Veterans’ Group Life Insurance (VGLI) is a type of term life insurance offered to former members of the military. It is a continuation of the Servicemembers' Group Life Insurance (SGLI) coverage offered to active military personnel. VGLI allows veterans to keep their term insurance for life as long as they pay the premiums. However, VGLI rates increase as the policyholder ages, which can make it expensive in later years. On the other hand, whole life insurance premiums are generally higher at younger ages but remain level for the life of the policy. This article will explore the key differences between VGLI and whole life insurance to help veterans make an informed decision about their insurance coverage.

What You'll Learn

- VGLI is a type of group term life insurance offered to former military members

- VGLI rates are based on age and coverage amount

- VGLI does not require a medical exam if enrolled within 240 days of leaving service

- VGLI coverage can be renewed every five years and has no age limit

- VGLI can be converted to a commercial whole life insurance policy at any time

VGLI is a type of group term life insurance offered to former military members

Veterans’ Group Life Insurance (VGLI) is a type of group term life insurance offered to former military members. It is an extension of Servicemembers’ Group Life Insurance (SGLI), which covers active military personnel. VGLI allows veterans to continue their life insurance coverage after leaving the military, as long as they pay the premiums. The amount of coverage provided by VGLI ranges from $10,000 to $500,000, depending on the veteran's previous SGLI coverage.

VGLI is a renewable term policy, which means it does not accumulate cash value over time like a whole life insurance policy. Instead, it provides death benefits to the beneficiaries of the veteran upon their death. VGLI offers several benefits, including low premiums, no health exam requirement if enrolled within 240 days of leaving the service, and no coverage restrictions based on gender, smoker status, occupation, or hobbies. The policy also has no age limit and remains in force as long as premiums are paid.

To be eligible for VGLI, veterans must have participated in SGLI during their service and apply for VGLI within one year and 120 days of leaving the military. VGLI is exclusively for veterans and is provided by Prudential. The cost of VGLI depends on the coverage amount and the age of the veteran, with premiums increasing as the veteran ages. While VGLI is a good option for some veterans, others may find more affordable coverage on the open market, especially if they are in good health.

Life Insurance Equity: What You Need to Know

You may want to see also

VGLI rates are based on age and coverage amount

Veterans’ Group Life Insurance (VGLI) is a type of group term life insurance offered to former members of the military. VGLI premium rates are based on age and the amount of insurance coverage desired.

The rates increase as the insured person ages, especially after age 50. VGLI is generally affordable for younger veterans, but rates can get high for older veterans. The monthly premiums for VGLI are based on age bands and the death benefit amount, with rates changing for each age range every five years.

For example, at age 30, one would pay $45 per month for $500,000 of coverage, which would increase to $165 per month by age 50 for the same death benefit. VGLI rates are also the same for smokers and non-smokers.

VGLI offers coverage ranging from $10,000 to $500,000, and this amount can be adjusted if needs change. The coverage amount can be increased by $25,000 every five years until the insured reaches the age of 60.

VGLI is a continuation of the Servicemembers' Group Life Insurance (SGLI) coverage offered to active military personnel. To qualify for VGLI, one must have had SGLI coverage at the time of discharge.

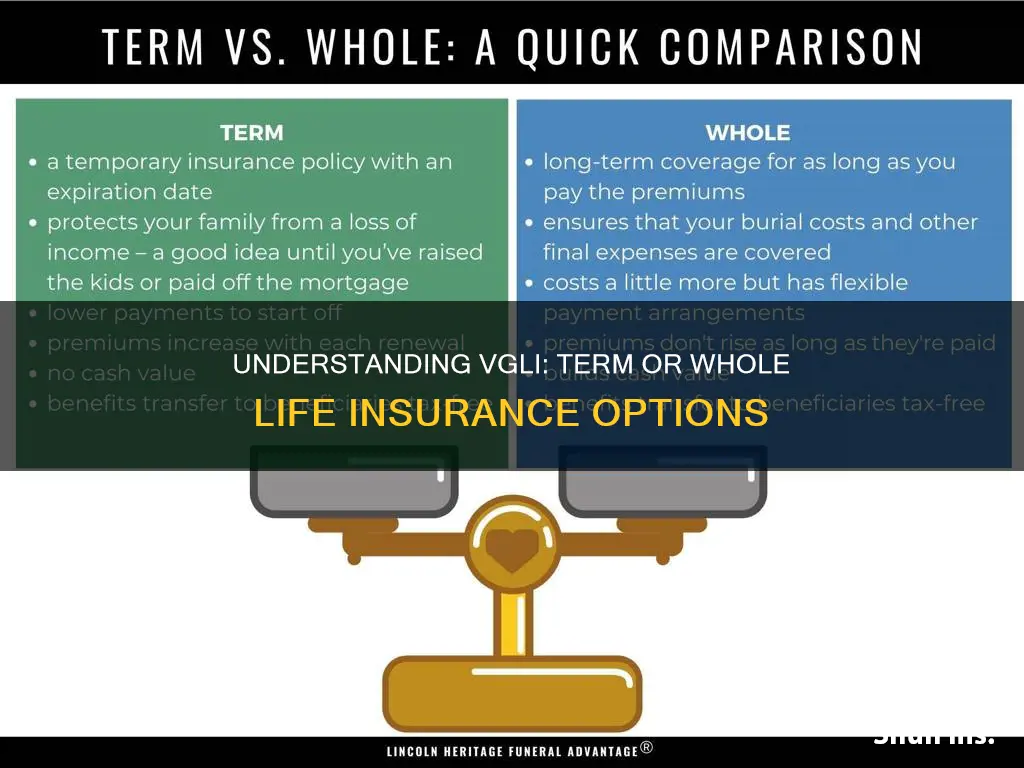

VGLI is a term life insurance policy, which is different from whole life insurance. Term life insurance provides death benefits only, with no cash value build-up over time. It is generally the most affordable type of life insurance to purchase and is purchased for a specific time period, during which premiums remain level. After this level premium period, premiums increase until a certain age is reached, at which point the coverage ends.

In contrast, whole life insurance provides death benefits as well as a cash value accumulation that builds during the life of the policy. Whole life insurance premiums are generally higher at younger ages than term life insurance premiums but remain level for the life of the policy.

Life Insurance Agents: Do They Call from Cell Phones?

You may want to see also

VGLI does not require a medical exam if enrolled within 240 days of leaving service

Veterans’ Group Life Insurance (VGLI) is a term life insurance policy that provides up to $500,000 of coverage to veterans after they have separated from the military. However, there is a time limit for applying for VGLI after leaving the service. Veterans have up to 1 year and 120 days to apply for VGLI, after which they are no longer eligible for coverage. Importantly, if veterans apply for VGLI within 240 days of leaving the military, they are not required to provide evidence of good health and can skip the health questionnaire. This is a significant advantage, as most private life insurance companies require either a medical questionnaire or a physical exam, and many military-related health conditions can disqualify individuals from obtaining private life insurance.

VGLI does not require a medical exam if enrolled within 240 days of leaving the service. This is a crucial benefit for veterans, as it ensures they can obtain life insurance coverage regardless of any health conditions or injuries sustained during their military service. Private insurers often use health reviews to determine eligibility, and certain medical conditions can make it challenging to obtain coverage. By contrast, VGLI offers a "no-health" application period of 240 days, during which eligible members can be approved without any health review, regardless of the severity of their health issues. This feature of VGLI makes it a priority for those with medical conditions that may affect their insurability.

The "no-health" application period for VGLI is especially beneficial for veterans with health conditions or disabilities that may make obtaining an individual policy from a commercial insurer difficult. Without the requirement for a medical exam, veterans can secure life insurance coverage and peace of mind. Additionally, the absence of health questions in the application process means that VGLI does not exclude applicants for reasons related to mental health, PTSD, or TBI. This inclusive approach ensures that veterans with mental health challenges are not discriminated against and can access the financial protection provided by VGLI.

The 240-day period after leaving the military is a critical window for veterans to take advantage of the "no-health" application process for VGLI. By enrolling within this timeframe, they can secure life insurance coverage without the usual health requirements, ensuring their financial protection and that of their beneficiaries.

Suffolk County Correction Officers: Life Insurance Coverage Explained

You may want to see also

VGLI coverage can be renewed every five years and has no age limit

Veterans' Group Life Insurance (VGLI) is a type of group term life insurance offered to former members of the military. VGLI coverage can be renewed every five years and has no age limit. This means that veterans can keep their life insurance coverage for as long as they continue to pay the premiums. However, it's important to note that VGLI premium rates are based on age and the amount of coverage, and rates adjust (increase) at five-year age brackets.

VGLI provides a solid foundation of coverage for life. Once approved, no medical questions are asked, and coverage will continue as long as premiums are paid. VGLI coverage can be renewed every five years and does not terminate as long as premium payments are made on time. There is no age limit or term limit to the coverage.

Veterans who want to maintain their life insurance coverage after leaving the military can take advantage of VGLI to do so. VGLI allows them to continue their Servicemembers' Group Life Insurance (SGLI) coverage after separating from service, but they must enroll within a specific time frame to be eligible. This time frame is typically within one year and 120 days from discharge or separation.

It's important to highlight that those who apply for VGLI within the first 240 days of discharge or separation can obtain coverage without providing proof of good health, even if they have a serious injury or medical condition. On the other hand, those who apply after this 240-day period must answer health questions and meet good health requirements to qualify for VGLI coverage.

VGLI offers flexibility in terms of coverage amounts. Veterans can choose coverage amounts between $10,000 and $500,000, and they can increase their coverage by $25,000 every five years up to the maximum limit of $500,000 until they reach the age of 60. This flexibility allows veterans to adjust their coverage as their needs change.

In summary, VGLI coverage can be renewed every five years and has no age limit, providing veterans with the ability to maintain their life insurance coverage for life as long as they continue to pay the premiums. However, it's important to keep in mind that VGLI premium rates will increase with age, and there may be more cost-effective options available in the long run.

Understanding Life Insurance: Choosing Your Beneficiaries

You may want to see also

VGLI can be converted to a commercial whole life insurance policy at any time

Veterans’ Group Life Insurance (VGLI) is a form of term life insurance that allows veterans to maintain their Servicemembers' Group Life Insurance (SGLI) coverage after leaving the military. VGLI is often confused with whole life insurance, which has different features.

VGLI coverage can be converted to a commercial whole life insurance policy at any time. This can be done without providing evidence of good health. To convert VGLI coverage, the policyholder must:

- Select a company from the list of participating companies.

- Apply to the local sales office of the chosen company.

- Obtain a letter from the Office of Servicemembers' Group Life Insurance (OSGLI) verifying coverage (VGLI Conversion Notice).

- Give a copy of that notice to the agent who takes the application.

It is important to note that the conversion policy must be a permanent policy, such as a whole life policy. Other types of policies, such as term, variable life, or universal life insurance, are not allowed as conversion policies. Additionally, supplementary policy benefits, like Accidental Death and Dismemberment or Waiver of Premium for Disability, are not considered part of the conversion policy.

VGLI provides a range of benefits to veterans, including the ability to maintain life insurance coverage after leaving the military, flexible payment options, and the option to increase coverage over time. It is important for veterans to carefully consider their insurance needs and compare the features of VGLI with other insurance products to make an informed decision about their coverage.

Get Your Life Insurance License: Steps to Success

You may want to see also

Frequently asked questions

Veterans' Group Life Insurance (VGLI) is a type of group term life insurance offered to former members of the military. It is a continuation of the Servicemembers' Group Life Insurance (SGLI) coverage offered to active military personnel.

VGLI is term life insurance, which means it only provides death benefits with no cash value accumulation. Whole life insurance provides both death benefits and a cash value accumulation that builds during the life of the policy. Whole life insurance premiums are generally higher at younger ages, but they remain level for the life of the policy.

To qualify for VGLI, you must have participated in SGLI during your military service and apply for VGLI within one year and 120 days of leaving the service. If you apply within the first 240 days, you do not need to provide proof of good health.