Tricare is a health insurance program provided by the federal government to active-duty and retired military personnel and their families. It is a health care program of the United States Department of Defense Military Health System. Tricare provides civilian health benefits for U.S. Armed Forces military personnel, retirees, and their dependents, including some members of the Reserve Component. It is managed by the Defense Health Agency under the leadership of the Assistant Secretary of Defense (Health Affairs).

| Characteristics | Values |

|---|---|

| What is Tricare? | A health insurance program provided by the federal government |

| Who is it for? | Active duty and retired military personnel and their family members |

| Who manages it? | The Defense Health Agency under the leadership of the Assistant Secretary of Defense (Health Affairs) |

| What does it cover? | Comprehensive coverage for medical necessities |

| How many plans are there? | 13 types of Tricare plans, with three types being compatible with an employer-based supplement |

| What are the three types of plans compatible with an employer-based supplement? | Tricare Prime, Tricare Select, and Tricare Retired Reserves (TRR) |

| How many people does it cover? | Over nine million individuals worldwide |

What You'll Learn

- TRICARE is a health insurance program provided by the federal government

- It covers active and retired military personnel, and their families

- There are 13 types of TRICARE plans, including Prime, Select, and TRR

- TRICARE is managed by the Defense Health Agency

- TRICARE for Life (TFL) is a program for Medicare-eligible retirees and their dependents

TRICARE is a health insurance program provided by the federal government

TRICARE covers over nine million individuals worldwide, including active-duty service members, retired military service members, members of the National Guard, their families, and the surviving dependents of military personnel who lost their lives. It offers comprehensive coverage to all beneficiaries, with most TRICARE health plans meeting the requirements for minimum essential coverage under the Affordable Care Act.

There are several types of TRICARE plans available, including TRICARE Prime, TRICARE Select, and TRICARE Retired Reserves (TRR). TRICARE Prime is a managed care option primarily offered to active-duty service members, while TRICARE Select is a fee-for-service option for non-active duty service members. TRR is similar to TRICARE Select but is exclusively for retired reserve and National Guard members not eligible for other TRICARE coverage.

TRICARE's comprehensive health coverage includes medical necessities, and additional benefits can be directly purchased, such as the TRICARE Retiree Dental Program for retired military personnel. Depending on the plan and the status of the enrollee, TRICARE often provides lower out-of-pocket costs compared to private health insurance, benefiting both the member and their dependents.

Haven Insurance: Understanding the Fine Print

You may want to see also

It covers active and retired military personnel, and their families

TRICARE is a health insurance program provided by the federal government to active-duty and retired military personnel and their families. It is a health care program of the United States Department of Defense Military Health System. It covers over nine million individuals worldwide, including active-duty service members, retired military service members, members of the National Guard, their families, and the surviving dependents of military personnel who lost their lives.

TRICARE provides comprehensive coverage to all beneficiaries, and most TRICARE health plans meet the requirements for minimum essential coverage under the Affordable Care Act. The program is managed by the Defense Health Agency under the leadership of the Assistant Secretary of Defense (Health Affairs).

Active-duty military personnel always have priority for care in military medical facilities. However, after World War II and the Korean War, access to care in military facilities became increasingly limited for military retirees and the dependents of both active-duty and retired military personnel due to resource constraints and growing demands on the system. To address this issue, Congress passed the Dependents Medical Care Act of 1956 and the Military Medical Benefits Amendments of 1966, which allowed the Secretary of Defense to contract with civilian healthcare providers. This civilian healthcare program became known as the Civilian Health and Medical Program of the Uniformed Services (CHAMPUS) in 1966.

Today, TRICARE offers several health plan options, including TRICARE Prime, TRICARE Select, and TRICARE Retired Reserves (TRR). These plans cater to the diverse needs of active-duty service members, retired military members, and their families, offering comprehensive coverage and access to a wide range of healthcare providers.

TRICARE's comprehensive health coverage includes medical necessities, and additional benefits such as the TRICARE Retiree Dental Program for retired military personnel. Depending on the plan and the status of the enrollee, TRICARE often provides lower out-of-pocket costs than private health insurance for both the member and their dependents.

The Hidden Meaning of Riders: Unlocking the Full Potential of Your Insurance Policy

You may want to see also

There are 13 types of TRICARE plans, including Prime, Select, and TRR

Tricare is the US military's health care program and is considered a government-managed health insurance program. It is managed by the Pentagon's Defense Health Agency and provides health care for millions of current and former service members and their families.

Tricare offers several different health plans, 13 to be exact, and plan availability depends on who you are and where you live. Here is a list of the 13 types of Tricare plans:

- Tricare Prime: This plan is like a civilian health maintenance organization (HMO). Users are assigned a primary care manager and must get referrals to access specialty care. User costs depend on military service status. For example, an active-duty family enrolled in Tricare Prime pays no fees as long as they follow referral rules, but retiree families do pay out of pocket.

- Tricare Prime Remote: This option is for active-duty service members and their family members.

- Tricare Prime Overseas: This plan is for retirees and their family members.

- Tricare Prime Remote Overseas

- Tricare Select: This plan is like a civilian preferred provider organization (PPO). Users can select their own primary care manager and self-refer to specialists. While some provider appointments, such as well-child visits, carry no fees, others do. How much users pay and whether they face an enrollment fee depends on their service status.

- Tricare Select Overseas

- Tricare Reserve Select: This plan is for traditional Guard and reservists and functions like Tricare Select, with the difference being that users must pay a monthly premium.

- Tricare Retired Reserve

- Tricare for Life: This is a supplemental health coverage plan for retirees and their spouses over the age of 65. To use this plan, retirees must also be enrolled in Medicare Part B and pay Part B monthly premiums.

- Tricare Young Adult: This plan is available in both Prime and Select versions and is offered to military dependents who are full-time students between the ages of 23 and 25 or non-students between the ages of 21 and 25. Users pay enrollment fees set by law.

- Tricare Dental Plan: Managed by a contractor, United Concordia, this plan is available for purchase by active-duty family members and Guard and Reserve members and their families.

- US Family Health Plan: A Tricare Prime-sponsored health plan option, available through nonprofit health care providers in the Northeast US, Southeast Texas/Southwest Louisiana, and the Puget Sound region of Washington state.

- Tricare Overseas: This plan provides health care support for those relocating overseas.

- Tricare Pharmacy: This plan allows prescriptions to be filled at military or civilian pharmacies.

- Tricare for Guard & Reserve: This plan offers insurance programs for Reserve and Guard members and their families.

Terminal Illness: Understanding Its Coverage in Term Insurance Plans

You may want to see also

TRICARE is managed by the Defense Health Agency

TRICARE is a health care program that provides civilian health benefits for US Armed Forces military personnel, military retirees, and their dependents, including some members of the Reserve Component. TRICARE is managed by the Defense Health Agency (DHA) and provides comprehensive coverage to all beneficiaries.

The DHA supports uniformed services healthcare and falls under the leadership of the Assistant Secretary of Defense (Health Affairs). Before October 1, 2013, TRICARE was managed by the Tricare Management Activity under the authority of the Assistant Secretary of Defense. On that date, the management was transferred to the newly established Defense Health Agency.

TRICARE is the civilian care component of the United States Department of Defense Military Health System. Historically, it also included healthcare delivered in military medical treatment facilities. The program aims to enhance the Department of Defense and the nation's security by providing health support for the full range of military operations and sustaining the health of all those entrusted to its care.

The Department of Defense operates a healthcare delivery system that served approximately 9.4 million beneficiaries in 2018. The Department's unified medical program represents $50.6 billion, or 8% of the total FY2019 US military spending. TRICARE provides coverage to most health plans that meet the requirements for minimum essential coverage under the Affordable Care Act.

The Renewal Riddle: Unraveling the Mystery of Level Term Insurance

You may want to see also

TRICARE for Life (TFL) is a program for Medicare-eligible retirees and their dependents

TRICARE is a health care program of the United States Department of Defense Military Health System. It provides civilian health benefits for U.S. Armed Forces military personnel, military retirees, and their dependents. TRICARE is managed by the Defense Health Agency under the leadership of the Assistant Secretary of Defense (Health Affairs).

TRICARE for Life (TFL) is a program that provides Medicare-wraparound coverage for TRICARE-eligible beneficiaries who have Medicare Part A and Part B. This includes retirees and their dependents, but not active-duty service members and their families. TFL coverage is automatic once you have Medicare Part A and Part B, and there are no additional enrollment fees. However, beneficiaries must pay the Medicare Part B monthly premium.

TFL is available worldwide, and coverage starts the first day that Medicare Part A and B are in effect. To use TFL, individuals need their Medicare card and military ID as proof of coverage. They can visit any authorized provider, including military hospitals and clinics if space is available.

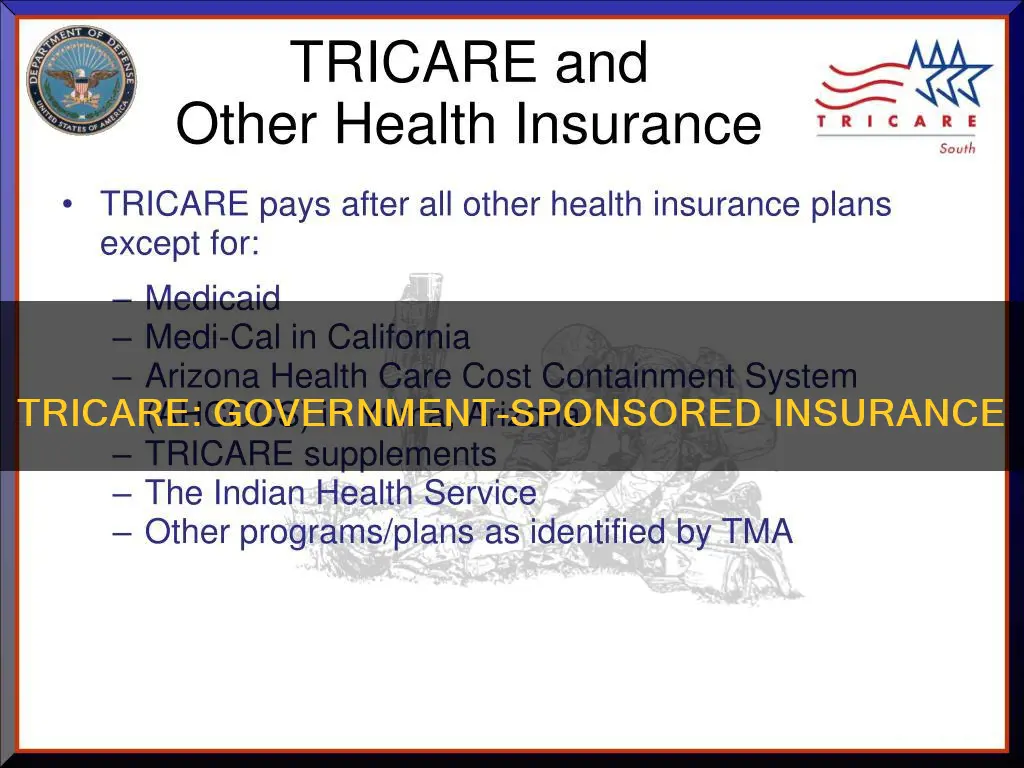

In most cases, the provider will file claims with Medicare, which pays its portion first and then sends the claim to the TFL claims processor. TFL then pays the provider directly for TRICARE-covered services. If an individual has other health insurance, such as an employer-sponsored plan, Medicare pays first, followed by the other insurance, and then TFL pays its portion.

With TFL, there are generally no out-of-pocket costs for services covered by both Medicare and TRICARE. However, individuals will have out-of-pocket expenses for care that isn't covered by one or both of the programs. When using TFL overseas, TRICARE is the primary payer, and individuals are responsible for paying TRICARE's annual deductible and cost shares.

Understanding Cobra Insurance Billing: The Arrears Conundrum

You may want to see also

Frequently asked questions

Yes, Tricare is a health insurance program provided by the federal government to active-duty and retired military personnel and their family members.

Tricare is available to active-duty service members, retired military service members, members of the National Guard, their families, and the surviving dependents of military personnel who lost their lives.

There are 13 types of Tricare plans, but the three most popular are:

Tricare Select: A fee-for-service option for non-active duty service members with higher out-of-pocket costs but greater freedom in choosing providers.