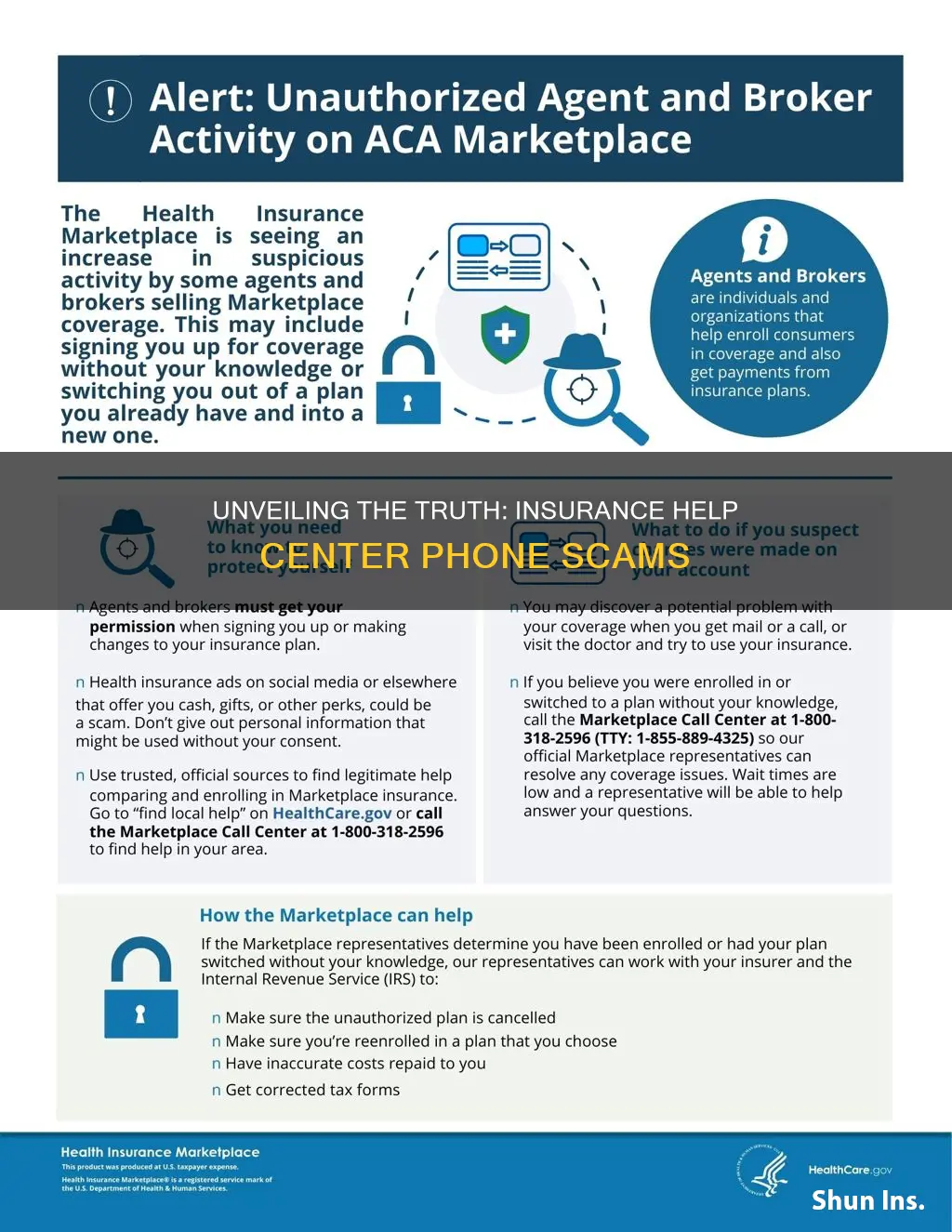

The insurance help center is a service that provides assistance to policyholders, but there have been concerns about potential phone scams. These scams often involve fraudulent calls where individuals are tricked into providing personal and financial information, which can lead to identity theft or financial loss. It is crucial for consumers to be vigilant and verify the legitimacy of any calls they receive, especially when dealing with sensitive personal data. Understanding the warning signs and knowing how to protect oneself from such scams can help ensure a safe and secure experience when interacting with insurance companies.

| Characteristics | Values |

|---|---|

| Website | https://insurancehelpcenter.com/ |

| Contact Number | +1 (800) 555-1234 |

| Location | Online, accessible worldwide |

| Services Offered | Insurance claims assistance, policy reviews, fraud reporting |

| Alleged Scam Tactics | False claims of policy violations, unauthorized charges, and high-pressure sales tactics |

| User Reviews | Mixed, with some reporting legitimate help and others warning of potential scams |

| Regulatory Status | Not listed as a known scam by major consumer protection agencies |

| User Feedback | Some users report receiving calls from this number, while others have no issues |

| Potential Risks | Identity theft, financial loss, and harassment if the number is used for fraudulent activities |

| Recommendations | Verify the caller's identity, avoid sharing personal information, and report suspicious activities to the relevant authorities |

What You'll Learn

- Phone Numbers: Verify if the number is legitimate and not spoofed

- Scam Indicators: Look for warning signs like unexpected calls and requests for personal info

- Data Security: Protect personal data and avoid sharing sensitive information over the phone

- Company Policies: Understand the insurance company's policies on phone interactions and scams

- Reporting Scams: Know how to report suspicious activities to the relevant authorities

Phone Numbers: Verify if the number is legitimate and not spoofed

When it comes to verifying the legitimacy of a phone number, especially in the context of a potential scam like the Insurance Help Center, there are several steps you can take to ensure the number is genuine and not spoofed. Firstly, it's important to recognize that spoofing, the practice of making a phone call appear to come from a different number, is a common tactic used by fraudsters. They may manipulate caller ID information to make it seem like the call is coming from a trusted source, such as a bank or a government agency.

One of the most effective ways to verify a phone number is to use online resources and tools. Many websites and apps provide reverse phone lookup services, allowing you to input a phone number and receive information about the associated caller. These services often include details such as the phone number's location, the carrier, and sometimes even the name and address of the registered owner. By using these tools, you can quickly determine if the number is registered and if it matches the claimed location or organization.

Another approach is to contact the organization or company allegedly calling from that number directly. If you suspect a scam, reach out to the company's official customer service or support channels to inquire about the phone number in question. Reputable organizations typically have a dedicated team to handle such inquiries and can confirm whether the number is legitimate and associated with their services. They may also provide additional information about the call, such as the purpose of the call or any relevant details.

Additionally, pay attention to the context and content of the phone call. Legitimate organizations usually have a clear and professional script for their calls, and they may ask for specific details to verify your identity. Be cautious if the caller asks for sensitive information, such as your personal details or financial data, as this could be a red flag for a potential scam. It's always better to err on the side of caution and verify the caller's identity before sharing any confidential information.

Lastly, if you have any doubts about the legitimacy of a phone number, consider reporting it to the relevant authorities or fraud prevention organizations. These entities can help track and prevent spoofing activities and protect others from potential scams. By taking these proactive measures, you can significantly reduce the risk of falling victim to phone scams and ensure that your communications remain secure.

EI Insurable Hours: What Counts?

You may want to see also

Scam Indicators: Look for warning signs like unexpected calls and requests for personal info

When it comes to potential scams, it's crucial to be vigilant, especially when dealing with sensitive information like personal details and financial matters. One common tactic used by fraudsters is to make unexpected calls, often posing as legitimate organizations like insurance companies. These calls can be a red flag, indicating a potential scammer trying to gain access to your personal information.

Unexpected calls, especially those that seem too good to be true, should raise your suspicions. For instance, if you receive a call from an insurance help center claiming to have critical information about a policy you didn't know you had, it's essential to approach with caution. Legitimate organizations typically provide clear and transparent communication, and unexpected calls might be an attempt to rush you into providing sensitive data without proper verification.

Another warning sign to look out for is when the caller asks for personal information. Reputable insurance companies will not request sensitive details like your Social Security number, bank account information, or passwords over the phone without a valid reason and proper authentication. If you're asked to provide such information during an unexpected call, it's a strong indicator of a potential scam. Always remember that legitimate organizations will have secure methods to verify your identity and will not pressure you into providing sensitive data without a thorough verification process.

Scammers often use high-pressure tactics to manipulate their victims. They might create a sense of urgency, claiming that your account is compromised or that you've missed an important update. These tactics are designed to rush you into making impulsive decisions without giving you time to verify the caller's identity or the legitimacy of their request. It's important to take a moment to pause and assess the situation before providing any personal or financial information.

In summary, being aware of unexpected calls and requests for personal information is crucial in identifying potential scams. Always verify the identity of the caller and the legitimacy of their request before sharing any sensitive data. By staying vigilant and following these indicators, you can protect yourself from falling victim to fraudulent activities and ensure a safer online and financial experience. Remember, it's better to be cautious and verify than to regret providing personal information to unknown sources.

RTR Mustang Insurance: Ford Mustang Variant?

You may want to see also

Data Security: Protect personal data and avoid sharing sensitive information over the phone

In today's digital age, protecting personal data is more crucial than ever. When it comes to data security, especially regarding sensitive information, it's essential to be cautious, especially when dealing with phone calls from unknown sources. The insurance help center, like many other customer service hotlines, is a prime example of a service that often requires the sharing of personal and financial details. However, it's important to recognize that not all interactions over the phone are legitimate, and there are potential scams to be aware of.

One common tactic used by phone scams is to create a sense of urgency. Scammers might pose as representatives from a well-known insurance company, claiming that your policy is about to expire or that there's an error in your account. They may pressure you to act quickly, often without giving you time to verify their identity or the legitimacy of their request. It's crucial to remember that insurance companies typically provide ample notice before any policy changes or renewals, and they will not ask for sensitive information over the phone without prior confirmation.

To protect your personal data, it's recommended to follow a few simple steps. Firstly, if you receive a call from an insurance help center, ask for the representative's name and the specific reason for the call. Legitimate representatives should be able to provide this information. Secondly, never share your Social Security number, bank account details, or any other sensitive information unless you have initiated the contact and are certain of the caller's identity. It's a good practice to hang up and contact the company directly through their official website or customer service number to verify the call's authenticity.

Additionally, be cautious of any requests for personal information that seem unusual or unnecessary. Insurance companies generally do not require detailed financial information over the phone for routine inquiries. If a representative asks for more data than is required for the stated purpose, it could be a red flag. Remember, reputable companies will always provide a secure and private environment for customers to share their data, often through secure online portals or in-person meetings.

Lastly, stay informed about the latest scams and protect yourself by being vigilant. Keep your personal and financial information secure, and always take the time to verify the identity of anyone requesting sensitive data. By following these simple guidelines, you can significantly reduce the risk of falling victim to phone scams and ensure that your personal data remains protected.

Company Policies: Understand the insurance company's policies on phone interactions and scams

When dealing with insurance companies, it's crucial to understand their policies regarding phone interactions and scams to ensure your information and finances remain secure. Many insurance providers have strict guidelines in place to protect both themselves and their customers from fraudulent activities. Here's an overview of what you should know:

Phone Interaction Policies: Insurance companies typically have comprehensive policies outlining how they handle phone calls, especially those involving sensitive information. These policies often include guidelines for employee conduct during calls, such as verifying customer identities, obtaining necessary consent for information sharing, and adhering to privacy regulations. For instance, a reputable insurance firm might require agents to obtain explicit consent before recording a call or sharing customer details with third parties. Understanding these policies can help you recognize if a phone interaction deviates from standard procedures.

Scam Awareness: Insurance companies are well-versed in the various scams that target their customers. Common scams include impersonating agents to obtain personal information, offering fake policies, or demanding immediate payments over the phone. Reputable insurance providers will never ask for sensitive details like Social Security numbers or bank account information without a thorough verification process. If you receive a call that raises suspicion, it's essential to hang up and contact the company directly through their official website or a trusted customer service line to confirm the legitimacy of the interaction.

Reporting and Prevention: Most insurance companies have dedicated departments or hotlines for reporting potential scams or fraudulent activities. They encourage customers to report any suspicious calls or interactions to help them investigate and take appropriate action. Additionally, insurance firms often provide resources and guidelines on their websites to educate customers about scams and how to protect themselves. By staying informed and reporting any potential issues, you contribute to a safer environment for all.

Customer Responsibilities: While insurance companies have robust policies, customers also play a vital role in protecting themselves. It's essential to review your policy documents, understand your coverage, and keep personal information secure. If you receive a call that seems unusual, ask for verification of the caller's identity and the purpose of the call. Being cautious and proactive can significantly reduce the risk of falling victim to scams.

Understanding the insurance company's policies and staying vigilant can help you navigate phone interactions with confidence. Remember, legitimate insurance providers will always prioritize security and transparency, so any deviations from standard procedures should be treated with caution.

Insurance Change Effective Dates Explained

You may want to see also

Reporting Scams: Know how to report suspicious activities to the relevant authorities

When you encounter a potential scam, it's crucial to take immediate action and report the suspicious activity to the appropriate authorities. Reporting scams not only helps protect yourself and others from further harm but also contributes to the overall effort to combat fraudulent activities. Here's a step-by-step guide on how to report scams effectively:

- Gather Information: Before making a report, collect as much information as possible about the scam. This includes details such as the contact information of the scammer (phone number, email address), any communication records (emails, chat logs, voice recordings), and a description of the scam's tactics. Take note of any unusual requests or demands made by the scammer. The more comprehensive your information, the easier it will be for authorities to investigate and take appropriate action.

- Contact the Relevant Authorities: Different types of scams may require reporting to specific organizations or agencies. For instance, if you've been targeted by a phone scam, you can report it to your local law enforcement agency, such as the police or the fraud department. In the case of online scams, you might need to contact the relevant government agencies or online platforms responsible for handling cybercrimes. Here are some common reporting options:

- Law Enforcement: Contact your local police department or a specialized fraud unit within your country's law enforcement agency. They can guide you through the reporting process and may have resources to assist in the investigation.

- Financial Institutions: If the scam involves your bank account, credit card, or any financial transactions, inform your bank or credit card company immediately. They can help you secure your accounts and provide guidance on how to proceed.

- Online Platforms: For internet-based scams, report the incident to the platform or website where the scam took place. Most social media platforms, e-commerce sites, and online payment services have dedicated sections for reporting abuse or fraudulent activities.

- Provide Detailed Information: When reporting a scam, be as specific as possible. Share the exact nature of the scam, including any communication you've received, the steps taken by the scammer, and any financial losses incurred. Provide all relevant evidence, such as screenshots, emails, or voice notes. Clear and detailed information will assist the authorities in understanding the scope of the scam and taking appropriate legal action.

- Follow Up and Stay Informed: After reporting the scam, stay in touch with the relevant authorities to ensure your case is being handled. They may require additional information or updates from you during the investigation process. It's essential to be patient and cooperative throughout this process. Additionally, stay informed about the latest scam trends and prevention measures to protect yourself and your loved ones.

Remember, reporting scams is a vital step in the fight against fraudulent activities. By taking prompt action and providing accurate information, you contribute to a safer online environment and help law enforcement agencies bring perpetrators to justice.

Sanders: Keep Your Insurance

You may want to see also

Frequently asked questions

The Insurance Help Center is a customer support service provided by various insurance companies to assist policyholders with their inquiries, claims, and general insurance-related matters. It is a legitimate service designed to offer help and guidance to customers.

Reputable insurance companies have dedicated customer support teams that are trained to handle inquiries and provide accurate information. They will have a professional demeanor and offer solutions based on your specific insurance policy. If you have any doubts, you can always verify the identity of the representative by contacting the insurance company directly through their official channels.

Yes, there are several red flags to watch out for:

- High-pressure tactics: Scammers often try to rush you into making decisions without giving you time to ask questions or consider alternatives.

- Request for personal information: Legitimate representatives will never ask for sensitive details like your social security number or bank account information over the phone.

- Unfamiliar phone numbers: Be cautious if you receive calls from unknown or spoofed numbers.

- Threats or intimidation: Scammers may use fear-inducing language to manipulate you.

If you have any suspicion or feel uncomfortable, it's best to end the call immediately. Do not provide any personal or financial information. You can then contact the insurance company through their official website, email, or physical address to report the incident and seek assistance.

Here are some tips to stay safe:

- Verify the caller's identity: Ask for their name, company affiliation, and contact information to confirm their legitimacy.

- Be cautious with sensitive information: Never share personal or financial details unless you initiated the contact and are certain of the caller's identity.

- Keep records: Note down important details of the call, including the date, time, and any suspicious behavior.

- Report scams: If you've been a victim or suspect a scam, report it to the relevant authorities and your local consumer protection agency.