When considering borrowing from whole life insurance, it's important to understand the potential benefits and risks. Whole life insurance is a long-term financial product that provides coverage for your entire life, offering a sense of security and financial stability. Borrowing from this type of insurance can be a strategic move for those who need immediate funds, as it allows you to access a portion of your policy's cash value without selling the policy or disrupting your coverage. This can be particularly useful for significant expenses like education, home improvements, or business ventures, providing a reliable source of funds while maintaining the insurance policy's benefits. However, it's crucial to carefully evaluate your financial situation and consult with a financial advisor to ensure that borrowing is a wise decision and to understand the associated fees and potential impacts on your insurance coverage.

| Characteristics | Values |

|---|---|

| Financial Need | Borrowing from whole life insurance can be a good option when you have a significant financial need that cannot be met through other means. This could include covering unexpected expenses, funding a business venture, or consolidating debt. |

| Emergency Funds | Whole life insurance loans can provide quick access to cash in emergencies, ensuring you have a safety net for unexpected costs. |

| Debt Consolidation | If you have multiple high-interest debts, borrowing from your whole life insurance policy can help consolidate them, potentially saving on interest and simplifying payments. |

| Investment Opportunities | With the loan proceeds, you might consider investing in assets that have the potential to generate returns, thus growing your wealth over time. |

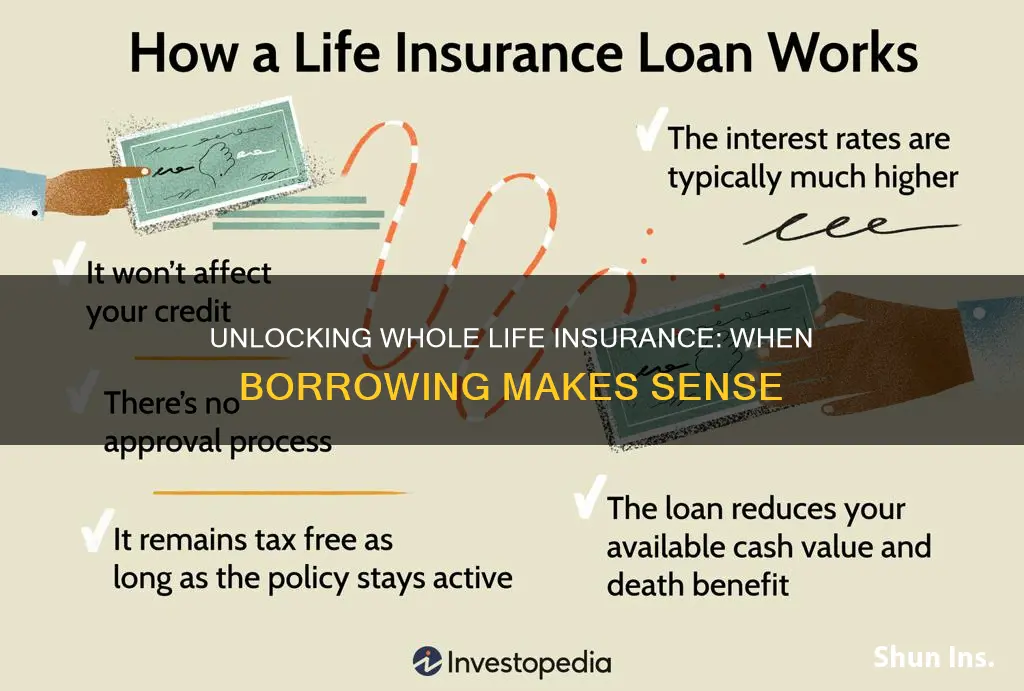

| Tax Advantages | Loans from whole life insurance policies are often tax-free, as they are considered a loan rather than a withdrawal. This can be an advantage compared to other forms of borrowing. |

| No Credit Check | Borrowing from whole life insurance typically doesn't require a traditional credit check, making it accessible to those with limited or poor credit history. |

| Flexible Repayment | Loan repayment terms can be flexible, allowing you to choose a repayment schedule that suits your financial situation. |

| Death Benefit Preservation | Borrowing from whole life insurance does not typically reduce the death benefit, ensuring that your beneficiaries still receive the full death benefit amount upon your passing. |

| No Prepayment Penalties | You can usually repay the loan early without incurring any penalties, providing flexibility in managing your finances. |

| Long-Term Financial Planning | Borrowing from whole life insurance can be a strategic move for long-term financial planning, allowing you to access funds while maintaining the policy's value. |

What You'll Learn

- Tax Advantages: Whole life insurance loans offer tax-free borrowing, unlike bank loans

- Low Interest Rates: Interest rates on whole life loans are typically lower than credit cards

- No Credit Checks: Borrowing from whole life insurance doesn't require a credit check, unlike traditional loans

- Flexible Repayment: Loan repayment terms are flexible, allowing for adjustments based on financial needs

- Death Benefit Protection: Proceeds from a whole life insurance policy can be used to repay the loan, ensuring coverage

Tax Advantages: Whole life insurance loans offer tax-free borrowing, unlike bank loans

When considering borrowing options, it's essential to understand the tax implications of different financial instruments. Whole life insurance loans provide a unique advantage in this regard, offering tax-free borrowing, which sets them apart from traditional bank loans. This feature is particularly beneficial for individuals who want to avoid the tax consequences often associated with other forms of borrowing.

One of the key advantages of whole life insurance loans is that they are typically considered tax-free loans. This means that the interest you pay on the loan is not subject to income tax. In contrast, bank loans often require the interest payments to be reported as income, which can result in higher tax liabilities. By avoiding this tax burden, whole life insurance loans can be a more attractive option for those looking to manage their finances efficiently.

The tax-free nature of these loans is a significant benefit, especially for high-income earners or individuals in higher tax brackets. With traditional bank loans, a substantial portion of the interest paid may be taxable, reducing the overall benefit of the loan. However, with whole life insurance, the tax-free aspect ensures that more of the loan amount goes towards the principal, potentially saving borrowers a considerable amount of money over time.

Furthermore, the tax advantages of whole life insurance loans can extend beyond the interest payments. When you borrow from your whole life insurance policy, you are essentially accessing the cash value that has accumulated over time. This process is generally tax-free, allowing you to utilize the funds for various purposes without incurring additional tax obligations. This flexibility can be advantageous for individuals who need to access funds for investments, education, or other financial goals.

In summary, the tax advantages of whole life insurance loans are a compelling reason to consider this borrowing option. By offering tax-free borrowing, these loans provide a unique benefit that can help individuals manage their finances more effectively. Understanding these advantages can empower borrowers to make informed decisions and potentially save a significant amount of money in the long run.

Employee Life Insurance: Understanding Your Supplemental Coverage

You may want to see also

Low Interest Rates: Interest rates on whole life loans are typically lower than credit cards

When considering borrowing options, it's essential to understand the advantages of using whole life insurance as a source of funds. One of the most compelling benefits is the low-interest rates associated with whole life loans. This feature makes whole life insurance an attractive alternative to credit cards and other high-interest debt.

Whole life insurance loans are secured by the cash value of the insurance policy, which means the lender has a lower risk compared to unsecured loans. As a result, the interest rates on these loans are often significantly lower than those charged by credit card companies, which typically have high-interest rates that can quickly accumulate and become unmanageable. By borrowing from your whole life insurance, you can access funds at a much more affordable rate, allowing you to manage your finances more effectively.

The low-interest rates on whole life loans can be particularly beneficial for individuals who need to cover unexpected expenses, consolidate debt, or make significant purchases. For example, if you have a large medical bill or need to finance a home renovation, borrowing from your whole life insurance can provide the necessary funds without the burden of high-interest payments. This can help you avoid the pitfalls of high-interest credit and keep your overall financial costs low.

Additionally, the interest rates on whole life loans are usually fixed, meaning they remain constant throughout the loan term. This predictability allows borrowers to plan their finances with greater accuracy, as they know exactly how much they will need to repay each month. In contrast, credit card interest rates can fluctuate, making it challenging to budget and manage debt effectively.

In summary, the low-interest rates on whole life loans make it an excellent choice for borrowing when compared to credit cards. This feature, combined with the security and predictability of the loan, can help individuals manage their finances more effectively and avoid the high costs associated with other borrowing options. Understanding the benefits of whole life insurance as a borrowing tool can empower individuals to make informed financial decisions.

Who Can Get Life Insurance on Your Behalf?

You may want to see also

No Credit Checks: Borrowing from whole life insurance doesn't require a credit check, unlike traditional loans

When considering borrowing options, it's important to understand the unique advantages of tapping into your whole life insurance policy. One of the most significant benefits is the absence of a credit check, which sets it apart from traditional loans. This feature is particularly appealing to individuals who may have a less-than-perfect credit history or those who prefer to avoid the potential risks associated with a credit inquiry.

In traditional lending, a credit check is a standard procedure to assess an individual's creditworthiness. Lenders review credit reports to determine the likelihood of the borrower repaying the loan. However, with whole life insurance, the borrowing process takes a different approach. Since the insurance policy already exists and is owned by the policyholder, the focus shifts from credit history to the policy's value and the borrower's relationship with the insurance company.

Borrowing from whole life insurance offers a secure and straightforward way to access funds without the typical scrutiny of a credit check. This is especially beneficial for those who may have faced challenges in obtaining loans through conventional means. By utilizing the cash value accumulated in the policy, individuals can secure a loan without the need for extensive documentation or a detailed credit review.

The process typically involves the insurance company advancing a portion of the policy's cash value to the policyholder as a loan. This loan is then repaid, often with interest, using the policy's future dividends or the policyholder's future premium payments. The key advantage here is that the insurance company's focus is on the policy's value and the borrower's ability to repay, rather than their credit score.

In summary, borrowing from whole life insurance provides a credit-friendly alternative for individuals seeking financial flexibility. It offers a unique way to access funds without the typical credit check, making it an attractive option for those who may have been previously overlooked by traditional lenders. Understanding this aspect of whole life insurance can empower individuals to make informed decisions about their financial needs.

Life Insurance Proceeds: Taxable or Not?

You may want to see also

Flexible Repayment: Loan repayment terms are flexible, allowing for adjustments based on financial needs

When considering borrowing from whole life insurance, understanding the concept of flexible repayment is crucial. This feature allows policyholders to customize their loan repayment terms according to their financial circumstances, providing a level of flexibility that can be highly beneficial. The ability to adjust repayment plans means that individuals can manage their loans more effectively, especially during times of financial strain or uncertainty.

Flexible repayment terms typically involve a range of options for loan repayment. These may include the possibility of making additional payments when finances allow, thus reducing the overall loan term and interest burden. Conversely, during challenging financial periods, policyholders can opt for smaller, more manageable payments, ensuring that the loan remains affordable without causing undue financial stress. This adaptability is particularly useful for those who experience fluctuations in income or unexpected expenses.

The key advantage of this flexibility is the ability to tailor the loan repayment strategy to individual financial goals and situations. For instance, a policyholder might choose to borrow a significant amount and opt for a shorter repayment period if they plan to retire early and want to clear the debt before their retirement income begins. Alternatively, someone with a stable income and long-term financial goals might prefer a longer repayment term to keep monthly payments low, allowing for potential savings or investments.

In practice, this flexibility can be a powerful tool for managing personal finances. It enables individuals to make informed decisions about borrowing, ensuring that the loan remains a viable and sustainable option. By adjusting repayment terms, policyholders can maintain control over their financial obligations, even in the face of changing economic conditions or personal circumstances.

In summary, the concept of flexible repayment in whole life insurance loans empowers individuals to take charge of their financial well-being. It provides a practical solution for those seeking to borrow while maintaining financial flexibility and control. This feature, combined with the potential tax advantages and the safety net of the insurance policy, makes whole life insurance loans an attractive option for those looking to borrow wisely and manage their finances effectively.

Life Insurance: Laid-Off, Now What?

You may want to see also

Death Benefit Protection: Proceeds from a whole life insurance policy can be used to repay the loan, ensuring coverage

When considering borrowing from your whole life insurance policy, it's essential to understand the concept of death benefit protection. This feature is a significant advantage of whole life insurance, offering financial security and peace of mind. Here's how it works and why it's a valuable consideration:

Whole life insurance is designed to provide a death benefit, which is a lump sum paid to your beneficiaries upon your passing. This benefit is typically tax-free and can be a substantial financial resource for your loved ones. However, it's not just about the payout; it also includes the ability to borrow from the policy's cash value. The death benefit protection aspect comes into play when you take out a loan against your policy. In the event of your death, the loan amount is deducted from the death benefit, ensuring that the remaining proceeds are used to cover any outstanding debts or provide financial support to your beneficiaries. This feature is particularly useful for those who want to ensure that their loved ones are protected financially even in their absence.

Borrowing from your whole life insurance policy can be a strategic move when you need immediate funds for various purposes. It allows you to access cash without selling assets or going through a lengthy and potentially costly process. The loan is typically interest-free, and the terms are flexible, allowing you to repay the amount at your convenience. This can be especially beneficial for covering unexpected expenses, starting a business, or making significant investments. By borrowing from your own policy, you maintain control over your finances and avoid the potential drawbacks of other borrowing methods.

The key advantage of this approach is the security it provides. When you borrow, you are essentially using your policy's future death benefit as collateral. This ensures that even if you fail to repay the loan, the death benefit remains intact, providing coverage for your beneficiaries. It's a way to safeguard your loved ones' financial future while also accessing the funds you need today. Additionally, the interest rates on these loans are generally lower compared to other personal loans, making it a cost-effective option.

In summary, borrowing from your whole life insurance policy offers a unique way to access funds while maintaining death benefit protection. It provides a safety net for your beneficiaries and allows you to utilize your policy's cash value for various financial needs. Understanding this feature can empower you to make informed decisions about your insurance and overall financial strategy.

Life Insurance: A Dependent's Safety Net and Financial Security

You may want to see also

Frequently asked questions

Borrowing from a whole life insurance policy can be a strategic financial move when you need immediate funds for significant expenses or investments. This option is particularly useful when you want to avoid the potential risks and costs associated with other borrowing methods, such as high-interest credit cards or loans. Whole life insurance policies typically offer a loan feature, allowing policyholders to borrow against the cash value of their policy, which can be a valuable source of funds without the need for extensive credit checks or collateral.

One of the key advantages is the relatively low-interest rate compared to other borrowing options. The interest rate on a whole life insurance loan is usually tied to the policy's investment performance and is generally more favorable than traditional loans. Additionally, borrowing from your own policy means you retain full ownership and control over the funds, avoiding the potential risks of debt accumulation or the need to secure a loan with collateral.

While borrowing from whole life insurance can be beneficial, it's essential to understand the potential risks. One significant consideration is the possibility of reducing the death benefit if the loan is not repaid. If the policy's cash value is insufficient to cover the loan and interest, the policy may lapse, and the death benefit may be reduced. It's crucial to ensure that you have a plan to repay the loan to maintain the policy's integrity and the intended financial security for your beneficiaries.

Accessing funds from your whole life insurance policy for borrowing is typically straightforward. You can contact your insurance provider or financial advisor to initiate the loan process. They will guide you through the necessary steps, which may include filling out loan applications, providing relevant documentation, and agreeing to the terms and conditions. The funds can then be borrowed as a loan, providing you with immediate access to the policy's cash value without surrendering the policy or taking out a separate loan.