Ticket insurance is an optional add-on that can be purchased alongside tickets for live events, such as sports games and concerts. It provides coverage for unforeseen circumstances that may prevent the ticket holder from attending the event, such as illness, travel delays, or issues with employment. The cost of ticket insurance varies and is typically a small percentage of the ticket price, with some providers, like Allianz, charging a non-refundable fee. While ticket insurance offers peace of mind and protection for ticket buyers, it's important to carefully review the policy details and fine print, as not all situations are covered.

| Characteristics | Values |

|---|---|

| Purpose | Ticket insurance reimburses your ticket purchase if you can't attend an event for certain covered, unexpected reasons. |

| Cost | A small percentage of the ticket price. |

| Covered reasons | Serious unforeseen illness, injury, traffic accident, issues with your home or business, airline delays, termination of employment, etc. |

| Additional benefits | Access to the Allianz Global Assistance 24-hour assistance hotline for medical, legal, or travel-related emergencies. |

| Refund process | Upload proof of receipt and a signed letter from your employer explaining your absence. Wait several days for the claim decision. |

| Exclusions | Some events or festivals may not offer ticket insurance. |

| Alternatives | Reselling tickets on online marketplaces such as StubHub, TicketNetwork, or VividSeats. |

What You'll Learn

- Ticket insurance can cover the full cost of the ticket, taxes, fees and other event-related costs

- It can be purchased as an add-on when buying tickets to live events like sports games and concerts

- Ticket insurance may be the only option to receive a full refund on short notice

- Some credit cards offer exclusive event benefits, like pre-sales to concerts and sports games

- Ticket insurance is not always offered and is dependent on the venue and event

Ticket insurance can cover the full cost of the ticket, taxes, fees and other event-related costs

Ticket insurance is a type of protection that reimburses your ticket purchase if you can't attend an event for certain covered, unexpected reasons. It is offered as an add-on when purchasing tickets to live events such as sports games and concerts. Given the high cost of tickets for popular events, ticket insurance can be an attractive option for consumers.

Ticket insurance can cover the full cost of the ticket, including taxes, fees, and other event-related costs. For example, Ticketmaster's Event Ticket Protector, offered by Allianz Global Assistance, provides coverage for 100% of the ticket price, including taxes, convenience fees, and shipping charges. It also covers other eligible event-related items added to your order, such as parking.

The coverage provided by ticket insurance typically includes a range of unforeseen circumstances that may prevent attendance, such as serious illness or injury, traffic accidents, mechanical breakdown, airline delays, and issues with your home or business. This comprehensive coverage ensures that customers are protected in various situations and provides peace of mind when purchasing tickets for events.

While ticket insurance can be a valuable option, it is important to carefully review the terms and conditions before purchasing. Exclusions and limitations may apply, and certain situations may not be covered. Additionally, customers should consider their existing insurance policies to avoid overlap with their ticket insurance coverage. Nevertheless, ticket insurance can provide financial protection and flexibility for consumers, especially when attending high-demand events with expensive tickets.

How Much Does Family Auto Insurance Cost Monthly?

You may want to see also

It can be purchased as an add-on when buying tickets to live events like sports games and concerts

Ticket insurance is a type of protection that might reimburse your ticket purchase if you can't attend an event for certain covered, unexpected reasons. It can be purchased as an add-on when buying tickets to live events like sports games and concerts.

Ticketmaster, the world's largest ticket seller, offers Event Ticket Protector, an insurance service provided by Allianz Global Assistance. This insurance costs about 10% of the ticket price and can be purchased at checkout. Allianz Global Assistance also provides a 24-hour assistance hotline for medical, legal, or travel-related emergencies.

Event Ticket Protector covers a range of unforeseen circumstances, including serious illness, traffic accidents, issues with your home or business, airline delays, and even termination of employment. However, it's important to note that there are exclusions to the coverage, and certain situations may not be covered.

Purchasing ticket insurance can provide peace of mind, especially when considering the high cost of tickets for in-demand events. For example, the average price for an NFL ticket is about $84, and tickets for popular musicians can cost more than $100. With ticket insurance, you can rest assured that you will receive a refund if you are unable to attend the event due to covered reasons.

However, it's worth mentioning that claiming a refund through ticket insurance may not always be a straightforward process. In some cases, you may need to provide solid documentation and wait several days for a claim decision. Additionally, it is recommended to check your other insurance policies to avoid overlapping coverage with ticket insurance.

Georgia's Ticket Forwarding: Insurance Implications and You

You may want to see also

Ticket insurance may be the only option to receive a full refund on short notice

Ticket insurance is a type of protection that reimburses your ticket purchase if you can't attend an event for covered, unexpected reasons. Covered reasons include serious unforeseen illness, traffic accidents, issues with your home or business, airline delays, and even termination of employment. Ticket insurance is typically offered as an add-on when purchasing tickets to live events like sports games and concerts.

The cost of ticket insurance is usually a small percentage of the ticket price, and it can provide peace of mind in case unexpected circumstances prevent you from attending the event. It is important to note that not all ticket insurance policies are the same, and it may be a good idea to check your other insurance policies to see if there is any overlap with ticket insurance coverage. For example, some travel insurance policies may cover the cost of an event that you couldn't attend due to travel-related complications.

When deciding whether to purchase ticket insurance, it's essential to consider the likelihood of needing to cancel your attendance at the event. If you anticipate any potential issues that may arise, ticket insurance may be a worthwhile investment. On the other hand, if you are confident in your ability to attend the event and don't foresee any problems, the additional cost of ticket insurance may be unnecessary.

Overall, while ticket insurance may come with an additional cost, it can provide valuable peace of mind and ensure that you receive a full refund if you are unable to attend an event due to covered reasons.

College Degree: Friend or Foe on the Road?

You may want to see also

Some credit cards offer exclusive event benefits, like pre-sales to concerts and sports games

While ticket insurance is a great way to protect your investment in tickets, it is important to note that some credit cards offer exclusive event benefits, such as pre-sales to concerts and sports games. These benefits can include early access to tickets, special on-site perks, and the ability to upgrade experiences using reward points or miles.

For instance, Capital One offers several cards that provide early access to tickets, special perks at specific venues, and the ability to upgrade experiences using Capital One miles. Similarly, Chase offers its Chase Experiences to all cardholders, which include access to exclusive events and Chase Dining experiences, along with additional benefits at festivals and events like the U.S. Open.

American Express, or AmEx, also provides its cardholders with access to exclusive events and experiences. The Platinum Card from American Express, for example, offers access to Amex Centurion Lounges, Delta Sky Clubs, Lufthansa Lounges, and more. AmEx cardholders can also enjoy special seating at certain events through the American Express Preferred Seating program.

Other credit card issuers, such as Citi Entertainment and Wells Fargo, also offer their cardholders similar benefits, such as VIP access, preferred seating, and early access to ticket sales for concerts, sports games, and other exclusive events. These benefits can enhance the overall experience for cardholders and provide them with opportunities to attend sought-after events.

Therefore, while ticket insurance is a valuable option, considering credit cards with exclusive event benefits can also be a great way to secure early access to tickets and enhance your overall experience.

Get Auto Insurance for Your New Vehicle: A Step-by-Step Guide

You may want to see also

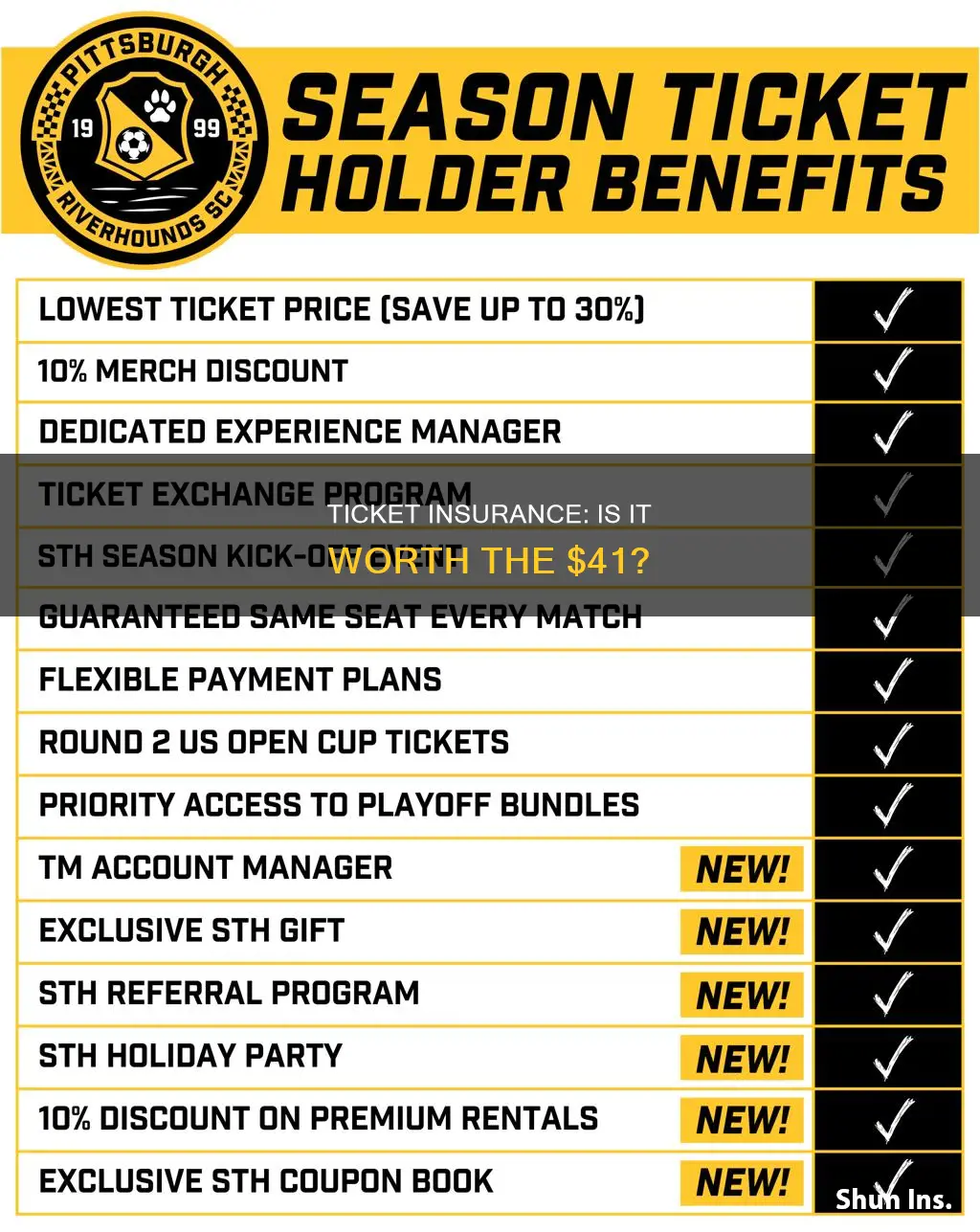

Ticket insurance is not always offered and is dependent on the venue and event

Ticket insurance is an optional extra offered by some ticket providers, such as Ticketmaster, to protect your investment in the event that you can't attend. It is not always offered and is dependent on the venue and event. For example, Ticketmaster offers Event Ticket Protector insurance, provided by Allianz Global Assistance, at the checkout for ticket purchases. This insurance service covers the ticket price, taxes, convenience fees, shipping charges, and other eligible event-related items, such as parking.

The availability of ticket insurance may depend on the location of the event and the laws in that state. For example, reselling tickets, or "scalping," may be prohibited by some state, local, or venue laws, which could impact the availability of ticket insurance.

Additionally, ticket insurance may not be offered for certain events or venues if there is a high risk of cancellation or delay. In such cases, the event organizer or venue may voluntarily issue refunds instead of offering ticket insurance.

It is worth noting that ticket insurance does not cover the cost of ticket purchases in the event of cancellation or delay by the venue or promoter. This means that ticket insurance is not always a guarantee of a refund, and it is important to carefully review the terms and conditions before purchasing.

Before purchasing ticket insurance, it is recommended to check your other insurance policies, such as travel insurance, as there may be areas of coverage that overlap with ticket insurance. Additionally, some credit cards offer exclusive event benefits, like early access to tickets and special perks at specific venues, which could provide an alternative way to protect your investment.

Stop-Gap Insurance: Filling the Gaps

You may want to see also

Frequently asked questions

Ticket insurance is a type of protection that might reimburse your ticket purchase if you can't attend an event for certain covered, unexpected reasons.

The cost of ticket insurance is usually a small percentage of the ticket price. For example, the Allianz Ticket Protector fee is non-refundable, and prices for tickets for Swift's Eras tour ran from $50 to $900 at face value.

Ticket insurance covers a range of unforeseen circumstances, including serious illness, travel delays, accidents, and issues with your home or business.

You can purchase ticket insurance as an add-on when buying tickets to live events. During checkout, you will usually be given the option to select 'yes' to insurance.