In the United States, health insurance is provided by a mix of public and private sources. The number of uninsured Americans has fluctuated over the years, influenced by various factors such as economic conditions, policy changes, and demographic factors. As of 2022, the number of non-elderly uninsured individuals stood at 25.6 million, a decrease from previous years. This translates to an uninsured rate of 9.6%, the lowest since 2017. The decline in the uninsured rate can be attributed to coverage expansions put in place by the Affordable Care Act (ACA) and pandemic-era policies such as continuous enrollment for Medicaid enrollees and enhanced Marketplace subsidies.

The uninsured population in the US is characterised by racial and ethnic disparities, with people of colour constituting a significant proportion. Additionally, most uninsured individuals belong to low-income families, and a substantial number are children. The primary reason cited for lacking insurance coverage is the high cost of insurance, with many individuals unable to afford the premiums. As a result, the United States remains the only industrialised nation without universal healthcare coverage, despite its economic power.

| Characteristics | Values |

|---|---|

| Total number of people without health insurance in the US | 27.2 million (2021), 26 million (2022), 25.6 million (2022) |

| Percentage of people without health insurance in the US | 8.3% (2021), 7.9% (2022), 9.6% (2022) |

| Number of people with private health insurance | 216.5 million (2021) |

| Percentage of people with private health insurance | 66% (2021), 67.3% (2018) |

| Number of people with public health insurance | 119.1 million (2021) |

| Percentage of people with public health insurance | 35.7% (2021), 34.4% (2018) |

| Number of people with employer-based insurance | 159 million (2019), 179.8 million (2022) |

| Number of people with Medicaid | 61.6 million (2022) |

| Number of people with Medicare | 60 million (2021) |

| Number of children without health insurance | 3 million (2022), 3.7 million (2019) |

| Percentage of children without health insurance | 5.0% (2021), 5.4% (2022), 5.5% (2018) |

What You'll Learn

The uninsured rate in the US

The United States is the only industrialized nation without universal healthcare coverage. In 2019, there were 30 million uninsured people in the US, a number that has risen in recent years. The uninsured rate in the US averaged 15% in the decade before the Affordable Care Act (ACA) was enacted in 2010. The ACA enabled states to expand Medicaid eligibility and establish health insurance marketplaces, contributing to a 3-percentage-point decrease in the share of uninsured people nationally in the initial year. As more states adopted Medicaid expansion in the mid-2010s, the uninsured rate continued to drop, falling below 10% and remaining there since.

The uninsured rate reached an all-time low of 8% in early 2022, with 5.2 million people gaining coverage since 2020. This was due to the implementation of the American Rescue Plan's enhanced Marketplace subsidies, the continuous enrollment provision in Medicaid, several recent state Medicaid expansions, and substantial enrollment outreach by the Biden-Harris Administration. The uninsured rate among adults aged 18-64 declined from 14.5% in late 2020 to 11.8% in early 2022, while the uninsured rate among children aged 0-17 fell from 6.4% to 3.7% during the same period.

However, the improvement in coverage began to reverse under President Trump. The number of uninsured persons rose from 27.3 million in 2016 to 29.6 million in 2019, an increase of 2.3 million. The uninsured rate rose from 8.6% in 2016 to 9.2% in 2019, with the 2017 increase being the first since 2010. The Commonwealth Fund estimated that the number of uninsured increased by 4 million from early 2016 to early 2018, with the rate rising from 12.7% to 15.5%. This increase disproportionately impacted lower-income adults and was more significant in the South and West than in the North and East.

While the number of uninsured Americans remained relatively stable during the pandemic, there were still 26 million uninsured people in 2022. Non-white Americans had the highest rates of being uninsured, and they continue to be the most heavily affected by COVID-19 in terms of employment and health. The high number of uninsured people in the US is concerning, as lack of health insurance is associated with increased mortality, ranging from 30,000 to 90,000 deaths per year, according to various studies.

Navigating COBRA Insurance Billing: A Step-by-Step Guide for Providers

You may want to see also

Public vs private insurance coverage

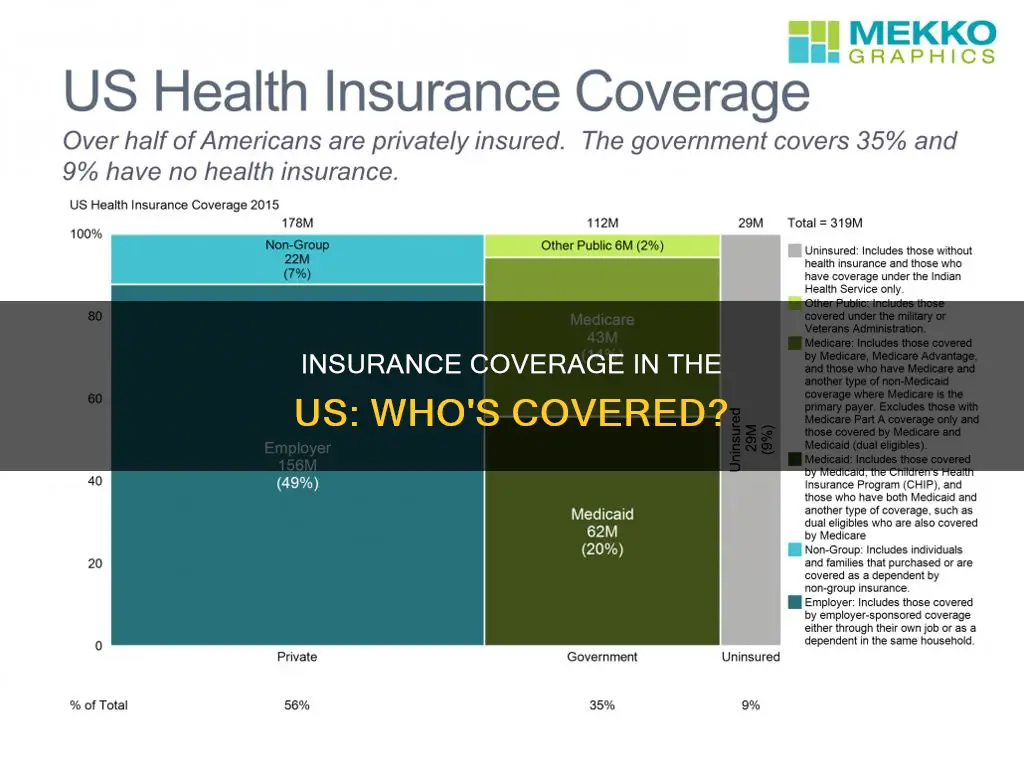

In the United States, the majority of people have private health insurance, with 66% of Americans holding private plans compared to 36% with public plans. However, this varies depending on the year and the demographic. For example, in 2021, 66% of people had private insurance and 35.7% had public insurance.

Private health insurance is provided by private companies, often through an employer or another organisation. It can also be purchased by individuals directly from a health insurance company. The Affordable Care Act (ACA) mandates that employers with over 50 full-time employees must provide affordable health coverage to avoid a tax penalty. Private insurance is more flexible, giving policyholders more options for doctors and medical facilities, but it is also more expensive. Private insurance is typically paid for through monthly or yearly premiums, which may be unaffordable for some.

Public health insurance, on the other hand, is provided by the government for low-income individuals, families, the elderly, and other individuals that qualify for special subsidies. The main public health programs in the US are Medicare, Medicaid, and the Children's Health Insurance Program (CHIP). Medicare is a federal social insurance program for seniors (generally aged 65 and over) and certain disabled individuals. Medicaid covers very low-income children and their families, and is funded by both the federal government and states, but administered at the state level. CHIP is a federal-state partnership that serves children and families who do not qualify for medical assistance but cannot afford private coverage. Public health insurance is more affordable, with lower administrative costs and often no co-pays or deductibles. However, it is less flexible, with policyholders given a limited selection of medical service providers.

While the debate over whether public or private insurance is more economically efficient continues, the number of uninsured Americans has decreased since the implementation of the ACA in 2010. In 2022, 26 million people (7.9% of the population) were uninsured, the lowest since 2017. This decrease is partly due to policies implemented during the COVID-19 pandemic, which increased enrollment in public health insurance programs.

Insurance Switch: New Patient Status?

You may want to see also

Racial disparities in insurance coverage

The United States has long observed racial and ethnic disparities in health coverage, which contribute to disparities in health outcomes. Non-elderly Hispanic, Black, Asian, American Indian and Alaska Native (AIAN), and Native Hawaiian and Other Pacific Islander (NHOPI) people were more likely to be uninsured compared to their White counterparts. These disparities are driven by lower rates of private coverage among these groups.

Hispanic and AIAN people were at the highest risk of lacking coverage, with their higher uninsured rates reflecting more limited access to affordable health coverage options. While the majority of individuals have at least one full-time worker in the family across racial and ethnic groups, there are ongoing disparities in employment and income that result in some individuals not having coverage offered by an employer or having difficulty affording private coverage when it is available.

Prior to the Affordable Care Act (ACA) in 2010, about 19% of the non-elderly US population was uninsured, but the prevalence of uninsurance differed substantially by race or ethnic group. About 20% of African Americans were uninsured, compared to about 13% of non-Hispanic whites, and about 18% of Asians. Hispanics had the highest prevalence of uninsurance, with about a third of Hispanics living in the United States without health insurance.

The ACA has spurred a decline in uninsured rates across all US racial and ethnic groups and reduced disparities in coverage, especially between Blacks and Whites. Gaps in health coverage rates between Blacks, Hispanics, and Whites have narrowed since the ACA, but the gap has shrunk more in states that expanded Medicaid than in those that did not. All racial and ethnic groups saw gains in health coverage between 2013 and 2016, but these gains were especially pronounced for minority groups and individuals with incomes below 139% of the federal poverty level.

Despite coverage gains, disparities in coverage persisted as of 2022. Non-elderly AIAN and Hispanic people had the highest uninsured rates at 19.1% and 18.0%, respectively. Uninsured rates for non-elderly NHOPI (12.7%) and Black people (10.0%) were also higher than the rate for their White counterparts (6.6%). Coverage disparities have persisted over time and, in some cases, widened, despite recent gains and earlier large gains in coverage under the ACA.

Uninsured rates in states that have not expanded Medicaid are higher than rates in expansion states across most racial and ethnic groups as of 2022. Further, the differences in coverage rates between Hispanic, Black, and NHOPI people compared with White people are larger in non-expansion states compared with expansion states. The relative risk of being uninsured for Black and Hispanic people compared to White people is similar in expansion and non-expansion states.

The ongoing racial and ethnic disparities in coverage could further widen amid the unwinding of the Medicaid continuous enrollment provision. The provision, which halted Medicaid disenrollments since March 2020, ended on March 31, 2023. As states unwind the provision, they will redetermine eligibility for all Medicaid enrollees and will disenroll those who are no longer eligible or unable to complete the renewal process. Since states began redeterminations, millions of people have been disenrolled from the program. While the limited data available on disenrollments by race and ethnicity do not point to racial and ethnic disparities in disenrollment rates, Hispanic, Black, AIAN, and NHOPI people are likely disproportionately affected by the unwinding since they are more likely to be covered by Medicaid compared with their White counterparts.

Efforts to prevent coverage losses and further close coverage disparities are crucial for addressing longstanding racial disparities in health. Addressing inequities within the healthcare system and across the broad range of social and economic factors that drive health will also be important.

Billing Aetna Insurance for Acupuncture Services: A Guide for Practitioners

You may want to see also

The impact of the Affordable Care Act

The Affordable Care Act (ACA) has had a significant impact on health insurance coverage and access in the United States. Here is a detailed analysis of its effects:

Reducing the Number of Uninsured Americans

The ACA has led to a substantial decrease in the number of uninsured individuals in the country. By early 2021, the act had provided insurance coverage to an additional 31 million people, reducing the number of uninsured Americans by approximately 20 million. This reduction in uninsured individuals is a key achievement, as it ensures that more people have access to essential health services.

Advancing Health Equity

The ACA has advanced health equity by improving access to healthcare for specific populations, including women, families, children, older adults, people with disabilities, LGBTQI+ individuals, and communities of color. For instance, the act mandates that insurance plans cover women's preventive health services, such as birth control, counselling, cancer screenings, and prenatal care, at no additional cost to the woman. The ACA has also reduced the uninsured rate among LGBTI+ populations by nearly half since 2010.

Protecting Individuals with Pre-existing Conditions

One of the most significant impacts of the ACA is protecting individuals with pre-existing conditions. More than 133 million people are now protected from being denied coverage or charged higher rates due to health conditions such as cancer, asthma, or diabetes. This provision ensures that individuals with pre-existing conditions can access affordable health insurance, which was often challenging before the ACA.

Expanding Medicaid Coverage

The ACA has allowed states to expand Medicaid eligibility, connecting more people to coverage and improving health outcomes, especially for low-income individuals and families. As of March 2022, 38 states and Washington, D.C., had adopted Medicaid expansion, and it is expected to be implemented in a total of 41 states and jurisdictions. This expansion has contributed to the decrease in the uninsured rate and improved access to healthcare for vulnerable populations.

Improving Access to Healthcare for Young Adults

The ACA has helped increase insurance coverage among young adults by allowing them to remain on their parent's health insurance plans until the age of 26. This provision has contributed to the decline in the uninsured rate among young adults, ensuring that they have access to essential health services during their formative years.

Enhancing Mental Health and Substance Use Support

The act has also had a positive impact on mental health and substance use support services. It established the Substance Abuse and Mental Health Services Administration (SAMHSA) Office of Behavioral Health Equity, which works to reduce disparities in mental and substance use disorders across different populations. The ACA has also contributed millions of dollars to grant programs focused on suicide prevention, mental health promotion, and substance use treatment, benefiting millions of individuals across the country.

Impact on Healthcare Costs

While the ACA has successfully increased insurance coverage, its effects on healthcare costs are more nuanced. On the one hand, the act has reduced out-of-pocket health costs for enrolled individuals, particularly through Medicaid expansion and marketplace subsidies. On the other hand, the federal government has spent a significant amount on these expansions and subsidies, amounting to $128 billion in 2019, although this is lower than the initially projected $172 billion.

Impact on Healthcare Quality and Efficiency

The ACA has initiated efforts to improve healthcare quality and efficiency by introducing changes to Medicare and Medicaid reimbursement structures. These changes aim to encourage healthcare providers to adopt more clinically integrated and cost-effective practices, ultimately improving patient care and reducing wasteful spending.

Strengthening Primary Healthcare Access

The act has also made significant investments in strengthening primary healthcare access, particularly for medically underserved communities. It has provided funding for expanding community health centers and the National Health Service Corps, aiming to double the number of patients served by these centers.

Uncertainties and Challenges

While the ACA has achieved notable successes, it has also faced uncertainties and challenges. Efforts to roll back key provisions or invalidate the act entirely have caused disruptions and uncertainty for individuals relying on the ACA for their healthcare coverage. Additionally, the complex nature of the US healthcare system makes it challenging to discern the act's effects on healthcare costs and quality.

In conclusion, the Affordable Care Act has had a profound impact on health insurance coverage and access in the United States. It has successfully reduced the number of uninsured individuals, advanced health equity, protected individuals with pre-existing conditions, and improved access to healthcare for specific populations. However, ongoing political and legal challenges have created uncertainties about the act's future, underscoring the need for continued efforts to ensure accessible and affordable healthcare for all Americans.

Insurance: Year Built vs Remodel

You may want to see also

The cost of insurance

The cost of health insurance in the US is a major concern for Americans and visitors alike. The US spends nearly $4 trillion on healthcare, yet coverage varies widely. The average annual cost of health insurance in the US is $7,739 for an individual and $22,221 for a family, as of 2021. These costs are usually funded by employers, who typically pay around three-quarters of the bill.

The cost per person can vary based on factors such as age, location, employer size, and the type of plan. While premiums are not determined by gender or pre-existing health conditions, other factors influence what individuals pay. For example, deductibles, or out-of-pocket fees, are common in American health insurance policies, meaning upfront costs are often incurred even for those with insurance. The average size of a deductible is $1,644 for individuals.

The average monthly cost of a Silver plan for a 40-year-old in the US is $584, a 4% increase from 2023. The average monthly cost of private health insurance is $584 for a 40-year-old on a Silver plan. Private insurance costs vary based on factors such as age and location. For example, a 40-year-old in Alaska pays an average of $948 a month for a Silver plan, while the same plan in New Hampshire costs an average of $373.

The type of network the plan uses is another factor that influences rates. Health maintenance organizations (HMOs) tend to be the most restrictive about which doctors you can see, but they usually have lower premiums. Preferred provider organizations (PPOs) tend to be the most expensive, while high-deductible health plans (HDHPs) cost the least.

State laws can also dictate what health insurance must cover and affect competition, thereby influencing costs. For instance, a 2017 Maine law instructs insurers to compensate customers who find a better deal on certain services. In contrast, some states have certificate-of-need (CON) laws that may decrease competition and keep costs higher.

Overall, the cost of health insurance in the US is impacted by a range of factors, and individuals and families can expect to pay varying amounts depending on their specific circumstances.

Specialty Drugs: What's Covered by Insurance?

You may want to see also

Frequently asked questions

In 2022, 26 million people, or 7.9% of the population, were uninsured.

In 2021, 66% of the population had private insurance.

In 2021, 35.7% of the population had public insurance.

The number of insured people in the US has generally increased over time, with some fluctuations. For example, the number of uninsured people decreased from 2013 to 2016, but then increased from 2016 to 2019. The most recent data shows that the number of uninsured people decreased again from 2019 to 2022.